Will the SPY bounce today? Day Trading Ideas for Apr 17

SMCI swing working, NVDA on watch for trend reclaim

Good morning traders!

Yesterday I asked if BTFD will come or will we get 3 days of selling. In a way neither. In another way we got BTFD depending on the stock. That said, there were no shortage of 3-5x trades in the afternoon, some over 10x. I focused on the easy money trades credit sells and was mostly done.

Yesterdays' price action was essentially a bull bear fight and consolidation. We had a failed breakdown and a failed breakout. So the jury is still out for how today plays out but I’m leaning toward a bounce coming to back test the break down before another leg down develops.

Let’s get into yesterday’s action and also the BTFD trade that developed in SMCI.

Then we will get into some trade ideas for today.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas each morning, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Apr 16 - SPX 5140/5135 bull puts - Entry $2.50 ($2500 premium potential) drawdown < $300

Apr 12 - SPX 5100p $1. (dipped to 1.30) - Entry $2 ($2500 premium potential)

Apr 11 - SPX 5180/5185 bear calls - Entry $2.50 ($2500 premium potential)

Apr 10 - SPX 5180/5185 bear calls - Entry $2.50 ($2500 premium potential)

Apr 10 - SPX 5170c - Entry 0.50 ($500 → $5000 potential)

Apr 9 - SPX 5185/5180 bull puts - Entry $3 ($3000 premium potential)

Apr 9 - SPX 5205c - Entry $0.50 ($500→ $6000 potential)

Apr 8 - SPX 5225/5230 bear calls - Entry $1.20 ($1200 premium potential)

Apr 8 - SPX 5200/5195 bear puts - Entry $0.10 ($1000→ $8000 potential)

Apr 4 - SPX 5250p - Entry $4 ($4000→ $100k potential)

Apr 4 - SPX 5180p - Entry $1.30 ($1300 > $32k potential)

Apr 3 - SPX 5175/5170 bull put - Entry $1.50 ($1500 premium potential)

Apr 2 - SPX 5175/5170 bull put - Entry $1.50 ($1500 premium potential)

Apr 2 - SPX 5205/5200 bull put - Entry $1.50 ($1500 premium potential)

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Tuesday’s Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

SPY/SPX

I fall back into these habits of overtrading and yesterday’s chop definitely baited me because I didn’t want to miss the range breaks. But each potential setup failed to get follow through and so the trades turned into small wins 30%+ or 50% losses on the “unplanned” trades.

The planned trades all worked to either pay or take small loss.

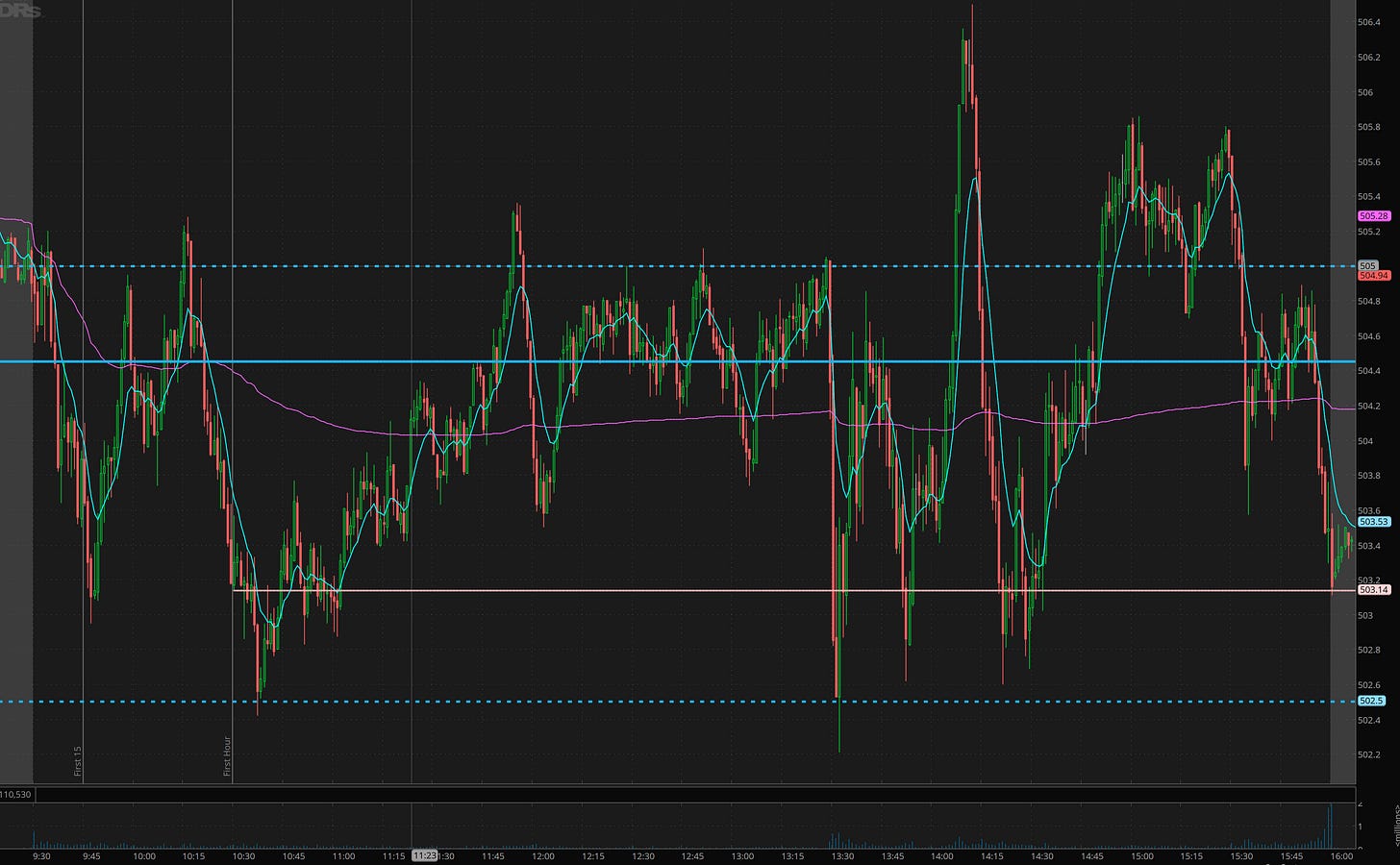

Overall SPY was essentially pinned between 503 and 505 all day and if you played for the chop you would make bank. I love credit sells!

I took bull puts every time we got to 502.50 because I was in the came that we will back test 509+ before more lows come.

Notice in the morning we had a dip, and then a failed push over 505? How do you recognize a failed puts, when it makes a new higih/crosses a level and immediately reverses. confirmation is typically the break under vwap. it then got to 502.50. to lock in 80% of the gains.once it got back over the peach line, it was time to lock in the rest of the puts and add/take bull puts.

You may be wondering why I do credit sells more. The reason is that I have an 90% win rate on these and I can just set it and forget it. I either get paid end of day or I don’t. I’ve been refining processes so I can spend less time at screen and bank regularly.

Wouldn’t you risk 3500 to make on average 1500 with a 90% win rate? Let’s do the math. 1500*10 -15000. $15000-3500= $11500. And one can do this using just $5k in capital. cool stuff!

One of the key tenets for THT is to avoid trading in the middle of the range. If you waited for failed moves relative to the levels you were rewarded. My biggest trade on failed break setup yesterday added up to about $12k in gains.

TSLA

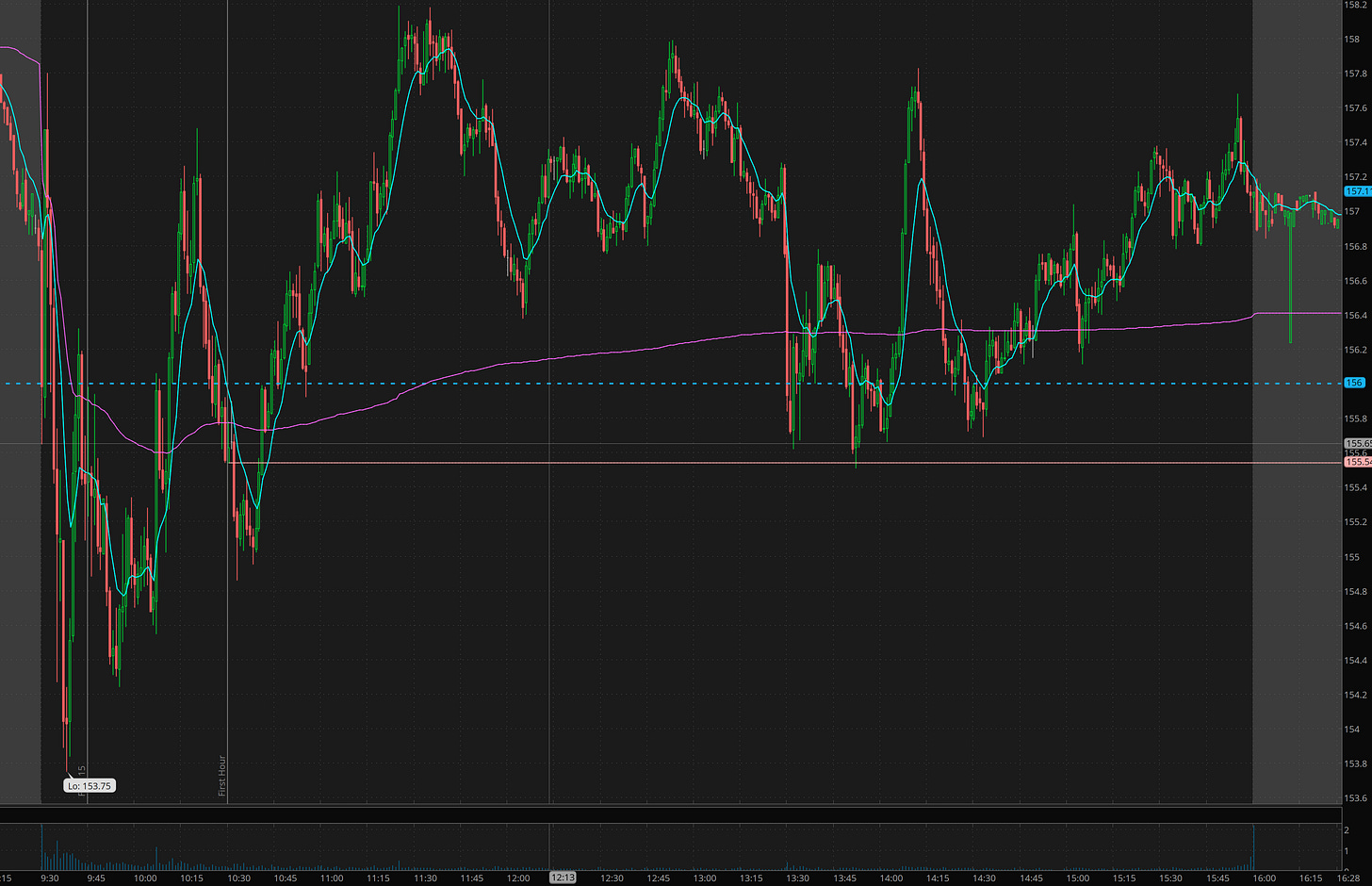

Yesterday I said that my swing target on TSLA was 158. I was open to 150 coming, but most of my work was done and left a runner to do its thing. (in this case getting stopped out)

2 rules I want to share with you.

Rule 1: On overnight trades, any time I have a gap in my favor I sell 80-100% into the spike during first 15 minutes. 90% of the time I can reload at a better price. You can see how selling into the spike under 156 paid out.

Rule 2: If after the first hour on a gap down, the price is over vwap, exit runners.

SMCI

SMCI got a bunch of upgrades with a 1500 target.

Study this pattern. This name had multiple red days, and a positive new catalyst.

Then it provide a failed breakdown reversal after first hour. This is when I said I like SMCI long on dips. In the afternoon you can see how morning highs were cleared and backtested. This is where I got added tripled my long and said we should see 1020 tomorrow. the 960c for $20-$30 I’m looking for a $60+ exit. I sold some at 42 because of overnight risk.

Trade Ideas - Plan for Wed Apr 17

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Overall focus will be on bull puts on SPY and possible yolo calls. I will cut all calls if SPY break 502.50 again and likely scale in on next failed pop with size short.

I will be watching SPY, NVDA, SMCI