Will SPY break range today - Trade ideas for Tuesday Oct 29, 2024

Are you planning trades that pay as much as 5 to 20 times your risk? If not, join THT-PRO. The Ultimate BTFD strategy in 2024 pays again!

Good morning traders!

One thing I found about SPX 0DTE in a tight range, is that you can predict entry points easily and so I can leverage my dip buying super power. My favorite trade of yesterday was 200% in under 15 minutes!

We didn’t get a squeeze,, but I’ll take the fast gains and left runners in case it went, but it got stopped.

Overall, yesterday I did a lot of waiting. Bottom line SPY didn’t setup into one of my ideal trade setups. Made 2 attempts to short for some gap fill in the morning the contracts were so juiced that they only did about 50%-90% gains from my entry and I ended up stopping out flattish. I warned members that to avoid trading that action and maybe we get something in afternoon.

Monday’s Price Action

SPY basically consolidated in a 1 pt range all day yesterday establishing 580.50 as support. Nothing really to do but wait or play for fast buck scalps in the chop. 581.50 was the magnet.

TSLA - tested 271 and gave me my favorite gap up reversal setup, however it stopped me out at first and had to go back in. It finally broke 268 support and sold off to 260.

QQQ - based on 496 area all day long and finally faded to 495.

NFLX - basing on 750, watch for a failed breakdown reversal to come

MSTR - is a beast! Rand to 251 target dipped and likely clears with btc over 70k

Tuesday’s Premarket Action

SPY is gapping down under the 580.50 needs to reclaim quickly otherwise a break of 578 can come.

TSLA gapping up a little. In theory after the recent rally it needs a breather. I would not be a surprised if dips to 250 this week ahead of elections, but currently it seems like a Trump win is an Elon win and a possible TSLA win. If Harris wins, will TSLA get smoked?

MCD beat, but dumping. It broke 291 which was the low from the EColi news. Has room to 280-285 on downside.

PYPL has had a VERY rangy morning. Overnight it gapped up to 86 from 84 and then in premarket dumped to 74 and has recovered to 84 — essentially unchanged.

RCL has been on a huge run since last E/R and is up 5x in 2 years. Will this e/r tigger some profit taking? In premarket it dumped to 192 and bounced as high as 202. Under 198, make have it want to gap fill to 185.

MSTR is gapping up 270! Watch all dips!

Let’s review the trade signals in SPY and go over ideas for today.

Join THT PRO to get alerts, real-time commentary, and improve trading habits.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading—your daily source for market insights and trading opportunities. Here, you’ll find comprehensive market analysis, educational lessons, and trade ideas to help you excel in trading, all while spending less than two hours a day.

What Subscribers Get

Subscribers receive daily market analysis updates, educational content, and up to three trade ideas each morning based on real-life examples and my trading approach.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

2024 Q4 Alert Leaderboard

Here's a look at some of the potential gains achieved through our entry alerts:

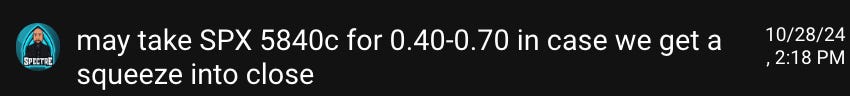

Oct 28 - SPY 5840c $0.50 → $1.80 ($500 → $1800 potenital)

Oct 25 - QQQ 499p $0.80 → $4.50 ($800 → $4500 potential)

Oct 25 - TSLA 265c $1.25 → $4.65 ($1250 → 4650 potential)

Oct 24 - SPX 5770p $2 → $6.2 ($2000 → $6200 potential)

Oct 24 - SPX 5810c $0.20 → $2.05 ($2000 → $20500 potential)

Oct 24 - SPX 5810/5805 Bull puts for $3.20 went to -> 0.12 (collect 90%+ premium)

Oct 23 - SPX 5790p $3 → $27.80 ($3000 → $27800 potential)

Oct 23 - SPX 5830c $6 → 11.20 5R ($6000 → $11000 potential)

Oct 23 - TSM 205c 0.55 → 1.55 ($550 → 1555 potential)

Oct 23 - MSTR 217.5c $3 → ? 20+ (swing). sold 50% at 6 for 100% gain!

Oct 23 -NFLX 750p $3.50 → 9.20 ($3500 → $9200 potential)

Oct 22 - SPX 5850c $3 (dipped to 1) ran to $14.80 on Round 1 ($3000 → $14800 potential)

Oct 22 - SPX 5850c $3 ran to $11 on Round 2 ($3000 → $11000 potential)

Oct 21 - SPX 5850c $1.50 ran to $5.6 on Round 1 ($1500 → $5600 potential)

Oct 21 - SPX 5850c $0.45 ran to $4.8 on Round 2 ($450 → $4800 potential)

Oct 21 - NFLX 775c $4 ran to $9.52 ($4000 → $9520 potential)

Oct 18- MSTR 210c $1 → $8.50 ($1000 —> $8500 potential)

Oct 17 - NFLX 705 commons buy after earning earnings. Exit 761. $56 Dollars!

Oct 17- SPX 5870c $1.80 → $7 ($1800 —> $7000 potential)

Oct 15- SPX 5800p $2.20 → $5.50 ($2200 —> $5500 potential)

Oct 15 - SMCI 50c $0.60→ $1.85 ($600 —> $1850 potential)

Oct 15 - SPX 5830c $4 → $18 ($4000 —> $18000 potential)

Oct 14 - SPX 5870c $0.45 → $4.4 ($450 —> $4400 potential)

Oct 14 - MSTR 210p 4.50 →$13.7 ($4500 → 13700 potential)

Oct 14 - PDD 135p(swing) 1.50 → $12 ($1500 → $12000 potential)

Oct 11 - SPX 5810c $5 → $14 ($5000 —> $14000 potential)

Oct 11 - SPX 5805p $1 → $13.50 ($1000 —> $13500 potential)

Oct 10 - SPX 5800c $2 → $6 ($2000 —> $6000 potential)

Oct 10 - SPX 5750p $0.50 → $3.40 ($500 —> $3400 potential)

Oct 09 - SPX 5775c $2.5 (thanks JY!) → $22 ($2500 —> $22000 potential)

Oct 09 - SPX 5800c $0.5 (dipped 0.20) → $2.45 ($500 —> $2450 potential)

Oct 09 - SPX 5790c $1 (dipped 0.70) → $8.65 ($1000 —> $8650 potential)

Oct 09 - SPX 5790c Round 2 $3.5 → $7.5 ($3500 —> $7500 potential)

Oct 08 - SPX 5750c $1 (dipped 0.70) → $2.30 ($1000 —> $8400 potential)

Oct 08 - SPX 5750c $2 (dipped 1.70) → $8.40 ($2000 —> $8400 potential)

Oct 08 - MSFT 415c $3 risk 0.20 —> 4.10 ($3000 → $4100) 5R!

Oct 07 - SPX 5720c $1 (dipped 1.20) → $3.30 ($1200 —> $3300 potential)

Oct 07 - SPX 5690p $1.50 (dipped 1.55) → $10.50 ($1550 —> $10500 potential)

Oct 07 - PDD 145p $2.35 (swing) → 5

Oct 04 - SPX 5700p $5 → $15.50 ($5000 —> $15500 potential)

Oct 04 - SPX 5730c $6 → $23.90 ($6000 —> $23900 potential)

Oct 04 - SPX 5740c $1.50 → $14 ($1500 —> $14000 potential)

Oct 04 - SPX 5750c $1 → $5 ($1000 —> $5000 potential)

Oct 04 - OXY 55c $0.35 → $0.80 ($3500 —> $8000 potential)

Oct 04 - META 595c $0.12 → 1.90 ($1200 —> $19000 potential)

Oct 03 - SPX 5655p $1 → $5 ($1000 —> $5000 potential)

Oct 03 - SPX 5690c $2 → $14.20($2000 → $14200 potential)

Oct 03 - SPX 5695c $1-2 → $9.80 ($1500 → $9800 potential)

Oct 03 - NVDA 125c $0.55 (swing)

Oct 03 - XOM 123c $0.22 (swing)

Oct 03 - OXY 55c $0.33 (swing)

Oct 03 - PDD 155c $1.20 (swing)

Oct 03 - SPX 5720/25 bear calls $2 —> 0 (risk $500 to collect $2000 premium)

Oct 02 - SPX 5700p $2.50 → $8.50 ($2500 —> $8500 potential)

Oct 02 - SPX 5720/25 bear calls $2.50 —> 0 (risk $500 to collect $2500 premium)

Oct 01 - SPX 5720p $3 → $12 ($3000 —> $12000 potential)

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Trade Recap for Monday Oct 28

GOLD BOLD ITALIC = price action signal

GOLD REGULAR = action to take/taken

GREEN REGULAR = trades I should have taken

SPY / SPX

Overall super tight range. Let the first hour develop, and based on the volume and action it looked like a chop consolidation day coming and that’s what we got. I made a couple of attempts to show shooting for gap fill at 579, but no joy and then in afternoon we got a sexy yolo that paid 200%.

There was pretty much nothing to do.

TSLA

Went short and was up 50% and then got stopped. Was too soon. Then after 11am we got exhaustion. and there were multiple short signals.

271-274 was previous sell zone on daily

strong rejection at 273 and back test with lower high

morning high break and below 10:30 high

VWAP back test and rejecton on a failed push after 1pm.

268 break and then low of day beak/ back test.

This all led to a 4 level drop. Given the run up we could see 245-250 retested ahead of elections.

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Education - How to Join a Strong Trend

The process I typically follow for joining a strong trend are as follows:

All day grinder: join on dips to 20ma

Multi-day grinder:

Join either on support test of morning lows/failed breakdown reversal

Join at vwap mid day or end of day

Keep it simple. Don’t chase, wait for support levels for great risk/reward entries!

Education - Systematic Profit Taking

How do I take profits? I keep it relatively simple. Depending on the entry and range to the next levels I typically with take profits 50-100% of my profits at 3-10R and then raise stops to above entry with a goal of letting runners take me to the next level or 2 and to then reload if I believe we are consolidating before the next leg.

I then repeat the same process on the reload.

Let me know in the comments if you have questions or would like to see examples, I’ll share them.

Trade Ideas - Plan for Tueday Oct 29

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Ideas

We have a big week of earnings and econ data ahead. expecting some early profit taking on gap up and then maybe some dip buying

Be sure to read this post in preparation for action this week ahead of elections.

Let’s go over the ideas…