Will CPI numbers carry SPY to 590+? Trade ideas for Jan 15, 2024

Are you planning trades that pay as much as 5 to 20 times your risk? ! If not, Join THT to improve your trading.

Good morning traders !

Solid planning yesterday for gap fill, actually I ended up being surprised by how much SPY went red on the day.

Remember the TSLA 430c swing and target sell exit of 5-10. Alerted exits at $8 from our sub $1.50 scoops!

Tuesday Highlights

SPY - gapped up into 585 and then flushed into 578 before ripping into 582 for the close.

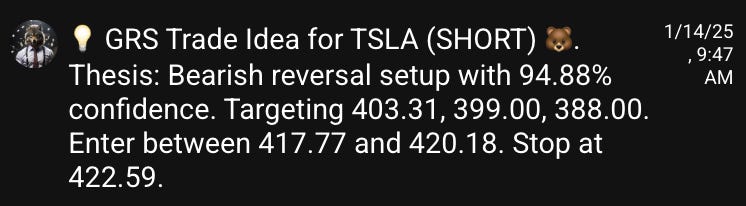

TSLA - gapped up and ran to 420! Playbook scanner generated this signal in backtesting.. Overall TSLA flushed more than I was expecting, all the way to sub 399. Amazing that the scanner signaled short with 94.88% confidence and that T2 was met by end of day.

MSTR - held up and pushed exactly to 355 level in afternoon. Algo generated these short signals in backtesting.

Still running into hiccups with getting the playbook scanner to alert in real time but making progress toward that.

Wed Premarket Highlights

SPY - gapping up again toward 585 ahead of CPI numbers. SPX IV is at over 43%!!!

TSLA - gapping up over 400

Join THT PRO to get alerts, real-time commentary, and improve trading habits.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading—your daily source for market insights and trading opportunities. Here, you’ll find comprehensive market analysis, educational lessons, and trade ideas to help you excel in trading, all while spending less than two hours a day.

What Subscribers Get

Subscribers receive daily market analysis updates, educational content, and up to three trade ideas each morning based on real-life examples and my trading approach.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

2025 Q1 Alert Leaderboard

Here's a look at some of the potential gains achieved through our entry alerts:

Intraday Alerts

2024-01-02 SPX 5880p 11 to 40+

2024-01-02 SPX 5820p $2 to 10

2024-01-03 SPX 5930c $2, dipped to $3 and ran to $11

2024-01-06 SPX 5980p $1.70 → $20 ($1700 to $20k potential)

2024-01-07 SPX 5900p $0.50 → $11 ($500 to $11000 potential)

2024-01-07 SPX 5930p $5 → $17.4 ($5000 to $17400 potential)

2024-01-07 SPX 5930p $5 → $40 ($500 to $4000 potential)

2024-01-08 SPX 5800p 1/10 $4 → $10 ($400 to $1000 potential)

2024-01-10 SPX 5800p 1/10 $4 → $10 ($400 to $1000 potential)

2024-01-13 SPX 5820c $5 → $10 ($400 to $1000 potential) **Round 1

2024-01-13 SPX 5820c $2.80 → $16 ($400 to $1000 potential) ** Round 2

2024-01-13 SPX 5820c $4.50 → $16 ($400 to $1000 potential)** Round 3

2024-01-14 SPX 5870c $0.75 → $3.75 ($750 to $3750 potential)

2024-01-14 TSLA 430c $0.75 → $3.75 ($750 to $3750 potential)

Swing Alerts

2024-01-13 TSLA 430c $1.30 → 9 (1300 to $9000 potential) **alerted exits at 6.50 and 8

Credit Sell Alerts

2024-01-14 SPX 5800.5795 bull puts for 1.50-2.50. $2000 credit potential using 10 contracts and $1000 risk.

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Trade Recap for Tuesday Jan 14

GOLD BOLD ITALIC = price action signal

WHITE REGULAR = action to take/taken

GREEN REGULAR = trades I should have taken

SPY / SPX

Were you able to spot the signals?

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Education - How to Join a Strong Trend

The process I typically follow for joining a strong trend are as follows:

All day grinder: join on dips to 20ma

Multi-day grinder:

Join either on support test of morning lows/failed breakdown reversal

Join at vwap mid day or end of day

Keep it simple. Don’t chase, wait for support levels for great risk/reward entries!

Education - Systematic Profit Taking

How do I take profits? I keep it relatively simple. Depending on the entry and range to the next levels I typically with take profits 50-100% of my profits at 3-10R and then raise stops to above entry with a goal of letting runners take me to the next level or 2 and to then reload if I believe we are consolidating before the next leg.

I then repeat the same process on the reload.

Let me know in the comments if you have questions or would like to see examples, I’ll share them.

Trade Ideas - Plan for Wed Jan 15

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Ideas

Need to watch or market reaction after CPI. With SPX IV being over 43% I will likely look for credit sells and directional trades after 11am

Read on for my thoughts/plans…