We had great success with NVDA and SPY trade ideas yesterday. Can SPY continue its upward trend today? RIVN is soaring... - Trade Ideas for June 26, 2024

Our NVDA and SPY long ideas were spot on. Discover how, when, and why to enter long positions based on price action.

Good morning traders!

Tuesday provided another great day. I took AVGO long for sympathy move with our NVDA long idea and it failed. Upon trade review, I was to excited for the possible gains, that I didn’t wait for the entry I really wanted. Thankfully small losses. Bottom line, I didn’t follow process on this trade. (greed outweighed proper execution — yes still happens to me)

But not to fret, our NVDA and SPY longs paid!

The best part is that SPY/SPX provided multiple 4x+ trades!

In today’s blog I’ll go over the trade setups, and the planning of the trades.

I’ll also include RIVN and possible trade ideas on it.

If you're struggling, take some time to review past blog posts and learn the processes and core trade setups I use. Patience is key. Don't force yourself into a trade. Only enter trades at or near key levels with enough range to the next level to provide a great risk/reward opportunity.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas each morning, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

June 25 - SPX 4470c $1 —> ($1000—> $5000 potential)

June 24 - SPX 4460p $1 —> ($1000—> $12000 potential)

June 20 - NVDA 135p $0.75 —> ($750—> $5000 potential)

June 20 - SPX 4480p $1.50 —> ($1500—> $10000 potential)

June 20 - SPX 4475p $0.50 —> ($500—> $5000 potential)

June 13 - SMCI 820c $10 stops $5 —> ($1000—> $6200 potential)

June 13 - SMCI 900c $2.50 stops $1.25 —> ($2500—> $13000 potential)

June 13 - AVGO 1650p $5 stops $3 —> ($5000—> $22500 potential)

June 12 - SPX puts on SPY 544 reject —> SPX 5220p went from $1 to $12

June 12 - AAPL 220c $0.85 —> ($850 —> $2800 potential)

June 11 - AAPL 200c $1.50 —> ($1500 —> $7500 potential —> $20000 if swung)

June 11 - AAPL 205c 6/21 $1 (swing) —> ($1000 -$6000 —> $15000 if swung)

June 11 - SPX 5360c $2.50 —> ($2500 —> $15000 potential)

June 10 - SPX 5350c $4.20 —> ($4200 —> $16000 potential)

June 6 - NVDA 1220c $12 —> ($1200 —> $2100 potential)

June 5- SPX 5350c 0.30 —> ($3000 —> $45000 potential)

June 5 - META 490c $3 —> ($3000 —> $9500 potential)

June 4 - SPX 5290/95 bear calls $1.80 —> ($1500 credit potential, $1000 if held to close)

June 3 - SPX 5280p $5 —> ($500 —> $4500 potential)

May 22 - SPX 5280p $0.10 —> ($1000 —> $43000 potential)

May 22 - SPX 5300p $0.50 —> ($500 —> $15000 potential)

May 21 - SPX 5320c $0.50 (alert: 0.25 target $2-5) —> ($500 —> $6000 potential)

May 21 - SMCI 1000c $9.25 Swing (entry day before) —> ($925 —> $2100 potential)

May 17 - AMD 170c $0.20 Swing (entry day before) —> ($200 —> $1500 potential)

May 16 - SPX 5300p $0.20 Round 3 —> ($200 —> $2800 potential)

May 16 - SPX 5300p $0.50 Round 2 —> ($500 —> $2600 potential)

May 16 - SPX 5300p $1 Round 1 —> ($1000 —> $5000 potential)

May 15 - SMCI 850c $12 —> ($1200 —> $10000 potential)

May 14 - SPX 5240c $0.50 —> ($500 —> $10600 potential)

May 14 - SPX 5230/5225 bull puts $4 —> ($4000 premium potential)

May 14 - SPX 5245c $0.20 —> ($200 —> $6000 potential)

May 14 - SPX 5240c $0.50 —> ($500 —> $10600 potential)

May 14 - SPX 5230/5225 bull puts $4 —> ($4000 premium potential)

May 13 - SPX 5220/5215 bull puts $2.50 —> ($2500 premium potential)

May 13 - TSLA 170p $1.90 —> ($1900 —> $2890 potential)

May 10 - AMD 162.50p $0.25 (0.25 entry) —> ($250 —> $1600 potential)

May 9 - SPX 5210c $1.25 (1-1.50 entry) —> ($1250 —> $6200 potential)

May 9 - SPX 5220c $0.20 —> ($200 —> $1100 potential)

May 9 - SPX 5200c $3 —> ($3000 —> 15800 potential) (dipped to 2.20)

May 8 - SPX 5200/5205 bear calls $1.20 —> ($1200 premium potential)

May 8 - SPX 5190/5195 bear calls $1.50 —> ($1500 premium potential)

May 8 - SPX 5180c $4 —> ($400—> $1100 potential)

May 7 - SPX 5190c $1 —> ($1000—> $4000 potential)

May 7 - SPX 5190c $1 —> ($1000—> $4000 potential)

May 7 - DIS 105p $0.40 —> ($400—> $1600 potential)

May 6 - SPX 5170c $3 —> ($300—> $1100 potential)

May 6 - SPX 5175c $0.40 —> ($400 —>$7000 potential)

May 3 - SPX 5150/5155 bear calls $1.50 —> ($1500 premium potential)

May 2 - SPX 5020p $7 —> ($700 → $2180 potential)

May 2 - SPX 5070c $1.20 —> ($1500 → $7200 potential)

May 2 - SPX 5070c $3—> ($3000 → $7200 potential)

Apr 30 - SPX 5080p $3 —> ($3000 → $45000 potential)

Apr 23 - SPX 5060/5055 bull puts - Entry $1.75 ($1750 premium potential) drawdown < $200

Apr 22 - SPX 5050c swing - $5.50 → ($5500 → $42000 potential)

Apr 22 - SPX 5000c - $3.20 → ($3200 → $39000 potential)

Apr 22 - SPX 5020c - $0.20 alert, dipped to 0.55, fill at $0.70 → ($700 → $20000 potential)

Apr 19 - SMCI 750p - $1.50 → ($1500 → $38k+ potential)

Apr 19 - NVDA 800p - Entry $0.5 ($500→$40k potential)

Apr 18 - SPX 5050c - Entry $6 ($6000→$16000 potential)

Apr 18 - SPX 5020p - Entry $4 ($5000→$20000 potential)

Apr 16 - SPX 5140/5135 bull puts - Entry $2.50 ($2500 premium potential) drawdown < $300

Apr 12 - SPX 5100p $1. (dipped to 1.30) - Entry $2 ($2500 premium potential)

Apr 11 - SPX 5180/5185 bear calls - Entry $2.50 ($2500 premium potential)

Apr 10 - SPX 5180/5185 bear calls - Entry $2.50 ($2500 premium potential)

Apr 10 - SPX 5170c - Entry 0.50 ($500 → $5000 potential)

Apr 9 - SPX 5185/5180 bull puts - Entry $3 ($3000 premium potential)

Apr 9 - SPX 5205c - Entry $0.50 ($500→ $6000 potential)

Apr 8 - SPX 5225/5230 bear calls - Entry $1.20 ($1200 premium potential)

Apr 8 - SPX 5200/5195 bear puts - Entry $0.10 ($1000→ $8000 potential)

Apr 4 - SPX 5250p - Entry $4 ($4000→ $100k potential)

Apr 4 - SPX 5180p - Entry $1.30 ($1300 > $32k potential)

Apr 3 - SPX 5175/5170 bull put - Entry $1.50 ($1500 premium potential)

Apr 2 - SPX 5175/5170 bull put - Entry $1.50 ($1500 premium potential)

Apr 2 - SPX 5205/5200 bull put - Entry $1.50 ($1500 premium potential)

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Tuesday’s Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

Please note all times are Eastern/New York regardless of what time zone I happen to be in.

SPY / SPX

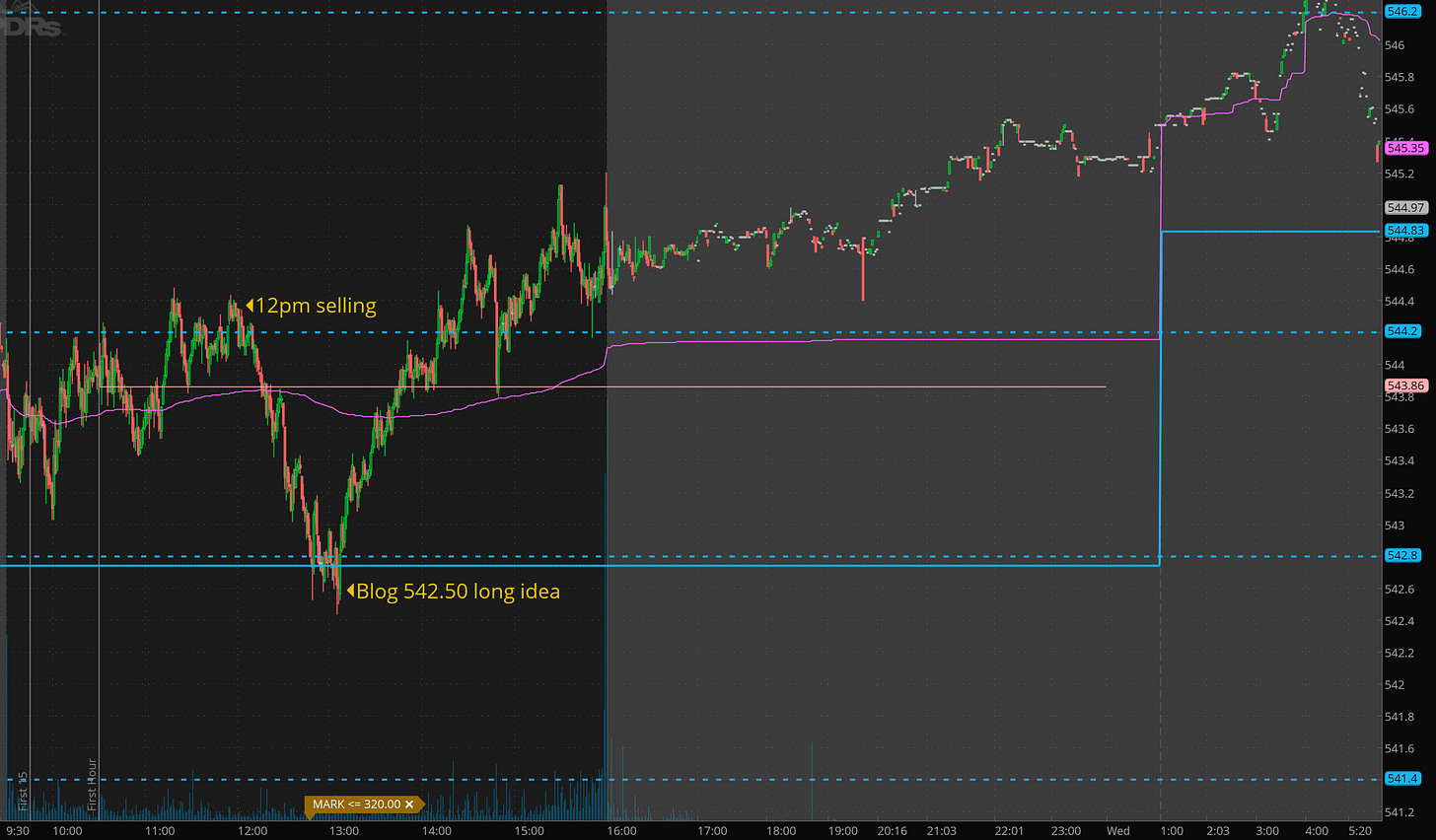

Yesterday I wrote, that I wanted a dip ad rip of 542.50 and that is exactly what we got after lunch at 1pm.

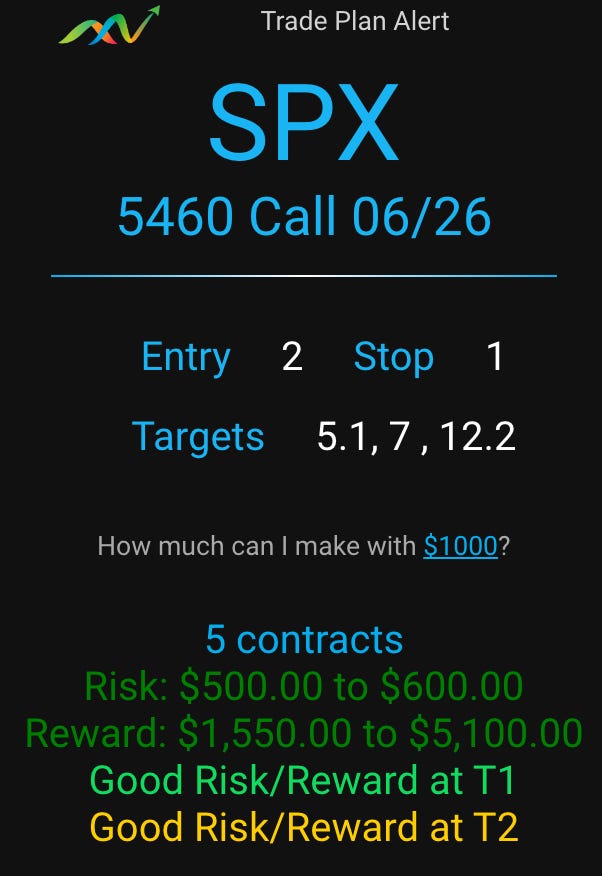

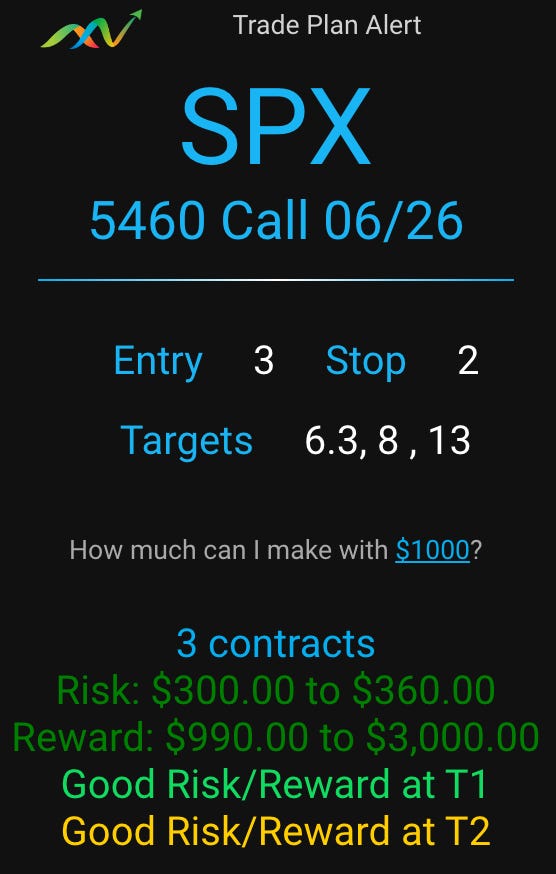

Taking SPX 5460c for $2-3 would have got you $10-$12 for an exit comfortably.

So what is the trigger for entry? Notice the new low and reclaim of 542.80, that is the trigger with a defined stop. There are 2 methods I use.

Method 1 - Anticipate Reversal. If I have high confidence in the reversal at that level, after the initial dip I will place an order just below or near that price. In this case it was 2.09 so I would place an order at $2 and $1.80, anticipating the failed break down reversal.

Method 2 - After Reversal. After observing the failed breakdown reversal, I can get long and use the low from the reversal as a stop.

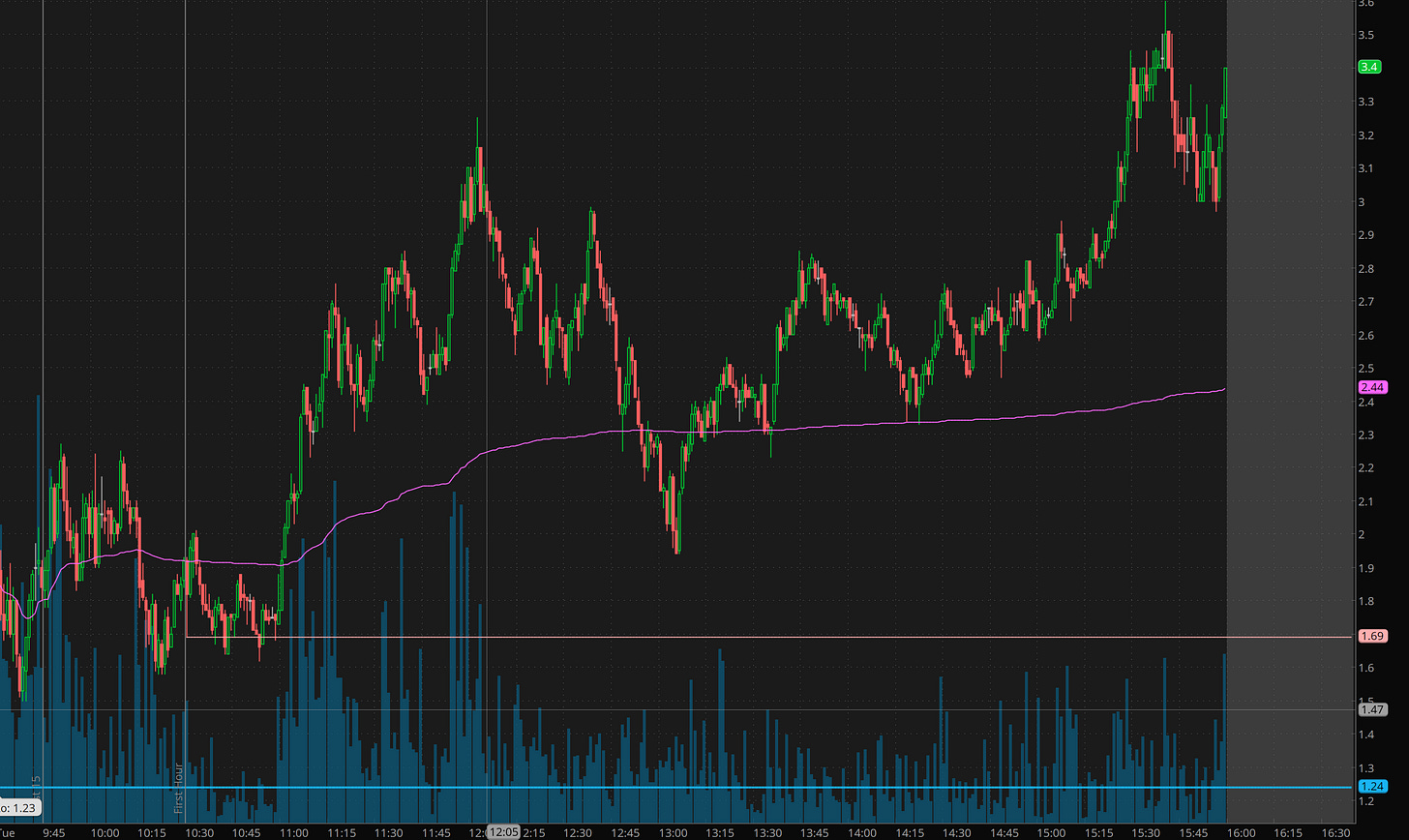

Here the chart for the 5460c. Where would you enter?

Need help figuring out what price to sell at? Edge Trade Planner can help. Check out the sell targets with the chart above:

Method 1 Plan:

Method 2 Plan:

I built edge trade planner to provide a consistent guide for where to sell so I don’t sell too soon or too late. With a priority on consistently collecting profits. Do you have this problem?

NVDA

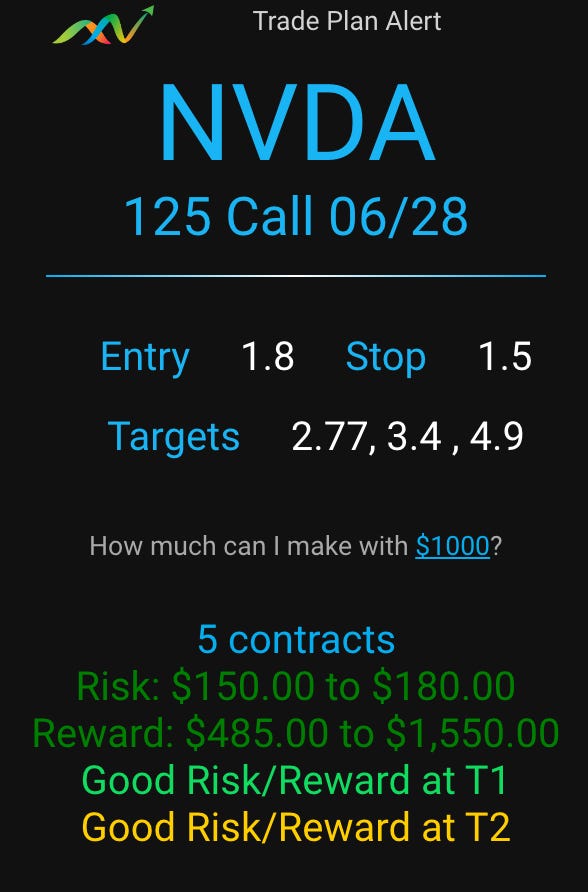

In yesterday’s blog I wrote I wanted 118 dip and rip for a move into 125-130. We only got 120 failed breakdown reversal. So no entry for 118. After the first hour we consolidated over vwap. So what do we do? the 120 failed breakdown establishes the upside thesis. First I wait for the first hour to complete. There are 2 ways to enter. Since I have a bullish bias I can go with 2 triggers. Enter near vwap / any basing of 10:30 (peach line ) level or wait for high of day break.

We want to target 130.50 for this move. So let’ take 125c and see what happens. If 130.50 comes, they will hit $5-6

Using Edge Trade Planner, I can enter for 1.80 and use 1.50 - 1.55 as the stop (previous lows). Plugging that into edge gives us this plan.

Not bad targeting by the planner with both T1 and T2 hit by end of day. T3 might be filled today!

Look at how much time is saved by combining process, the levels, and the planner. You can create bracket orders for the exits and walk away for the day! This is how I am able to trade with less stress, less effort, and fewer trades. Do you want this? if so try edge trade planner out or message me with questions.

Trade Ideas - Plan for Wed June 26

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Ideas

SPY tagged the 456.20 target I had overnight and now is back to yesterday’ close. I wanted this level to consider a short entry for next leg down.

Overall I think we are in for a bit of chop/consolidation action over the next couple of weeks unless some news comes that change that.