We got over 20x yesterday! Finally a Green Day after 6 red ones. Is it time to buy the dip? Day Trading Ideas for Apr 23

TSLA reports tonight with a large bearish bet placed yesterday

Good morning traders!

How would you like to turn $1000 into $10-20k? You can if you follow process and planning.

Last week on Friday I was looking for a reversal play. Yesterday was the same thought process and if paid off. Having a systematic process will can and should regularly produce results. Our planning led to multiple wins yesterday ranging from 3 to 25x. That’s right. Not 30%, but 300 to 2500%.

I was wrong on the reversal happening on Friday, but did it deter me? Even Friday being wrong, we flipped and got puts and got paid by following process. Same thing with yesterday. Followed process, got positioned, and this time the reversal played out. We used the levels to take profits and did solid work.

One of the things I can’t stress enough. Don’t worry about making money in trading, worry about planning and executing trades well to what ever process you have. The profits will come as a natural by product. Don’t measure your success daily by how much you made or lost, but by how well you executed to process. Change that value system and I process not only will your account grow, but you will be a calmer, happier trader.

In today’s blog I’ll review how I planned for the massive gains and how the Edge Scanner nailed catching the action in NVDA.

The big question on everyone’s mind is, Is it time to buy the dip? I’ll go over my thoughts on this along with trade ideas for today.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas each morning, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Apr 22 - SPX 5000c - $3.20 → ($3200 → $39000 potential)

Apr 22 - SPX 5020c - $0.20 alert, dipped to 0.55, fill at $0.70 → ($700 → $20000 potential)

Apr 19 - SMCI 750p - $1.50 → ($1500 → $38k+ potential)

Apr 19 - NVDA 800p - Entry $0.5 ($500→$40k potential)

Apr 18 - SPX 5050c - Entry $6 ($6000→$16000 potential)

Apr 18 - SPX 5020p - Entry $4 ($5000→$20000 potential)

Apr 16 - SPX 5140/5135 bull puts - Entry $2.50 ($2500 premium potential) drawdown < $300

Apr 12 - SPX 5100p $1. (dipped to 1.30) - Entry $2 ($2500 premium potential)

Apr 11 - SPX 5180/5185 bear calls - Entry $2.50 ($2500 premium potential)

Apr 10 - SPX 5180/5185 bear calls - Entry $2.50 ($2500 premium potential)

Apr 10 - SPX 5170c - Entry 0.50 ($500 → $5000 potential)

Apr 9 - SPX 5185/5180 bull puts - Entry $3 ($3000 premium potential)

Apr 9 - SPX 5205c - Entry $0.50 ($500→ $6000 potential)

Apr 8 - SPX 5225/5230 bear calls - Entry $1.20 ($1200 premium potential)

Apr 8 - SPX 5200/5195 bear puts - Entry $0.10 ($1000→ $8000 potential)

Apr 4 - SPX 5250p - Entry $4 ($4000→ $100k potential)

Apr 4 - SPX 5180p - Entry $1.30 ($1300 > $32k potential)

Apr 3 - SPX 5175/5170 bull put - Entry $1.50 ($1500 premium potential)

Apr 2 - SPX 5175/5170 bull put - Entry $1.50 ($1500 premium potential)

Apr 2 - SPX 5205/5200 bull put - Entry $1.50 ($1500 premium potential)

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Monday’s Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

SPY/SPX

We finally got the reversal setup we were looking for.

The opening action gave a long entry signal so we got long , but I noticed that SPY was struggling/rejecting premarket highs. So had to stop out.

It then broke morning lows popped for a short entry as it started selling again. At this point I was looking for the solid blue line to come and if it broke another day like Friday.

However in the back of my mind, I’m still looking for a reversal / green day to develop. So we wait and let the price action tells us.

Review the chart above for how I started planning the reversal and the long and where we got in for the upside and how I targeting 501.50 for exits.

The key factors that let me hold size on not sell early this time were

1 - I’ve seen how strong reversal days can be

2 - VIX was plummeting.

SPX 5020c went from 0.55 at the lows, to 0.60 around 11:41 (notice how we didn’t have to enter at absolute low, and you can wait for confirmation) to $20!!! I sold most at 17ish when it got to 501.50.

Learn to plan trades and use the levels as your guide!

NVDA

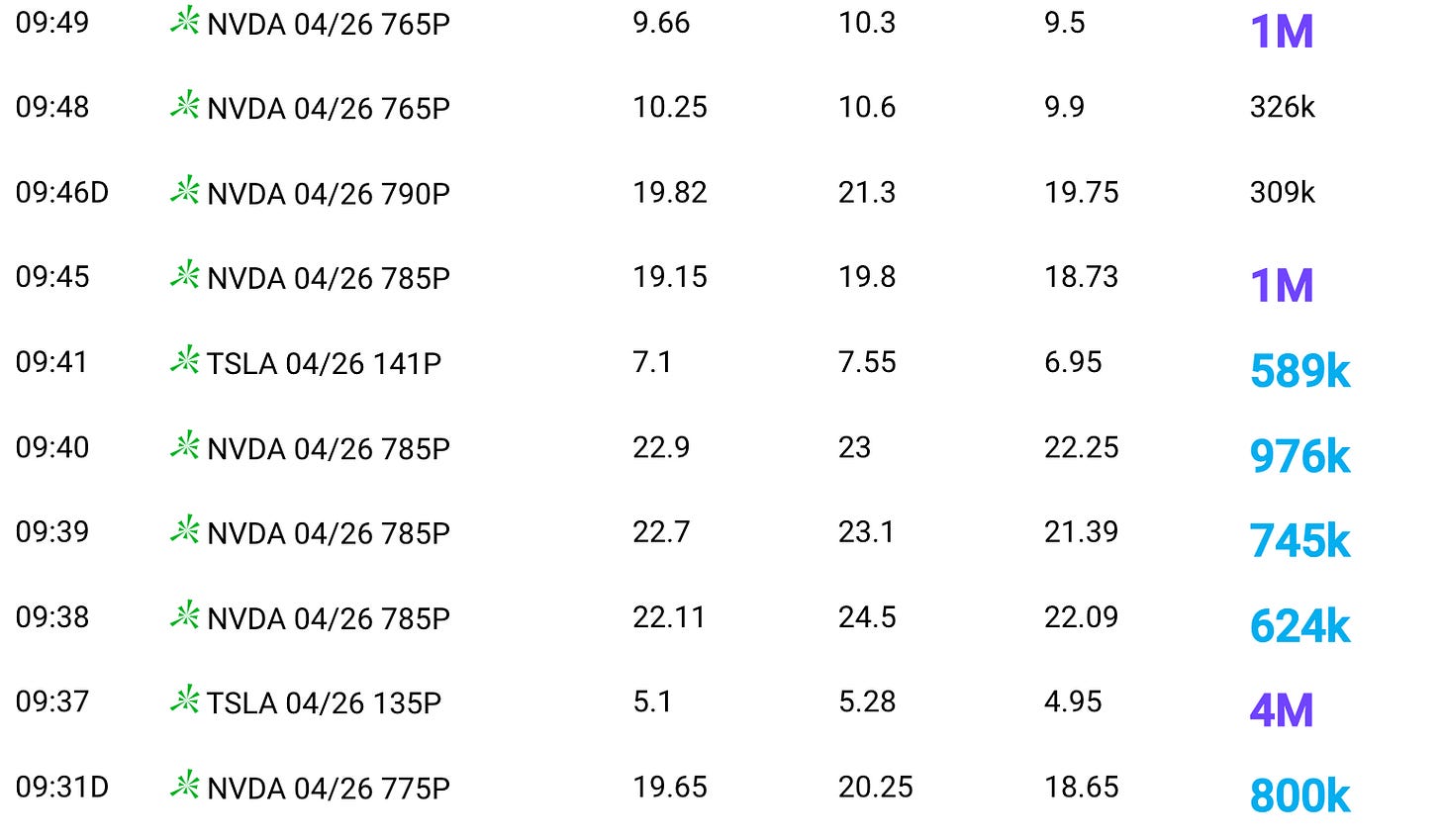

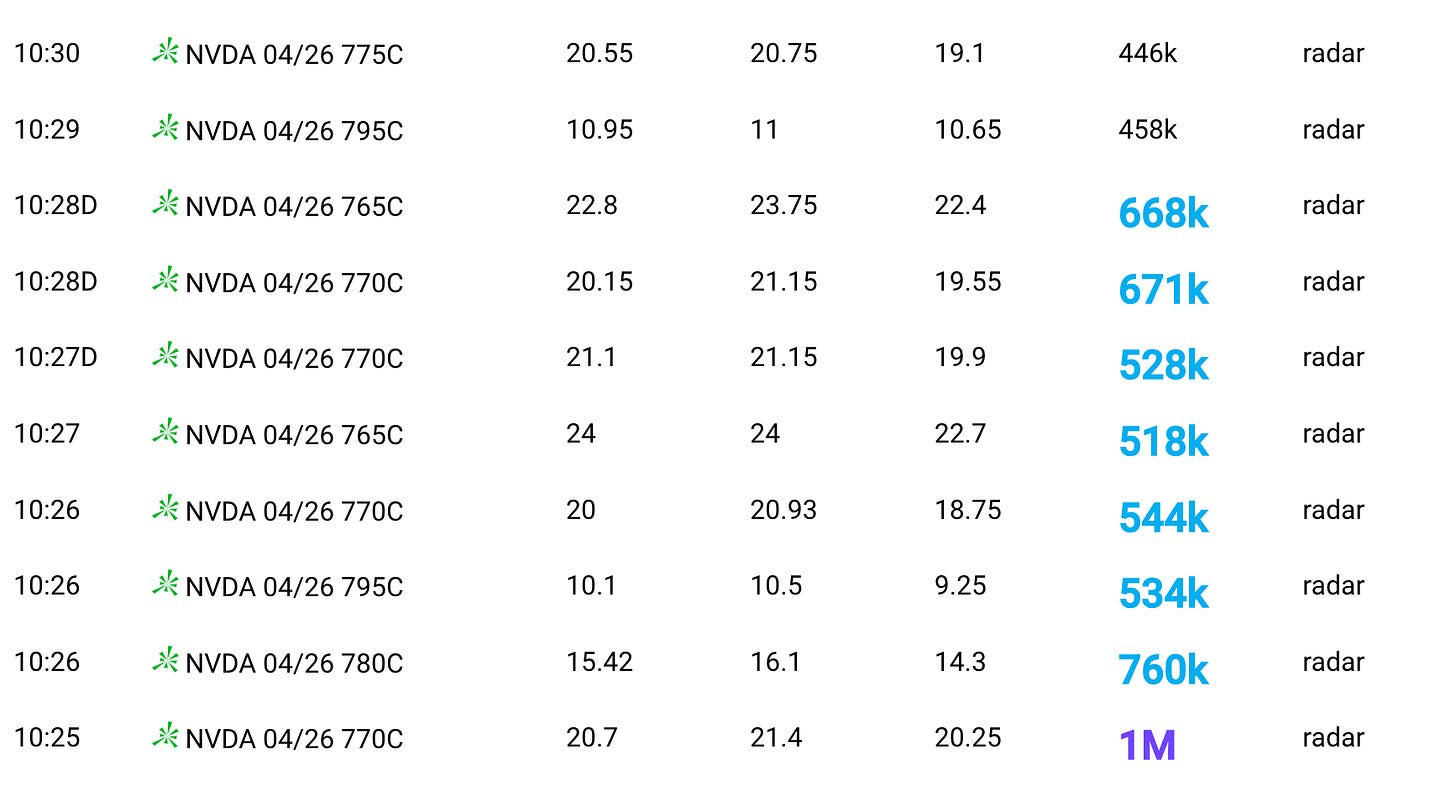

I didn’t trade NVDA yesterday, but Edge’s Scanner was on fire.

It caught heavy sell positioning into opening rally. NVDA proceeded to dump from 795 to 765 over night 45minutes.

Then guess what. Edge Scanner caught a bunch of BTFD come in.

This morning NVDA has gapped up over 800! :)

I have very specific criteria for the scanner to help identify how is big money possibly positioning. Paying attention to this can really pay off!

Trade Ideas - Plan for Tuesday Apr 23

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Market was gapping up but has filled most of the gap. My normal suggest would be to assume BTFD will come today for a second green day however given recent selling I give it more of a 60/40 chance instead of 80/20 chance of day 2 rally.

There is a risk today turns into a consolidation day with range bound action between 499 and 503 as the market waits on PCE numbers and earnings results.

Tomorrow I will be trading TSLA, today, the contracts are juiced and so I will skip it.

I’m watching today: SPY, NVDA, GS