Time for a backtest in SPY? Trade ideas for Wed May 8

Disney break support, SPY gaping down, TSLA drops

Good morning traders!

A big part of trading and is one of the most important skills to develop is waiting. Waiting for entry and waiting for exits.

Yesterday made a thesis, on DIS and contracts dropped significantly in price to provide an amazing return and if right the swing will provide even more!

I then made a plan to trade the last 30mins and place cheap yolo orders in anticipating a squeeze at the close again. This time it worked but only provided 3-7x.

I’ll go over my planning and profit taking process.

As for today, so far premarket is looks a bit weak and the closing action hinted at some market weakness. This is normal. We just ran over 120 points without a backtest.

Let’s get into the review and then into ideas for today…

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas each morning, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

May 7 - SPX 5190c $1 —> ($1000—> $4000 potential)

May 7 - DIS 105p $0.40 —> ($400—> $1600 potential)

May 6 - SPX 5170c $3 —> ($300—> $1100 potential)

May 6 - SPX 5175c $0.40 —> ($400 —>$7000 potential)

May 3 - SPX 5150/5155 bear calls $1.50 —> ($1500 premium potential)

May 2 - SPX 5020p $7 —> ($700 → $2180 potential)

May 2 - SPX 5070c $1.20 —> ($1500 → $7200 potential)

May 2 - SPX 5070c $3—> ($3000 → $7200 potential)

Apr 30 - SPX 5080p $3 —> ($3000 → $45000 potential)

Apr 23 - SPX 5060/5055 bull puts - Entry $1.75 ($1750 premium potential) drawdown < $200

Apr 22 - SPX 5050c swing - $5.50 → ($5500 → $42000 potential)

Apr 22 - SPX 5000c - $3.20 → ($3200 → $39000 potential)

Apr 22 - SPX 5020c - $0.20 alert, dipped to 0.55, fill at $0.70 → ($700 → $20000 potential)

Apr 19 - SMCI 750p - $1.50 → ($1500 → $38k+ potential)

Apr 19 - NVDA 800p - Entry $0.5 ($500→$40k potential)

Apr 18 - SPX 5050c - Entry $6 ($6000→$16000 potential)

Apr 18 - SPX 5020p - Entry $4 ($5000→$20000 potential)

Apr 16 - SPX 5140/5135 bull puts - Entry $2.50 ($2500 premium potential) drawdown < $300

Apr 12 - SPX 5100p $1. (dipped to 1.30) - Entry $2 ($2500 premium potential)

Apr 11 - SPX 5180/5185 bear calls - Entry $2.50 ($2500 premium potential)

Apr 10 - SPX 5180/5185 bear calls - Entry $2.50 ($2500 premium potential)

Apr 10 - SPX 5170c - Entry 0.50 ($500 → $5000 potential)

Apr 9 - SPX 5185/5180 bull puts - Entry $3 ($3000 premium potential)

Apr 9 - SPX 5205c - Entry $0.50 ($500→ $6000 potential)

Apr 8 - SPX 5225/5230 bear calls - Entry $1.20 ($1200 premium potential)

Apr 8 - SPX 5200/5195 bear puts - Entry $0.10 ($1000→ $8000 potential)

Apr 4 - SPX 5250p - Entry $4 ($4000→ $100k potential)

Apr 4 - SPX 5180p - Entry $1.30 ($1300 > $32k potential)

Apr 3 - SPX 5175/5170 bull put - Entry $1.50 ($1500 premium potential)

Apr 2 - SPX 5175/5170 bull put - Entry $1.50 ($1500 premium potential)

Apr 2 - SPX 5205/5200 bull put - Entry $1.50 ($1500 premium potential)

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Tuesday Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

SPY / SPX

Great trade plans. I had to wait until after lunch to make any money on SPY/SPX. but it paid.

In premarket I shared that my plan was to see a rejection at 518.50 and to get short.

If you follow my process, you know that I look for 2 level moves away from the r/g on gap up for a short entry and yesterday we got exactly that.

With that in mind as market moved closer to 518.50, I alerted my plan for credit sells as well as a swing short order on SPX 5180p for 5/8.

Credit sell plan. short around $2 stops 2.50 on SPX 5200/5205 bear calls. These filled and went to 0 by end of day.

Swing short plan. I feel like we are over due a 3-5 point yank so wanted to take a stab at it. SPX 5180p for today was 8-10 for a big part of the day, but I’m a cheap bastard. I wanted it for 5. and so I place the order in advance. Members will attest to how crazy my dip buying estimates can be. Sure enough during 518.50 spike the contracts hit $5 and then ran to $11.. What do I do? Sell 50-80%. swing the rest. Its now a free trade.

By being patient for the entries, I was able to secure 100% gains on a swing in under 2 hours and capitalize on credit sells without much if any draw down.

I also made a plan to look for a trade in last 15minutes.

This time the logic was, maybe we get a short squeeze again. So using the levels, a squeeze would mean 5199 would come. so I want to buy SPX 5190c $0.90 or less and 5195c for $0.40 or less.

Experience has taught me that I can probably get 5195c for 0.20 and it will goto 0 or give me at least a spike over $1 if I’m a little right directionally.

Both orders filled. Profit taking logic is to lock 50-80% between for 3-5x.

SPX 5190c ripped to 4.50. locked 50% at 3.5 and 30% at 4. stopped balance at 2.20

SPX 5195c ripped to 1.70. locked 30% at 0.60, 50% at 1.20 (missed the 1.50+ exits I had order at 2 for 10x) and stopped the rest at 0.60

Solid trading day! Please notice how I planned the discount shop. for a large part of the day these contracts were way more expensive. The notice how I systematically take profits. I don’t worry about max gains, I worry about consistently extracting profit and good reward/risk.

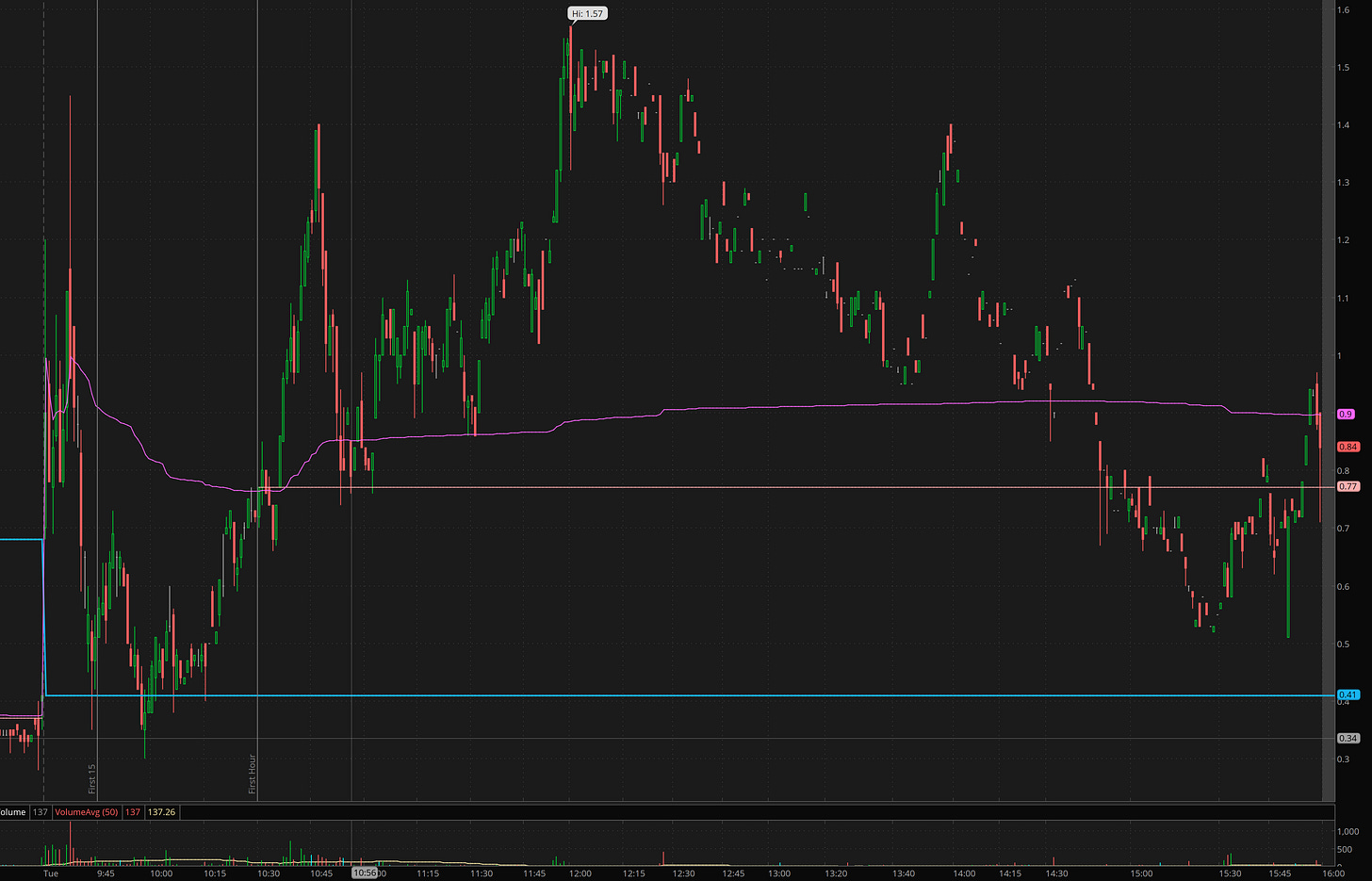

DIS

We also got a short in on this name as it followed process. Gave us a solid paying trade in the first 2 hours of trading.

Check out the huge gap down on DIS after e/r. At first I wanted a pop to 110 to get short, but the premarket action showed weakness, and then at the 15min mark there was a strong rejection of vwap. so we plan the short. I was already anticipating the rejection, and my plan for 101.50 or less target meant an entry under 0.50 would be good.

The contracts spike to 1.40 on the initial dip and then came all the way down to 0.30. During the first spike they dipped to 0.40 and I got in. then on the back test it dipped to 0.30. This had me worried, but given the morning spike and that it was Tuesday, I decided I had enough time, and 106 major support level was breached, ad so as long as we didn’t start getting closes over vwap I am going to stick to my thesis.

Sure enough we dumped. Though we didn’t get to my swing target yet. Following profit taking process at 1.20 and 1.40 I locked in 50-80%. (1.40 being previous high) and then anticipated vwap for a reload around .75 which came. We then got another spike in the contracts to 1.50, but this time it couldn’t hold so I got stopped at 1.20. I then made a plan to wait for vwap to reload the swing.

During the late afternoon we got vwap and a chance to reload under 0.60.

Trade Ideas - Plan for Wed May 8

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Crypto name swing ideas

BTC is back at 64k. as long as 60k can hold hawking dip buys on COIN, and MSTR.

COIN sub 220, and MSTR sub 1200

Ideas

Today I’m focused on TSLA, SHOP, and SPY.

TSLA can’t catch a break. Remember a few years ago, when amazon would announce entering a segment and market leaders would dump? The same thing may have just happened to TSLA by Toyota on announcement of large investments in going electric, hydrogen powered cars, and AI.

TSLA also has a DOJ probe regarding self driving and the last kick in the pants… China sales are down BIG! 30% from march, 18% year over year.

Here are the levels and ideas I’m looking at.