SPY taps previous all time highs at 565 overnight. MSFT increases dividend. FOMC meets tomorrow. Trade ideas for Tuesday Sept 17, 2024

Are you planning trades that pay as much as 5 to 20 times your risk? If not, join THT-PRO.

Good morning traders!

Yesterday more or less went the way I expected. We got one good short trade on, and one good credit sell. The rest of the day was a waste energy on SPY. Meanwhile some name in tech started running.

Yesterday also was the 6th green day for SPY. So what is next? While I think more highs are coming, I hate chasing long into high.

On gap ups, my goto trade is looking for a gap up reversal. That said, recent rally, gap ups, have had follow through all days grinds some 50% of the time I feel.

If the market does clear 565 ahead of FOMC that is some risky behavior ahead of a major news event imho.

The 3rd week of September is usually not good for bulls so will market seasonality kill this rally?

I focus on position trades and shooting for typically 2 level moves and possibly 1 level moves if I expect tight consolidation.

I would expect us to get some gap fill and profit taking today ahead of tomorrow as a function of just hedging and taking some risk off but who knows if that is what the market ends up doing.

The important thing is to make bull and bear plans at key levels and then let the price action tell you what action to take.

Join THT PRO to get alerts, real-time commentary, and improve trading habits.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading—your daily source for market insights and trading opportunities. Here, you’ll find comprehensive market analysis, educational lessons, and trade ideas to help you excel in trading, all while spending less than two hours a day.

What Subscribers Get

Subscribers receive daily market analysis updates, educational content, and up to three trade ideas each morning based on real-life examples and my trading approach.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

2024 Alert Leaderboard

Here's a look at some of the potential gains achieved through our entry alerts:

Sep 16 - SPX 5600p $3 → 10.50 ( $3000 → $10500 potential )

Sep 11 - SPX 5500c $0.50 → 60 ( $1000 → $120000 potential )

Sep 11 - SPX 5450c $4.5 → 110 ( $4500 → $110000 potential )

Sep 11 - SPX 5400p $2.75 → 14 ( $2750 → $14000 potential )

Sep 10 - SPX 5450p $3.50 → 18 ( $3500 → $18000 potential )

Sep 09 - SPX 5450p $2.35 → 8 ( $2350 → $8000 potential )

Sep 09 - NVDA 102p $1.35 → 2.15 ( $1350 → $2100 potential )

Sep 06 - SPX 5430p $3 → 29.60 ( $3000 → $29600 potential )

Sep 06 - SPX 5430p $8 → 29.60 ( $8000 → $29600 potential )

Sep 06 - SPX 5450c 0.30 → 1.70 ( $3000 → $17000 potential )

Sep 06 - TSLA 220p 0.60 → 7 ( $600 → $7000 potential )

Sep 06 - NVDA 102p 0.20 —> 1.50 ( $2000 → $15000 potential )

Sep 05 - TSLA 230c 2.30 → 7 ( $2300 → $7000 potential )

Sep 05 - SPX 5620p 6 → 37 ( $6000 → $37000 potential )

Sep 05 - SPX 5480p 0.5 (dipped to 0.22) → 5.20 ( $1000 → $10000 potential )

Sep 04 - SPX 5630p 6 → 26 ( $6000 → $26000 potential )

Sep 03 - SPX 5630p 0.20 (dipped to 0.75) ( $750 → $19000 potential )

Sep 03 - SPX 5555p 4.50 → 46 ( $4500 → $46000 potential )

Sep 03 - NVDA 110p 1.4 —> 4.4 (1400 → 4400 potenial)

Sep 03 - UVXY 25c 1.2 —> 5.4 ( $1200 → $5400 potential)

Aug 30 - SPX 5640c 0.20 (dipped to 0.30) —> 14 ($3000 → $140000 potential)

Aug 29 - SPX 5650c 3.50 —> 6 ($3500 → $6500 potential)

Aug 29 - MSFT 420c 1.30 —> 4 ($1300 → $4000 potential)

Aug 28 - SPX 5560p 1 —> 8.70 ($1000 → $8700 potential)

Aug 28 - SPX 5560p 1 —> 8.70 ($1000 → $8700 potential)

Aug 28 - SPX 5580p 1.75 —> 21 ($1750 → $21000 potential)

Aug 27-28 - PDD 95p 0.75 → $7 ($750 → $7000 potential) *swing trade

Aug 27 - SPX 5620c 4.50 → $19 ($4500 → $19500 potential)

Aug 27 - PDD 95p 0.75 → $1.66 ($750 → $1660 potential) *swing still in play

Aug 26 - PDD 100P $1.50 → $6.50 ($1500 → $6500 potential)

Aug 23 - SPX 5600p $7 → 38 ($7000 → $38000 potential)

Aug 22 - SPX 5600p $7 → 38 ($7000 → $38000 potential)

Aug 21 - META 535c $3 → 8.50 ($3000 → $8500 potential)

Aug 20 - SPX 5600p $4.50 → 15 ($4500 → $18000 potential)

Aug 20 - SPX 5580p $2 → 7 ($2000 → $7000 potential)

Aug 19 - SPX 5600c $0.4 → 8.25 ($400 → $8250 potential)

Aug 15 - SMCI 600c (swing) $2 → 38 ($2000 → $38000 potential)

Aug 15 - SPX 5540c 0.50 —> 3.50 ($500 → $3500 potential)

Aug 14 - SPX 5400p 5.50 → 10 ($5500 → $10000 potential)

Aug 14 - SPX 5450c 4 → 10 ($4000 → $10000 potential)

Aug 14 - SPX 5450c 1.50 → 10 ($1500 → $10000 potential)

Aug 14 - SPX 5460c 0.20 → 3 (0.10 entry goal, took small 0.20) ($200 → $3000 potential)

Aug 13 - SMCI 600c swing $2.5 ($2500 → $10500 potential)

Aug 13 - SPX 5400p 17 stops 15 ($1700 —> $2300 potential)

Aug 12 - SPX5350c $8 stops 7 ($8000 → $25000 potential)

Aug 12 - SPX5340c $0.5 ($500 → $4500 potential)

Aug 09 - NVDA107c $0.2 stops .10 ($2000 → $7000 potential)

Aug 09 - LLY900c $3.50 stops 1.50 ($3500 → $11500 potential)

Aug 07 - SPX 5280p $10 stops 8 ($1000 → $8000+ potential)

Aug 07 - SPX 5200p $1 stops 0.5 ($1000 → $7000+ potential)

Aug 07 - NVDA 100p $0.8 stops 0.4 ($800 → $3300+ potential)

Aug 06 - SPX 5250c $10 stops 8 ($1000 —> $6000+potential)

Aug 06 - SPX 5250p $1.5 stops 0.75($1500 —> $13000+potential)

Aug 05 - SPX 5300c $3.50 stops 2.50 ($3500 —> $11000 +potential)

Aug 02 - SPX 5350p $5.50 (overnight swing from Aug 01) ($5500 —> $45000 +potential)

Aug 01 - SPX 5480p $4.50 ($4500 —> $65000 potential)

July 31 - SPX 5520c $12 ($1200 —> $3390 potential)

July 30 - SPX 5430p $2.50 ($2500 —> $30000 potential)

July 30 - SPX 5400p $2 ($2000 —> $10000 potential)

July 30 - TSLA 220p $1.50 ($1500 —> $5000 potential)

July 30 - SPX 5450c $0.20 ($200 —> $5000 potential)

July 29 - SPX 5450p $4.50 ($4500 —> $16000 potential)

July 29 - SPX 5460p $0.20 ($200 —> $1100 potential)

July 29 - SPX 5470p $1.5 ($1500 —> $8000 potential)

July 29 - SPX 5480c credit sell - collect $2700 risk $500

July 29 - SPX 5400p $2 out $6 ($2000 —> $6000 potential)

July 26 - SPX 5400p $2 out $6 ($2000 —> $6000 potential)

July 26 - SPX 5450c $4 out $12 reached 15.50 ($4000 —> $15500 potential)

July 25 - SPX 5450c $1, $1.50, and $1.75. target $10. reached $10! ($1000 —> $10000 potential)

July 25 - SPX 5450c $5. reached $41.70! ($5000 —> $41700 potential)

July 22 - CRWD 240p $1.7. reached $3.5! ($1700 —> $3500 potential)

July 22 - SPX 5580c $0.5. reached $3.3! ($500 —> $3300 potential)

July 19 - SPX 5500p $2. reached $12! ($2000 —> $12000 potential)

July 18 - SPX 5580p $5. reached $53+! ($5000 —> $53000 potential)

July 17 - SPX 5540c $2. reached $16! ($2000 —> $16000 potential)

July 16 - SPX 5660c $2. reached $10! ($2000 —> $10000 potential)

July 15 - SPX 5650c $1. reached $4! ($1000 —> $4000 potential)

July 11 - SPX 5600p $2. reached $23! ($2000 —> $23000 potential)

July 09 - Credit Sell SPX 5590/5595 bear calls 2.30-2.50 stops at 2.60 ( $2500 premium collected per 5k position risking $300)

July 08 - AVGO 1800c 13( $1300—> $2250 potential)

July 08 - SPX 5560p 2.50 stops 2.30 ( $2500—> $5000 potential)

July 08 - TSLA 270c 4.50 target 7.50 ( $4500—> $7600 potential)

July 03 - SPX 5520 2.5 ($2500—> $18000 potential)

July 02 - TSLA 225c 3.5 ($3500—> $8500 potential)

July 02 - SPX 5500c 2.50 ($2500 —> $10000 potential)

July 02 - SPX 5470 Bull Puts 2.50 ($2500 credit collected)

July 01 - closed TSLA Swing $2.65—> $12.00

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

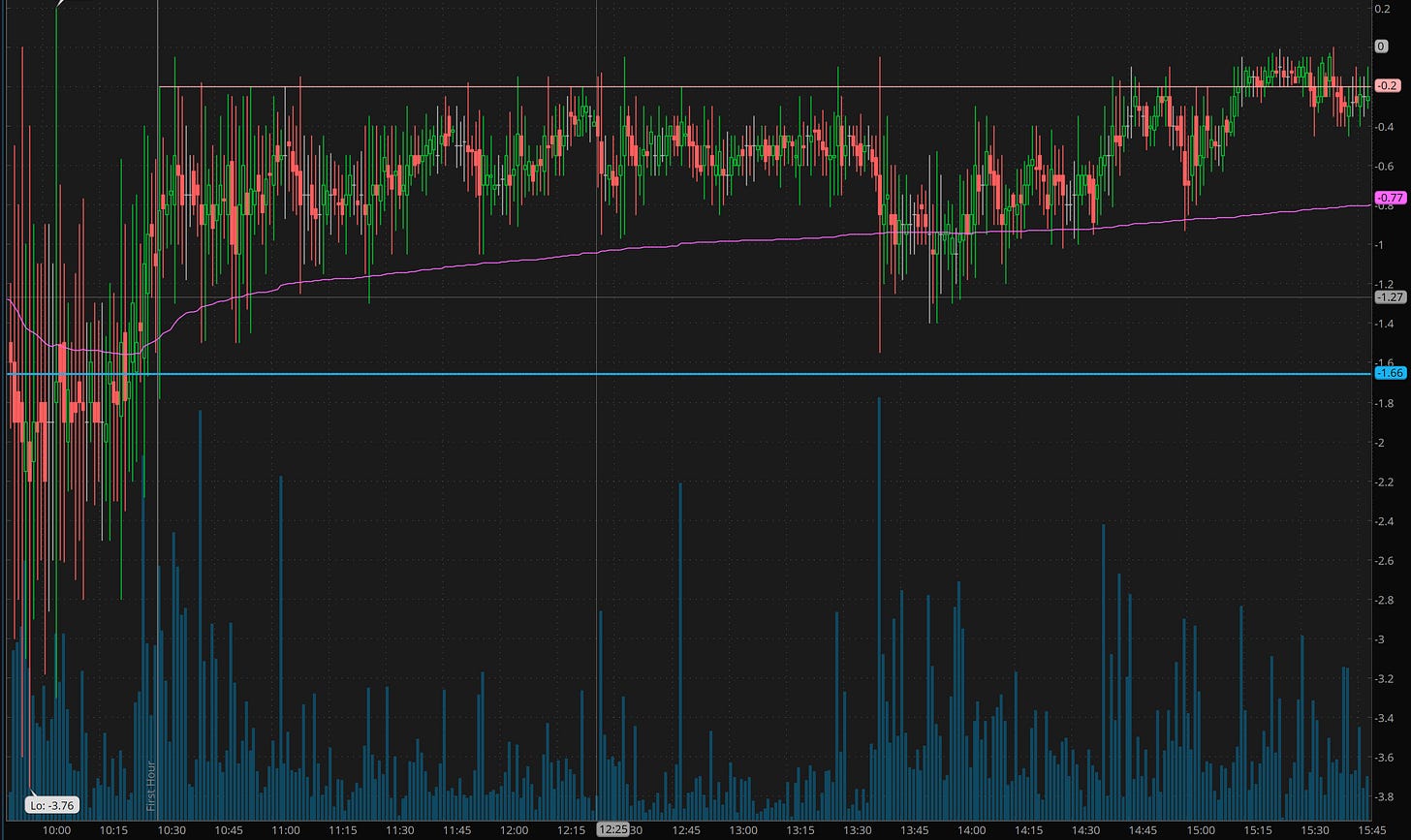

Trade Recap for Monday Sep 16

GOLD BOLD ITALIC = price action signal

GOLD REGULAR = action to take/taken

GREEN REGULAR = trades I should have taken

We pretty much nailed the initial short off the 562.50 level. Why was I interested in the short. 5 green days, and my bias was that we would not see 564 without at least a 560 test, and preferably 557.50 back test.

So I start with that thesis and look for price action to follow that story. We had mix of of confirmation from price action on SPY and option contract volume on 5600p

The interesting thing here is that if you missed that entry at $3, you still could have entered at 3.60-4 when vwap broke. that still left almost 200% of upside that paid in less than an hour!

I’m regularly done with profitable trades by 11:30am by following this simple process

I also alerted that given the expectation of a chop/consolidation day, I like SPX 5640/45 bear calls. Here is what those did.

from 3.50 during first 15min to rought 2.50-2 credits to 0.30 within first 2 hours and 0 by end of day.

With 10 contracts and using $5000 in capital you can collect $2000+ in premium with max loss of $3000. My win rate on these is around 70-80% and when wrong can using exit for $500-1500 max loss instead of 3000.

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Education - How to Join a Strong Trend

The process I typically follow for joining a strong trend are as follows:

All day grinder: join on dips to 20ma

Multi-day grinder:

Join either on support test of morning lows/failed breakdown reversal

Join at vwap mid day or end of day

Keep it simple. Don’t chase, wait for support levels for great risk/reward entries!

Education - Systematic Profit Taking

How do I take profits? I keep it relatively simple. Depending on the entry and range to the next levels I typically with take profits 50-100% of my profits at 3-10R and then raise stops to above entry with a goal of letting runners take me to the next level or 2 and to then reload if I believe we are consolidating before the next leg.

I then repeat the same process on the reload.

Let me know in the comments if you have questions or would like to see examples, I’ll share them.

Trade Ideas - Plan for Tuesday Sept 17

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Ideas

Stick to process.

Today I’ll be focused on: AAPL, MSFT, and SPY