SPY put it in 2 green days. What's next? Day Trading Ideas for Apr 24

TSLA shorts got squeezed overnight. Will it continue higher or will seller use this as a chance to exit?

Good morning traders!

Yesterday, I didn’t get the dip I wanted for entry long on SPY, BUT that was ok, because I had planned a swing trade the day before. On Monday I alerted SPX 5050c for 4.50-5.50. These ran to $18. Being systematic, I sold into that spike with plan to reload. I alerted the reload toward the close around $8. With the gap up, following process again I sold 50% into opening spike and the rest around $30.

I don’t like to chase longs and so there wasn’t much for me to do regarding SPY other that the hard job of doing nothing.

Once we started consolidating, I became convinced that we were going to go lower, and I then took bull puts. I alerted my plan to take SPX 5060/5055 bull puts for credit of 2.50-1.75 when it was at 1.25. It popped o 1.75 to give us a stress free entry and by end of day it got to 0.

There are many techniques to profit from the market and credit selling SPX has become a favorite tool for me. I can collect $1000-$2500 in premium regularly using $5000 in capital.

Yesterday gave us a second green day and overall I’m ooking for a 3rd green day today, but I’m cautious now about where to get long.

In today’s blog I’ll review how I planned a trade in SMCI and how I determined which credit sell bull puts to take.

I also go over TSLA earning short squeeze and how I plan to trade that.

Finally a reminder, META and MSFT earnings will likely set the tone, and so I am not convinced that a bottom is in and that we are back to BTFD. If anything, with interest rates higher, I’m looking for the supply zone to reload short in the coming days, unless SPY 510 is reclaimed.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas each morning, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Apr 23 - SPX 5060/5055 bull puts - Entry $1.75 ($1750 premium potential) drawdown < $200

Apr 22 - SPX 5050c swing - $5.50 → ($5500 → $42000 potential)

Apr 22 - SPX 5000c - $3.20 → ($3200 → $39000 potential)

Apr 22 - SPX 5020c - $0.20 alert, dipped to 0.55, fill at $0.70 → ($700 → $20000 potential)

Apr 19 - SMCI 750p - $1.50 → ($1500 → $38k+ potential)

Apr 19 - NVDA 800p - Entry $0.5 ($500→$40k potential)

Apr 18 - SPX 5050c - Entry $6 ($6000→$16000 potential)

Apr 18 - SPX 5020p - Entry $4 ($5000→$20000 potential)

Apr 16 - SPX 5140/5135 bull puts - Entry $2.50 ($2500 premium potential) drawdown < $300

Apr 12 - SPX 5100p $1. (dipped to 1.30) - Entry $2 ($2500 premium potential)

Apr 11 - SPX 5180/5185 bear calls - Entry $2.50 ($2500 premium potential)

Apr 10 - SPX 5180/5185 bear calls - Entry $2.50 ($2500 premium potential)

Apr 10 - SPX 5170c - Entry 0.50 ($500 → $5000 potential)

Apr 9 - SPX 5185/5180 bull puts - Entry $3 ($3000 premium potential)

Apr 9 - SPX 5205c - Entry $0.50 ($500→ $6000 potential)

Apr 8 - SPX 5225/5230 bear calls - Entry $1.20 ($1200 premium potential)

Apr 8 - SPX 5200/5195 bear puts - Entry $0.10 ($1000→ $8000 potential)

Apr 4 - SPX 5250p - Entry $4 ($4000→ $100k potential)

Apr 4 - SPX 5180p - Entry $1.30 ($1300 > $32k potential)

Apr 3 - SPX 5175/5170 bull put - Entry $1.50 ($1500 premium potential)

Apr 2 - SPX 5175/5170 bull put - Entry $1.50 ($1500 premium potential)

Apr 2 - SPX 5205/5200 bull put - Entry $1.50 ($1500 premium potential)

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Tuesday’s Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

SPY/SPX

Yesterday we got the continuation I was planning on. I wasn’t as confident it would play out so I didn’t add to the swing long, I just let it work. I did try a scalp short that gave $2 profit before stopping out for small gains.

Because of the gap up, I didn’t want to chase long and we already had a great long position from the day before on the SPX 5050c from $5 and $8 reload. Following process I was out majority at 506 for $25-30. I added small back on the dip under 27 anticipating a gap up and placed sell orders at $42 in case of over night pop. We popped to 42.80 :) before dipping back to 32.

Once 502.80 was back tested and held we ran to 506. Over lunch I decided we were going to close green and above vwap. So I started planning.

How did I target 5060? I used the 504.20 dip as the low I didn’t expect to go below. So I then cross checked the SPX chart and that was 5057. So I figured 5060/5055 was a good to maximize gains if I can fill for 2.50-1.75. I basically had $0.50-1 of risk for $1.70+ gain with a 90% chance imho of winning. I take that bet and you should learn how to do this too.

TSLA

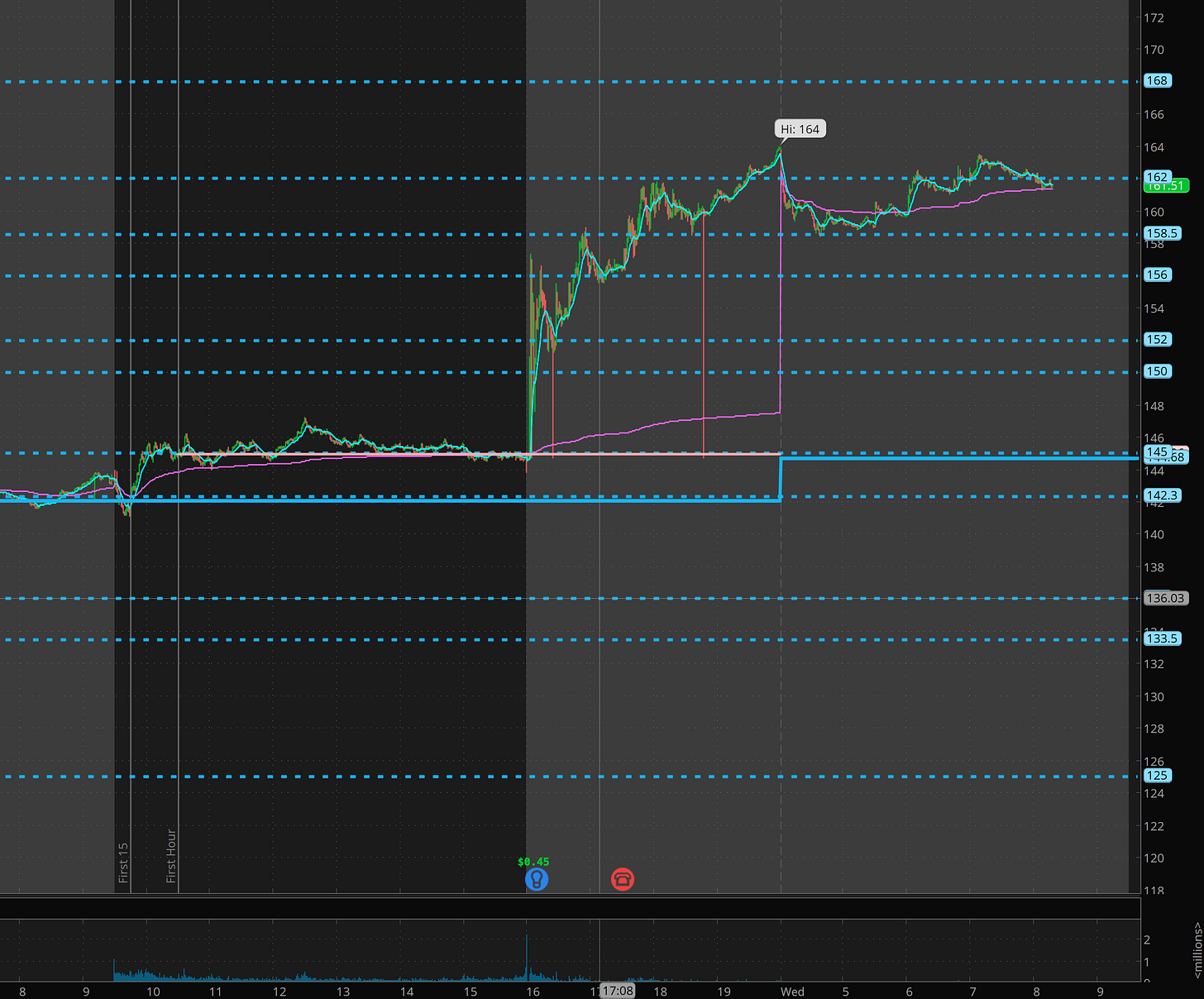

Tesla reported and the numbers were awful, but Musk came out swinging and gave hope triggering imho a decent short squeeze. The question is what will happen next. Will buyers come in today valuing the future and the prospect or will sellers take this opportunity to get out.

I see 162-165 will be key. over 165 I’ll start hawking dips for the ext squeeze into 176-180. break over 156, and 158 becomes a ceiling I’ll join the bears.

Overall I have a bullish bias becomes hope for a stock like tesla can make things dangerous and dicy for bears.

In case you are wondering the key points that bulls could latch onto are:

Musk said will sell more cars this year

Optimus robot sails to begin

Robotaxi unveiled (but will likely require years) - so this could be smoke/mirrorss

Tesla Energy division running at over 24% margin

Trade Ideas - Plan for Wed Apr 24

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

I’m expecting some rally and then maybe some chop today so be careful.

My focus today: SPY, TSLA, AMD