SPY perfectly hits my 561.50 level yesterday. How will market reaction to CPI today? Trade ideas for Thursday July 11, 2024.

Being patient for entries is essential and credit selling on consolidation days can be a winning strategy. Learn how...

Good morning traders!

Yesterday SPY broke out of consolidation and did an amazing move right to the last level I had listed at 561.50. Why is that important? Because by watching the price action and knowing where it is going you can plan entries and exits!

Did you know that the last hour provided a 20x+ opportunity yesterday. Checkout the SPX 5630c. They were 0.20 and ran to $5+!!! Unfortunately I fell asleep watching the candles since 1pm for 2 hours after wait for trades to set up and getting stopped out twice on shorts for small losses. (Those stop out were clues for upside)

Wednesday’s Recap and Trade Ideas for Today

Let’s review Wednesday’s trades and explore some ideas for today. There were so many great trades in the morning and then scoops for reloads later.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading—your daily source for market insights and trading opportunities. Here, you’ll find comprehensive market analysis, educational lessons, and trade ideas to help you excel in trading, all while spending less than two hours a day.

What Subscribers Get

Subscribers receive daily market analysis updates, educational content, and up to three trade ideas each morning based on real-life examples and my trading approach.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

2024 Alert Leaderboard

Here's a look at some of the potential gains achieved through our entry alerts:

July 09 - Credit Sell SPX 5590/5595 bear calls 2.30-2.50 stops at 2.60 ( $2500 premium collected per 5k position risking $300)

July 08 - AVGO 1800c 13( $1300—> $2250 potential)

July 08 - SPX 5560p 2.50 stops 2.30 ( $2500—> $5000 potential)

July 08 - TSLA 270c 4.50 target 7.50 ( $4500—> $7600 potential)

July 03 - SPX 5520 2.5 ($2500—> $18000 potential)

July 02 - TSLA 225c 3.5 ($3500—> $8500 potential)

July 02 - SPX 5500c 2.50 ($2500 —> $10000 potential)

July 02 - SPX 5470 Bull Puts 2.50 ($2500 credit collected)

July 01 - closed TSLA Swing $2.65—> $12.00

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Wednesday’s Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

Please note all times are Eastern/New York regardless of what time zone I happen to be in.

SPY / SPX

Yesterday I misread the action, wanting a gap fill/profit taking ahead of CPI. However if you follow process, the action above is pretty clear. You can see the failed breakdown at 11am. and then the range break at 12. I have a lunchtime gym appointment with a trainer at 12 so missed the long so I tried for the short at 559.60 getting almost 100% on some puts. But the trend was VERY strong. I mentioned this in the chat given how VWAP kept climbing.

SPY/SPX did an incredible 4 level move by the close!

If you were wondering where to join long on a strong trend, entering on the 20ma would have worked great. So don’t forget the rules for how to join a strong trend.

If you planned accordingly you could have scooped SPX 5630c for 0.20 targeting a $3-5 exit! Unfortunately I fell asleep after watching the consolidation for 2 hours. (the trainer has been pushing me and I had too large a lunch)

Market is still in full BTFD mode until major supports break. That said, I feel like we are getting way overextended without a pull back. lets see what CPI brings today.

AMD

AMD gave a clean setups with a news catalyst. I alerted that I wanted AMD long on a dip into 177-178 to THT PRO members and we got exactly that at the open. If you missed that dip, getting long either on vwap cross of 15 min ORB breakout ended up paying handsomely.

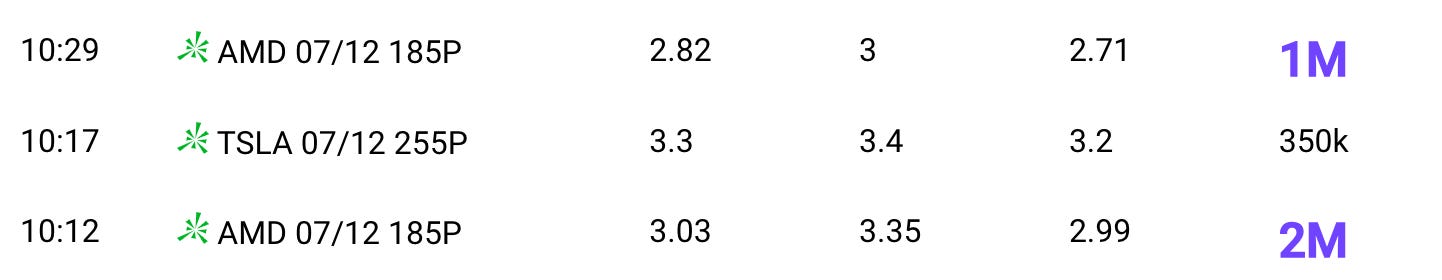

Here is the interesting thing. During the rally 2 large put bets on 185p came in that went from $3-5. Edge’s Option Scanner caught this! This is a signal to also lock in profits on longs and consider a short when the 10:30 peach level broke.

Education - How to Join a Strong Trend

The process I typically follow for joining a strong trend are as follows:

All day grinder: join on dips to 20ma

Multi-day grinder:

Join either on support test of morning lows/failed breakdown reversal

Join at vwap mid day or end of day

Keep it simple. Don’t chase, wait for support levels for great risk/reward entries!

Trade Ideas - Plan for Wed July 10

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Ideas

Watching for market’s reaction to CPI data. So far we had a push to 563.50 on SPY. if rejects again during regular market hours will consider a short.