SPY continues its Rampage! For how long? Trade ideas for Tuesday Oct 15, 2024

Are you planning trades that pay as much as 5 to 20 times your risk? If not, join THT-PRO.

Good morning traders!

Want more discipline and planning in your trading? Join the small account challenge now!

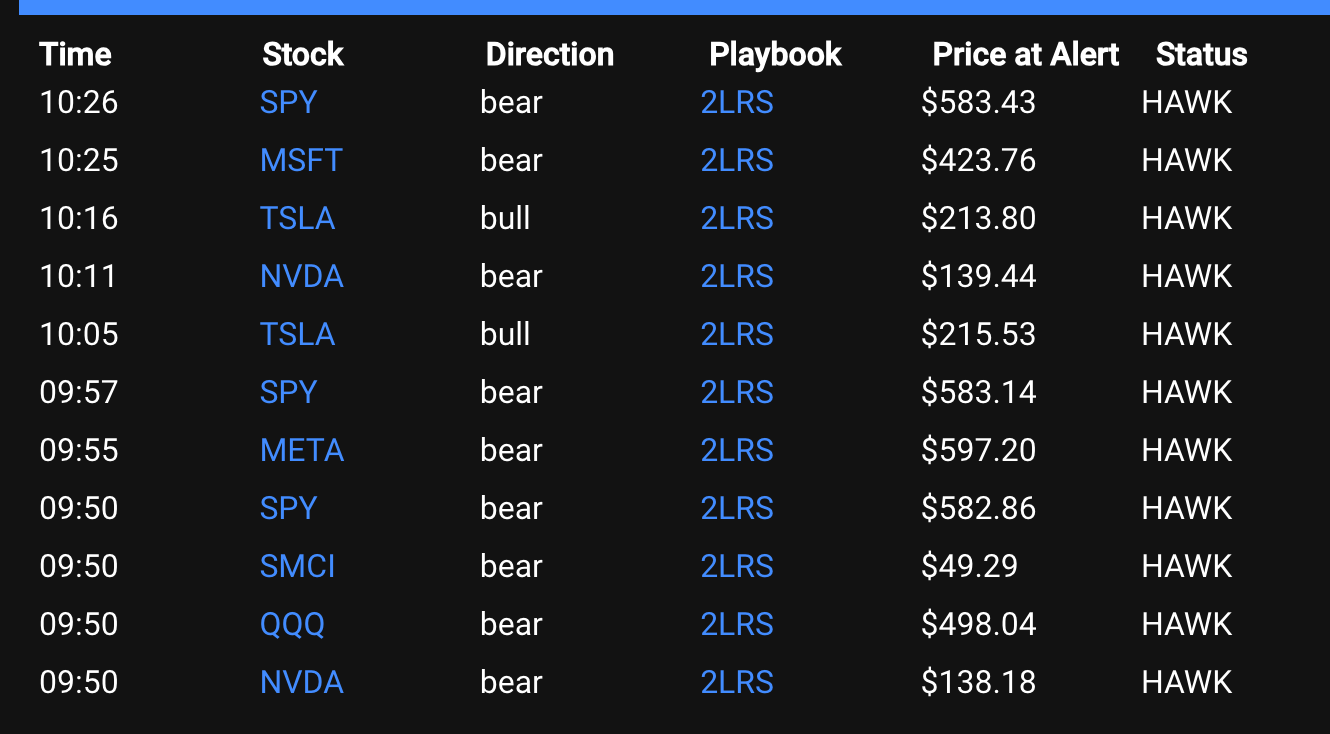

Here is the latest Playbook Scanner Update after making bug fixes for yesterday’s action.

NOTICE the TSLA “start hawking” for a long on TSLA at 215 and 213.80 dips.

More improvements to come. I also need some suggestions or ideas on how to filter out false positives / include a strong bull trend so skip the bear playbook.

The goal is that a Setup should lead to a 1 to 2 level move minimum.

Most of my default plays are based on catching reversals, and in the current market, that is difficult for me. So I will be adding Join Trend and Squeezer setups when I get a chance.

Monday’s Price Action

SPY backtested Friday’s highs and then launched in minutes reaching 584 and almost the to 585.50 level! My level was missed by 0.24!

NVDA also launched and closed at a new all time high.

TSLA failed at 222 and dumped right to the 215 support level and bounce back to 220. There are dip buyers out there.

PDD rejected 144 and broke 138. I alerted 135p targeting 127-130 this week.

MSTR gave a gorgeous textbook gap up reversal play. I alerted 210p target of 197-202. and that bids should show up around there. We hit 201s!

Tuesday Premarket Action

SPY is so far holding it gains. I can’t believe we are at 584s in October! And we still have 2.5 months to hit 600 by Jan-Feb like I predicted a few weeks ago!

NVDA, AMD, and SMCI dipping due to expansion of chip export ban.

PDD hit 129s in premarket. The air in this China rally coming out! Took 1 week longer than I thought. Watching for possible dip buys to some sub 125.

GS - Gapping up after e/r

SCHW - Gapping up after e/r

Let’s review the trade signals in SPY and go over ideas for today.

Join THT PRO to get alerts, real-time commentary, and improve trading habits.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading—your daily source for market insights and trading opportunities. Here, you’ll find comprehensive market analysis, educational lessons, and trade ideas to help you excel in trading, all while spending less than two hours a day.

What Subscribers Get

Subscribers receive daily market analysis updates, educational content, and up to three trade ideas each morning based on real-life examples and my trading approach.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

2024 Q4 Alert Leaderboard

Here's a look at some of the potential gains achieved through our entry alerts:

Oct 14 - SPX 5870c $0.45 → $4.4 ($450 —> $4400 potential)

Oct 14 - MSTR 210p 4.50 →$13.7 ($4500 → 13700 potential)

Oct 14 - PDD 135p 1.50 (swing) →$?

Oct 11 - SPX 5810c $5 → $14 ($5000 —> $14000 potential)

Oct 11 - SPX 5805p $1 → $13.50 ($1000 —> $13500 potential)

Oct 10 - SPX 5800c $2 → $6 ($2000 —> $6000 potential)

Oct 10 - SPX 5750p $0.50 → $3.40 ($500 —> $3400 potential)

Oct 09 - SPX 5775c $2.5 (thanks JY!) → $22 ($2500 —> $22000 potential)

Oct 09 - SPX 5800c $0.5 (dipped 0.20) → $2.45 ($500 —> $2450 potential)

Oct 09 - SPX 5790c $1 (dipped 0.70) → $8.65 ($1000 —> $8650 potential)

Oct 09 - SPX 5790c Round 2 $3.5 → $7.5 ($3500 —> $7500 potential)

Oct 08 - SPX 5750c $1 (dipped 0.70) → $2.30 ($1000 —> $8400 potential)

Oct 08 - SPX 5750c $2 (dipped 1.70) → $8.40 ($2000 —> $8400 potential)

Oct 08 - MSFT 415c $3 risk 0.20 —> 4.10 ($3000 → $4100) 5R!

Oct 07 - SPX 5720c $1 (dipped 1.20) → $3.30 ($1200 —> $3300 potential)

Oct 07 - SPX 5690p $1.50 (dipped 1.55) → $10.50 ($1550 —> $10500 potential)

Oct 07 - PDD 145p $2.35 (swing) → 5

Oct 04 - SPX 5700p $5 → $15.50 ($5000 —> $15500 potential)

Oct 04 - SPX 5730c $6 → $23.90 ($6000 —> $23900 potential)

Oct 04 - SPX 5740c $1.50 → $14 ($1500 —> $14000 potential)

Oct 04 - SPX 5750c $1 → $5 ($1000 —> $5000 potential)

Oct 04 - OXY 55c $0.35 → $0.80 ($3500 —> $8000 potential)

Oct 04 - META 595c $0.12 → 1.90 ($1200 —> $19000 potential)

Oct 03 - SPX 5655p $1 → $5 ($1000 —> $5000 potential)

Oct 03 - SPX 5690c $2 → $14.20($2000 → $14200 potential)

Oct 03 - SPX 5695c $1-2 → $9.80 ($1500 → $9800 potential)

Oct 03 - NVDA 125c $0.55 (swing)

Oct 03 - XOM 123c $0.22 (swing)

Oct 03 - OXY 55c $0.33 (swing)

Oct 03 - PDD 155c $1.20 (swing)

Oct 03 - SPX 5720/25 bear calls $2 —> 0 (risk $500 to collect $2000 premium)

Oct 02 - SPX 5700p $2.50 → $8.50 ($2500 —> $8500 potential)

Oct 02 - SPX 5720/25 bear calls $2.50 —> 0 (risk $500 to collect $2500 premium)

Oct 01 - SPX 5720p $3 → $12 ($3000 —> $12000 potential)

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Trade Recap for Monday Oct 14

GOLD BOLD ITALIC = price action signal

GOLD REGULAR = action to take/taken

GREEN REGULAR = trades I should have taken

SPY / SPX

They ripped it again yesterday out of the gate. I struggle to go long on gap ups. Just have to accept that and wait. The first short was a 50% gainer. I wanted more much more and so I broke rules and didn’t take profit and stopped flat.

Tried short twice amore for small losses or gains.

Then I saw a squeeze could come given overall action on the day

And we got a gorgeous dip to fill 5770c for 0.45 with a 2.50-4.50 sell target. The hit 4.40

BE PATIENT, I WAS GETTING FRUSTRATED. But sure enough a play came our way! We get 100-500% baggers almost every day! Have you noticed that?

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Education - How to Join a Strong Trend

The process I typically follow for joining a strong trend are as follows:

All day grinder: join on dips to 20ma

Multi-day grinder:

Join either on support test of morning lows/failed breakdown reversal

Join at vwap mid day or end of day

Keep it simple. Don’t chase, wait for support levels for great risk/reward entries!

Education - Systematic Profit Taking

How do I take profits? I keep it relatively simple. Depending on the entry and range to the next levels I typically with take profits 50-100% of my profits at 3-10R and then raise stops to above entry with a goal of letting runners take me to the next level or 2 and to then reload if I believe we are consolidating before the next leg.

I then repeat the same process on the reload.

Let me know in the comments if you have questions or would like to see examples, I’ll share them.

Trade Ideas - Plan for Tuesday Oct 15

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Ideas

Watching SPY, NVDA today! Same process, will be looking for shorts on exhaustion and scoop long on back tests of key level.

Let’s go over the ideas…