[RESEND] Trump Day 1. How will SPY and QQQ react ? Trade ideas for Jan 21, 2024

Are you planning trades that pay as much as 5 to 20 times your risk? ! If not, Join THT to improve your trading.

Good morning traders !

Friday was another exceptional day. I’ll go over that in a minute. First, let’s talk about Trump. Remember how I said 2025 is going to be volatile and the market will provide many opportunities… I have 100% conviction in that statement. If you traded in 2017-2020 you experienced how Trump would say something and the markets would make sudden moves. His personality does seem a little different so far this second term, but the important thing is to be mentally prepared for the unexpected. I do think markets will continue to react strongly to his words, but there is a chance that the reactions may be more muted this go around. Let’s see if that is the case. Regardless, it will be ever more important to be nimble, to be prepared for losses, but also insane gains an opportunity. You might be in a position that gets suddenly wrecked. Use stops to protect capital. It may stop you out and then suddenly reverse… Don’t be afraid to reposition in your original idea at possible a much better price as long as key support levels are not broken. If they are and then reclaim, that should provide us with great opportunities!

Think of it like this, the market will have a general trend and expect Trump to say things that will trigger wild moves that provide blips outside of the trend, but then return to it. I’m looking forward to 2025 to be the year I hit high 7 maybe 8 figures in my trading.

Options Scanner Update

The scanner is amazing, however on Friday I discovered that there is a problem with the data collection and I will be needing to devote more time to make sure the feed is updating. That said here are some of the highlights we should have got on time and we would have been able to take advantage of:

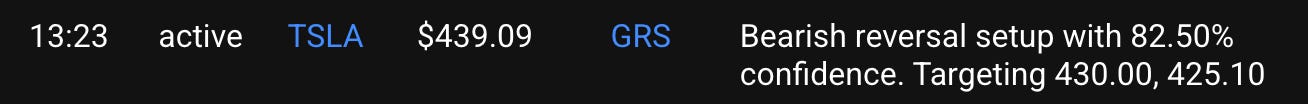

TSLA Short starting at 2pm

I also updated the logic in the playbook scanner so that next time is should catch the short

Why is this important?, on Fridays, with the right targeting, the TSLA 430p went from 0.20 to over$3!!! for 1500%.

Playbook Scanner Update

The gap up reversal scanner is great but not perfect. It doesn’t do well with all day grinders and so there will “failed” setups. But that is what risk/reward is for. In Trading you need an edge.

NFLX short alert

Let’s use this and an example. The timing for the short was correct, however there wasn’t follow through. With proper management small wins or losses should be possible and the attempt would present a good risk/reward opportunity.

The point is there are 3 metrics that matter. Win Rate, Drawdown, and Yield over 50+ trades. Being systematic it is less important that 1 trade wins as it is, how does it perform over many trades. I hope to run more backtests this week on the strategy to get that answer. For example, there may be 50 trades where 10 are losers, 20 are small wins or small losses, and 20 go on to yield over 300 or 500% gains. Getting the metrics will help me hold for those gains and happily accept losses when they come.

Here is the signals for TSLA. notice how the first one failed.but the second one nailed it! Process and being systematic is essential!

OK. So let’s get into Friday’s action

Friday Highlights

SPY - Based on 596 early Friday and then ripped toward 599.50 like we wanted. On Thursday I shared my rare overnight swing yolo for 6000c to scoop under $3. These reached $17.20 on Friday!

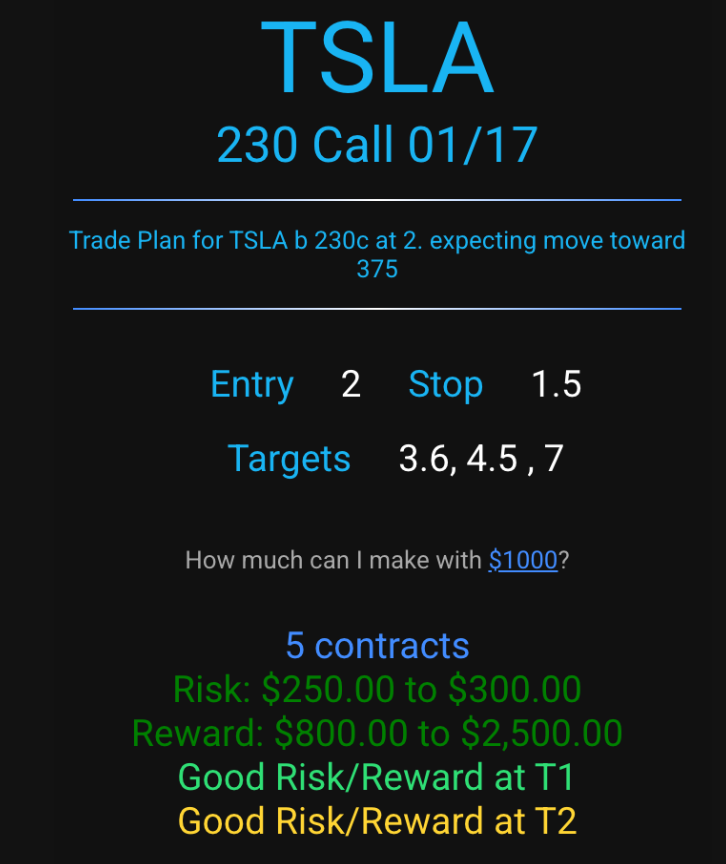

TSLA - Was our big payer. We nailed the trade and TSLA loved the levels. These reached over $9! for 300%+ payout. The best part was we nailed the reload opportunity when it pushed to 5 and dipped back at 2.30 before going to 8+

NFLX - Pushed on 860s again then based on 855 and slowly started to grind back over 860 and reached 865 before closing at 858.

GS - ripped dipped, and then started grinding reaching 626 and over 630 in after hours. Our 610c swing from $2 reached over $16!!!! for 700% gains potential.

Tuesday Premarket Highlights

SPY - gapping up over 599.50 and tested 601 level after printing at 595 early Monday morning.

AAPL - looking weak. gapping down and tested 225. Pelosi filed she some shares last week.

NFLX - tested 875 in premarket and now holding gap up around 865 from 858 close. Reminder NFLX reports this week

MSTR - gapped down to 381 in premarket and now back to Friday close at 396

AVGO - gapping up into 242 from 238 close.

GS - Gapping down under 620. May need a 600-610 level back test this week.

Join THT PRO to get alerts, real-time commentary, and improve trading habits.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading—your daily source for market insights and trading opportunities. Here, you’ll find comprehensive market analysis, educational lessons, and trade ideas to help you excel in trading, all while spending less than two hours a day.

What Subscribers Get

Subscribers receive daily market analysis updates, educational content, and up to three trade ideas each morning based on real-life examples and my trading approach.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

2025 Q1 Alert Leaderboard

Here's a look at some of the potential gains achieved through our entry alerts:

Intraday Alerts

2024-01-02 SPX 5880p 11 to 40+

2024-01-02 SPX 5820p $2 to 10

2024-01-03 SPX 5930c $2, dipped to $3 and ran to $11

2024-01-06 SPX 5980p $1.70 → $20 ($1700 to $20k potential)

2024-01-07 SPX 5900p $0.50 → $11 ($500 to $11000 potential)

2024-01-07 SPX 5930p $5 → $17.4 ($5000 to $17400 potential)

2024-01-07 SPX 5930p $5 → $40 ($500 to $4000 potential)

2024-01-08 SPX 5800p 1/10 $4 → $10 ($400 to $1000 potential)

2024-01-10 SPX 5800p 1/10 $4 → $10 ($400 to $1000 potential)

2024-01-13 SPX 5820c $5 → $10 ($400 to $1000 potential) **Round 1

2024-01-13 SPX 5820c $2.80 → $16 ($400 to $1000 potential) ** Round 2

2024-01-13 SPX 5820c $4.50 → $16 ($400 to $1000 potential)** Round 3

2024-01-14 SPX 5870c $0.75 → $3.75 ($750 to $3750 potential)

2024-01-14 TSLA 430c $0.75 → $3.75 ($750 to $3750 potential)

2024-01-15 SPX 5950c $9 → $14 ($9000 to $14000 potential)

2024-01-15 GS 610c $2 → $4.50 ($2000 to $4500 potential)

2024-01-15 TSLA 430c $3-4 → $8.20 ($3500 to $8200 potential)

2024-01-15 QQQ 514p $0.8 → $1.82 ($8000 to $18200 potential)

2024-01-16 AAPL 235p $0.7 → $7 ($700 to $7000 potential)

2024-01-16 SPX 5980c $7 → $12 ($700 to $1200 potential)

2024-01-16 SPX 5970c $2 → $5 ($2000 to $5000 potential)

2024-01-16 SPX 5970c $2 → $5 ($2000 to $5000 potential)

2024-01-17 SPX 6000c $8 → $17.2 ($8000 to $17200 potential)

2024-01-17 TSLA 430c $2 → 5.20 ($2000 to $5200 potential)** Round 1

2024-01-17 TSLA 430c $2.30 → 9.9 ($2000 to $9900 potential)** Round 2

2025-01-17 SPX 6000p $0.50 → $5 ($500 to $5000 potential)

2025-01-17 SPX 6020c $0.50 → $0.30 ($500 to $300 stopped.) ** was a combo trade with the 6000p

Swing Alerts

2024-01-13 TSLA 430c $1.30 → 8.82 ($1300 to $8820 potential) **alerted exits at 6.50 and 8

2024-01-15 GS 610c $2 → 8 ** exit on 1/16

2024-01-15 GS 610 $2 → $16 ** missed reload on dips. exit on 1/17

2025-01-16 SPX 6000c 1/17 $3 → 17.20 ** dipped to $2 on Thursday, exit majority at $12.

Credit Sell Alerts

2024-01-14 SPX 5800/5795 bull puts for 1.50-2.50. $2000 credit potential using 10 contracts and $1000 risk.

2024-01-15 SPX 5950/5955 bear calls for $2→0. $2000-4200 credit potential. Round 1 dipped to 0.75. Round 2 ran to $4.20 and then dropped to 0.

2024-01-16 SPX 5950/5955 bear calls for $2→0. $2000-3000 credit potential. Round 1 dipped to 0.75. Round 2 ran to $3 and then dropped to 0. ** not a typo, same play paid.

2024-01-16 SPX 6020/6025 bear calls for 3.50 ** DID NOT FILL. (the 1.50 at time of alert went to 0)

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Trade Recap for Friday Jan 16

GOLD BOLD ITALIC = price action signal

WHITE REGULAR = action to take/taken

GREEN REGULAR = trades I should have taken

SPY / SPX

TSLA

Look at all the volatility to profit from ! :)

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Education - How to Join a Strong Trend

The process I typically follow for joining a strong trend are as follows:

All day grinder: join on dips to 20ma

Multi-day grinder:

Join either on support test of morning lows/failed breakdown reversal

Join at vwap mid day or end of day

Keep it simple. Don’t chase, wait for support levels for great risk/reward entries!

Education - Systematic Profit Taking

How do I take profits? I keep it relatively simple. Depending on the entry and range to the next levels I typically with take profits 50-100% of my profits at 3-10R and then raise stops to above entry with a goal of letting runners take me to the next level or 2 and to then reload if I believe we are consolidating before the next leg.

I then repeat the same process on the reload.

Let me know in the comments if you have questions or would like to see examples, I’ll share them.

Trade Ideas - Plan for Tuesday Jan 21

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Ideas

Overall I’m wanting to see how markets react to Trumps first day in office. My original thesis was if we were at 615 to 620 and gapping up to go short. now that we had the recent dip, and at 599-601. It can go either way.

I’m also very interested in a name that Pelosi invested in last week…

Let’s go over the stocks I’m watching and my ideas for today.