Red Red SPY...? Was yesterday exhaustion? Ideas for Tues Mar 11, 2025

Are you averaging 300-500%+ on your trades in this elevated volatility? If not, join THT PRO.

I focused on 2 trades yesterday. This high IV environment has NOT been easy but we still were able to make it work for us. Finally got a potential near term capitulation dip yesterday.

The trades…. Hope you got these!

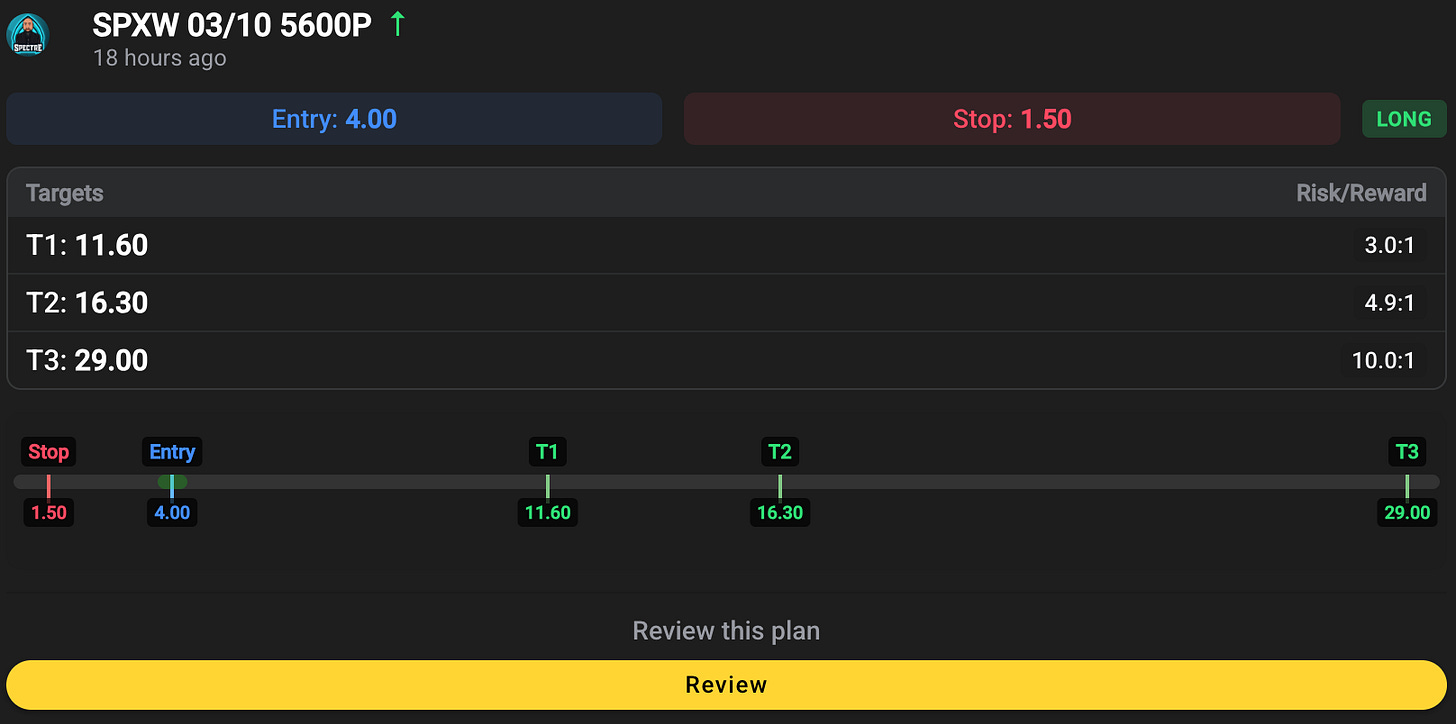

SPX 5600p on the dump for want 562.80 or less. after saw the price action I made 555-557 my target. Here is the plan for the puts. NIce 300-700% trade.

It hit 30 and I was out. This coincided with the reversal plan I shared. That on the dump under 5580 I wanted to ge long.

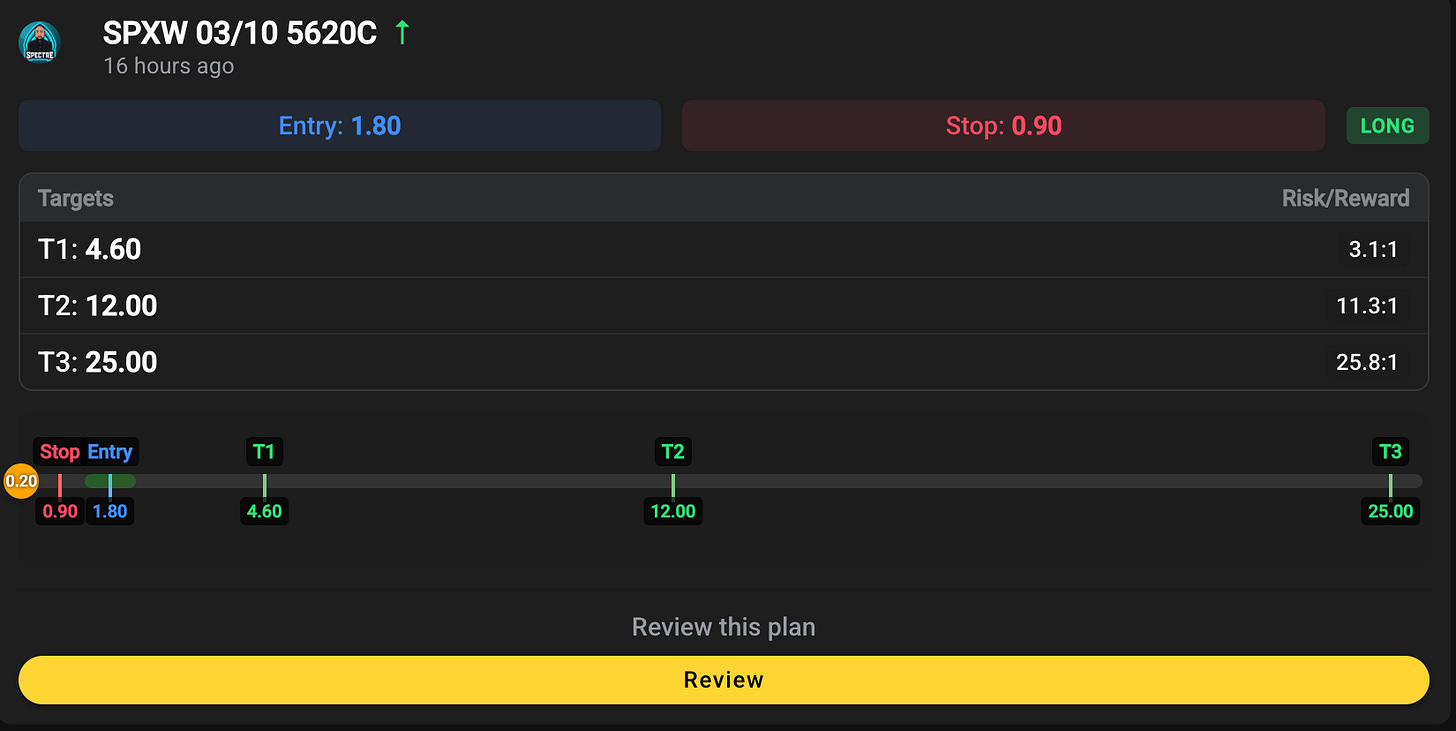

I originally wanted in for 0.50 and then revised my entry goal to be 0.50-2 as I told members. I screwed up here as I didn’t share this revised plan until later. But I did tell members I was targeting 5630-5650.

We got $1.80 to $15 in like 15 minutes!!! That is my kind of trade! But mind you I waited over an hour for this trade to develop. I did not watch the candles. I watched did it get my targets or not.

I had my sell and buy orders in place and then we it got close and we got to 3:00 I shifted gears to Hunt Mode.

Don’t let watching candles wear you down! I designed the SpectreMeter to give me a quick perspective of my plan and the price action. I’ll be adding more things to the meter so I can get to trading super efficiently, and with less stress.

Yesterday’s action

It made the first attempt at recovery. Today we need to see if bulls can make a dent in the selling or if the dump continues. Be patient and use my levels o plan trade 1 to 2 levels at a time. I’m long biased but open to more carnage.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

2025 Q1 Alert Leaderboard

Here's a look at some of the potential gains achieved through our entry alerts:

Intraday Alerts

2024-01-02 SPX 5880p 11 to 40+

2024-01-02 SPX 5820p $2 to 10

2024-01-03 SPX 5930c $2, dipped to $3 and ran to $11

2024-01-06 SPX 5980p $1.70 → $20 ($1700 to $20k potential)

2024-01-07 SPX 5900p $0.50 → $11 ($500 to $11000 potential)

2024-01-07 SPX 5930p $5 → $17.4 ($5000 to $17400 potential)

2024-01-07 SPX 5930p $5 → $40 ($500 to $4000 potential)

2024-01-08 SPX 5800p 1/10 $4 → $10 ($400 to $1000 potential)

2024-01-10 SPX 5800p 1/10 $4 → $10 ($400 to $1000 potential)

2024-01-13 SPX 5820c $5 → $10 ($400 to $1000 potential) **Round 1

2024-01-13 SPX 5820c $2.80 → $16 ($400 to $1000 potential) ** Round 2

2024-01-13 SPX 5820c $4.50 → $16 ($400 to $1000 potential)** Round 3

2024-01-14 SPX 5870c $0.75 → $3.75 ($750 to $3750 potential)

2024-01-14 TSLA 430c $0.75 → $3.75 ($750 to $3750 potential)

2024-01-15 SPX 5950c $9 → $14 ($9000 to $14000 potential)

2024-01-15 GS 610c $2 → $4.50 ($2000 to $4500 potential)

2024-01-15 TSLA 430c $3-4 → $8.20 ($3500 to $8200 potential)

2024-01-15 QQQ 514p $0.8 → $1.82 ($8000 to $18200 potential)

2024-01-16 AAPL 235p $0.7 → $7 ($700 to $7000 potential)

2024-01-16 SPX 5980c $7 → $12 ($700 to $1200 potential)

2024-01-16 SPX 5970c $2 → $5 ($2000 to $5000 potential)

2024-01-16 SPX 5970c $2 → $5 ($2000 to $5000 potential)

2024-01-17 SPX 6000c $8 → $17.2 ($8000 to $17200 potential)

2024-01-17 TSLA 430c $2 → 5.20 ($2000 to $5200 potential)** Round 1

2024-01-17 TSLA 430c $2.30 → 9.9 ($2000 to $9900 potential)** Round 2

2025-01-17 SPX 6000p $0.50 → $5 ($500 to $5000 potential)

2025-01-17 SPX 6020c $0.50 → $0.30 ($500 to $300 stopped.) ** was a combo trade with the 6000p

2025-01-21 SPX 6035c $5→ $15 ($5000 to $15000 potenital.)

2025-01-21 TSLA 440c $2.90→ $5.30 ($2900 to $5300 potenttal.) **dipped to 2.58. alerted 2.50 entry wanted.

2025-01-22 NFLX 950p $3.25→ $10.60 ($3250 to $10600 potenital.)

2025-01-22 SPX 6090p $1→ $5.80 ($1000 to $5800 potenital.) **dipped to 0.65

2025-01-23 SPX 6110c $0.80→ $8.60 ($800 to $8600 potential)

2025-01-24 SPX 6100p $3.30→ $2.30 (stopped) ** round 1 stopped

2025-01-24 SPX 6100p $1.50→ $12 ($1500 to $12000 potential) ** round 2 we banked

2025-01-24 AAPL 222.50p $0.25→ 0.80 ($2500 → $8000 potential)

2025-01-24 AAPL 222.50p $0.25→ 0.80 ($2500 → $8000 potential)

2025-01-24 AMD 123p $0.10 → 1.72 ($1000 → $17200 potential)

2025-01-27 SPX 5950p $9 → 40 ($900 → $4000 potential) ** premarket trade

2025-01-27 SPX 5950p $1.50 → 3.50 ($1500 → $3500 potential)

2025-01-27 NVDA 117p $1.5 → 5.4 ($1500 → $5400 potential)

2025-01-27 AVGO 200p $1.8 → 9.10 ($1800 → $9100 potential)

2025-01-28 SPX 6040c $8.50 → 33.50 ($8500 → $33500 potential)

2025-01-28 SPX 6080c $0.20 → 2.25 ($3500 → $22500 potential)

2025-01-28 SPX 6070c $0.70 → 6.20 ($7000 → $62000 potential) *Round 1

2025-01-28 SPX 6070c $0.90 → 6.20 ($9000 → $62000 potential) *Round 2

2025-01-29 SPX 6000p $4.50 → 12 ($4500 → $12000 potential)

2025-01-29 SPX 6060c $1.5 → 5.20 ($1500 → $5200 potential)

2025-02-03 SPX 6000c $5.5 → 22 ($5500 → $22000 potential)

2025-02-04 SPX 6030c $5.5 → 16.5 ($5500 → $16500 potential)

2025-02-04 SPX 6030c $4.5 → 14.2 ($4500 → $14200 potential)

2025-02-05 SPX 6060c $0.75 → 3.3 ($750 → $3300 potential) * Round 1

2025-02-05 SPX 6060c $0.40 → 2.25 ($600 → $3375 potential) * Round 2 (I filled at 0.40 and 0.20 - Great Risk/Reward!!!)

2025-02-06 SPX 6080c $0.25 → 5 ($2500 → $50000 potential)

2025-02-06 SPX 6075c $0.70 → 7.50 ($7000 → $75000 potential) ** dipped to 0.50, took 50% off at 1.20 to pay for risk

2025-02-07 SPX 6100c $4 → 12 ($4000 → $12000 potential)

2025-02-11 SPX 6080c $0.40 → 3 ($400 → $3000 potential)

2025-02-12 SPX 6000p - $2.35 —> 5.50 ($134% gain)

2025-02-12 SPX 6060c - $1→$4 (300% gain)

2025-02-12 SPX 6050c - $0.40→$2 (400% gain)

2025-02-13 SPX 6100c - $1→$5 (400% gain) *Round 1

2025-02-13 SPX 6100c - $0.8→$17.5 ($800 —> $17500% potential) * Round 2 with $15 target

2025-02-13 APP 450p - $3→$12 ($600 —> $2400 potential)

2025-02-18 SPX 6100p - $1→$7 ($1000 —> $7000 potential)

2025-02-19 SPX 6130c - $3→$18 ($3000 —> $18000 potential)

2025-02-19 MSFT 417c - $0.30→$2 ($3000 —> $20000 potential)

2025-02-19 SMCI 62c - $1.75→$6.20 ($1750 —> $6200 potential)

2025-02-20 APP 460p - $2→$33 ($2000 —> $33000 potential)

2025-02-20 APP 460p - $2→$33 ($2000 —> $33000 potential)

2025-02-21 SPX 6050p - $2.50→$42 ($2500 —> $42000 potential) ** I got stopped on this and screwed up the execution.

2025-02-24 SPX 6000p - $2.50→$19 ($2500 —> $19000 potential) ** I got stopped after taking some profit multiple times on $4. It then dipped to $1 before running to 19.

2025-02-25 SPX 5950p - $0.50→$5 ($2500 —> $25000 potential) ** took too much off at 1.50 :(

2025-02-25 SPX 5930p - $1.20 → $4.40 ($1200 —> $4400 potential) ** Edge Trade Planner nailed the T1 and T2 targets!

2025-02-25 SPX 5970c - $2.40 → $12.60 ($2400 —> $12600 potential) ** I got greedy on this. Kudos to CG for catching the action in the Option Scanner and saying something.

2025-02-26 SPX 5950p - $1.90 → $21 ($1900 —> $21000 potential)

2025-02-27 SPX 5930p - $3->$66 ($3000 —> $66000 potential)

2025-02-27 SPX 5900p - $2 -> 40 ($2000 —> $40000 potential)

2025-02-27 SPX 5880p - $2->$20 ($2000 —> $20000 potential)

2025-02-27 SPX 5870p - $1->$10 ($1000 —> $10000 potential)

2025-02-28 SPX 5920c - $0.60->$40 ($600 —> $40000 potential)

2025-02-28 SPX 5850p - $0.37->$1.55 ($3700 —> $15500 potential)

2025-03-03 SPX 5880p - $3.80->$62.70 ($3800 —> $62700 potential)

2025-03-03 SPX 5820p - $1->$13 ($1000 —> $13000 potential)

2025-03-03 SPX 5920c - $3.80->$11.20 ($3800 —> $11200 potential)

2025-03-04 SPX 5940c - $2->$24 ($2000 —> $24000 potential) ** My target was 10-15. I was out at 12. mission accomplished.

2025-03-10 SPX 5600p - $4->$32 ($4000 —> $32000 potential) ** Took all day!

2025-03-10 SPX 5620c - $1.8->$15 ($1800 —> $15000 potential) ** My target was 10-15. I was out at 12. mission accomplished.

Swing Alerts

2024-01-13 TSLA 430c $1.30 → 8.82 ($1300 to $8820 potential) **alerted exits at 6.50 and 8

2024-01-15 GS 610c $2 → 8 ** exit on 1/16

2024-01-15 GS 610 $2 → $16 ** missed reload on dips. exit on 1/17

2025-01-16 SPX 6000c 1/17 $3 → 17.20 ** dipped to $2 on Thursday, exit majority at $12.

2025-01-21 SPX 6070c 1/17 $6.50 → 30+. *exit on 1/22

2025-01-21 AVGO 242.50c 1/24 $2.50 → 6 *exit on 1/22

2025-01-21 ORCL 180c 1/31 $2 → 11 *exit on 1/22

2025-01-22 NVDA 145p 0.75 → $2 *exit on 1/23

2025-01-23 ORCL 190c 1/31 $2 → 3.20 *exit on 1/24

2025-01-27 META 700c 1/31 $7 → ? rare e/r yolo **hope to sell 50% at $14 make it risk free hold into report.

2025-01-27 AVGO 225c 1/31 $0.25 → 2.50 **reached on 1/30 but I didn’t sell and got stopped at 1.50 and reloaded at 0.35-0.40

2025-02-04 AAPL 225p 2/7 $0.59 → 1.1 ** no bids

2025-02-04 NFLX 1000c 2/7 $4.5 → ? ** Locked some in at $10 to make it free

2025-02-05 TSLA 375p 2/7 $3.5 → 10.50 ** nailed it!! exit on 2/6

2025-02-06 SPX 6150 2/7 $1 avg → 0 ** yolo failed

2025-02-06 BABA 103c 2/7 $0.25 → 4.30

2025-02-06 BABA 130c 1/16/26 $9 → ? **leaps targeting 160+

2025-02-06 PLTR 120c 2/14 $0.50 → 3 ** locked 50% for 500% gains and risk free. Goal is $5-10.

2025-02-10 AAPL 235c 2/14 $0.35 → 1.80 and 2.30 on 2/11

2025-02-10 TSLA 330p 2/14 $2.10 → 5.50 and 11 on2/11

2025-02-19 NFLX 1060c 2/21 $1.60 → 3.20 ** locked 50% the rest went to 0

2025-02-19 MSFT 417c - $0.30→$3.50 -* Exit 3.30 ($3000 —> $35000 potential)

2025-02-19 APP 450p - $0.80→$23 -? ($800 —> $23000 potential) ** got stopped at 0.40 and needed to reload on 0.60 reclaim

2025-02-24 PDD 125c 2/28- $1.2→ 0 ** failed

2025-02-25 AAPL 140p 2/28. - $0.50 → 2

2025-02-27 NVDA 125p 2/28. - $1.10 → 7

2025-02-28 NFLX 1110c 3/7 - $4.50 → ?

2025-02-28 TSLA 300c 3/7 - $5.20 → ?

2025-02-28 META 690c 3/7 - $2.50→ ?

2025-02-28 AAPL 242.50c 3/7 - $1.55 →?

On swing trades, I usually with secure any big profits in first 15min and then look to reload later in the day.

Credit Sell Alerts

2024-01-14 SPX 5800/5795 bull puts for 1.50-2.50. $2000 credit potential using 10 contracts and $1000 risk.

2024-01-15 SPX 5950/5955 bear calls for $2→0. $2000-4200 credit potential. Round 1 dipped to 0.75. Round 2 ran to $4.20 and then dropped to 0.

2024-01-16 SPX 5950/5955 bear calls for $2→0. $2000-3000 credit potential. Round 1 dipped to 0.75. Round 2 ran to $3 and then dropped to 0. ** not a typo, same play paid.

2024-01-16 SPX 6020/6025 bear calls for 3.50 ** DID NOT FILL. (the 1.50 at time of alert went to 0)

2024-01-21 SPX 6035/6050 bear calls for 2 stopped 2.50

2024-01-27 SPX 5950/5945 bull puts for 2.50 → 0 **premarket

2024-01-30 SPX 6060/6055 bull puts for 4.50 → 0

2024-02-04 SPX 6050/6055 bear call for 1.20-1.50 → 0

2024-02-05 SPX 6030/6035 bear call for 2.50→3 ** lost 0.50

2024-02-06 SPX 6070/6065 bull puts for 4.20→0

2024-02-10 SPX 6070/6065 bear calls for 2.50→0

2024-02-14 SPX 6100/6095 bull puts for 2 → 0

2024-02-20 SPX 6110/6005 bull puts for 4 → 0 ** alert was for 4.50 entry but it only popped to 4. 3.60 realistic fill.

2024-02-21 SPX 6000/6005 bear calls for 2 → 0

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Trade Recap for Mon Mar 10

GOLD BOLD ITALIC = price action signal

WHITE REGULAR = action to take/taken

GREEN REGULAR = trades I should have taken

SPY / SPX

Took all day of failed pushes to finally get the afternoon dump. Key Secret Tip. the 5600p was holding 4-5 for hours! Normally they would have decayed. It gave me confidence downide was coming.

Nailed hat dip target and scoop the the rally in last hour.

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Adjusting for IV gave u good entries and onley 200-300% gains. Hard to get 10x+

Perfect flip top with volume to kick off the elling. out 5730p paid

Perfect reload short off vwap!

My focus was to win 2 trades for 150% and 300-500% gains. and I got that. good enough

Education - How to Join a Strong Trend

The process I typically follow for joining a strong trend are as follows:

All day grinder: join on dips to 20ma

Multi-day grinder:

Join either on support test of morning lows/failed breakdown reversal

Join at vwap mid day or end of day

Keep it simple. Don’t chase, wait for support levels for great risk/reward entries!

Education - Systematic Profit Taking

How do I take profits? I keep it relatively simple. Depending on the entry and range to the next levels I typically with take profits 50-100% of my profits at 3-10R and then raise stops to above entry with a goal of letting runners take me to the next level or 2 and to then reload if I believe we are consolidating before the next leg.

I then repeat the same process on the reload.

Let me know in the comments if you have questions or would like to see examples, I’ll share them.

Trade Ideas - Plan for Tue Mar 11

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Ideas

Possible capitulation near term yesterday. Watching dips to get long as long as 557 doesn’t break again. That said, We may not be out of the woods and another big sell leg down can come. So stay frosty. I don’t plan to open trade until after 11 or 12pm today. If i miss it I miss it. but I don’t want to tie up capital for a shitty 50-150% gain.