PPI today. How will market react? Day Trading Ideas for Apr 11

NVDA upgrades and strong bounce from gap fill.

Good morning traders!

What an initial premarket move after CPI yesterday followed by a whole lot of nothing. Its essential to focus on 2-3 trades. I nailed the 2 to 3 trades in morning, and a few in the afternoon, but scalping chop in the afternoon also triggered some losers.

I had to look back at why did I over trade… It comes down, to I was forcing and wanting a big range move vs letting it happen. I wasn’t happy with a 5-8% account gain.

CPI came in hot yesterday and we should have dumped sub 510. But market had another idea. The strong basing at 513 and selling at 515 puts us in a stalement for direction. Let’s see if PPI gives us a range break.

NVDA also had a large rally after our 831 scoops into the 871 level. This took our 850c from $10 to $25+ :)

Let’s review yesterday’s price action and come up with a couple of trade ideas for today.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas each morning, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Apr 10 - SPX 5180/5185 bear calls - Entry $2.50 ($2500 premium potential)

Apr 10 - SPX 5170c - Entry 0.50 ($500 → $5000 potential)

Apr 9 - SPX 5185/5180 bull puts - Entry $3 ($3000 premium potential)

Apr 9 - SPX 5205c - Entry $0.50 ($500→ $6000 potenitl)

Apr 8 - SPX 5225/5230 bear calls - Entry $1.20 ($1200 premium potential)

Apr 8 - SPX 5200/5195 bear puts - Entry $0.10 ($1000→ $8000 potential)

Apr 4 - SPX 5250p - Entry $4 ($4000→ $100k potential)

Apr 4 - SPX 5180p - Entry $1.30 ($1300 > $32k potential)

Apr 3 - SPX 5175/5170 bull put - Entry $1.50 ($1500 premium potential)

Apr 2 - SPX 5175/5170 bull put - Entry $1.50 ($1500 premium potential)

Apr 2 - SPX 5205/5200 bull put - Entry $1.50 ($1500 premium potential)

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Tuesday’s Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

SPY/SPX

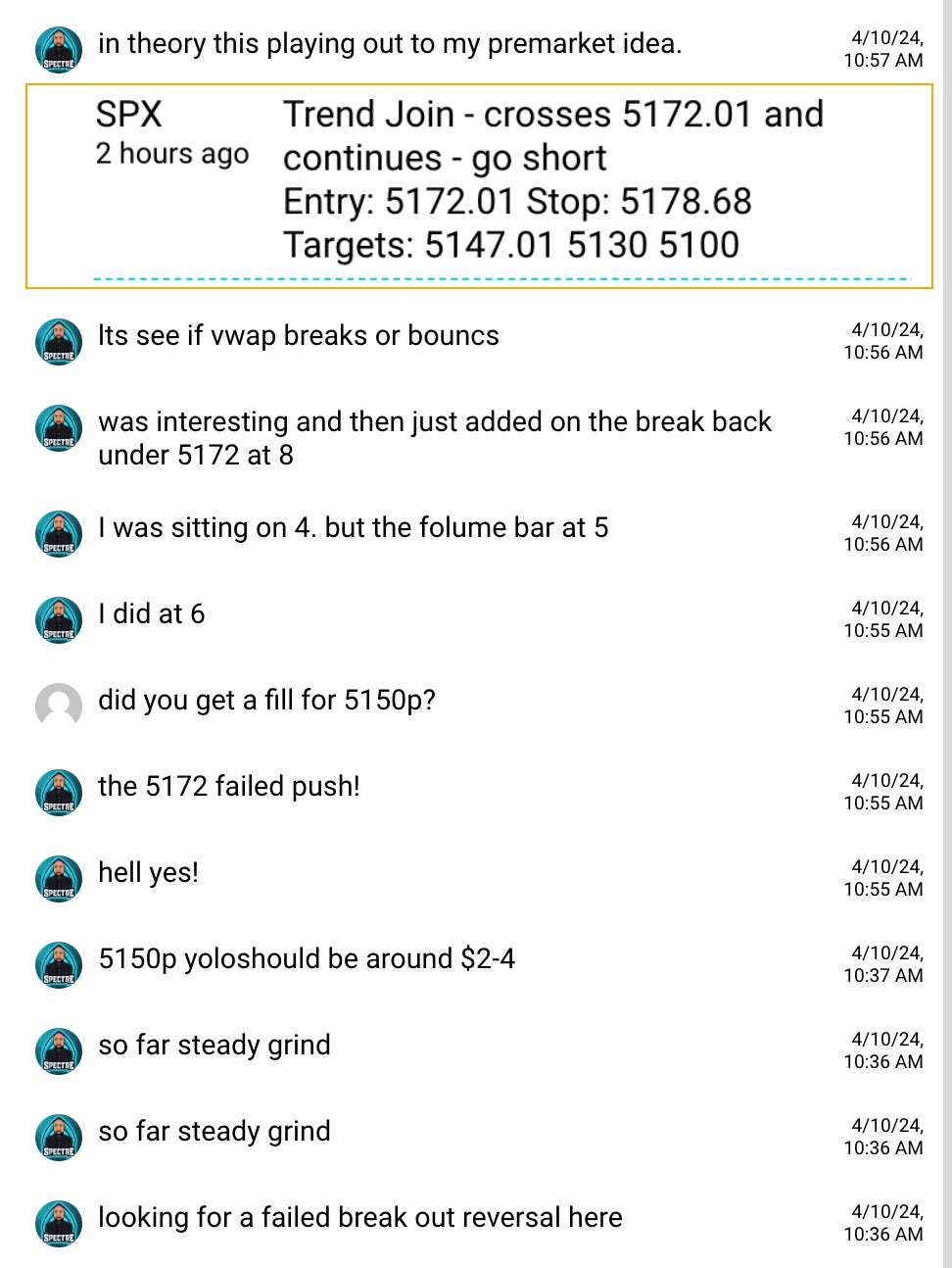

We planned for a squeeze right to the levels above and then got short.

Overall. I made a plan to get short on the push into SPY 515/ SPX 5172 and alerted the members of my plan to short ahead of time.

SPX 5150p went from $5 to $15+ into the 2 level drop.

The key for this trade was I shared the idea in premarket looking for BTFD at the open and then estimating where selling would happen. The look for the price action to confirm, join the trade and take 80% off on the 2 level move.

After this I told members that I expect us to chop around for rest fo the day which what more or less happened.

I also planned early morning that 5180+ wasn’t coming I wanted to load up on credit sells on that level. This worked out great!

Trade Ideas - Plan for Thursday Apr 11

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

All eyes on on PPI and market reaction to it. As usual, I’ll be training and will miss the 8:30am action. I’m ok with it, because I know there will be more opportunity today.

Remember to breath, be patient, and let the trades come to you

I’m not going to predict up or down or how today plays out because anything can happen. I was expecting CPI to trigger a larger move, now let’s see if PPI brings the catalyst.

Today I will be watching: SPY, NVDA, TSLA, PLNT

BE PATIENT, if we don’t get range today, don’t sweat it. Earnings season is coming and we should get a number of imbalances to take advantage of!