Market rally heats up. CPI coming this morning. Will SPY reclaim over 453.50? Trade ideas for Wed Aug 14, 2024

Are you planning trades that pay as much as 5 to 20 times your risk? If not, join THT-PRO

Good morning traders!

yesterday I was too patient and missed the perfect entry for a long, wanting a backing test to fill some of the overnight gap. That said. I used Edge to plan and trade according to the plan and we got a base hit. The big home run was the swing in SMCI 600c from 2.50 the day before to 10.50 yesterday. If this rally continues there is a chance this hits 620-650 by Friday.

After that I placed dip by orders that kept missing by small amounts. I had an order on 5420c for 1.50. while it was at 3.50 targeting a $15-18 exit.

And an order for SPX 5430c for $1 targeting a 4-8 exit, but that was missed by 0.30.

Sometimes that will happen. I prefer to avoid chasing gap ups and so need great risk/reward entries for possible 10R+ gains.

On the bright side, the sell targets were spot on. Even though I didn’t profit, its ok, I can still be happy I planned exits well and review, what can I do differently for next time. In this case, the lesson learned is when the previous day is heavy consolidation, and vwap holds, go ahead and join at 25-50% size, and average down at ideal entry price if it comes. using $2 for risk, would have still yielded a 5R+ trade.

As for this morning, SPY 543.50 is the 50dma and it was tagged after CPI released and we had a quick flush into 541 and than back to 542.

Algo caught the bull signal on SPY yesterday, so it is looking promising , but the key problem is figuring out trend day vs consolidation day targeting.

Join THT PRO to get alerts, real-time commentary, and improve trading habits.

Let’s review yesterday’s trades/signals and then get into ideas for today.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading—your daily source for market insights and trading opportunities. Here, you’ll find comprehensive market analysis, educational lessons, and trade ideas to help you excel in trading, all while spending less than two hours a day.

What Subscribers Get

Subscribers receive daily market analysis updates, educational content, and up to three trade ideas each morning based on real-life examples and my trading approach.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

2024 Alert Leaderboard

Here's a look at some of the potential gains achieved through our entry alerts:

Aug 13 - SMCI 600c swing $2.5 ($2500 → $10500 potential)

Aug 13 - SPX 5400p 17 stops 15 ($1700 —> $2300 potential)

Aug 12 - SPX5350c $8 stops 7 ($8000 → $25000 potential)

Aug 12 - SPX5340c $0.5 ($500 → $4500 potential)

Aug 09 - NVDA107c $0.2 stops .10 ($2000 → $7000 potential)

Aug 09 - LLY900c $3.50 stops 1.50 ($3500 → $11500 potential)

Aug 07 - SPX 5280p $10 stops 8 ($1000 → $8000+ potential)

Aug 07 - SPX 5200p $1 stops 0.5 ($1000 → $7000+ potential)

Aug 07 - NVDA 100p $0.8 stops 0.4 ($800 → $3300+ potential)

Aug 06 - SPX 5250c $10 stops 8 ($1000 —> $6000+potential)

Aug 06 - SPX 5250p $1.5 stops 0.75($1500 —> $13000+potential)

Aug 05 - SPX 5300c $3.50 stops 2.50 ($3500 —> $11000 +potential)

Aug 02 - SPX 5350p $5.50 (overnight swing from Aug 01) ($5500 —> $45000 +potential)

Aug 01 - SPX 5480p $4.50 ($4500 —> $65000 potential)

July 31 - SPX 5520c $12 ($1200 —> $3390 potential)

July 30 - SPX 5430p $2.50 ($2500 —> $30000 potential)

July 30 - SPX 5400p $2 ($2000 —> $10000 potential)

July 30 - TSLA 220p $1.50 ($1500 —> $5000 potential)

July 30 - SPX 5450c $0.20 ($200 —> $5000 potential)

July 29 - SPX 5450p $4.50 ($4500 —> $16000 potential)

July 29 - SPX 5460p $0.20 ($200 —> $1100 potential)

July 29 - SPX 5470p $1.5 ($1500 —> $8000 potential)

July 29 - SPX 5480c credit sell - collect $2700 risk $500

July 29 - SPX 5400p $2 out $6 ($2000 —> $6000 potential)

July 26 - SPX 5400p $2 out $6 ($2000 —> $6000 potential)

July 26 - SPX 5450c $4 out $12 reached 15.50 ($4000 —> $15500 potential)

July 25 - SPX 5450c $1, $1.50, and $1.75. target $10. reached $10! ($1000 —> $10000 potential)

July 25 - SPX 5450c $5. reached $41.70! ($5000 —> $41700 potential)

July 22 - CRWD 240p $1.7. reached $3.5! ($1700 —> $3500 potential)

July 22 - SPX 5580c $0.5. reached $3.3! ($500 —> $3300 potential)

July 19 - SPX 5500p $2. reached $12! ($2000 —> $12000 potential)

July 18 - SPX 5580p $5. reached $53+! ($5000 —> $53000 potential)

July 17 - SPX 5540c $2. reached $16! ($2000 —> $16000 potential)

July 16 - SPX 5660c $2. reached $10! ($2000 —> $10000 potential)

July 15 - SPX 5650c $1. reached $4! ($1000 —> $4000 potential)

July 11 - SPX 5600p $2. reached $23! ($2000 —> $23000 potential)

July 09 - Credit Sell SPX 5590/5595 bear calls 2.30-2.50 stops at 2.60 ( $2500 premium collected per 5k position risking $300)

July 08 - AVGO 1800c 13( $1300—> $2250 potential)

July 08 - SPX 5560p 2.50 stops 2.30 ( $2500—> $5000 potential)

July 08 - TSLA 270c 4.50 target 7.50 ( $4500—> $7600 potential)

July 03 - SPX 5520 2.5 ($2500—> $18000 potential)

July 02 - TSLA 225c 3.5 ($3500—> $8500 potential)

July 02 - SPX 5500c 2.50 ($2500 —> $10000 potential)

July 02 - SPX 5470 Bull Puts 2.50 ($2500 credit collected)

July 01 - closed TSLA Swing $2.65—> $12.00

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Tuesday Recap

Let’s review the trades and price action. Did you take advantage? If not read on an learn how.

SPY/SPX

So we nailed the short following process on gap up. The challenge was that we got a failed breakdown reversal on vwap and 10:30 level. I was stubborn and wanted at least one more vwap test if nto 535 back test to trap shorts before the run to 543. That was my thesis, it didn’t develop and so I missed the long trade. Guys, that is perfectly ok. You want to have a thesis, and make a plan. If it doesn’t develop so be it.

Avoid getting caught up in chasing. I did notice the consolidation for an hour just above 538, that was the signal for it to be OK to go long. I marked up the charts with Green text to indicate where I should have gone long. I actually shifted to a long bias, but I wasn’t getting a dip to fill my long orders.

I had a discount buy set at 1.50 on 5420c, but what I failed to notice was that $3-3.50 vwap level on 5420 was being accumulated.

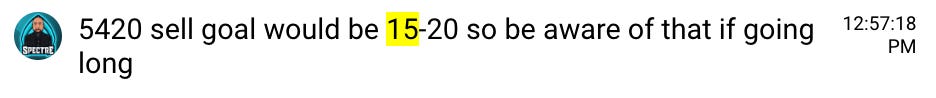

I posted this as my target for selling 5420c for those that went long. Look what happened mid afternoon, there was a dip, right back on to vwap at 4.50 and then where did we rip into? that 15-20 range with a high of 17.60! I missed this because I was being too cheap. I moved my 1.50 orders to $3. only to be missed by 1.50. The lesson learned, on strong trend, place starter order at vwap (and be sure update as the day progresses) as long as I still have a 5R potential trade.

So let’s talk R. If you grabbed 5420c at $5 risking $2 (stops at 3). and sold and 15. That is $10 profit with $2 risk. That is a 5R trade!

Are you wondering how I came up with a $15-20 sell target? It’s easy, THT-PRO members get access to the generated SPX levels. I was targeting 5441, but lately, we have been hitting the target levels overnight and not at the close, so I mentally decided to use 5435 as my targets. so 5435-5420=$15, with $5 of room in case 5441 comes or to catch some extra premium into a spike. Below is the chart of SPX yesterday.

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Education - How to Join a Strong Trend

The process I typically follow for joining a strong trend are as follows:

All day grinder: join on dips to 20ma

Multi-day grinder:

Join either on support test of morning lows/failed breakdown reversal

Join at vwap mid day or end of day

Keep it simple. Don’t chase, wait for support levels for great risk/reward entries!

Education - Systematic Profit Taking

How do I take profits? I keep it relatively simple. Depending on the entry and range to the next levels I typically with take profits 50-100% of my profits at 3-10R and then raise stops to above entry with a goal of letting runners take me to the next level or 2 and to then reload if I believe we are consolidating before the next leg.

I then repeat the same process on the reload.

Let me know in the comments if you have questions or would like to see examples, I’ll share them.

Trade Ideas - Plan for Wed Aug 14

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Ideas

As expected market ripped after PPI. The question is where will profit taking hit, and then where will BTFD come in. Overall I’m watching for similar action to yesterday with sudden drops that get bought up.