IBM, TSLA, META rally while CAT, MSFT ,NOW dump. Will SPY break out? Ideas for Jan 30, 2025

What happened to the market? SPY, QQQ, MSFT, NVDA and more all red. I'll discuss this and how I plan to profit in today's blog.

Good morning traders !

Overall its important to know when not to trade. I found a couple of trades that paid 50-200% but imho not worth the energy. As I said yesterday, wait until 2:45 for a trade in SPX was good use of mental energy. If you tried to trade before then except for the 1pm support break, you likely got chopped up, my bit “winner” that wasn’t satisfying was the vwap backtest short after the 1pm break into FOMC. I gambled and it paid of with the trade going from 4.50 to 12. after that it was back to decay and chop into the close.. NOT WORTH IT!

FOLKS know when not to trade will save you hundreds of thousands of dollars over time. Please stop trading to make money every day. Focus on trading great risk/reward setups and then be done. There are typically 1-3 great setups a day and that’s it. if you miss it you miss it. Don’t lose money for the sake of being in a trade and “doing some work” in the trading world. Trading can be unforgiving and you MUST NOT bring normal job “productivity’ measures into it. I did for years and lost millions because of it wanting to be profitable making lots of trades in a day. Profitability and consistency changed when I focused on 1-3 great trades, being patient and accepting doing nothing is 90% of trading.

If you have been debating about joining, now is the time. Volatility and momentum is my jam and it could be yours. Join THT PRO to get alerts, real-time commentary, and improve trading habits.

Take Azaan for example. On Tuesday Jan 28 he cleared over $10000 on round 1 of the rally yesterday.

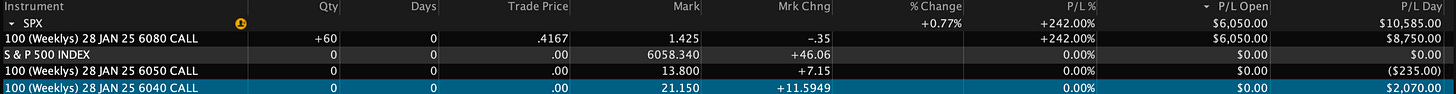

Notice how he kept his losses small and scaled on the dip buy I alerted for 6080c. I told members I wanted 6080c for 0.20. it dipped to 0.25 and we scooped between 0.25 and 0.45. It ran to over $2.25 for almost 1000% gains!

Wed Highlights

Overall SPY is compressing for a bigger move. on 602.50 break I was expecting 597.50 to come, instead it perfectly bounced after only doing a 1 level move to 599.50. Because of that and seeing 602.50, its a failed break down imho. and I have a bullish bias until 599.50 breaks.

SPY - consolidated most of the day with a sharp 1 level move from 602.50 to 599.50 and then push back on 603.50.

AVGO - consolidated above 200, spending most of the day between 202.50 and 205.

BABA - perfectly gapped hit 101.40 level and sold off toward dip buy levels.

Overall market consolidated while waiting for e/r reports and FOMC.

Thu Premarket Highlights

Mixed action ahead of FOMC today at 2pm

SPY 0.00%↑ - consolidating between 602.50 and 604.

TSLA 0.00%↑ - Wed ah dipped to 365, recovered, and today backtested 395 and testing 405 at the moment

AVGO 0.00%↑ - META said buying their chips… gapping nicely to 218, lets see if our 225c yolo at 0.25 pays off! If swinging 205c from Tuesday dips, you are up huge today.

META 0.00%↑ - gapping up again and testing 680s.

BABA 0.00%↑ - gapping up/continuation on LLM news.

Join THT PRO to get alerts, real-time commentary, and improve trading habits.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading—your daily source for market insights and trading opportunities. Here, you’ll find comprehensive market analysis, educational lessons, and trade ideas to help you excel in trading, all while spending less than two hours a day.

What Subscribers Get

Subscribers receive daily market analysis updates, educational content, and up to three trade ideas each morning based on real-life examples and my trading approach.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

2025 Q1 Alert Leaderboard

Here's a look at some of the potential gains achieved through our entry alerts:

Intraday Alerts

2024-01-02 SPX 5880p 11 to 40+

2024-01-02 SPX 5820p $2 to 10

2024-01-03 SPX 5930c $2, dipped to $3 and ran to $11

2024-01-06 SPX 5980p $1.70 → $20 ($1700 to $20k potential)

2024-01-07 SPX 5900p $0.50 → $11 ($500 to $11000 potential)

2024-01-07 SPX 5930p $5 → $17.4 ($5000 to $17400 potential)

2024-01-07 SPX 5930p $5 → $40 ($500 to $4000 potential)

2024-01-08 SPX 5800p 1/10 $4 → $10 ($400 to $1000 potential)

2024-01-10 SPX 5800p 1/10 $4 → $10 ($400 to $1000 potential)

2024-01-13 SPX 5820c $5 → $10 ($400 to $1000 potential) **Round 1

2024-01-13 SPX 5820c $2.80 → $16 ($400 to $1000 potential) ** Round 2

2024-01-13 SPX 5820c $4.50 → $16 ($400 to $1000 potential)** Round 3

2024-01-14 SPX 5870c $0.75 → $3.75 ($750 to $3750 potential)

2024-01-14 TSLA 430c $0.75 → $3.75 ($750 to $3750 potential)

2024-01-15 SPX 5950c $9 → $14 ($9000 to $14000 potential)

2024-01-15 GS 610c $2 → $4.50 ($2000 to $4500 potential)

2024-01-15 TSLA 430c $3-4 → $8.20 ($3500 to $8200 potential)

2024-01-15 QQQ 514p $0.8 → $1.82 ($8000 to $18200 potential)

2024-01-16 AAPL 235p $0.7 → $7 ($700 to $7000 potential)

2024-01-16 SPX 5980c $7 → $12 ($700 to $1200 potential)

2024-01-16 SPX 5970c $2 → $5 ($2000 to $5000 potential)

2024-01-16 SPX 5970c $2 → $5 ($2000 to $5000 potential)

2024-01-17 SPX 6000c $8 → $17.2 ($8000 to $17200 potential)

2024-01-17 TSLA 430c $2 → 5.20 ($2000 to $5200 potential)** Round 1

2024-01-17 TSLA 430c $2.30 → 9.9 ($2000 to $9900 potential)** Round 2

2025-01-17 SPX 6000p $0.50 → $5 ($500 to $5000 potential)

2025-01-17 SPX 6020c $0.50 → $0.30 ($500 to $300 stopped.) ** was a combo trade with the 6000p

2025-01-21 SPX 6035c $5→ $15 ($5000 to $15000 potenital.)

2025-01-21 TSLA 440c $2.90→ $5.30 ($2900 to $5300 potenttal.) **dipped to 2.58. alerted 2.50 entry wanted.

2025-01-22 NFLX 950p $3.25→ $10.60 ($3250 to $10600 potenital.)

2025-01-22 SPX 6090p $1→ $5.80 ($1000 to $5800 potenital.) **dipped to 0.65

2025-01-23 SPX 6110c $0.80→ $8.60 ($800 to $8600 potential)

2025-01-24 SPX 6100p $3.30→ $2.30 (stopped) ** round 1 stopped

2025-01-24 SPX 6100p $1.50→ $12 ($1500 to $12000 potential) ** round 2 we banked

2025-01-24 AAPL 222.50p $0.25→ 0.80 ($2500 → $8000 potential)

2025-01-24 AAPL 222.50p $0.25→ 0.80 ($2500 → $8000 potential)

2025-01-24 AMD 123p $0.10 → 1.72 ($1000 → $17200 potential)

2025-01-27 SPX 5950p $9 → 40 ($900 → $4000 potential) ** premarket trade

2025-01-27 SPX 5950p $1.50 → 3.50 ($1500 → $3500 potential)

2025-01-27 NVDA 117p $1.5 → 5.4 ($1500 → $5400 potential)

2025-01-27 AVGO 200p $1.8 → 9.10 ($1800 → $9100 potential)

2025-01-28 SPX 6040c $8.50 → 33.50 ($8500 → $33500 potential)

2025-01-28 SPX 6080c $0.20 → 2.25 ($3500 → $22500 potential)

2025-01-28 SPX 6070c $0.70 → 6.20 ($7000 → $62000 potential) *Round 1

2025-01-28 SPX 6070c $0.90 → 6.20 ($9000 → $62000 potential) *Round 2

2025-01-29 SPX 6000p $4.50 → 12 ($4500 → $12000 potential)

2025-01-29 SPX 6060c $1.5 → 5.20 ($1500 → $5200 potential)

Swing Alerts

2024-01-13 TSLA 430c $1.30 → 8.82 ($1300 to $8820 potential) **alerted exits at 6.50 and 8

2024-01-15 GS 610c $2 → 8 ** exit on 1/16

2024-01-15 GS 610 $2 → $16 ** missed reload on dips. exit on 1/17

2025-01-16 SPX 6000c 1/17 $3 → 17.20 ** dipped to $2 on Thursday, exit majority at $12.

2025-01-21 SPX 6070c 1/17 $6.50 → 30+. *exit on 1/22

2025-01-21 AVGO 242.50c 1/24 $2.50 → 6 *exit on 1/22

2025-01-21 ORCL 180c 1/31 $2 → 11 *exit on 1/22

2025-01-22 NVDA 145p 0.75 → $2 *exit on 1/23

2025-01-23 ORCL 190c 1/31 $2 → 3.20 *exit on 1/24

2025-01-27 META 700c 1/31 $7 → ? rare e/r yolo **hope to sell 50% at $14 make it risk free hold into report.

2025-01-27 AVGO 225c 1/31 $0.25 → ?

Credit Sell Alerts

2024-01-14 SPX 5800/5795 bull puts for 1.50-2.50. $2000 credit potential using 10 contracts and $1000 risk.

2024-01-15 SPX 5950/5955 bear calls for $2→0. $2000-4200 credit potential. Round 1 dipped to 0.75. Round 2 ran to $4.20 and then dropped to 0.

2024-01-16 SPX 5950/5955 bear calls for $2→0. $2000-3000 credit potential. Round 1 dipped to 0.75. Round 2 ran to $3 and then dropped to 0. ** not a typo, same play paid.

2024-01-16 SPX 6020/6025 bear calls for 3.50 ** DID NOT FILL. (the 1.50 at time of alert went to 0)

2024-01-21 SPX 6035/6050 bear calls for 2 stopped 2.50

2024-01-27 SPX 5950/5945 bull puts for 2.50 → 0 **premarket

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Trade Recap for Wed Jan 29

GOLD BOLD ITALIC = price action signal

WHITE REGULAR = action to take/taken

GREEN REGULAR = trades I should have taken

SPY / SPX

** Why wait? because of IV and contracts were juiced. I also took a handful of call scalps win case 603.50 break out but stopped flat after selling 50% for 100% gains.

Lessons to learn:

Pay attention to IV. Don’t trade SPX options at IV over 25%. prefer under 15% (IV was at 50%)

Wait for major levels. long at 599.50 was doable after double bottom and higher low.

Don’t forget trading futures /ES on high IV days is a GREAT alternative

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Education - How to Join a Strong Trend

The process I typically follow for joining a strong trend are as follows:

All day grinder: join on dips to 20ma

Multi-day grinder:

Join either on support test of morning lows/failed breakdown reversal

Join at vwap mid day or end of day

Keep it simple. Don’t chase, wait for support levels for great risk/reward entries!

Education - Systematic Profit Taking

How do I take profits? I keep it relatively simple. Depending on the entry and range to the next levels I typically with take profits 50-100% of my profits at 3-10R and then raise stops to above entry with a goal of letting runners take me to the next level or 2 and to then reload if I believe we are consolidating before the next leg.

I then repeat the same process on the reload.

Let me know in the comments if you have questions or would like to see examples, I’ll share them.

Trade Ideas - Plan for Thu Jan 30

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Ideas

We have a mixed bag of e/r results and reactions. So today likely will be cherry picking trades. SPY continues to coil. Could break range any day now. Maybe it’s waiting for AAPL e/r?