Did we see capitualtion yesterday? Will market continue to bounce? Trade ideas for Jan 28, 2025

What happened to the market? SPY, QQQ, MSFT, NVDA and more all red. I'll discuss this and how I plan to profit in today's blog.

Good morning traders !

What a time! I was hoping for bigger gains yesterday but we did pretty ok. Many of the trades gave 100-200% gainers before the afternoon reversals came in.

AUTOMATION UPDATE

I spent most of the night looking into a data collection issue and false positives in the reversal playbooks. Still don’t have a resolution on the false positives but made progress on the data collection. Why is it important?

One of the strongest features in Edge Planner is the Option Scanner and it between 1 and 2pm it noticed a bunch of put credit selling coming in. (or rather it would have if it had the data.)

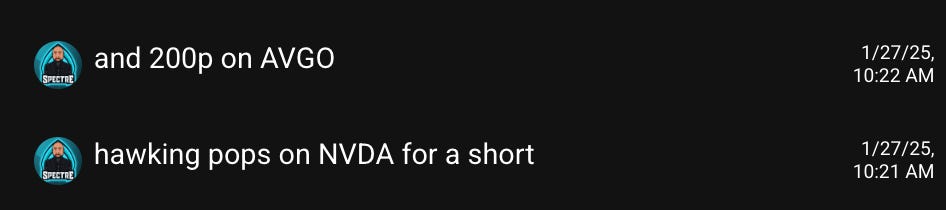

For example when the playbook scanner alerted AVGO long around 198 at 1pm, the option scanner (if it had data) would have alerted credit selling on puts at 196 dip at 1:30pm. That would have been a strong signal to take 205c and this morning AVGO hit 210.

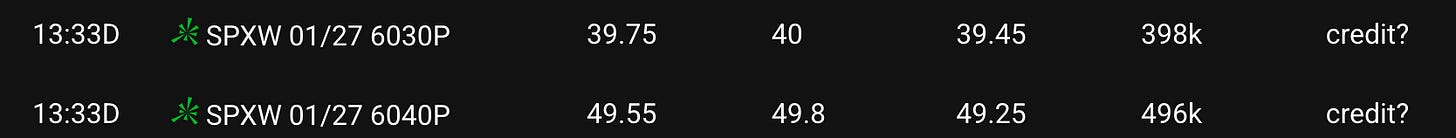

Same for SPX around 1:33, we should have seen this alert and planning could have taken 6000/5995 bull puts.

Why is this important? Because I want to watch screen less. I’m putting a fair amount of time and money into automation. Using this signal the bull puts we could have taken a $3500 credit position for $1500 risk with less that a $500-1000 drawdown and walked away.

Another way to to trade the signal is to have taken 6000/6005 vertical calls for $1. Risking $2000 for max gain on $8000.

I love that! Fire and forget. Why 6000/6005.. because the next level up in 6008 and we are looking for a close above that level. we closed at 6012!

TRADING UPATE

Anyways, we nailed shorts in AVGO, NVDA. AVGO dropped to 196 and NVDA to 117.

I took calls but the most they did was 100-150% so it was kind of blah. Glad I had the rule to take 50% profit at 100% gain. (I was too far out of the money. Need more time as the targets hit in premarket today)

I was so tired that /i fell asleep in last hour. And of course a 1000% trade developed in last 15 minutes. (Should have slept mid day when we were consolidating. tried to but just didn’t happen. was too amped from my premarket short payoff)

Monday Highlights

SPY - possible capitulation at 590. as long as 596 hold we can get back on the upside grind. dipped to 596 after open and ran to 599s. and then consolidate all day between 596 and 599

NVDA - big gap down pushed into 127/125 failed and flushed to 117 which has been long term support.

NFLX - surprisingly ran to 980 and then dumped back to 960.

AVGO - pushed 220 and then broke premarket 210 support and gave spectacular dump to 196. 185-195 is my relong scoop area for a swing.

META - WHAT A BEAST, gap down premarket and then cleared Friday highs and ran to 662. If beats on e/r I expect to see 720+ this week.

AAPL - ran to 230

WMT - make new all time highs

PDD, BABA - china names were strong

Tuesday Premarket Highlights

Bloodbath in the market with large drops across the board and especially in chips

SPY 0.00%↑ - premarket test 602 and now back to the close at 599.50.

NVDA 0.00%↑ - tested 125 level again in premarket

AVGO 0.00%↑ - tested 210 premarket

META 0.00%↑ - made a new high in premarket at 664

Do you see a theme? Basically AI stocks are getting repriced but market is overall still strong.

Join THT PRO to get alerts, real-time commentary, and improve trading habits.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading—your daily source for market insights and trading opportunities. Here, you’ll find comprehensive market analysis, educational lessons, and trade ideas to help you excel in trading, all while spending less than two hours a day.

What Subscribers Get

Subscribers receive daily market analysis updates, educational content, and up to three trade ideas each morning based on real-life examples and my trading approach.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

2025 Q1 Alert Leaderboard

Here's a look at some of the potential gains achieved through our entry alerts:

Intraday Alerts

2024-01-02 SPX 5880p 11 to 40+

2024-01-02 SPX 5820p $2 to 10

2024-01-03 SPX 5930c $2, dipped to $3 and ran to $11

2024-01-06 SPX 5980p $1.70 → $20 ($1700 to $20k potential)

2024-01-07 SPX 5900p $0.50 → $11 ($500 to $11000 potential)

2024-01-07 SPX 5930p $5 → $17.4 ($5000 to $17400 potential)

2024-01-07 SPX 5930p $5 → $40 ($500 to $4000 potential)

2024-01-08 SPX 5800p 1/10 $4 → $10 ($400 to $1000 potential)

2024-01-10 SPX 5800p 1/10 $4 → $10 ($400 to $1000 potential)

2024-01-13 SPX 5820c $5 → $10 ($400 to $1000 potential) **Round 1

2024-01-13 SPX 5820c $2.80 → $16 ($400 to $1000 potential) ** Round 2

2024-01-13 SPX 5820c $4.50 → $16 ($400 to $1000 potential)** Round 3

2024-01-14 SPX 5870c $0.75 → $3.75 ($750 to $3750 potential)

2024-01-14 TSLA 430c $0.75 → $3.75 ($750 to $3750 potential)

2024-01-15 SPX 5950c $9 → $14 ($9000 to $14000 potential)

2024-01-15 GS 610c $2 → $4.50 ($2000 to $4500 potential)

2024-01-15 TSLA 430c $3-4 → $8.20 ($3500 to $8200 potential)

2024-01-15 QQQ 514p $0.8 → $1.82 ($8000 to $18200 potential)

2024-01-16 AAPL 235p $0.7 → $7 ($700 to $7000 potential)

2024-01-16 SPX 5980c $7 → $12 ($700 to $1200 potential)

2024-01-16 SPX 5970c $2 → $5 ($2000 to $5000 potential)

2024-01-16 SPX 5970c $2 → $5 ($2000 to $5000 potential)

2024-01-17 SPX 6000c $8 → $17.2 ($8000 to $17200 potential)

2024-01-17 TSLA 430c $2 → 5.20 ($2000 to $5200 potential)** Round 1

2024-01-17 TSLA 430c $2.30 → 9.9 ($2000 to $9900 potential)** Round 2

2025-01-17 SPX 6000p $0.50 → $5 ($500 to $5000 potential)

2025-01-17 SPX 6020c $0.50 → $0.30 ($500 to $300 stopped.) ** was a combo trade with the 6000p

2025-01-21 SPX 6035c $5→ $15 ($5000 to $15000 potenital.)

2025-01-21 TSLA 440c $2.90→ $5.30 ($2900 to $5300 potenttal.) **dipped to 2.58. alerted 2.50 entry wanted.

2025-01-22 NFLX 950p $3.25→ $10.60 ($3250 to $10600 potenital.)

2025-01-22 SPX 6090p $1→ $5.80 ($1000 to $5800 potenital.) **dipped to 0.65

2025-01-23 SPX 6110c $0.80→ $8.60 ($800 to $8600 potential)

2025-01-24 SPX 6100p $3.30→ $2.30 (stopped) ** round 1 stopped

2025-01-24 SPX 6100p $1.50→ $12 ($1500 to $12000 potential) ** round 2 we banked

2025-01-24 AAPL 222.50p $0.25→ 0.80 ($2500 → $8000 potential)

2025-01-24 AAPL 222.50p $0.25→ 0.80 ($2500 → $8000 potential)

2025-01-24 AMD 123p $0.10 → 1.72 ($1000 → $17200 potential)

2025-01-27 SPX 5950p $9 → 40 ($900 → $4000 potential) ** premarket trade

2025-01-27 SPX 5950p $1.50 → 3.50 ($1500 → $3500 potential)

2025-01-27 NVDA 117p $1.5 → 5.4 ($1500 → $5400 potential)

2025-01-27 AVGO 200p $1.8 → 9.10 ($1800 → $9100 potential)

Swing Alerts

2024-01-13 TSLA 430c $1.30 → 8.82 ($1300 to $8820 potential) **alerted exits at 6.50 and 8

2024-01-15 GS 610c $2 → 8 ** exit on 1/16

2024-01-15 GS 610 $2 → $16 ** missed reload on dips. exit on 1/17

2025-01-16 SPX 6000c 1/17 $3 → 17.20 ** dipped to $2 on Thursday, exit majority at $12.

2025-01-21 SPX 6070c 1/17 $6.50 → 30+. *exit on 1/22

2025-01-21 AVGO 242.50c 1/24 $2.50 → 6 *exit on 1/22

2025-01-21 ORCL 180c 1/31 $2 → 11 *exit on 1/22

2025-01-22 NVDA 145p 0.75 → $2 *exit on 1/23

2025-01-23 ORCL 190c 1/31 $2 → 3.20 *exit on 1/24

2025-01-27 META 700c 1/31 $7 → ? rare e/r yolo **hope to sell 50% at $14 to make it risk free hold into report.

Credit Sell Alerts

2024-01-14 SPX 5800/5795 bull puts for 1.50-2.50. $2000 credit potential using 10 contracts and $1000 risk.

2024-01-15 SPX 5950/5955 bear calls for $2→0. $2000-4200 credit potential. Round 1 dipped to 0.75. Round 2 ran to $4.20 and then dropped to 0.

2024-01-16 SPX 5950/5955 bear calls for $2→0. $2000-3000 credit potential. Round 1 dipped to 0.75. Round 2 ran to $3 and then dropped to 0. ** not a typo, same play paid.

2024-01-16 SPX 6020/6025 bear calls for 3.50 ** DID NOT FILL. (the 1.50 at time of alert went to 0)

2024-01-21 SPX 6035/6050 bear calls for 2 stopped 2.50

2024-01-27 SPX 5950/5945 bull puts for 2.50 → 0 **premarket

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Trade Recap for Mon Jan 27

GOLD BOLD ITALIC = price action signal

WHITE REGULAR = action to take/taken

GREEN REGULAR = trades I should have taken

SPY / SPX

No much trading after morning action and was too tried in afternoon to trade effectively.

Overall thesis that we may be pinned in a range yesterday was right.

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Education - How to Join a Strong Trend

The process I typically follow for joining a strong trend are as follows:

All day grinder: join on dips to 20ma

Multi-day grinder:

Join either on support test of morning lows/failed breakdown reversal

Join at vwap mid day or end of day

Keep it simple. Don’t chase, wait for support levels for great risk/reward entries!

Education - Systematic Profit Taking

How do I take profits? I keep it relatively simple. Depending on the entry and range to the next levels I typically with take profits 50-100% of my profits at 3-10R and then raise stops to above entry with a goal of letting runners take me to the next level or 2 and to then reload if I believe we are consolidating before the next leg.

I then repeat the same process on the reload.

Let me know in the comments if you have questions or would like to see examples, I’ll share them.

Trade Ideas - Plan for Tues Jan 28

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Ideas

OK so we got a day 1 bounce. the question is do we get day 2? My plan is took love for 2 level moves up or down for possible reversals today. I’m mostly wanting to wait for market reaction after FOMC and earnings tomorrow and then start banking on trades on thursday/friday

Remember we have news catalysts this week.

Today 10AM - Consumer confidence

Wed 2pm - FOMC interest rate

Wed 3:20pm - FOMC Powell speaks

Wed After Hours - TSLA, META, MSFT, NOW report earnings

I typically don’t trade er names until after report so they wont be on the watchlist.

Let’s go over the ideas.