CPI today. Will SPY see 530+ today or break pattern and flush over 1.5%? Day Trading Ideas for Apr 10

Learn how nailing the lowest option price isn't the key to catching failed break reversals and how we took advantage of Edge's option scanner to credit sell and plan the afternoon squeeze.

Good morning traders! What a wild day yesterday.

I started the day bummed out because my laptop overheated and shut down right as SPY was rejecting 520 at the open. It took me a few minutes, but thanks to planning and writing out the ideas yesterday, I was able to chase NVDA and SPY shorts and get to 16% account growth in the first hour!

Some of you are wanting exact contracts to buy/sell and at what price in the morning blog. It’s incredibly difficult to predict that and I only share that in this blog when on the rare occasion I can make that prediction. What I do provide every day are lessons on how to translate the ideas, use price action, select option contracts, and execute the trade. These lessons teach you how to fish, while using the ideas as a guide. And remember I have zero problem flipping because when my idea is wrong, it usually means a strong move to the other side and I can often make even more money!

Please spend the time each day to read, learn, and take notes from the Education section. I takes me 20-30 minutes to analyze and provide ideas, but I spend an hour each day to write up the Education section.

Back to yesterday, I couldn’t be more proud of the NVDA plan. The precision on the target if selling came in was perfect! It let me catch the exit perfectly and flip long!

Given the chop/action we also got great credit/sell opportunities and an 8-20x trade for the afternoon. I’ll review that process as well.

One of key things you will see in today’s education is how to recognize and join a failed move.

As for CPI and yesterday’s super low volume day, today should offer multiple opportunities. If you haven’t mastered trading and even if you have, consider trading smaller size and sizing to risk 100% so if the market does do lots of faker moves and you are right, you can still make money. and if wrong you don’t get hurt.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas each morning, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Apr 9 - SPX 5185/5180 bull puts - Entry $3 ($3000 premium potential)

Apr 9 - SPX 5205c - Entry $0.50 ($500→ $6000)

Apr 8 - SPX 5225/5230 bear calls - Entry $1.20 ($1200 premium potential)

Apr 8 - SPX 5200/5195 bear puts - Entry $0.10 ($1000→ $8000 potential)

Apr 4 - SPX 5250p - Entry $4 ($4000→ $100k potential)

Apr 4 - SPX 5180p - Entry $1.30 ($1300 > $32k potential)

Apr 3 - SPX 5175/5170 bull put - Entry $1.50 ($1500 premium potential)

Apr 2 - SPX 5175/5170 bull put - Entry $1.50 ($1500 premium potential)

Apr 2 - SPX 5205/5200 bull put - Entry $1.50 ($1500 premium potential)

Mar 27 - SPX 5230c Entry $1.20 - High after $19 ($1200 → $19000 potential)

Mar 26 - SPX 5215p Entry $1.20 - High after $11.50 ($1200 → $11500 potential)

Mar 25 - SPX 5210p Entry $0.50 - High after $6.50 ($500 → $6500 potential)

Mar 22 - LULU 390p Entry $1.25 - High after $5.7 ($1125 → $5700 potential)

Mar 21 - SMCI 1000c Entry $4.80 - High after $22.60 ($480 → $2260 potential)

Mar 21 - SMCI 1000c Entry $4.80 - High after $22.60 ($480 → $2260 potential)

Mar 20 - SPX 4200c Entry $7.50 - High after $27.12 ($750 → $2710 potential)

Mar 19 - SPX 4170c Entry $1.10 - High after $11.30 ($1100 → $11300 potential)

Mar 18 - GOOGL 147p Entry $0.65 - High after $1.71 ($650 → $1700 potential)

*runner reached $2Mar 18 - SMCI 900p Entry $10 - High after $30 ($1000 → $3000 potenital)

*runner reached $60!Mar 14 - SPX 5150c Entry $3 - High after $10.50 ($3000 → $10500 potential)

Mar 12 - SPX 5150c Entry $4 - High after $27.50 ($4000 → $27500 potential)

Mar 11 - SPX 5120c Entry $3 - High after 7.50 ($3000 → $7500 potential)

Mar 8 - SMCI 1150p Entry $5 - High after $56.20 ($500 → $5620 potential)

Mar 8 - AMD 220c Entry $0.50 - High after $7.65 ($500 → $7650 potential)

Mar 7 - SPX 5175c Entry $0.50 - High after $2.40 ($500→ $2400 potential)

Mar 6 - SPX 5120c Entry $3.50 - High after $12+ ($3500→ $12000 potential)

Mar 5 - SPX 5070c Entry $0.50 - High after $10.75 ($500 → $10750 potential)

** alerted 0.30 entry wanted. dipped to 0.40. entered at 0.50Mar 5 - SPX 5070p Entry $1 - High after $13.50 ($1000 → $13500 potential)

Mar 4 - SMCI 1200c Entry $33 - High after $61 ($3300 —> $6100 potential)

Mar 1 - SPX 5120c Entry $2 - High after $20 ($2000 —> $20000 potential)

Feb 29 - SPX 5095c Entry 0.50 - High after $10 ($500 —> $10000 potential)

Feb 29 - SPX 5100c Entry 0.30 - High after $5+ ($300 —> $5000 potential)

Feb 27 - TSLA 195p Entry 0.90 - High after $2.30+ ($900 —> $2300 potential)

Feb 26 - SPX 5070p Entry 0.20 - High after $2. ($200 —> $2000 potential)

Feb 23 - NVDA 800p Entry 2.50 - High after $25.11 ($3000 → $25110 potential)

**Dipped to 2.57 (had to chase entry 3)

Feb 23 - NVDA 820c Entry 2.25 (swing from Thursday) - High after $25.00 ($2250 → $25000 potential)

Feb 22 - SPX 4090c Entry $2.50 - High after $9.20 ($2500 → $9200 potential)

Feb 16 - SMCI 1000p Entry $11 - High after $195 ($1100 → $19500 potential)

Feb 15 - TSLA 195c. Entry $1.20 - High after 5.95 ($1200 → $5950 potential)

Feb 14 - NVDA 720p. Entry $4.5 - High after $12 ($4500 → $12000 potential)

Feb 13 - SPX 4955p. Entry $5 - High after $34 ($5000 → $34000 potential)

Feb 12 - ARM 180c. Entry $1.20 - High after $14.10 ($1200 → $14000 potential)

Feb08 - ARM 100c. Entry $5 - High after $27.50. ($5000 → $27500 potential)

Feb07 - TSLA 185c. Entry $2.53 - Hight after $5.60 ($2530 —> $5600 potential)

Feb05 - SPX 4940c. Entry $3 - High after $16.60 ($3000 → $16,600 potential)

Feb02 - AMD 180c. Entry 0.15 - High after $1 ($1500 —> $10000 potential)

Jan 29 - SPX 4910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22000 potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Tuesday’s Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

SPY/SPX

I’m so proud of members in Two Hour Trading community. If you’ve followed me on twitter, you know how I call NFLX the harbinger of doom. Yesterday was a perfect example.

Moe called out the observation that NFLX 0.00%↑ is dumping and how 520 was struggling. Let’s look at the gap up reversal process I teach. Notice 2 levels above the solid blue line. That makes it a candidate for a gap up reversal. We then target the solid blue line and if it breaks we target 2 levels more or 515.50.

And here is what taking 5200p even with my “late” alert did. $5—>40

So where do you enter? There are multiple spots. First is on recognizing the push fail and break 520 around 9:15am. The second would be vwap on the contracts near $5, and the 3rd spot to add back any profit takes or to average up is at 8.20-10 once the r/g line broke. Isn’t this chasing? YES, but there is momentum across the board and there is a possibility of selling ahead of CPI.

Remember how I talked about being wrong. I was initially looking for a dip and rip off the 519 level, but when it broke I have a rule. When wrong, flip with double the size. sell 50% at double of any losses and ride the rest to targets. In this case, I never went long, but I did jump in with size.

As for taking profit. when 515.50 hits, take 80% off. no question, no hesitation, no choice. That is called being systematic. Do I get max gains this way? NO. Do I consistently grow my account and collect profits. Absolutely. That is what seasoned traders do. My focus isn’t on max gains, my focus is on systematically extracting profits from the market! Make that your maxim.

NVDA

Another good example of an idea being wrong but having plan b ready. Yesterday I wrote I was looking for a dip and rip off 860, but if we get into 853-858 I want to short targeting 831. Guess what happened.

That is it. Two hours and you could be done for the day. Actually closer to 90 minutes or less of trading!

SPY/SPX (afternoon)

I’m running out of time so I wont cover all the trades.

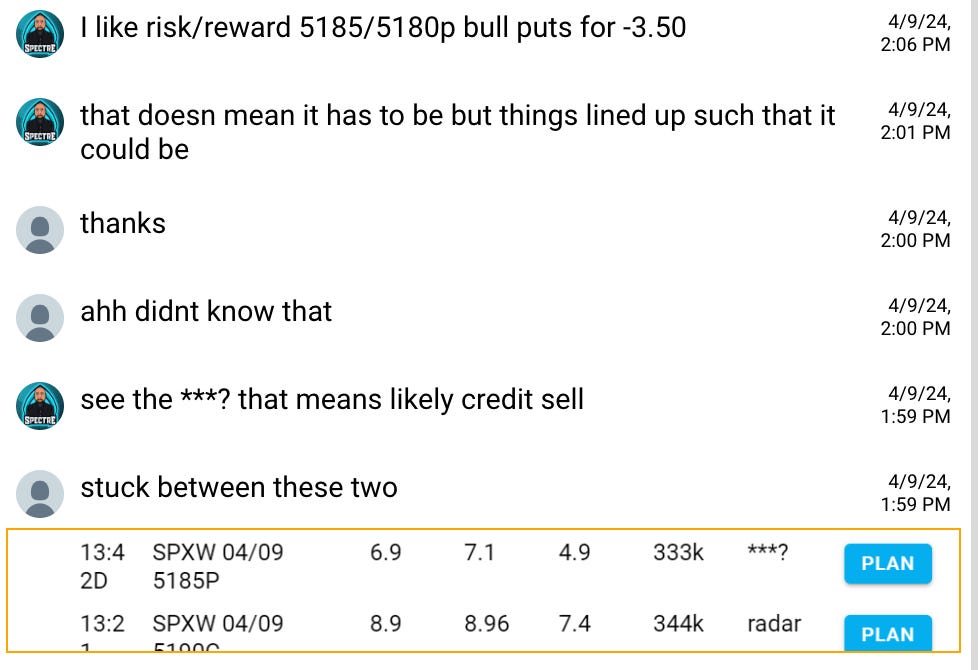

One of the THT members brought this to my attention in Edge Chat.

So this and additional scanner alerts got me thinking w could see upside into the close.

SPX 5185p/5180p dipped to $1.50 and then ripped back over $3-3.50 to give us $3000 of premium risking $2000, and assuming I’m right a 80-90% probability of a win. You take that bet. I then added to the possition at 1.20 when it started bleeding out in last 30minutes.

During the last 30 minutes, started hawking for a squeeze targeting 5210+ close. the contracts dipped to 0.50 and then 0.20 for amazing scoops. If you missed the 0.20 dip, that is ok, recognizing the turn/failed breakdown and the opportunity still makes it ok to enter at 0.50-0.60 after. These then ran to $6.

The Key to entering on failed break reversals

Let the support or resistance break happen. then when it crosses back across the level and can’t keep trend, that is where you enter, or even after there is more confirmation of the reversal. You may pay more than the low on the contracts, but you have more confirmation of the reversal, so less chance of getting chopped.

Review the charts above for that price action and see if that helps you. sorry I’m out of time this morning to give more examples.

Trade Ideas - Plan for Wed Apr 10

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

All eyes on on CPI and market reaction to it. I’ll be at training with coach so will miss the 8:30am action. I’m ok with it, because I know there will be more opportunity today.

Remember to breath, be patient, and let the trades come to you

I’m not going to predict up or down or how today plays out because anything can happen. Overall with very hot CPI numbers I think we could see a 1.5-3%+ drop over next week. If CPI comes in cool, a squeeze into 530+ into Friday. Inline, who knows.

Today I will be watching: SPY, TSLA, and NVDA again