CPI comes in way weaker. market gapping up strongly. How will market react after FOMC today? -- Trade ideas for Wed June 12, 2024

Godmorgen traders. I’ll be trading from Aarhus, Denmark until mid June.

Boy was I wrong about AAPL getting day 2 selling yesterday! But that is ok, because process dictated go long once 194.50 was reclaimed and 198 cleared. I targetted 202.80 based on levels to sell scalps and left runners for 205+ thinking we could see 210 and maybe 220+ next week.

Learn the trade setups I teach and especially failed break down reversals. On top of that when I’m wrong about a reaction to a level, as a general rule I flip direction with double the size! Try considering that logic in your trading.

Given the large gap up in premarket today and the FOMC risk today, I’ll be looking for exhaustion for some profit taking after the open and then some chop. The plan today is to trade first 1-2 hours and then return at 2:45pm to trade the after FOMC reaction.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas each morning, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

June 11 - AAPL 200c $1.50 —> ($1500 —> $7500 potential)

June 11 - AAPL 205c 6/21 $1 (swing) —> ($1000 -$6000 potential possibly much more)

June 11 - SPX 5360c $2.50 —> ($2500 —> $15000 potential)

June 10 - SPX 5350c $4.20 —> ($4200 —> $16000 potential)

June 6 - NVDA 1220c $12 —> ($1200 —> $2100 potential)

June 5- SPX 5350c 0.30 —> ($3000 —> $45000 potential)

June 5 - META 490c $3 —> ($3000 —> $9500 potential)

June 4 - SPX 5290/95 bear calls $1.80 —> ($1500 credit potential, $1000 if held to close)

June 3 - SPX 5280p $5 —> ($500 —> $4500 potential)

May 22 - SPX 5280p $0.10 —> ($1000 —> $43000 potential)

May 22 - SPX 5300p $0.50 —> ($500 —> $15000 potential)

May 21 - SPX 5320c $0.50 (alert: 0.25 target $2-5) —> ($500 —> $6000 potential)

May 21 - SMCI 1000c $9.25 Swing (entry day before) —> ($925 —> $2100 potential)

May 17 - AMD 170c $0.20 Swing (entry day before) —> ($200 —> $1500 potential)

May 16 - SPX 5300p $0.20 Round 3 —> ($200 —> $2800 potential)

May 16 - SPX 5300p $0.50 Round 2 —> ($500 —> $2600 potential)

May 16 - SPX 5300p $1 Round 1 —> ($1000 —> $5000 potential)

May 15 - SMCI 850c $12 —> ($1200 —> $10000 potential)

May 14 - SPX 5240c $0.50 —> ($500 —> $10600 potential)

May 14 - SPX 5230/5225 bull puts $4 —> ($4000 premium potential)

May 14 - SPX 5245c $0.20 —> ($200 —> $6000 potential)

May 14 - SPX 5240c $0.50 —> ($500 —> $10600 potential)

May 14 - SPX 5230/5225 bull puts $4 —> ($4000 premium potential)

May 13 - SPX 5220/5215 bull puts $2.50 —> ($2500 premium potential)

May 13 - TSLA 170p $1.90 —> ($1900 —> $2890 potential)

May 10 - AMD 162.50p $0.25 (0.25 entry) —> ($250 —> $1600 potential)

May 9 - SPX 5210c $1.25 (1-1.50 entry) —> ($1250 —> $6200 potential)

May 9 - SPX 5220c $0.20 —> ($200 —> $1100 potential)

May 9 - SPX 5200c $3 —> ($3000 —> 15800 potential) (dipped to 2.20)

May 8 - SPX 5200/5205 bear calls $1.20 —> ($1200 premium potential)

May 8 - SPX 5190/5195 bear calls $1.50 —> ($1500 premium potential)

May 8 - SPX 5180c $4 —> ($400—> $1100 potential)

May 7 - SPX 5190c $1 —> ($1000—> $4000 potential)

May 7 - SPX 5190c $1 —> ($1000—> $4000 potential)

May 7 - DIS 105p $0.40 —> ($400—> $1600 potential)

May 6 - SPX 5170c $3 —> ($300—> $1100 potential)

May 6 - SPX 5175c $0.40 —> ($400 —>$7000 potential)

May 3 - SPX 5150/5155 bear calls $1.50 —> ($1500 premium potential)

May 2 - SPX 5020p $7 —> ($700 → $2180 potential)

May 2 - SPX 5070c $1.20 —> ($1500 → $7200 potential)

May 2 - SPX 5070c $3—> ($3000 → $7200 potential)

Apr 30 - SPX 5080p $3 —> ($3000 → $45000 potential)

Apr 23 - SPX 5060/5055 bull puts - Entry $1.75 ($1750 premium potential) drawdown < $200

Apr 22 - SPX 5050c swing - $5.50 → ($5500 → $42000 potential)

Apr 22 - SPX 5000c - $3.20 → ($3200 → $39000 potential)

Apr 22 - SPX 5020c - $0.20 alert, dipped to 0.55, fill at $0.70 → ($700 → $20000 potential)

Apr 19 - SMCI 750p - $1.50 → ($1500 → $38k+ potential)

Apr 19 - NVDA 800p - Entry $0.5 ($500→$40k potential)

Apr 18 - SPX 5050c - Entry $6 ($6000→$16000 potential)

Apr 18 - SPX 5020p - Entry $4 ($5000→$20000 potential)

Apr 16 - SPX 5140/5135 bull puts - Entry $2.50 ($2500 premium potential) drawdown < $300

Apr 12 - SPX 5100p $1. (dipped to 1.30) - Entry $2 ($2500 premium potential)

Apr 11 - SPX 5180/5185 bear calls - Entry $2.50 ($2500 premium potential)

Apr 10 - SPX 5180/5185 bear calls - Entry $2.50 ($2500 premium potential)

Apr 10 - SPX 5170c - Entry 0.50 ($500 → $5000 potential)

Apr 9 - SPX 5185/5180 bull puts - Entry $3 ($3000 premium potential)

Apr 9 - SPX 5205c - Entry $0.50 ($500→ $6000 potential)

Apr 8 - SPX 5225/5230 bear calls - Entry $1.20 ($1200 premium potential)

Apr 8 - SPX 5200/5195 bear puts - Entry $0.10 ($1000→ $8000 potential)

Apr 4 - SPX 5250p - Entry $4 ($4000→ $100k potential)

Apr 4 - SPX 5180p - Entry $1.30 ($1300 > $32k potential)

Apr 3 - SPX 5175/5170 bull put - Entry $1.50 ($1500 premium potential)

Apr 2 - SPX 5175/5170 bull put - Entry $1.50 ($1500 premium potential)

Apr 2 - SPX 5205/5200 bull put - Entry $1.50 ($1500 premium potential)

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Tuesday’s Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

Please note all times are Eastern/New York regardless of what time zone I happen to be in.

SPY / SPX

Super clean long setup off the 532.50 level again and this morning gapping up int 542.

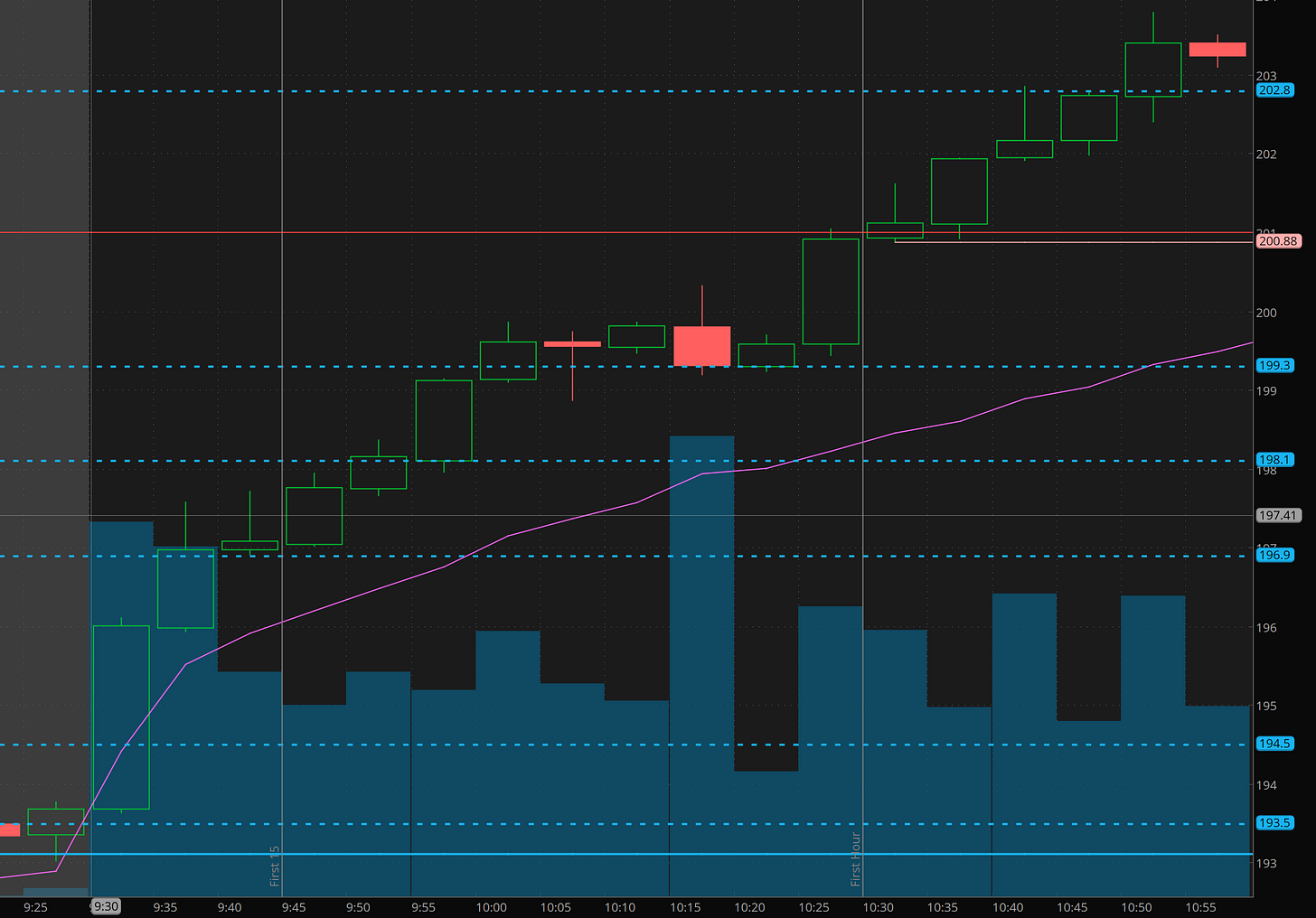

I missed the long in the early morning as I was focused on AAPL failed breakdown and volume long.

But you cans ee how there was a 4 level gap down into a key support levels at 532.50 as possible or getting long after vwap reclaim shooting for a gap fill move.

During the last hour I alerted and entry on 5360c for $2.50 and I wanted $1. It ran nicely to $15 into the close!

AAPL

Based on Monday’s reaction to the AAPL AI even I was looking for a pop into 193.50-194.50 to position short looking for 187 -190 to come and then flip back long. The market had a different idea.

You can see and market blew past 194.50 with volume at the open and ever dip was getting bought. At this point I decided that we should at least test 198 and if that clears we are going to 202.80 and possibly 210+ into next week as AAPL could breakout on the daily chart. Using the levels as a guide I alerted taking 200c and 205c for an extra week out as swing trades.

These paid nicely! I locked in 80% by the time we got to 202.80 and then left runners on the swing position. Solid morning and nothing more todo! I wasn’t even planning to trade until the first hour was up, but the price action and setup was there, so I jumped in!

Trade Ideas - Plan for Wed June 12

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Ideas

With the weak CPI numbers, the market is ripping hard and may be hopeful for FOMC today. Overall I think we could see SPY 442-445 today. I’ll be looking for a counter trend trade then or for some gap fill after 11am in case of profit taking/de-risking ahead of FOMC at 2pm.