Bulls are fully in control. Do we breakout higher or get profit taking? My plan for Fri Nov 17

$SPY $SPX likely gap up, but then what?

SPY Price Action

Let’s review the recent price action and process. Anytime there is a large gap up, especially a 2 level move, I will hawk for a short. looking for gap fill to possible reversal depending on the situation.

Tuesday’s short only gave a single level retracement and it held VWAP. Notice the angle on vwap. that means even with the large gap there is buying.

Wednesday we got a gap up again. This time nice clean double top and almost got gap fill. However we didn’t break 448 level to trigger some selling back into the gap. What’s going on here?

Yesterday, we got a mini failed breakout get short and it dipped into that 448.20 level perfectly, But I wanted it to break down. Our 4480p went from $2 to 5 if I remember correctly and that was it. Lots of 100% gainers on the short scalps. but where is the 10 bagger? Chart is consolidating so the 5 or 10x trades come in last 30 minutes now by anticipating where will we close. SPX 4510c went from 0.20 to $1 and back to 0.

I focused on SPX 4505c at $1-$1.25 target 5-8 and only got to 4.50. But that is also why I took 4520c for next day.

Let’s look at the chart above . Notice how 448.20 held? That is also vwap from Tuesday. Once it pushed over 449.50 again, this became a failed break down in my mind, and we are going to at least test 451.20 and more then likely see 453+ on Friday. So what is my job? to buy calls as cheap as possible. So we wait for late afternoon dip, but also take puts on lunch time r/g line test in case we are just consolidating and it breaks support. (we sell 50% at a double to position for free). In the meantime, I’m still hawking to get those calls on the cheap.

You can see where I saw the reversal candle, off 448.80 and started calls. once we crossed vwap, add more to the calls on dips and then started selling at $3+ per profit taking rules.

This morning the gap is developing. and we are over the 451.30 level. There is a good chance of the overall idea playing out.

This rally has been savage and anyone stuck thinking its too much and shorting and shorting and adding and adding is getting smoked. Remember our job as day traders isn’t about judging valuations. It is about identifying great risk/reward trade opportunities and taking advantage of it and being systematic.

I lost twice on puts or only made a double (I consider not a win. lol). but then got a 5 or 10x on calls. Why? I’m being systematic. I’m looking and positioning for opportunity and what if. This lets me make bull and bear plans at both ends of the range and let the market pay me if either is right. If I get stuck being too biased, I miss out on opportunities and worst keep adding when something is against me vs just eating the loss.

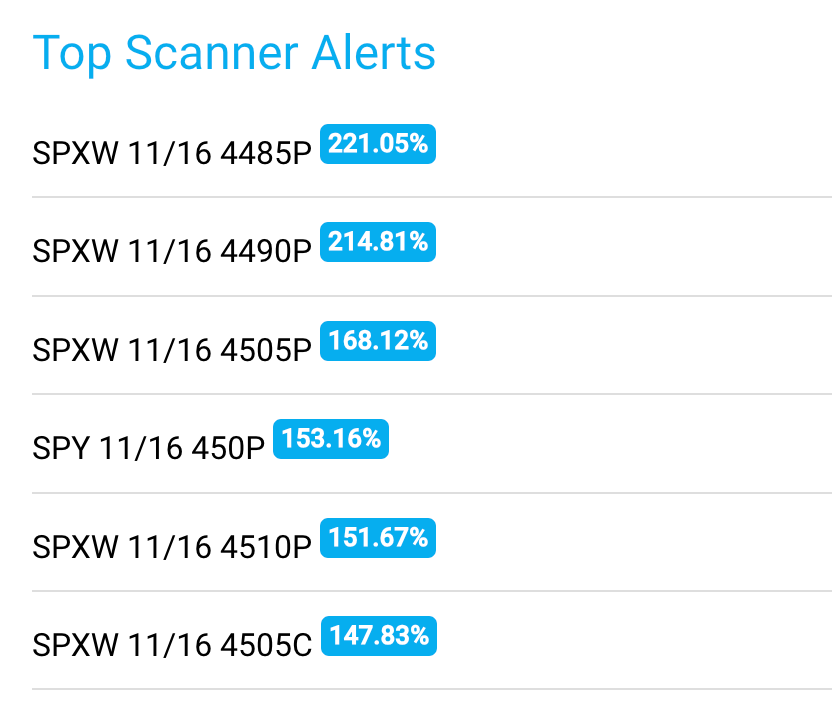

Yesterday’s Alerts

As you can see the gains were limited due to the tight range. But still these are not bad!

Would you like to have a workshop on how to read scanner alerts with the charts to see if it is premium selling or directional buying?

BTW, I’m using thing the scanner to recognize premium selling and sometimes joining the premium selling, but also to then discount shop directional buys for 100-400% gains.

My plan for Friday.

I will stick to process. The overnight swing calls I will sell 50-80% at open and hold balance for levels above.

I will look to short 453 and 455 levels if a gap up reversal setup forms. There is a chance that today is an exhaustion move but also market may be pinned. Recently OpEx days have been not rangy so I will be also focusing on doing credit sell trades

If break 449/450 and then turns into a ceiling, I will consider a short but really there isn’t a major trend short setup under 448 breaks or we get a parabolic rip exhaustion move to the upside to catch.

If we push dip and ahold 451 after the first hour and start, I’ll consider calls to join long targeting 453-455

I’m hawking for reaction around 500-503. either a break out move higher toward 508 or 517-520 or profit taking trade setup to capture 7 to 15 points.

Lots of profit taking yesterday after Musk twitter like. Watching dips for possible long off 232 area , but break of 231 could bring more selling back toward 221 to 225

Good luck all!