Big Moves Ahead: SPY & QQQ Tighten Up, $300B valuation swing in NVDA in play. Trade ideas for Wednesday Aug 28, 2024

Are you planning trades that pay as much as 5 to 20 times your risk? If not, join THT-PRO.

Good morning traders!

Are you monitoring comments on the blog? I corrected the blog yesterday after publishing with my game plan for SPY 0.00%↑ and it was spot on. I said, dip on 558.50 I like long for 561+. And we got EXACTLY that. dipped to 558.50 on the open and ran to 562!

I had also mentioned wanting to short PDD. I alerted dip buy at 0.75 when it was at 1.25. It dipped right to 0.75 and ripped to 1.6 for 100% gainer, and to allow us to sell 50% on the swing trade. My overall target on this is $5-13 by Friday.

Let’s see what today brings. While market waits for NVDA, I’ll be eyeing PDD and CAVA today.

Overall the action in SPY and QQQ is coiling with a light weakness bias in QQQ. This should be no surprise as the amount of capital in play on NVDA 0.00%↑ is an estimated $300B. That is an insane amount and the most even expected after an e/r report. Options bets are expecting a 9.8% move after NVDA reports earnings tonight.

Depending on market reaction, more money can come into the market, or it may signal a time to move to cash.

As for today, I’m keeping an open mind, but essentially same plan as yesterday — expecting SPY to consolidate but will take action and extreme range and/or break of range only. Otherwise skip it and focus on other names withs news catalysts.

Join THT PRO to get alerts, real-time commentary, and improve trading habits.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading—your daily source for market insights and trading opportunities. Here, you’ll find comprehensive market analysis, educational lessons, and trade ideas to help you excel in trading, all while spending less than two hours a day.

What Subscribers Get

Subscribers receive daily market analysis updates, educational content, and up to three trade ideas each morning based on real-life examples and my trading approach.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

2024 Alert Leaderboard

Here's a look at some of the potential gains achieved through our entry alerts:

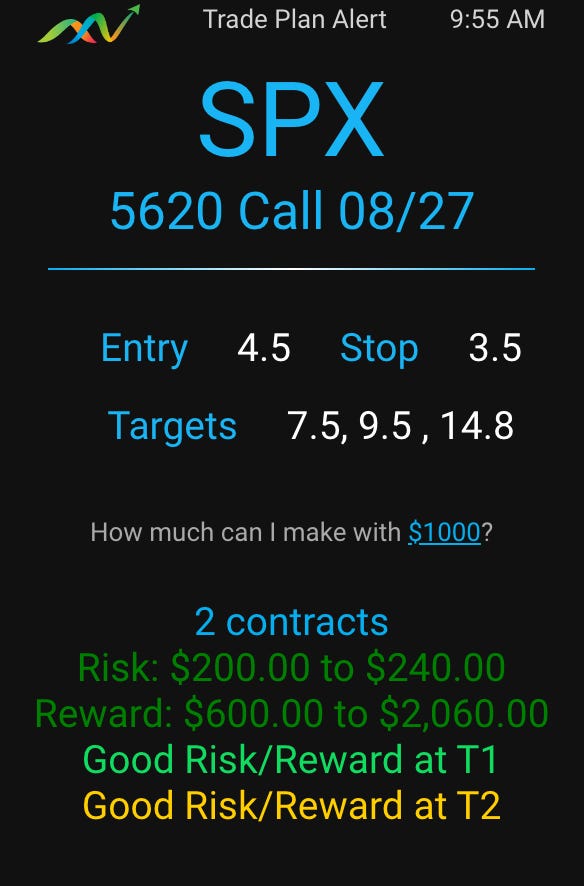

Aug 27 - SPX 5620c 4.50 → $19 ($4500 → $19500 potential)

Aug 27 - PDD 95p 0.75 → $1.66 ($750 → $1660 potential) *swing still in play

Aug 26 - PDD 100P $1.50 → $6.50 ($1500 → $6500 potential)

Aug 23 - SPX 5600p $7 → 38 ($7000 → $38000 potential)

Aug 22 - SPX 5600p $7 → 38 ($7000 → $38000 potential)

Aug 21 - META 535c $3 → 8.50 ($3000 → $8500 potential)

Aug 20 - SPX 5600p $4.50 → 15 ($4500 → $18000 potential)

Aug 20 - SPX 5580p $2 → 7 ($2000 → $7000 potential)

Aug 19 - SPX 5600c $0.4 → 8.25 ($400 → $8250 potential)

Aug 15 - SMCI 600c (swing) $2 → 38 ($2000 → $38000 potential)

Aug 15 - SPX 5540c 0.50 —> 3.50 ($500 → $3500 potential)

Aug 14 - SPX 5400p 5.50 → 10 ($5500 → $10000 potential)

Aug 14 - SPX 5450c 4 → 10 ($4000 → $10000 potential)

Aug 14 - SPX 5450c 1.50 → 10 ($1500 → $10000 potential)

Aug 14 - SPX 5460c 0.20 → 3 (0.10 entry goal, took small 0.20) ($200 → $3000 potential)

Aug 13 - SMCI 600c swing $2.5 ($2500 → $10500 potential)

Aug 13 - SPX 5400p 17 stops 15 ($1700 —> $2300 potential)

Aug 12 - SPX5350c $8 stops 7 ($8000 → $25000 potential)

Aug 12 - SPX5340c $0.5 ($500 → $4500 potential)

Aug 09 - NVDA107c $0.2 stops .10 ($2000 → $7000 potential)

Aug 09 - LLY900c $3.50 stops 1.50 ($3500 → $11500 potential)

Aug 07 - SPX 5280p $10 stops 8 ($1000 → $8000+ potential)

Aug 07 - SPX 5200p $1 stops 0.5 ($1000 → $7000+ potential)

Aug 07 - NVDA 100p $0.8 stops 0.4 ($800 → $3300+ potential)

Aug 06 - SPX 5250c $10 stops 8 ($1000 —> $6000+potential)

Aug 06 - SPX 5250p $1.5 stops 0.75($1500 —> $13000+potential)

Aug 05 - SPX 5300c $3.50 stops 2.50 ($3500 —> $11000 +potential)

Aug 02 - SPX 5350p $5.50 (overnight swing from Aug 01) ($5500 —> $45000 +potential)

Aug 01 - SPX 5480p $4.50 ($4500 —> $65000 potential)

July 31 - SPX 5520c $12 ($1200 —> $3390 potential)

July 30 - SPX 5430p $2.50 ($2500 —> $30000 potential)

July 30 - SPX 5400p $2 ($2000 —> $10000 potential)

July 30 - TSLA 220p $1.50 ($1500 —> $5000 potential)

July 30 - SPX 5450c $0.20 ($200 —> $5000 potential)

July 29 - SPX 5450p $4.50 ($4500 —> $16000 potential)

July 29 - SPX 5460p $0.20 ($200 —> $1100 potential)

July 29 - SPX 5470p $1.5 ($1500 —> $8000 potential)

July 29 - SPX 5480c credit sell - collect $2700 risk $500

July 29 - SPX 5400p $2 out $6 ($2000 —> $6000 potential)

July 26 - SPX 5400p $2 out $6 ($2000 —> $6000 potential)

July 26 - SPX 5450c $4 out $12 reached 15.50 ($4000 —> $15500 potential)

July 25 - SPX 5450c $1, $1.50, and $1.75. target $10. reached $10! ($1000 —> $10000 potential)

July 25 - SPX 5450c $5. reached $41.70! ($5000 —> $41700 potential)

July 22 - CRWD 240p $1.7. reached $3.5! ($1700 —> $3500 potential)

July 22 - SPX 5580c $0.5. reached $3.3! ($500 —> $3300 potential)

July 19 - SPX 5500p $2. reached $12! ($2000 —> $12000 potential)

July 18 - SPX 5580p $5. reached $53+! ($5000 —> $53000 potential)

July 17 - SPX 5540c $2. reached $16! ($2000 —> $16000 potential)

July 16 - SPX 5660c $2. reached $10! ($2000 —> $10000 potential)

July 15 - SPX 5650c $1. reached $4! ($1000 —> $4000 potential)

July 11 - SPX 5600p $2. reached $23! ($2000 —> $23000 potential)

July 09 - Credit Sell SPX 5590/5595 bear calls 2.30-2.50 stops at 2.60 ( $2500 premium collected per 5k position risking $300)

July 08 - AVGO 1800c 13( $1300—> $2250 potential)

July 08 - SPX 5560p 2.50 stops 2.30 ( $2500—> $5000 potential)

July 08 - TSLA 270c 4.50 target 7.50 ( $4500—> $7600 potential)

July 03 - SPX 5520 2.5 ($2500—> $18000 potential)

July 02 - TSLA 225c 3.5 ($3500—> $8500 potential)

July 02 - SPX 5500c 2.50 ($2500 —> $10000 potential)

July 02 - SPX 5470 Bull Puts 2.50 ($2500 credit collected)

July 01 - closed TSLA Swing $2.65—> $12.00

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Trade Recap for Tuesday Aug 27

SPY / SPX

What a gift yesterday morning right out the gate. SPY perfectly had dipped to 558.50 to give us the long entry and then ran to 561 and 562 (the previous sell zone).

Here is what the option contract did.

Here is the trade plan I alerted to THT PRO members

Nice 5R+ gain into the 561 push and 10R on the balance in to 14.80. Guys. that was roughly a 1 hour trade and mission accomplished! There is no need to trade all day!

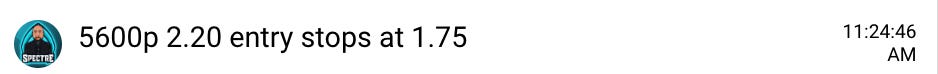

I waited and watch as 562 rejected and then struck…

Alerting locking in profits a 3.20 and 5.30 and stops at 5. Let’s do some math. 2.20-1.75 is 0.45 as my risk. So why did I sell some at 3.20? which is roughly 2R? Its because I wasn’t sure we weren’t going to chop and get theta decay. So I wanted some of my risk covered. I then let it run to 5.30. so 5.30-2.20 = 3.10. 3.10/0.45 = 6.8R. That is an incredible reward to risk ratio! Anything over 3R is good and over 5R is a home run imho.

Want to improve your trading results focus on getting great R!

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Education - How to Join a Strong Trend

The process I typically follow for joining a strong trend are as follows:

All day grinder: join on dips to 20ma

Multi-day grinder:

Join either on support test of morning lows/failed breakdown reversal

Join at vwap mid day or end of day

Keep it simple. Don’t chase, wait for support levels for great risk/reward entries!

Education - Systematic Profit Taking

How do I take profits? I keep it relatively simple. Depending on the entry and range to the next levels I typically with take profits 50-100% of my profits at 3-10R and then raise stops to above entry with a goal of letting runners take me to the next level or 2 and to then reload if I believe we are consolidating before the next leg.

I then repeat the same process on the reload.

Let me know in the comments if you have questions or would like to see examples, I’ll share them.

Trade Ideas - Plan for Wednesday Aug 28

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Ideas

Stick to process. I’m in no hurry to open trades today.

I will likely wait 30-60 minutes after open before opening a trade unless major levels are tested that give insane risk/reward opportunity.

Same as yesterday, I’ll be watching for a range break on SPY but for now assuming range bound action. Might look to do credit sells at major levels.

I’ll also be focused on PDD 0.00%↑ and CAVA 0.00%↑