AVGO and SMCI pay huge! -- Trade ideas for Friday June 14, 2024

Godmorgen traders. I’ll be trading from Aarhus, Denmark until mid June.

Wow! Yesterday my focus was on secondary names. I forgot to include AVGO in the blog yesterday — sorry about that.

In today’s blog I want to review the process I used for shorting AVGO and longing SMCI. Both yielded over 5-10R on their trades! Imagine risking $500 to make $2500-5000. That is what following process and planning can yield.

The purpose of this blog is to teach you the fundamental basics and concepts I use in my trading every day so you can make more with less effort!

Let’s get into the reviews and then talk a little about this overnight gap and down and where I see opportunity developing.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas each morning, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

June 13 - SMCI 820c $10 stops $5 —> ($1000—> $6200 potential)

June 13 - SMCI 900c $2.50 stops $1.25 —> ($2500—> $13000 potential)

June 13 - AVGO 1650p $5 stops $3 —> ($5000—> $22500 potential)

June 12 - SPX puts on SPY 544 reject —> SPX 5220p went from $1 to $12

June 12 - AAPL 220c $0.85 —> ($850 —> $2800 potential)

June 11 - AAPL 200c $1.50 —> ($1500 —> $7500 potential —> $20000 if swung)

June 11 - AAPL 205c 6/21 $1 (swing) —> ($1000 -$6000 —> $15000 if swung)

June 11 - SPX 5360c $2.50 —> ($2500 —> $15000 potential)

June 10 - SPX 5350c $4.20 —> ($4200 —> $16000 potential)

June 6 - NVDA 1220c $12 —> ($1200 —> $2100 potential)

June 5- SPX 5350c 0.30 —> ($3000 —> $45000 potential)

June 5 - META 490c $3 —> ($3000 —> $9500 potential)

June 4 - SPX 5290/95 bear calls $1.80 —> ($1500 credit potential, $1000 if held to close)

June 3 - SPX 5280p $5 —> ($500 —> $4500 potential)

May 22 - SPX 5280p $0.10 —> ($1000 —> $43000 potential)

May 22 - SPX 5300p $0.50 —> ($500 —> $15000 potential)

May 21 - SPX 5320c $0.50 (alert: 0.25 target $2-5) —> ($500 —> $6000 potential)

May 21 - SMCI 1000c $9.25 Swing (entry day before) —> ($925 —> $2100 potential)

May 17 - AMD 170c $0.20 Swing (entry day before) —> ($200 —> $1500 potential)

May 16 - SPX 5300p $0.20 Round 3 —> ($200 —> $2800 potential)

May 16 - SPX 5300p $0.50 Round 2 —> ($500 —> $2600 potential)

May 16 - SPX 5300p $1 Round 1 —> ($1000 —> $5000 potential)

May 15 - SMCI 850c $12 —> ($1200 —> $10000 potential)

May 14 - SPX 5240c $0.50 —> ($500 —> $10600 potential)

May 14 - SPX 5230/5225 bull puts $4 —> ($4000 premium potential)

May 14 - SPX 5245c $0.20 —> ($200 —> $6000 potential)

May 14 - SPX 5240c $0.50 —> ($500 —> $10600 potential)

May 14 - SPX 5230/5225 bull puts $4 —> ($4000 premium potential)

May 13 - SPX 5220/5215 bull puts $2.50 —> ($2500 premium potential)

May 13 - TSLA 170p $1.90 —> ($1900 —> $2890 potential)

May 10 - AMD 162.50p $0.25 (0.25 entry) —> ($250 —> $1600 potential)

May 9 - SPX 5210c $1.25 (1-1.50 entry) —> ($1250 —> $6200 potential)

May 9 - SPX 5220c $0.20 —> ($200 —> $1100 potential)

May 9 - SPX 5200c $3 —> ($3000 —> 15800 potential) (dipped to 2.20)

May 8 - SPX 5200/5205 bear calls $1.20 —> ($1200 premium potential)

May 8 - SPX 5190/5195 bear calls $1.50 —> ($1500 premium potential)

May 8 - SPX 5180c $4 —> ($400—> $1100 potential)

May 7 - SPX 5190c $1 —> ($1000—> $4000 potential)

May 7 - SPX 5190c $1 —> ($1000—> $4000 potential)

May 7 - DIS 105p $0.40 —> ($400—> $1600 potential)

May 6 - SPX 5170c $3 —> ($300—> $1100 potential)

May 6 - SPX 5175c $0.40 —> ($400 —>$7000 potential)

May 3 - SPX 5150/5155 bear calls $1.50 —> ($1500 premium potential)

May 2 - SPX 5020p $7 —> ($700 → $2180 potential)

May 2 - SPX 5070c $1.20 —> ($1500 → $7200 potential)

May 2 - SPX 5070c $3—> ($3000 → $7200 potential)

Apr 30 - SPX 5080p $3 —> ($3000 → $45000 potential)

Apr 23 - SPX 5060/5055 bull puts - Entry $1.75 ($1750 premium potential) drawdown < $200

Apr 22 - SPX 5050c swing - $5.50 → ($5500 → $42000 potential)

Apr 22 - SPX 5000c - $3.20 → ($3200 → $39000 potential)

Apr 22 - SPX 5020c - $0.20 alert, dipped to 0.55, fill at $0.70 → ($700 → $20000 potential)

Apr 19 - SMCI 750p - $1.50 → ($1500 → $38k+ potential)

Apr 19 - NVDA 800p - Entry $0.5 ($500→$40k potential)

Apr 18 - SPX 5050c - Entry $6 ($6000→$16000 potential)

Apr 18 - SPX 5020p - Entry $4 ($5000→$20000 potential)

Apr 16 - SPX 5140/5135 bull puts - Entry $2.50 ($2500 premium potential) drawdown < $300

Apr 12 - SPX 5100p $1. (dipped to 1.30) - Entry $2 ($2500 premium potential)

Apr 11 - SPX 5180/5185 bear calls - Entry $2.50 ($2500 premium potential)

Apr 10 - SPX 5180/5185 bear calls - Entry $2.50 ($2500 premium potential)

Apr 10 - SPX 5170c - Entry 0.50 ($500 → $5000 potential)

Apr 9 - SPX 5185/5180 bull puts - Entry $3 ($3000 premium potential)

Apr 9 - SPX 5205c - Entry $0.50 ($500→ $6000 potential)

Apr 8 - SPX 5225/5230 bear calls - Entry $1.20 ($1200 premium potential)

Apr 8 - SPX 5200/5195 bear puts - Entry $0.10 ($1000→ $8000 potential)

Apr 4 - SPX 5250p - Entry $4 ($4000→ $100k potential)

Apr 4 - SPX 5180p - Entry $1.30 ($1300 > $32k potential)

Apr 3 - SPX 5175/5170 bull put - Entry $1.50 ($1500 premium potential)

Apr 2 - SPX 5175/5170 bull put - Entry $1.50 ($1500 premium potential)

Apr 2 - SPX 5205/5200 bull put - Entry $1.50 ($1500 premium potential)

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Thursday Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

Please note all times are Eastern/New York regardless of what time zone I happen to be in.

SPY / SPX

The price action is a bit toppy. Unless you took a short at the open, ther wasn’t a trade setup. I even got faked out on my planned SPX 5420 bull puts. I had a 3.80-3.30 average but that lunch time dip under 540 had me doubt my plan and I exited for small gains instead of collecting full profits. Im ok with that. sometimes there isn’t a good trade setup.

After lunch, once vwap help we got a clean run to 543, but I couldn’t find a worthwile contract for 10x reward so I didn’t take a trade. Overall SMCI and AVGO from morning made it unnecessary to look for more trades.

AVGO

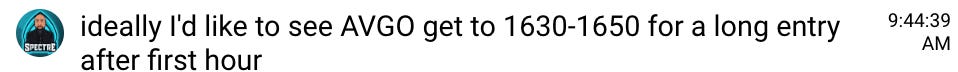

Great earnings but there was no way i could go long until I got a dip and so I planned for what? .. You guessed it, gap up reversal play.

Yesterday I commented in Edge that I think 1630-1650 could come and that is where I would consider a long. Let’s look at the price action and logic for the short…

You can see how 1720 was turning into resistance and so I assumed we would break vwap. So I made a plan for 1650p at $5 thinking if risk and 1620 comes, this could get over $30. Not a bad reward risking $2.

So here is what happened.

By 10:30am we almost get to 1650. Reaching over $20 was great gains and one has to lock in and then leave runners while raising stops. Imagine $5000—>22000 in under 45 minutes. Great gains!

So the logic I first got in at 5 it popped to 7.50 and then reversed. I stopped at 6. I then watched again. I wa slow to reload at 5 and ended up chasing at 8 once we crossed vwap. Why? I had confirmation and I recall how recently sometimes these fails take 2 or 3 tries and there is a higher probability that the 2nd break would have follow through.

The logic for this is that simple. Look for failed breakout and resistance to be established. get short and risk 50% and then wait. Add on vwap break/confirmation or start your position there. Then ride unitl 10:30am or targets being met and raise stops.

SMCI

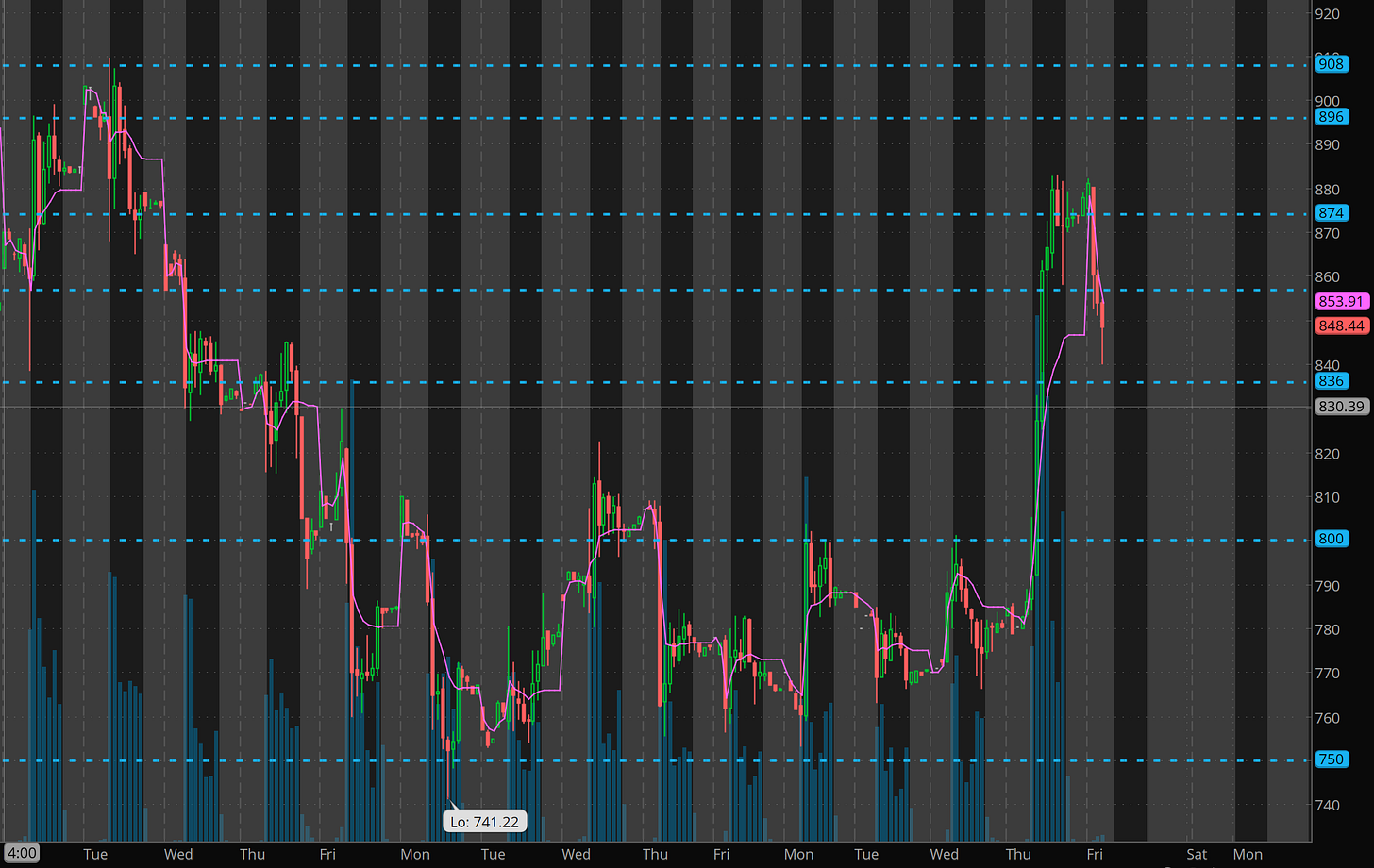

I had been hawking this name for weeks. Last week I think I tried the same 820c call trade and it didn’t work. but that is OK! We keep watching. SMCI had been consolidating for a long time and once it decides to go it can really go.

Let’s look at the action on the 20day hourly. you can see how 800 was a key resistance. Given what happened to AAPL and NVDA recently, I figured there would be fomo and volume on whatever secondary name broke out of range. In this case SMCI in sympathy to AVGO e/r.

I took 820c for $10 stops at $5. I told THT PRO members that I think $50-80 is doable on it. we reached over $62!!

Once 820 cleared, I alerted taking 900c for $2.50. These ran to over $13!!!

As each level above is met, we take profits. That all that has to be done. Be systematic.

Again this was all positioning during first hour or two of day. After there was nothing to do. Plan. Position. Profit. Two Hour Trading!

Trade Ideas - Plan for Friday June 14

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Ideas

Given the recent gap ups and run into resistance levels, I’m not too surprised by the overnight gap downs. Is the market overbought? I don’t know. What I do know is, that process wise, I’ll be looking for failed breakdown reversals today and Monday. I also know being patient, waiting for key levels, and price action to match pays consistently so we just need to keep doing more of the same.

Overall market is doing what it should, make new highs, and then pull back reestablish bids, and then rip again. Be patient and follow the process and trade setups I teach.