500-1000% on day 2 rally! Will FOMC kill it or juice it today? Trade ideas for Jan 29, 2025

What happened to the market? SPY, QQQ, MSFT, NVDA and more all red. I'll discuss this and how I plan to profit in today's blog.

Good morning traders !

Yesterday I wrote that I wanted SPY to dip to 597.50 and run to 603.50, and if 603.50 cleared I expect 607 to come. Well we got perfectly dipped to 597.50 and then ran to 603.50. At 603.50 we dipped right to vwap at 601 for a reload on the longs anticipating a 603.50 breakout and reached 605! not quite 607 but enough to get us 500-1000% returns!!! and this after missing the scoops at 597.50!

Be sure to check out the recap to learn the logic and planning!

If you have been debating about joining, now is the time. Volatility and momentum is my jam and it could be yours. Join THT PRO to get alerts, real-time commentary, and improve trading habits.

Take Azaan for example. Yesterday he cleared over $10000 on round 1 of the rally yesterday.

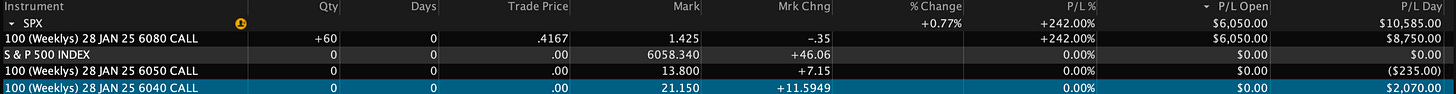

Notice how he kept his losses small and scaled on the dip buy I alerted for 6080c. I told members I wanted 6080c for 0.20. it dipped to 0.25 and we scooped between 0.25 and 0.45. It ran to over $2.25 for almost 1000% gains!

Tuesday Highlights

SPY - Perfectly followed idea. dipped to 597.50 and ran over 603.50 to 605!

NVDA - double bottomed at 117.60 and ran to 129.

NFLX - surprisingly ran to 980 and then dumped back to 960.

AVGO - broke 207 and dipped to 200-202 and then found support where took 205 and 225c yolos.

META - gave gap fill and then ripped back to highs! (our swing is on fire!). reached $14+ for our goal to sell 50% of our swing to make it risk free!

AAPL - continued its rally ahead of e/r and reached 240!

Wed Premarket Highlights

Mixed action ahead of FOMC today at 2pm

SPY 0.00%↑ - consolidating between 604.80 and 606.

NVDA 0.00%↑ - tested 132 in premarket and now red and testing 127.50

AVGO 0.00%↑ - tested 215 premarket and backtested 209, nor sitting aorund 211.

META 0.00%↑ - gapping up again and testing 680s.

BABA 0.00%↑ - gapping up/continuation on LLM news.

Join THT PRO to get alerts, real-time commentary, and improve trading habits.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading—your daily source for market insights and trading opportunities. Here, you’ll find comprehensive market analysis, educational lessons, and trade ideas to help you excel in trading, all while spending less than two hours a day.

What Subscribers Get

Subscribers receive daily market analysis updates, educational content, and up to three trade ideas each morning based on real-life examples and my trading approach.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

2025 Q1 Alert Leaderboard

Here's a look at some of the potential gains achieved through our entry alerts:

Intraday Alerts

2024-01-02 SPX 5880p 11 to 40+

2024-01-02 SPX 5820p $2 to 10

2024-01-03 SPX 5930c $2, dipped to $3 and ran to $11

2024-01-06 SPX 5980p $1.70 → $20 ($1700 to $20k potential)

2024-01-07 SPX 5900p $0.50 → $11 ($500 to $11000 potential)

2024-01-07 SPX 5930p $5 → $17.4 ($5000 to $17400 potential)

2024-01-07 SPX 5930p $5 → $40 ($500 to $4000 potential)

2024-01-08 SPX 5800p 1/10 $4 → $10 ($400 to $1000 potential)

2024-01-10 SPX 5800p 1/10 $4 → $10 ($400 to $1000 potential)

2024-01-13 SPX 5820c $5 → $10 ($400 to $1000 potential) **Round 1

2024-01-13 SPX 5820c $2.80 → $16 ($400 to $1000 potential) ** Round 2

2024-01-13 SPX 5820c $4.50 → $16 ($400 to $1000 potential)** Round 3

2024-01-14 SPX 5870c $0.75 → $3.75 ($750 to $3750 potential)

2024-01-14 TSLA 430c $0.75 → $3.75 ($750 to $3750 potential)

2024-01-15 SPX 5950c $9 → $14 ($9000 to $14000 potential)

2024-01-15 GS 610c $2 → $4.50 ($2000 to $4500 potential)

2024-01-15 TSLA 430c $3-4 → $8.20 ($3500 to $8200 potential)

2024-01-15 QQQ 514p $0.8 → $1.82 ($8000 to $18200 potential)

2024-01-16 AAPL 235p $0.7 → $7 ($700 to $7000 potential)

2024-01-16 SPX 5980c $7 → $12 ($700 to $1200 potential)

2024-01-16 SPX 5970c $2 → $5 ($2000 to $5000 potential)

2024-01-16 SPX 5970c $2 → $5 ($2000 to $5000 potential)

2024-01-17 SPX 6000c $8 → $17.2 ($8000 to $17200 potential)

2024-01-17 TSLA 430c $2 → 5.20 ($2000 to $5200 potential)** Round 1

2024-01-17 TSLA 430c $2.30 → 9.9 ($2000 to $9900 potential)** Round 2

2025-01-17 SPX 6000p $0.50 → $5 ($500 to $5000 potential)

2025-01-17 SPX 6020c $0.50 → $0.30 ($500 to $300 stopped.) ** was a combo trade with the 6000p

2025-01-21 SPX 6035c $5→ $15 ($5000 to $15000 potenital.)

2025-01-21 TSLA 440c $2.90→ $5.30 ($2900 to $5300 potenttal.) **dipped to 2.58. alerted 2.50 entry wanted.

2025-01-22 NFLX 950p $3.25→ $10.60 ($3250 to $10600 potenital.)

2025-01-22 SPX 6090p $1→ $5.80 ($1000 to $5800 potenital.) **dipped to 0.65

2025-01-23 SPX 6110c $0.80→ $8.60 ($800 to $8600 potential)

2025-01-24 SPX 6100p $3.30→ $2.30 (stopped) ** round 1 stopped

2025-01-24 SPX 6100p $1.50→ $12 ($1500 to $12000 potential) ** round 2 we banked

2025-01-24 AAPL 222.50p $0.25→ 0.80 ($2500 → $8000 potential)

2025-01-24 AAPL 222.50p $0.25→ 0.80 ($2500 → $8000 potential)

2025-01-24 AMD 123p $0.10 → 1.72 ($1000 → $17200 potential)

2025-01-27 SPX 5950p $9 → 40 ($900 → $4000 potential) ** premarket trade

2025-01-27 SPX 5950p $1.50 → 3.50 ($1500 → $3500 potential)

2025-01-27 NVDA 117p $1.5 → 5.4 ($1500 → $5400 potential)

2025-01-27 AVGO 200p $1.8 → 9.10 ($1800 → $9100 potential)

2025-01-28 SPX 6040c $8.50 → 33.50 ($8500 → $33500 potential)

2025-01-28 SPX 6080c $0.20 → 2.25 ($3500 → $22500 potential)

2025-01-28 SPX 6070c $0.70 → 6.20 ($7000 → $62000 potential) *Round 1

2025-01-28 SPX 6070c $0.90 → 6.20 ($9000 → $62000 potential) *Round 2

Swing Alerts

2024-01-13 TSLA 430c $1.30 → 8.82 ($1300 to $8820 potential) **alerted exits at 6.50 and 8

2024-01-15 GS 610c $2 → 8 ** exit on 1/16

2024-01-15 GS 610 $2 → $16 ** missed reload on dips. exit on 1/17

2025-01-16 SPX 6000c 1/17 $3 → 17.20 ** dipped to $2 on Thursday, exit majority at $12.

2025-01-21 SPX 6070c 1/17 $6.50 → 30+. *exit on 1/22

2025-01-21 AVGO 242.50c 1/24 $2.50 → 6 *exit on 1/22

2025-01-21 ORCL 180c 1/31 $2 → 11 *exit on 1/22

2025-01-22 NVDA 145p 0.75 → $2 *exit on 1/23

2025-01-23 ORCL 190c 1/31 $2 → 3.20 *exit on 1/24

2025-01-27 META 700c 1/31 $7 → ? rare e/r yolo **hope to sell 50% at $14 to make it risk free hold into report.

Credit Sell Alerts

2024-01-14 SPX 5800/5795 bull puts for 1.50-2.50. $2000 credit potential using 10 contracts and $1000 risk.

2024-01-15 SPX 5950/5955 bear calls for $2→0. $2000-4200 credit potential. Round 1 dipped to 0.75. Round 2 ran to $4.20 and then dropped to 0.

2024-01-16 SPX 5950/5955 bear calls for $2→0. $2000-3000 credit potential. Round 1 dipped to 0.75. Round 2 ran to $3 and then dropped to 0. ** not a typo, same play paid.

2024-01-16 SPX 6020/6025 bear calls for 3.50 ** DID NOT FILL. (the 1.50 at time of alert went to 0)

2024-01-21 SPX 6035/6050 bear calls for 2 stopped 2.50

2024-01-27 SPX 5950/5945 bull puts for 2.50 → 0 **premarket

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Trade Recap for Tuesday Jan 28

GOLD BOLD ITALIC = price action signal

WHITE REGULAR = action to take/taken

GREEN REGULAR = trades I should have taken

SPY / SPX

** Except for missing the 597.50 dip buy, we had flawless execution yesterday imho!

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Education - How to Join a Strong Trend

The process I typically follow for joining a strong trend are as follows:

All day grinder: join on dips to 20ma

Multi-day grinder:

Join either on support test of morning lows/failed breakdown reversal

Join at vwap mid day or end of day

Keep it simple. Don’t chase, wait for support levels for great risk/reward entries!

Education - Systematic Profit Taking

How do I take profits? I keep it relatively simple. Depending on the entry and range to the next levels I typically with take profits 50-100% of my profits at 3-10R and then raise stops to above entry with a goal of letting runners take me to the next level or 2 and to then reload if I believe we are consolidating before the next leg.

I then repeat the same process on the reload.

Let me know in the comments if you have questions or would like to see examples, I’ll share them.

Trade Ideas - Plan for Wed Jan 29

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Ideas

Kind of went out and celebrated last night. My head is paying for it today! So please take today’s ideas with a grain of salt.

Overall we have had a monster rally and FOMC is today at 2pm. I don’t have a bias today. Will stick to process where I look for support to form to go long, or rips to key levels for possible exhaustion shorts.

Overall I may stay out of market until 2:45pm today.