Wow 3 days of consolidation after 3 green weeks. MSFT snags Sam Altman and Greg Brockman. My plan for Monday Nov 20.

Ideas for $MSFT $SPY and more

Friday’s OpEx day didn’t disappoint in that while I planned for range break moves, I also planned for range bound action.

I love credit selling when there is a high possibility of range bound action. This popped to $2 and bled all day! With 10 contracts that is $500 risk for $2k gain with time working for you.

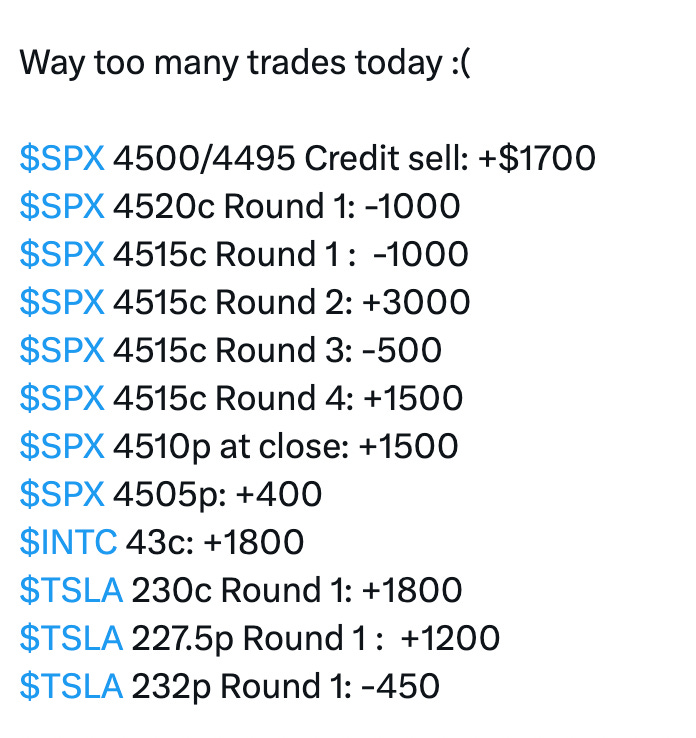

I got stopped twice on calls, because of the decay but eventually was able to find a couple of scalps on SPX, but it was way too much work and not worth the effort.

INTC 0.00%↑ provided a great trade setup. I had mentioned on Thursday that INTC could see 43.70 to 45 on Friday and so scooping it 0.10-0.15 on a dip was a no brainer. It hit 43.81 at the close.

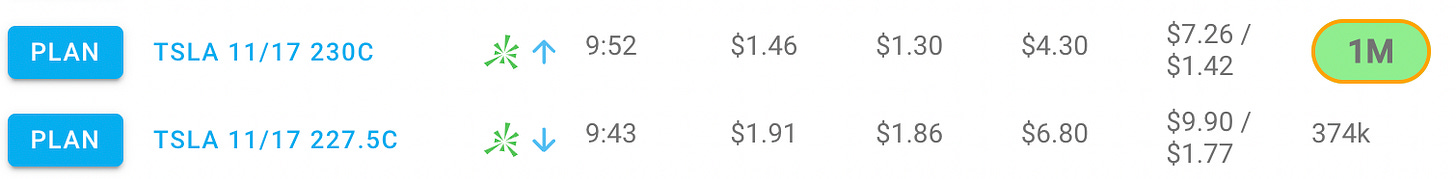

TSLA 0.00%↑ was the wild one. On 231 break at the open it was a no brainer to get short targeting 225 per plan Using the 227.50 puts. Here is a lesson for you all, if 225 is the target, the when 227.50p gets over 2.50, that is the intrinsic value. As a general rule, I will start selling a majority into that and raise stops. So while we didn’t get to 225 target, we got the valuation on the contracts as if it did! I could have been more aggressive on raising stops is one improvement, but I wanted to give it a chance to dip more. But as soon as I saw this flow, I was interested in flipping long…

This also followed one of my trade setups for gap down reversals. Once 231 was reclaimed, 238 became of interest for a target again and we got to 237.39.

So this trade was a combo setup of gap down reversal and failed breakdown reversal. even if you missed the 9:45 dip buys, at 10:40, a failed breakdown reversal was formed allowing for an entry long for the larger move.

Overall I consider my trading on Friday as crappy even though profitable. Why? because it didn’t align with my goals of trading much less for great gains. I over traded. Based on the trades from my process this was the rough tally if risking $1000/trade. Notice the gains didn’t follow my typical goal of 3R. Because of the range bound action, the moves were muted and had to cut for crap gains. TOO MUCH WORK/RISK.

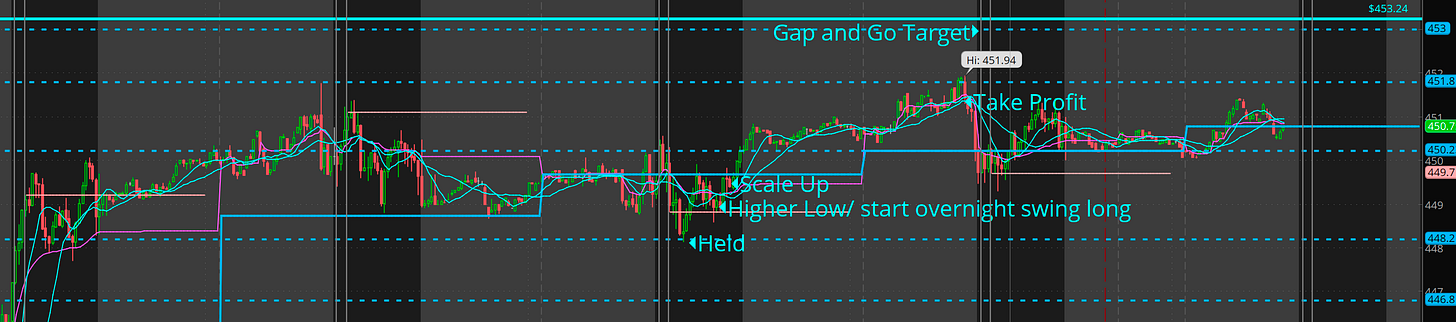

Ok so let’s get into what is going on with SPY

Basically range bound action on Friday and more consolidation. Will continue to watch dips for upside scalps. There is a chance this week is choppy and we get a gap up after thanksgiving weekend toward 460+

MSFT snags Sam Altman and Greg Brockman

This could be huge news. MSFT had a yank on Friday on the stock and is gapping up (currently 377 as I’m writing this) on the new hires. Long term this should add to the stocks value. Short term lets see the market reaction. There should be opportunity here. So I will be looking for gap up reversal, (sell the news event, meaning more sellers than buyers) or some gap fill, support being established and then new all time highs.

The impact of the new hires on product etc wont be immediate so this is hype. Let’s see how market reacts.

My plan for Mon Nov 20.

So this is a short week. If you want to take the week off and not trade a lot of traders do that. I’lll be focused on credit selling this week vs looking for trend trades unless we get a range break with volume.

I would prefer a pull back at this point into the end of the week to position for a rally next week.

449 and 452 continue to be the key range levels to watch on SPY.

TSLA dips on 233 that hold I like for a long, or breakout over 238

MSFT break of 367, I would likely load up short and then flip long with size if 370 is reclaimed. will also consider long if ABCD trade setups after first two hours.

I’ll be collecting data on the scanner, to help make a workshop on reading alerts for possible long/short positioning over the next week or two.. Hopefully we can do the workshorp 1st week of December.