Win Streak Broken? Market gapping down ahead of FOMC. How I plan to trade Wed Jan 31.

My take on GOOGL, MSFT, and AMD earnings.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas, all based on real-life examples and my personal approach to trading. Additionally, I’ll share the top day trade results for ideas from Edge Trade Planner (Beta), a powerful tool to enhance your trading decisions.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Jan 29 - SPX 5910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22k potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

Tuesday’s Price Action

Yesterday was frustrating. Especially after multiple 500-1000% gain days. That is part of the game and alway in back of my mind after a win streak.

I missed a couple of obvious short trades on SPY/NVDA. SMCI broke 530 quickly and the contracts were too juiced to be worth the risk for getting short. SMCI’s action was sell the news, I was hoping this would have developed AFTER FOMC instead of before.

SPY/SPX was essentially pinned most of the day moving in a tight range. WORST the original plan I had played out in after hours.

Overall yesterday’s action turned out to be toppy action and as members saw I kept saying I didn’t see any good trades setting up. My focus is primarily on same day trades.

Mission Profit: FAILED

Mission Capital Preservation: SUCCESS

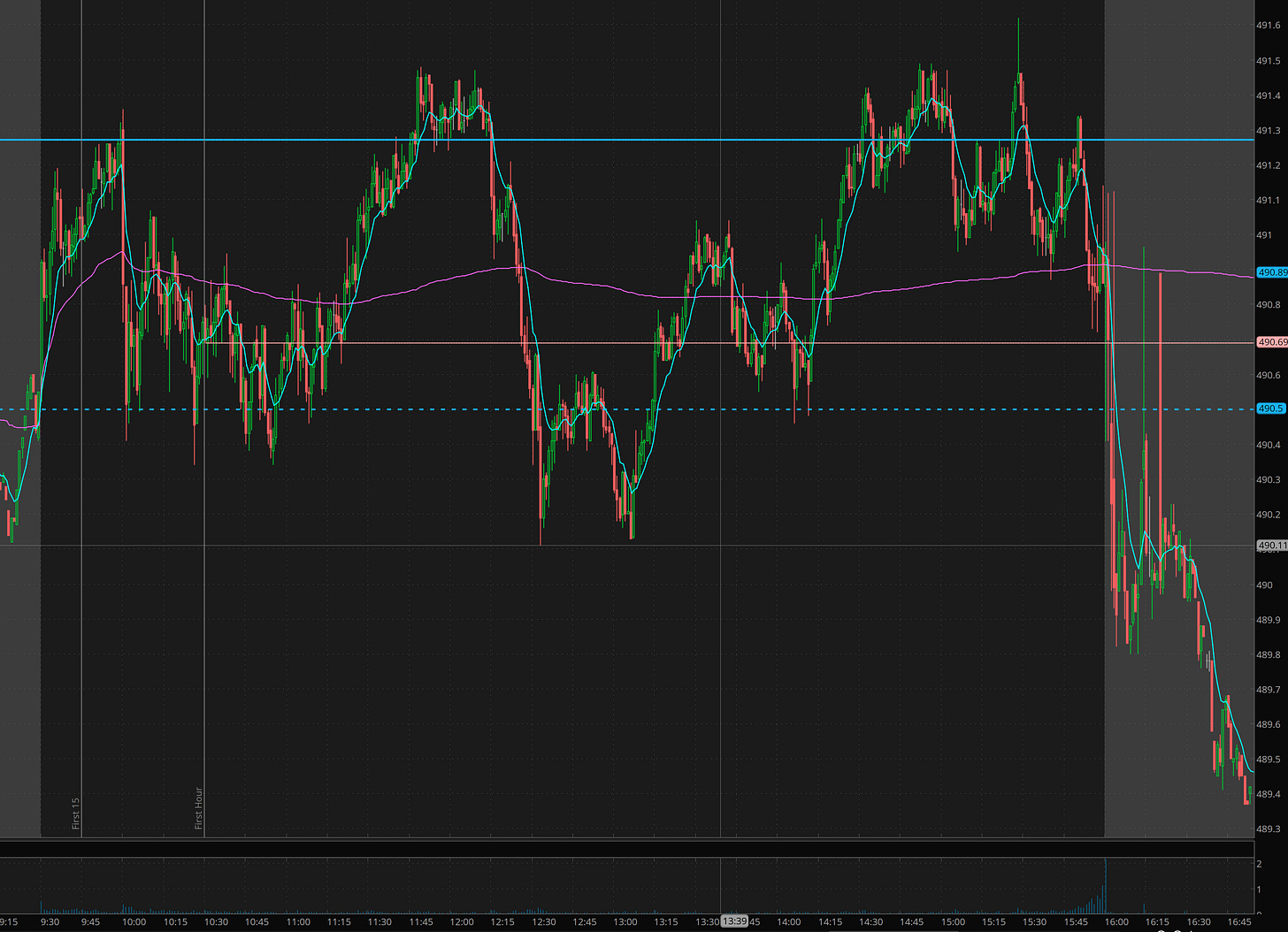

SPY

I was expecting a pop and drop to back test the 489 breakout. And so once we tested with that rejection candle on the solid blue line and dipped under vwap, I tried to get short and ended up stopping out for a $55 loss per contract. I stuck to process but seeing how the dips under 490.50 weren’t holding under, I couldn’t take a trade.

I didn’t want to go long for either because I didn’t trust that direction to play out. So I chose NO TRADES around 11:40 and will come back after 1:30-2pm to see if anything develops.

If I stayed, I likely would have caught the failed breakout short at 12pm but that is also going into lunch hour and I try to avoid opening trades during that hour unless I have strong conviction.

Turns out it was the right decision.

I made one more attempt short on the second cross below the peachline around 2pm with a tight stop and again got quickly stopped. At this point I could have flipped long, but I just didn’t think we would leg up and the contracts were too juiced for the risk/reward.

So overall very small losses on the attempts. In the past days like these could have turned me very red as I was married to have to make profits TODAY. I changed my measurement of success to be “If I dont see a great setup, my mission is to save my capital”

SMCI - with such a large beat why did it sell off?

You can see in the chart above how 530 broke. I had made a plan to go long there, but with the break that turns the play into sell the news/go short. If you didn’t catch the short at open, the only spot to enter was at vwap.

The problem for me was at 525-530, these were $8. My target r/g line breaks is 488. So $16-20 for the exit if right. and w could get a 10:30 reversal, so I didn’t like the reward for the risk. I could have taken $8 risking $4 and selling at $12 for 200% risk reward, but price action felt too sketchy. SO SKIP it.

TSLA - got our swing 195-197 target

We got the $6 target for 200% gains on swing and stopped out at $5 as peachline broke on the runners.

This is where I screwed up. My notes said look for a short, but because of the swing, I was looking to reload the swing. I was stuck with the bias that this is going to 200 before heading back to 183.

This was a perfect failed breakout move and getting short where i stopped out would have paid nicely. This trade setup has a 78.7% win rate and I didn’t take it!

One of the tools I use to give me a reversal signal for the setup didn’t signal. I checked over the logs in Edge and there must be a bug because the scanner didn’t find the reversal until after lunch.

I made a plan to use some of the profits from the swing for another swing trade. This time at the solid blue line (previous day close) I went long on 192.50 calls at 2.80 and 3 which ran to 3.50 back to 3 back to 3.50 a few times. I sized down at the close following my overnight sizing rules. But unfortunately TSLA has gapped down big overnight eating the profits from the Monday swing.

Summary Review of Market Price Action

Based on the price action during the day, the action of essentially skipping trades was the right thing to do. Learning when NOT to trade imho is as important as when to trade.

After AMD and MSFT reports, market flushed to the SPY 489 target taking a number of names in tech with it.

Educational Lessons

From the price action review you should have learned the following:

Switch between goals of making profit on the day to preserving capital. Preserving capital should be considered as big a win as a 5x gainer trade!

Don’t forget the core trade setups. Even I do sometimes. Missing the TSLA short was a reminder to not let swing trade positioning affect your day trade setups.

It’s OK to not win everyday if you preserve your capital. If taking less than A+ trade setups

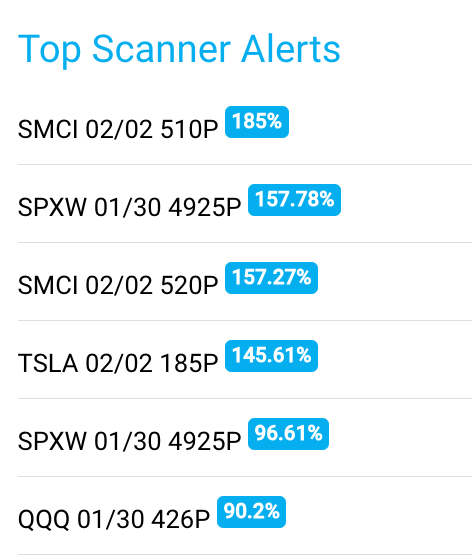

Edge Trade Planner - Top Scan Alerts

Even the scanner had a hard time finding great same day trades! I want 200%+ gainers.

I know 100% plus looks good, but it doesn’t leave room for human sloppiness in entries and exits.

We have a big week ahead between earnings reports and FOMC. I will continue to focus on SPY / SPX and any names with significant momentum or news

Key Events this week

Wednesday - 2pm ET - FOMC rate decision

Thursday - 8:30am ET - Initial Jobless claims

Friday - 8:30am ET - nonfarm payrolls and unemployment rate

Key Earnings Reports this week

Tuesday after close: AMD 0.00%↑ EA 0.00%↑ GOOGL 0.00%↑ MSFT 0.00%↑

Wednesday after close: QCOM 0.00%↑

Thursday after close: AMZN 0.00%↑ AAPL 0.00%↑ $MEA TEAM 0.00%↑ SKX 0.00%↑

Trade Ideas - Plan for Wednesday Jan 31

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

With the gap down on many names and FOMC today, which should get some range and volatility to profit from :)

Read on for the game plan and my take on GOOGL, MSFT, and AMD earnings.