Will today's CPI rocket SPY? My plan for Trading Dec 12 2022

The big take away I want readers to get from today’s trade reviews is the sense of trading less. making attempts, taking profits/being systematic (100% gains is still solid work!)

Trade Reviews

Yesterday I expected to be a consolidation day but was expecting more dip before going right SPY 462 into the close. Given Friday rally I was hawking for a short using SPX 4600 puts.

Here is what happened / the plan for trading the action for the short.

After we peaked around 11, I saw the put buying volume increase and joined the short. Given I’m betting against the larger trend, Immediately set sell orders near or over double the entry price to make the balance free.

Then let it work. As soon the previous high is cleared, raise stops on the price to just below the previous high. Got stopped.

Then start hawking for the next entry which came around 2.5-3. I was super excited and thought I might get to sell these for 10-20. so was patient.

The contracts double to 5.5, and again raised stops to 4. Unfortunately that failed. Turns out all that secondary volume over $4 was put selling for SPY/SPX to grind higher for the rest of the day.

And that was pretty much it for me for the day. There simply wasn’t any more great risk/reward trades.

If you need help on recognizing fails here is how I saw SPY. It made a new high over 461. I figured at worst I would get 460, and at best 458 backtest of breakout.

So I gave it a chance to play out, but then after 11:30, 460.20 was reclaimed and held. At that point I should have considered a long, but given how so many of the Mag 7 names were red, I decided to play it safe.

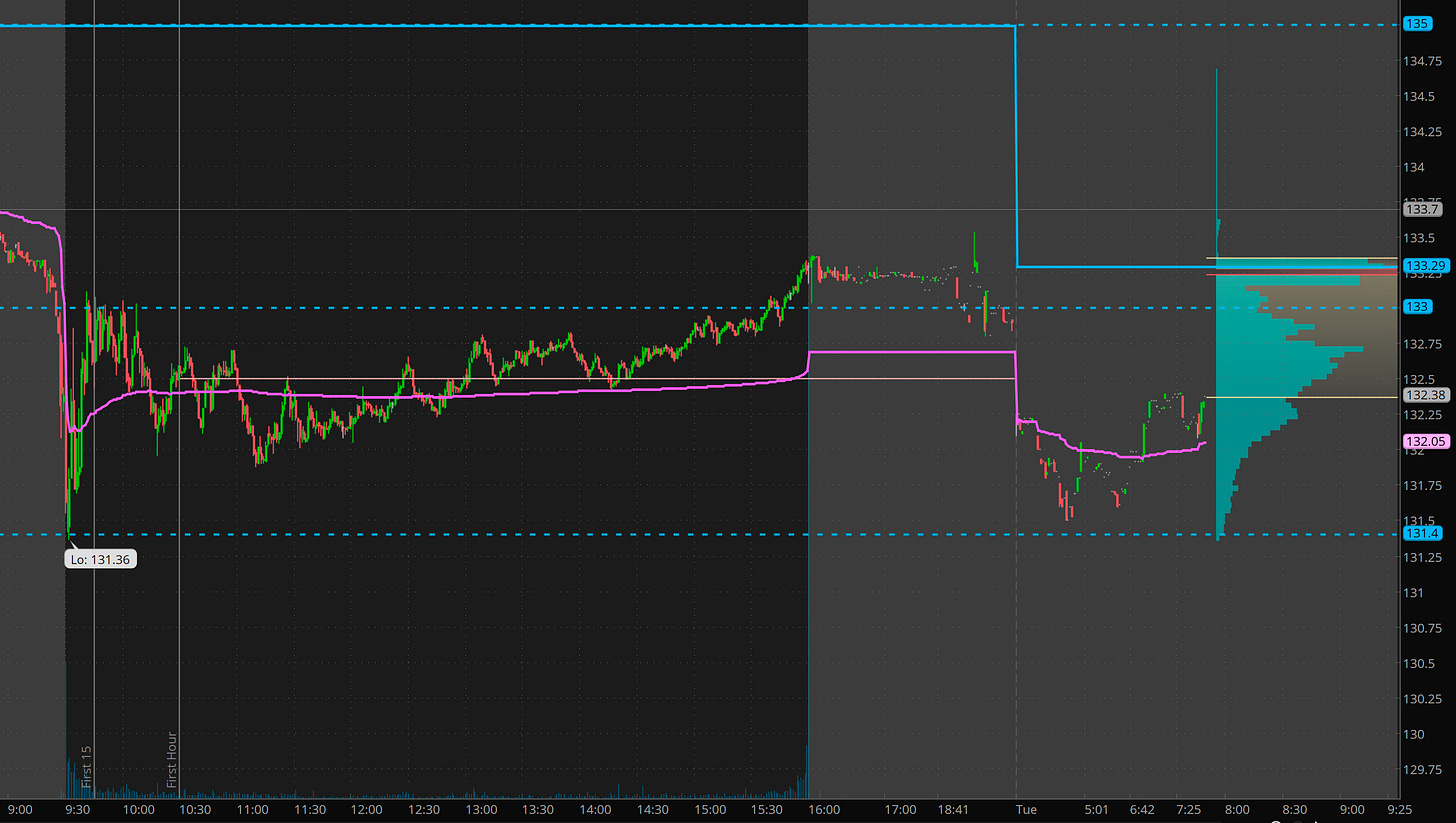

GOOGL - I was hawking for a short yesterday, due to the Gemini related news. However a trade didn’t develop. For Subscribers they get my exact levels. GOOGL dipped right to one of my levels on the open and held. so no trade. It was too much of a gap.

I considered a long off that 131.40, but I was too slow to snake the entry at the level, it with everything in tech selling, I didn’t like the risk/reward.

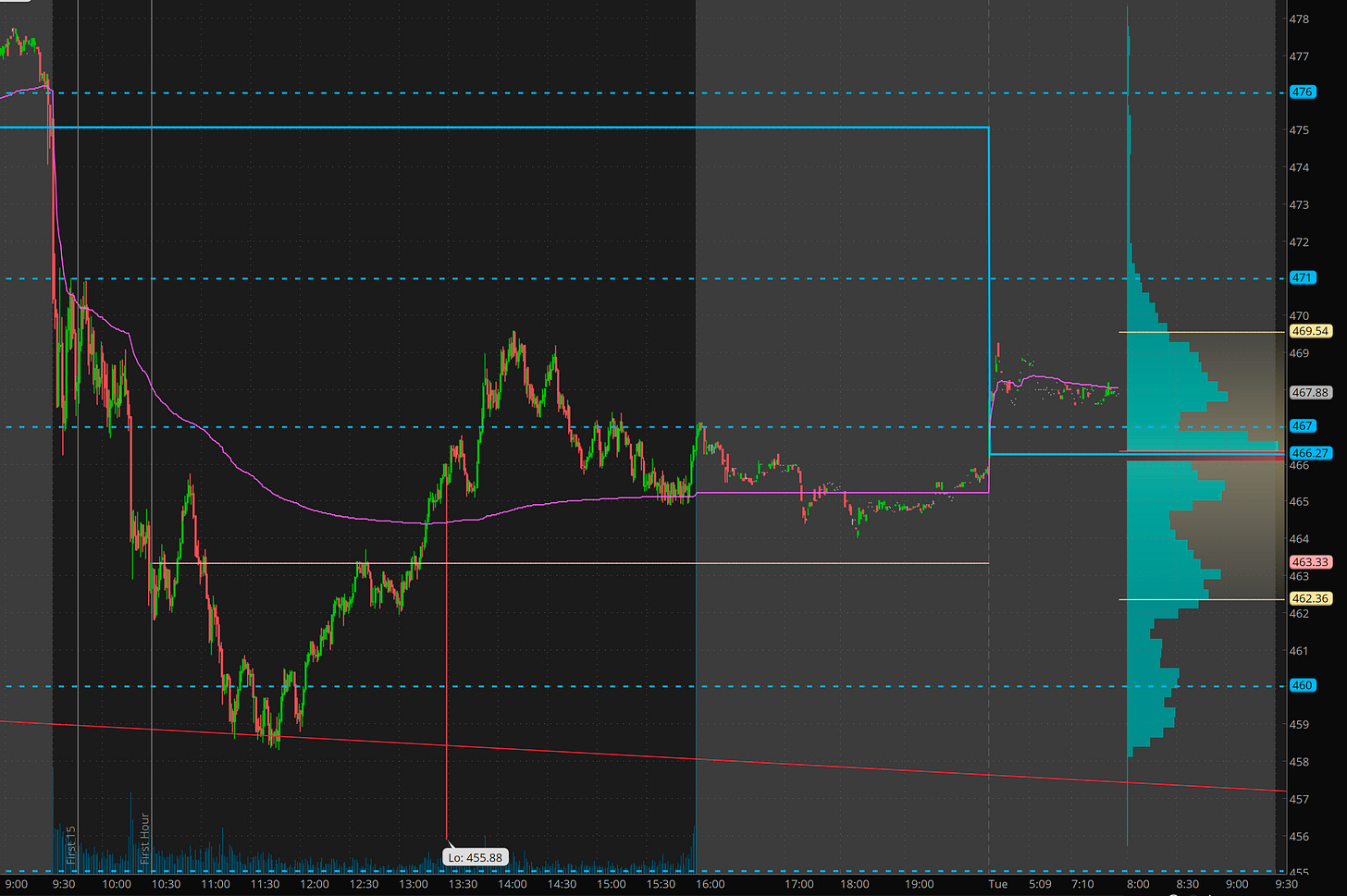

NVDA - I was looking for a bounce. First I wanted 467 to form support/double bottom after first hour. Instead it broke, so no trade.

I then was targeting 462 and 460 as possible reversal spots.

I attempted a long at 462 per plan, and once it got over 465, raised stops to just above entry. and got stopped out.

Then tried again after 11:30 and I started seeing a move back over 461. So why would I long NVDA and not SPY?

Because of the amount of gap down. This follows one of my go to trade setups for a reversal. We have a 3 level move away from previous day close and a failed breakdown once 462 was reclaimed. This allowed us to get a scalp on 467.50c from $5 to $8.

Overall I stuck to my plan from yesterday which was to avoid and limit trading as much as possible and not get to vested on positiioning for the week until after CPI and FOMC.

Plan for Tuesday Dec 12

Overall I’m going to need to wait for reaction to CPI. I will be watching for any 2 to 3 level move away from yesterday’s close as a possible reversal scalp entry.

Plan for large fast moves is roughly as follows:

So if we dip into SPY 458s, will consider a long and then again near 454/455.

If we rocket, I’ll be looking for a scalp short around 468-472.

Once the initial reaction is done, I’ll be looking for traps. How will I recognize it?

You guessed it. Failed moves with volume!

For the exact levels and commentary, be sure to subscribe to Daily Market Edge.

(Send me a message for details on how to sub)

Overall, I think between today and tomorrow’s reactions we could see anywhere from SPY 452 to 472 by end of week. So remember to be patient for entry, be systematic in profit taking, and let your runners give you the pay out.