Will SPY squeeze to new highs or will February seasonal selling take hold? Plan for Thursday Feb 15

The key level I'm watching for new highs or triggering February seasonal selling

Good morning traders.

Yesterday’s I wrote the SPY 495.20 is key support and that a retest of 499-500 area is likely before another leg down can come.

We tested 495.20 3 times and squeeze right to the 499 level into the close and this morning we are gapping up into 500.

In today’s blog lets we’ll cover how I traded yesterday, the price action, and answer “Will SPY squeeze to new highs or will February seasonal selling take hold?”

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to my THT PRO and ELITE members. (I will open up new memberships in mid Feb)

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Feb 14 - NVDA 720p. Entry $4.5 - High after $12 ($4500 → $12000 potential)

Feb 13 - SPX 4955p. Entry $5 - High after $34 ($5000 → $34000 potential)

Feb 12 - ARM 180c. Entry $1.20 - High after $14.10 ($1200 → $14000 potential)

Feb08 - ARM 100c. Entry $5 - High after $27.50. ($5000 → $27500 potential)

Feb07 - TSLA 185c. Entry $2.53 - Hight after $5.60 ($2530 —> $5600 potential)

Feb05 - SPX 4940c. Entry $3 - High after $16.60 ($3000 → $16,600 potential)

Feb02 - AMD 180c. Entry 0.15 - High after $1 ($1500 —> $10000 potential)

Jan 29 - SPX 4910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22000 potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

Wednesday’s Price Action (Education)

Overall I think my trading yesterday was sub par. I felt like I was getting in my own way, but the muscle memory and training around process really paid off.

SPY gap up, choppy session, with end of day rip

I tried to get long after I saw basing on vwap for a scalp toward 498.80 but couldn’t get filled at the price I wanted.

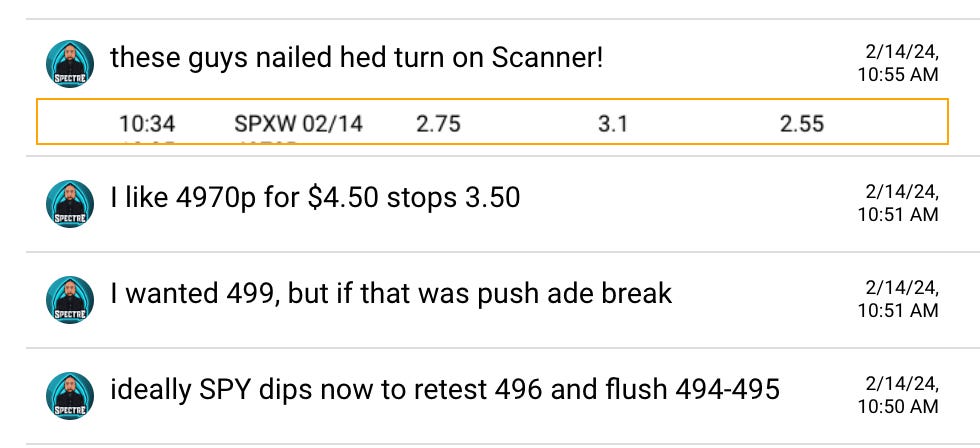

I wanted to see SPY push to 498.80 to load up short but then it rejected the peach line as you can see above and I waited to see if it breaks VWAP. As it did I alerted I like the 4970p. The problem was I was running slow. I alerted my planning about 7 minutes slower than I should have. As I entered and then started typing SPY broke. I was frustrated with myself for not sharing with members earlier.

The one really cool thing is the Options Scanner in Edge Trade Planner picked up the put buying on 4970p 15 minutes earlier at 2.50-3. That would have led to a 300-500% gain trade.

SPY flushed perfectly to 495.20 and since I scaled up that was good enough for me. $4.50→12 for over 100%.

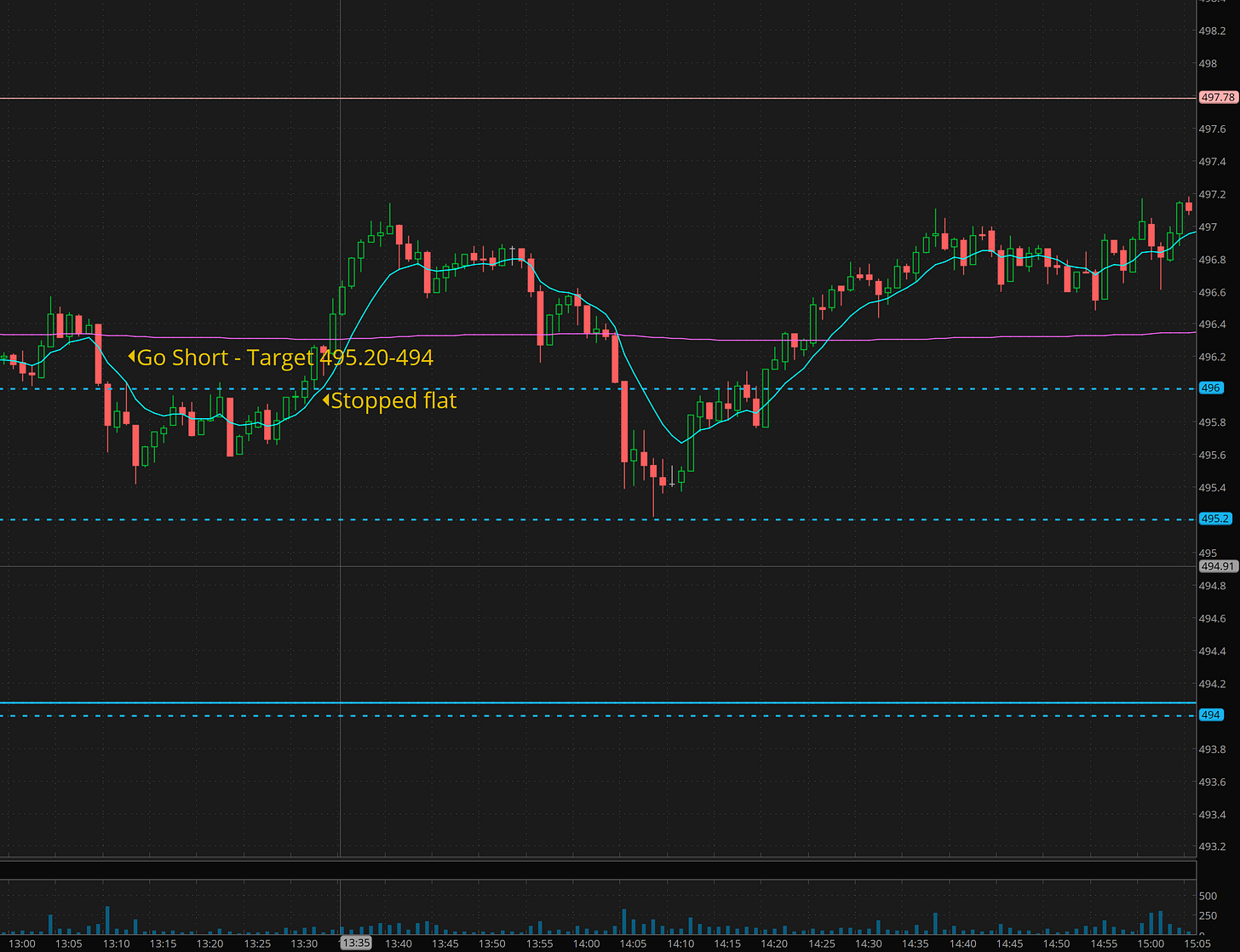

Now this is where I made a mistake. I got long off 495.20 and I had mentioned that 496.50 needed to reclaim for upside. I should have been reloading short around 496 for the next leg down/flush toward my overall 494 goal to get swing longs on SPY.

Given the morning gains, and frustrations, I chose to be content. It’s better to keep the gains that force trades when you are feeling off your game.

I then made the decision to wait for after lunch for next trade or call it a day.

SPY after lunch

I tried short again, (I really wanted 494 to come before going long) and was reacting to the failed push. But after this it got choppy. we had 2 failed moves to the upside and 2 failed moves to the downside. At this point, I decided I’m done for the day.

But then I wasn’t….

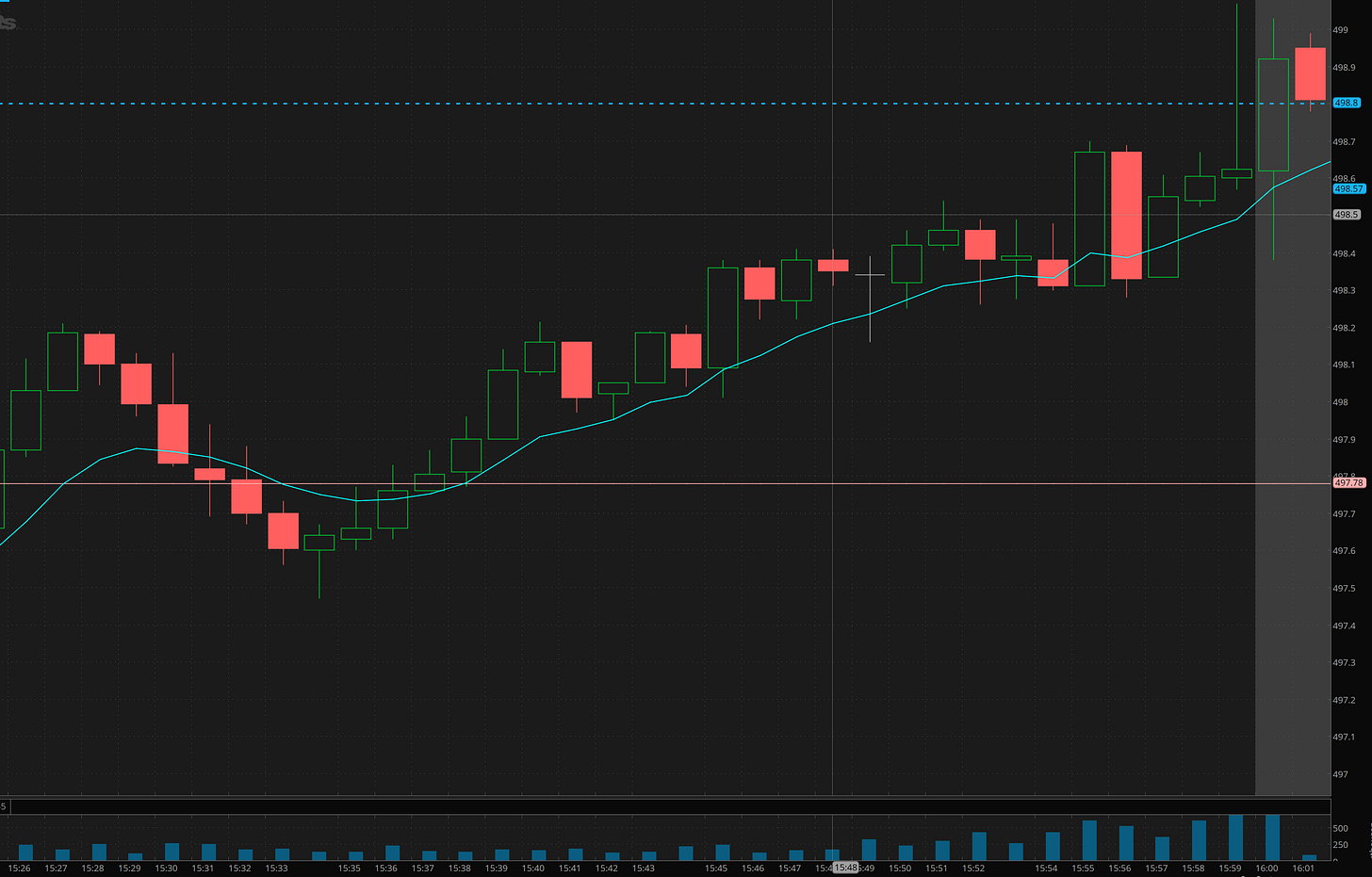

SPY last 30 minutes

SPY finally broke out of range. The peach line was key! I had an alert set to let me know if the peach line crossed.

I decided to yolo and placed an order on SPX 5000c for 0.30 and sell order at $3 in case we get a last minute stops triggering pop. Sure enough i got a dip to 0.25 popped to 1.50 then back to 0.15 and in last minute candle my $3 sell order filled!

Guess what. I loved the trade, but it was a crappy! I can accept lottery feel of it, but this was super not professional trading. (or maybe it was, I don’t know) but why not stack the deck in my favor?!

Look at these 2 charts which is the better trade?

IMHO the second one had a better chance of closing for a profit vs all or nothing. I’ll let you decide which is better.

I was too mentally tired from the chop so was unable to alert to members. Sorry folks.

NVDA

Given the rally in SMCI yesterday, I was sure NVDA was going to 750-760 yesterday and got long early. Unfortunately NVDA didn’t go and got stopped for only $2 gain.

I then noticed the exhaustion move on it alerted the short.

This was a text book gap up reversal trade I teach. Adding on vwap reject can boost your gains for limited risk (or open a new position if you missed hod reject)

And here is what happened. It flushed right to 720 for the exit and flip back long for a swing for 750.

The 720p went from $4 to $11. This was the big payer for the day.

Summary Review of Market Price Action

Overall yesterday did what we thought. I warned about the expected choppiness so trading the far ranges was key and we got the push to SPY 499 I wanted.

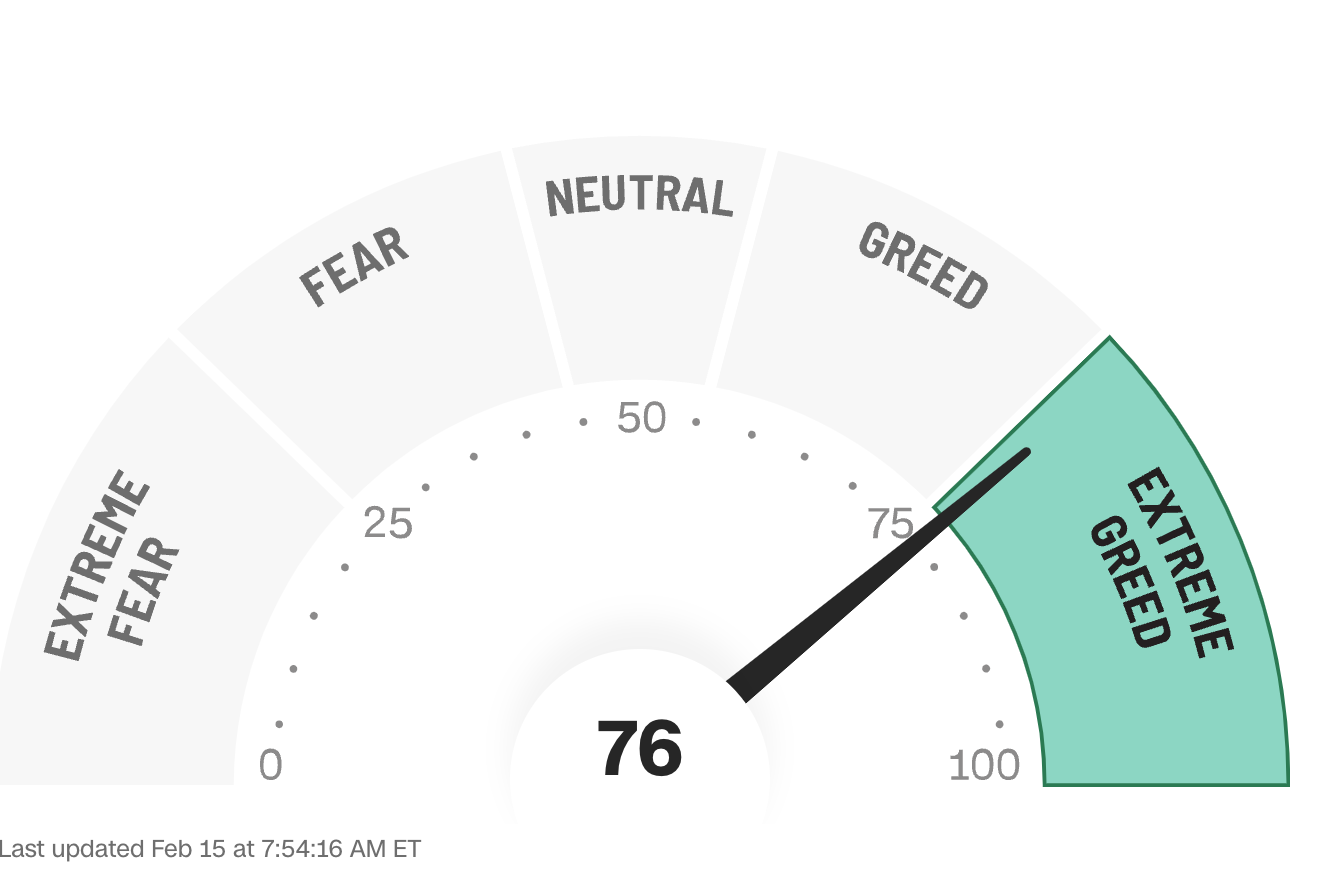

I’m not convinced of the rally tbh. So many people are ultra bullish.

This 500 level could be where big money chooses to unload to the retail bulls.

We are at extreme greed! That doesn’t mean we can’t keep going, but it does mean I will be cautious and also prepared for the big short.

At some point the rally will fail. Its ok to lose when that happens, because one should get excited about the short opportunity developing.

Continue to trade the price action targeting 2 level moves up and down using the Two Hour Trading process. I’ll shout out when I think a 4+ level move is coming.

Educational Lessons

From the price action review you should have learned the following:

learn the gap up reversal trade setup for 300%+ gainer trades

consider option strikes at the target price for fast move and SELL into the IV spike that comes.

Set sell orders systematically as soon as you enter the trade. Reward that habit/muscle building. Your account will thank you!

Use the levels I provide as a guide.

Watch for breakout/back tests in last 30min

Trade Ideas - Plan for Thursday Feb 15

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

So does SPY continue or does it begin feb seasonal selling?

I think we find out today or tomorrow. Regardless, using the levels and techniques I teach it doesn’t matter. We profit both ways. the only difference is at some point there will be a 20 to 100x trade opportunity. Until that develops our base hits beats 98% of the traders out there imho.

Jobs numbers come out at 8:30 today we have PPI tomorrow as catalysts.

Read on for my thoughts/plan