Will SPY hold and close above 500 today? Plan for Monday Feb 12

Good morning traders. Big week ahead with market holding over 500, CPI and jobs data this week.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to my THT PRO and ELITE members. (I will open up new memberships in mid Feb)

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Feb08 - ARM 100c. Entry $5 - High after $27.50. ($5000 → $27500 potential)

Feb07 - TSLA 185c. Entry $2.53 - Hight after $5.60 ($2530 —> $5600 potential)

Feb05 - SPX 4940c. Entry $3 - High after $16.60 ($3000 → $16,600 potential)

Feb02 - AMD 180c. Entry 0.15 - High after $1 ($1500 —> $10000 potential)

Jan 29 - SPX 4910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22000 potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

Friday’s Price Action (Education)

Consolidation in COIN after gap up

Very choppy action on COIN as emotions ran too with the gap up. using 140p I was taking $3+ exit targeting that 137.30 level and then also a flip long there.

I got stopped on first short attempt, but after the failed push over premarket highs, it gave a nice entry and one had to be patient.

the 140p came down to sub 0.50 providing a 500% opportunity at $3.

COIN dipped and reversed right at the 137.30 level. Wild prediction on that level !? The key is too look at how does it react to that level.

You can also see how heavy volume came into the 140c near 137.30 and 138 higher lows. If plan for at high of days being tested the entering for 0.60 with a possible $4.50 sell makes a great risk/reward. So using 50% for stop where does one set sell targets? For me I would automatically set sell orders at 1.50 and 2.10 for 50% and more at 3.2 near the previous highs. to get down to 20% size ad then raise stops to 2.10. Why? I want to always collect at 3-5R no matter what.

SPY

Launched out of the gate but I always have to wait for dip. I had place a buy order for 5010c at $5 and 5020c at $0.50. but wasn’t getting the dip I wanted to get filled. Eventually the 5010s dipped to 5.40. so what do you do?

There is where where learning price action is key. We have the double bottom on the peach line and hold of vwap. I missed that entry as I had errands to run and it was at the start of the lunch. I focus on trading 2 hours a day. I had secured profits via COIN and TSLA already in the morning. I didn’t need to force a trade that didn’t fit the pricing / plan I had originally paid. This where traders imho trip up. They keep chasing trades in fear of missing out vs looking at risk/reward assessment. If one decided that $6 is ok and use $4 for a stop and that targeting a $16+ exit is a good risk/reward one can take the trade.

However, I prefer to avoid trades outside my trading windows, being systematic means you will miss trades, BUT it should also mean you avoid bad trades. I value bad trade avoidance over winning trades. Notice how I say bad trade avoidance vs losing trades. Losing on trades is part of trading, but if it is systematic in nature, the losses should be covered by the wins. Bad trades are one that are impulsive, don’t match my systematic process and criteria and overall don’t support me achieving my goals.

One the worst trades a person can make is a winning trade that reinforces bad trade execution and planning

Overall, dips continue to get bought. SPY held 500 and we get the push into the 501-502 area.

Here is the price action on the 5020c I wanted for 0.50. you can see how it dipped to $2 and ran to $11. This is a great example of how one can be right on sell targets, but if you can’t fill where you want, you might miss the trade. I’m ok with that. Part of the reason I’m developing a scanner and algo is to find outsized reward to risk/opportunity that is supported by price action. I typically want 10R and in this case buying at $2 and risking $1 would have supported that, but buying at $2 risking 100% would have yield only 5R.

I leave the judgement call to you for if it was worth it. For me entering over lunch 4x the price of what I wanted to pay wasn’t.

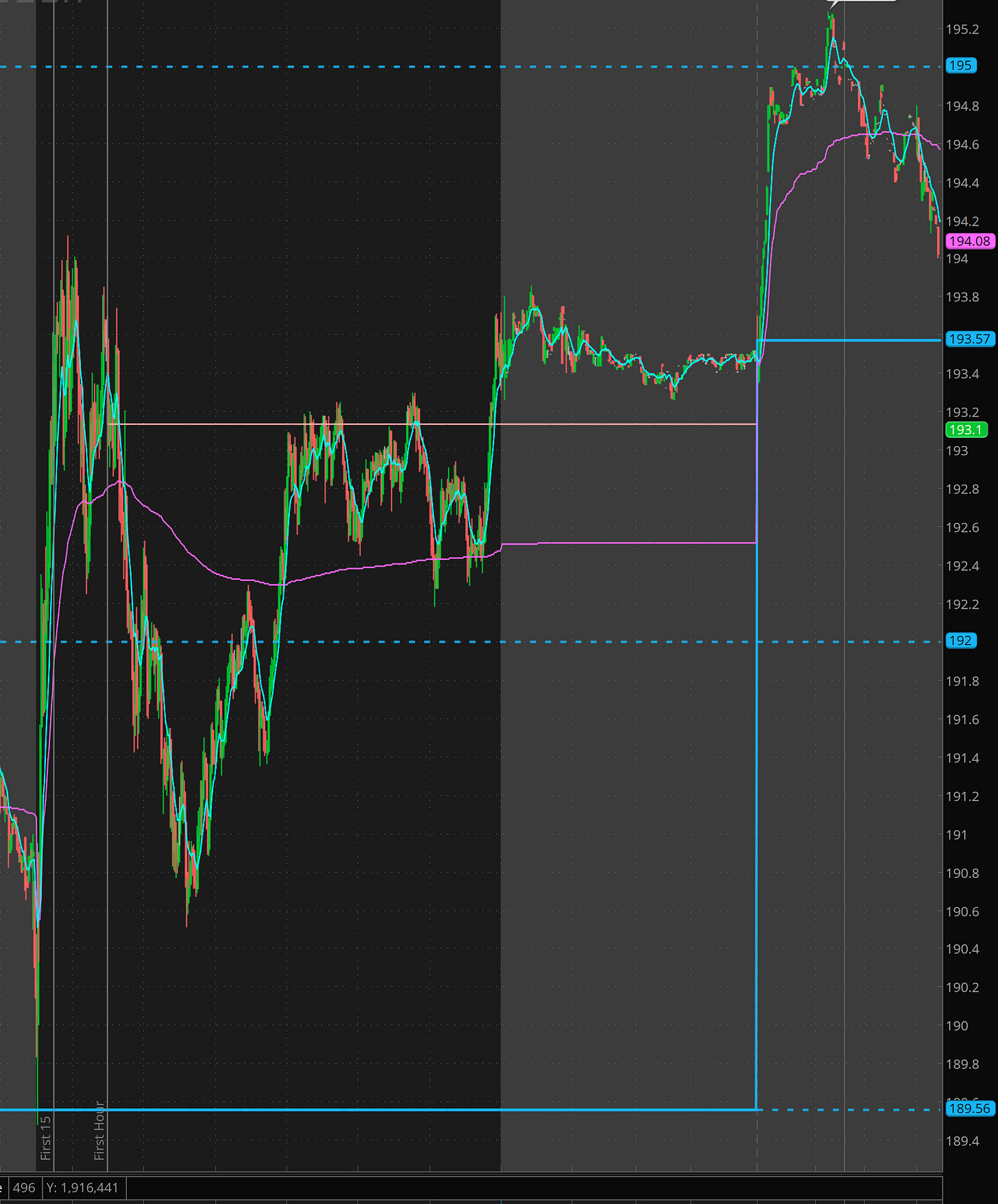

TSLA

TSLA provided 2 trades. You can see how on open it filled the gap and so taking 192.50c was the way to go.

Then at 11:30 it tested the open and that gave us another trade entry.

Summary Review of Market Price Action

The BTFD theme continues and some smaller names are starting to breakout so look for those plays as well.

if SPY continues to hold dip, I’m starting to expecting volume to increase as move higher and FOMO starts to kick in for 500.

Bottom line. If you look back, every dip in market has been bought since December. Bears keep trying to be first in on the reversal short and keep getting crushed.

Educational Lessons

From the price action review you should have learned the following:

Decide what your minimum Reward to Risk is and only take trades that support that

It’s ok to miss trade opportunities and not enter trades during lunch hour.

Set sell orders systematically as soon as you enter the trade. Reward that habit/muscle building. Your account will thank you!

Use the levels I provide as a guide.

Trade Ideas - Plan for Monday Feb 12

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

I’m excited about this week. We have more earning action and tomorrow we CPI numbers followed by jobs numbers on Thursday. This all means potential for volatility

Stocks I’m focused on today are: TSLA, NVDA, and SPY/SPX

Let’s get into the plans