Will SPY continue to consolidate or ignite xmas rally? -- Plan for Wed Dec 17

Our Bear Calls paid! AlphaOS is making Credit Selling a no-brainer. Debit spreads paying 100-200%. Spectre Special at the close paid over 800%. SpectreAI anlaysis sharing great ideas!

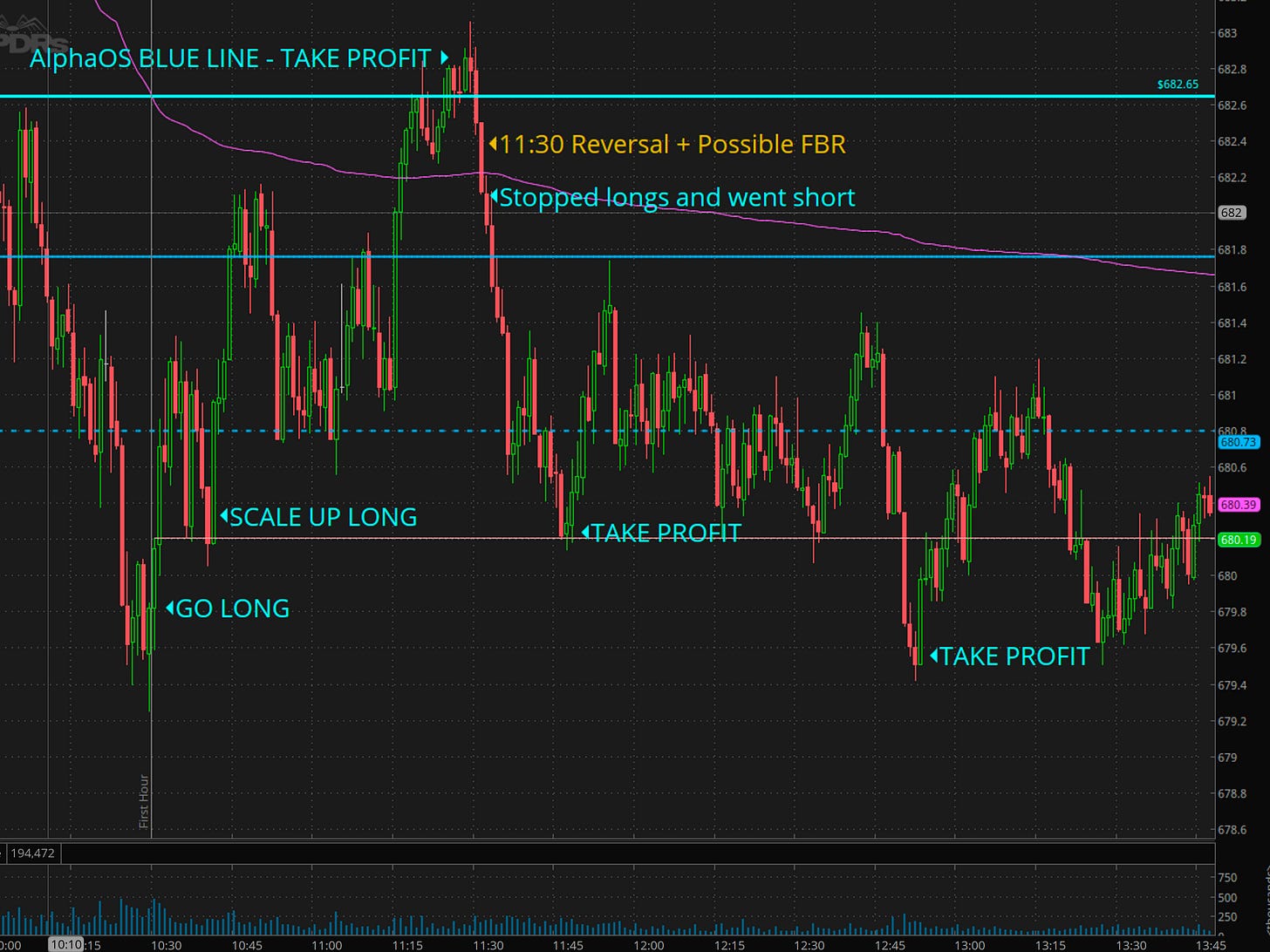

I missed the morning short, but we got long at 10:30 for a nice 3 point rally into the AlphaOS blue trend line. Its a custom trend line I have as part of the AlphaOS platform. (Rebranding Edge to AlphaOS) since it is geared to help traders extract Alpha systematically.

Here are the longs from 10:30

Per process locked into blue line but then got stopped on runnders on vwap break and flipped short. Perfect systematic process.

Process = Profits

Lately I’ve been doing the following:

Premarket establish where we likely wont reach. Sell premium for 0.8-0.60 on open.

After 11: second positioning of credit sells.

After 3:30: start hawking/planning for a Spectre Special

What’s a Spectre Special? One of my yolo trades that goes 300-1000% in under 30min.

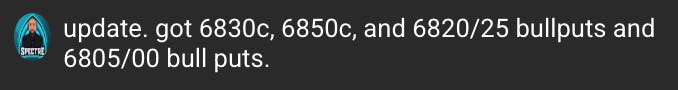

Credit Selling

SPX 6800/05 - WON

SPX 6840/45 - WON

Spectre Special

SPX 6810P 1.25 → 11

VIDEO RECAP SPY/SPX on Dec 16

If you are tired of overtrading, not knowing how to plan trades, and want to make more in less time, come join us.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Plan for Wed Dec 17

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

SPY Survival Guide: Dodge the Breakdown Trap

SPY Survival Guide: Dodge the Breakdown Trap

Pinpoint reversals around 678.61 to lock in quick gains amid Fed chatter.

Market Context

SPY enters today after a choppy close on December 16, hovering in premarket around 680 with a neutral-to-bearish bias. The index showed resilience above 678 but failed to sustain momentum above 682, forming a potential double-top pattern near recent highs. Volume was moderate in late trading, suggesting indecision, but downside risks loom if supports crack, especially with Fed speakers potentially swaying sentiment. Overall, expect range-bound action unless economic whispers trigger a breakout, with sellers eyeing a retest of lower pivots.

Key Events Today

8:15 AM ET: Fed Governor Chris Waller speaks – Watch for comments on rate cuts; dovish tones could lift SPY toward 682.25.

9:05 AM ET: New York Fed President John Williams opening remarks – His views on inflation may spark volatility around the pivot at 678.61.

12:30 PM ET: Atlanta Fed President Raphael Bostic speaks – Hawkish signals could pressure supports like 675.01, targeting deeper pullbacks.

No major data releases today, but these speeches could amplify moves in a low-volume pre-holiday environment.