Will PCE break SPY out of it's tight range? Plan for Thursday Feb 29

Earnings trigger moves in SNOW, DUOL, BIDU, OKTA, CRM

Good morning traders.

Yesterday produced a gap down and weak consolidation day as markets await reactions to PCE this morning.

Fear and Greed Index continues to hold at 78.

With. a number of names triggering moves from e/r and PCE data, today should provide a pay day to those who are patient and wait for the trades to come to them.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Feb 27 - TSLA 195p Entry 0.90 - High after $2.30+ ($900 —> $2300 potential)

Feb 26 - SPX 5070p Entry 0.20 - High after $2. ($200 —> $2000 potential)

Feb 23 - NVDA 800p Entry 2.50 - High after $25.11 ($3000 → $25110 potential)

**Dipped to 2.57 (had to chase entry 3)

Feb 23 - NVDA 820c Entry 2.25 (swing from Thursday) - High after $25.00 ($2250 → $25000 potential)

Feb 22 - SPX 4090c Entry $2.50 - High after $9.20 ($2500 → $9200 potential)

Feb 16 - SMCI 1000p Entry $11 - High after $195 ($1100 → $19500 potential)

Feb 15 - TSLA 195c. Entry $1.20 - High after 5.95 ($1200 → $5950 potential)

Feb 14 - NVDA 720p. Entry $4.5 - High after $12 ($4500 → $12000 potential)

Feb 13 - SPX 4955p. Entry $5 - High after $34 ($5000 → $34000 potential)

Feb 12 - ARM 180c. Entry $1.20 - High after $14.10 ($1200 → $14000 potential)

Feb08 - ARM 100c. Entry $5 - High after $27.50. ($5000 → $27500 potential)

Feb07 - TSLA 185c. Entry $2.53 - Hight after $5.60 ($2530 —> $5600 potential)

Feb05 - SPX 4940c. Entry $3 - High after $16.60 ($3000 → $16,600 potential)

Feb02 - AMD 180c. Entry 0.15 - High after $1 ($1500 —> $10000 potential)

Jan 29 - SPX 4910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22000 potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

Tuesday’s Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

Using Edge Trade Planner (beta)

Gapped down and made an attempt to join a trend short but 772.50 proved strong and got stopped flat to small loss. The waited for the original plan to get short after gap will which came later.

What this video to see how I shared the idea in Edge Trade Planner 2 hours before the setup developed and how to plan a trade. Please fast forward 9 seconds to skip the silence. (sorry didn’t have time to edit)

You can also take advantage of the option scanner which showed a 300k bet for downside when NVDA got to the 787 level.

Semi Chip Stocks

Yesterday I asked the question will the chip stocks continue to sell-off and they did. Let’s review the action and how to trade them.

NVDA

Waiting for the 787 level and then getting short provided a $4—> 7.50 opportunity on 770p, with most of the flush coming in last 30 minutes.

SMCI

Definitely weaker than NVDA as it couldn’t even get to fill the gap. it provided a double top and failed breakout reversal on break below 841, eventually selling off to the 790 target in after hours.

SPY

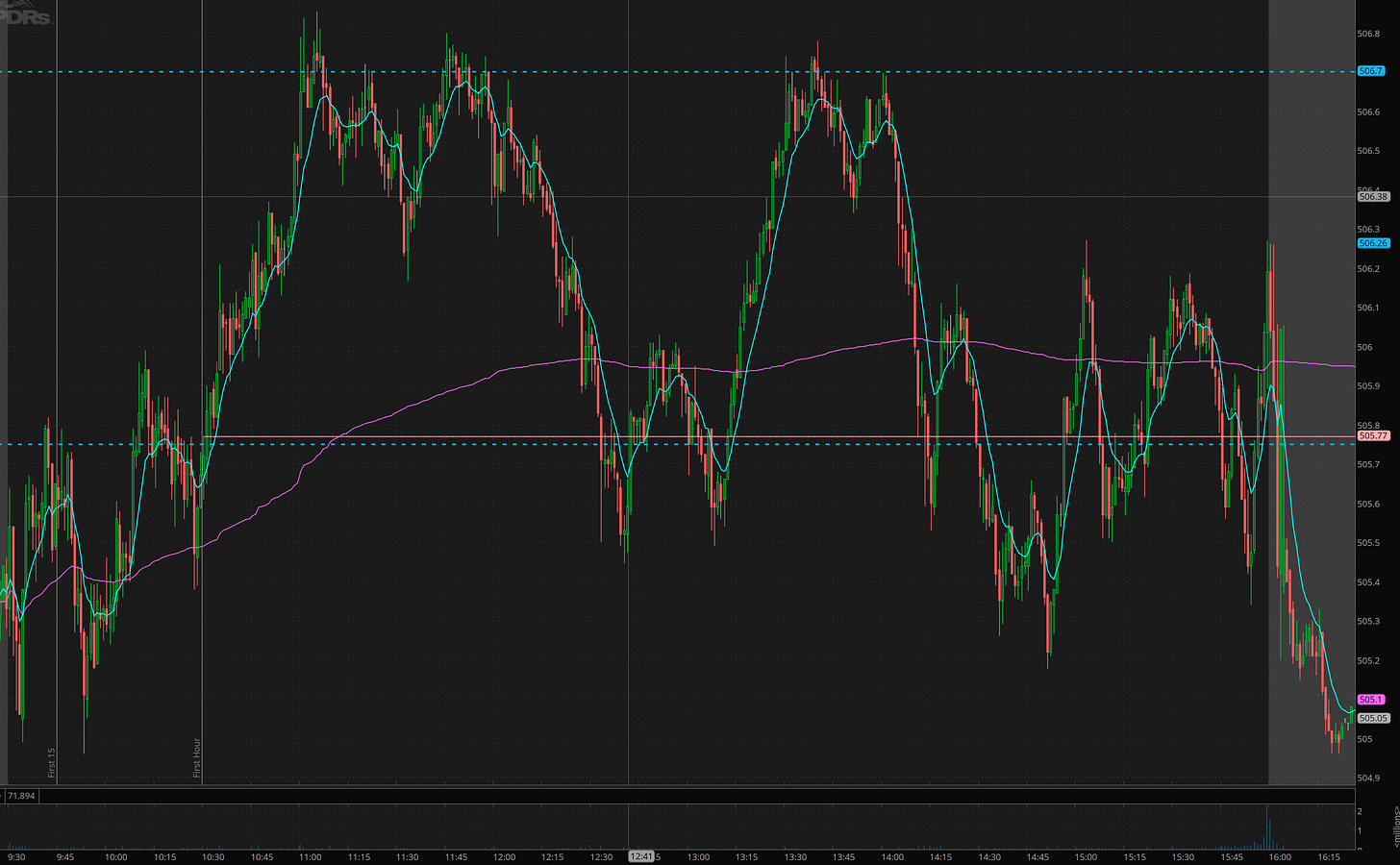

SPY consolidated in a tight range most of yesterday. I got chopped a bit trying to scalp it yesterday eating up most of my gains.

This was really dumb, because 100-300% opportunities were there if you played the chop only getting short at 506.70.

Summary Review of Market Price Action

Overall semiconductor stucks are searching for support now that the NVDA e/r catalyst is gone.

SPY is acting weaker but still in tight range as it awaits PCE data.

Educational Lessons

From the price action review you should have learned the following:

Wait for the levels to plan trades

Wait for gap fills to enter a trade.

Use Edge Trade Planner’s scanner to find trades.

Wait for the entry and price to confirm on the Trade Ideas in Edge

Take profits quickly on choppy days

Trade Ideas - Plan for Thursday Feb 29

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Overnight E/R movers

SNOW

Massive dump overnight on bad guidance the unexpected departure of CEO. It got multiple price target downgrades below the current price with targets of 170 and 175.

DUOL

Great rally overnight. Will market think that there is an unexpected gem here and carry it further? Great revenue and user growth! I’ll be watching dips for a swing long. It got a 275 price target by UBS.

BIDU

Citron of famed short selling has become a bull for BIDU stating it’s AI tech should carry the stock to $210. This led to a rally over the last week to 113. Will investors panic and drive BIDU to 90 to 95 this week even though their numbers beat expectations?

I’ll consider some leaps after I see support form, but this could take a lot of time to play out given China names aren’t getting any love.

OKTA

Nice move after profit numbers. if 110 can turn into support this could begin a multi-week breakout. Unfortunately the PT upgrade was only to 125 with all time highs over 200. Could be tricky to trade today.

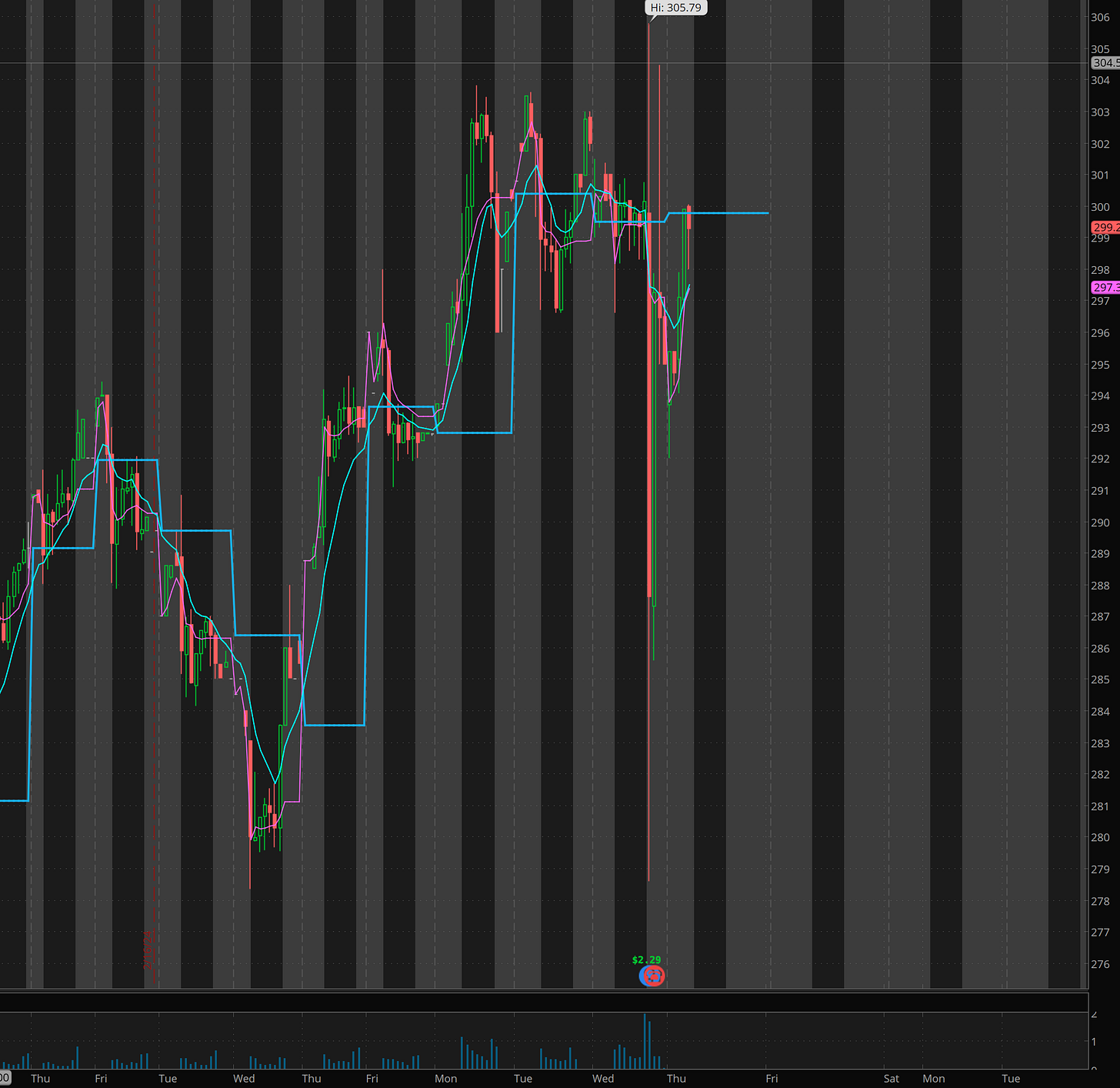

CRM

Mixed bag reaction to e/r. Depending on PCE and market trend I think CRM can go either way . Maybe long off 293 vs 290 break given raised PT of 345, but other banks raised PT to just 300.

Wow lots to watch. I’ll be watching the above names plus SPY and NVDA today and maybe TSLA. There has been a lot of call flow so it may get that 210 gap fill into tomorrow if market can catch a bid after PCE.

Read on for my thoughts/plan for today.