Will FOMC make or break the rally? Trade Ideas for Wed May 7

Are you planning trades that pay over 300%?

After the recent rally, SPY has taken a 3 day breather. This is healthy and normal. It does not mean that the rally is broken but it sure could mean that it may have lost steam. The big question is, how will the market react to today’s FOMC meeting and Powell’s comments.

I’ve started short swings into 565+ per plan, and all was looking good as we drooped to 559 yesterday, however overnight there was news of possible trade talks with China this weekend. Overall its just noise imho, until we get actual news.

In the ideas section, I’ll conve the major levels I’ll be watching for today especially after 2:30pm.

As for trading it was a bit hectic for my taste but that said. We nailed a number of trades. I was late to the short at the close though I perfectly predicted the entry spot.

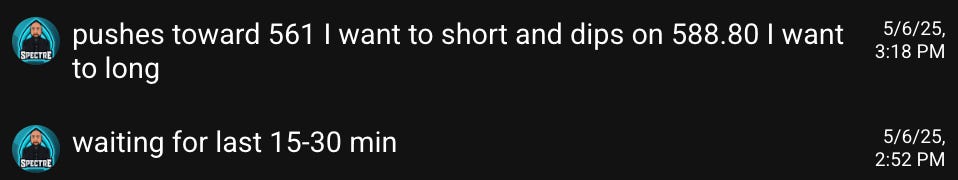

As we approached the last 30 minutes of the market I shared:

At 15:45 we pushed perfectly to 561 to 561.20. I missed the entry on SPX 5620 and ended up chasing 5615p and 5610pf for rough 2-5x gains. But if I would have been able to grab 5620p for $1 instead of $3 and 5615p for 0.30 which would have paid.

Overall still solid work on a consolidation day. Be sure to check out the recap section to see all chop and learn the reasoning for longs and shorts yesterday.

Stop being a hobbyist and invest in becoming a focused disciplined trader with a trade to win mindset with us.

Overnight Action

SPY - gapping up on china trade talk hopes hitting 564 but has since faded to 561s.

AMD - reported earning triggering rangy moves between 96 and 106 but is now virtually unchanged from yesterday’s close.

MRVL - gapping down on expected uncertainty due to market conditions

SMCI - gapping down though it reported expectations of strong demand but uncertainty in international business.

EA - gapping up on e/r

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

Trade Recap for Tue May 6

GOLD BOLD ITALIC = price action signal

SOFT YELLOW = thinking/anticipation

WHITE REGULAR = action to take/taken

GREEN REGULAR = trades I should have taken

SPY / SPX

Notice how the key price action for each of these was recognizing the failed break signals especial near key levels.

GET EXCITED. I’ll be publishing a book called Trading To Win: Stop trading to NOT lose. Title is still in the works. I plan to include exercises to help you improve your mindset and your trading. Leave a comment or send me a message if interested in the book. My birthday is coming in May - I hope to release this before then.

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Education

How to Join a Strong Trend

The process I typically follow for joining a strong trend are as follows:

All day grinder: join on dips to 20ma

Multi-day grinder:

Join either on support test of morning lows or failed breakdown reversal at key level

Join at VWAP mid day or end of day

Keep it simple. Don’t chase, wait for support levels for great risk/reward entries!

Systematic Profit Taking

How do I take profits? I keep it relatively simple. Depending on the entry and range to the next levels I typically with take profits 50-100% of my profits at 3-10R and then raise stops to above entry with a goal of letting runners take me to the next level or 2 and to then reload if I believe we are consolidating before the next leg.

I then repeat the same process on the reload.

Trade Ideas - Plan for Wed May 7

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Ideas

it’s FOMC day. I will check out until 2:30pm. Why? Because contracts are juiced and unless a major level is tested and reverses or breaks the most I hope to make is 100-200% and there is often a lot of chop. Overall the price action on these days can be mentally draining and i want to be mentally rested to read the action after Powell speaks. It also happens to be the time frame where I’ve caught over 1000% gainer trades. So unless a major key level is tested and provides an A+ trade setup, I’ll be waiting for 2:30pm.