We got the squeeze! Short Trading Week. Does SPY make a new high? My plan for Thursday March 28

Want to make bank? Use my levels to plan and get 10x+ trades.

Good morning traders!

Yesterday was more of the same. Wait for the close and get paid big. However I did get faked first but that is no matter — because I stick to process. I have zero issue flipping. Yesterday delivered the move I was looking for to happen the day before.

Now that we got the big rip what is next? This is a short week with Friday being a holiday, but that also presents a problem. PCE data comes out tomorrow. So the question today is will the market be bought up to new highs ahead of the data or will the market continue to have slow structured selling on gap ups? Will we be pinned?

In today’s blog I will review how you can plan a 10x trade too and what I am looking for to make a trade.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas each morning, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Mar 27 - SPX 5230c Entry $1.20 - High after $19 ($1200 → $19000 potential)

Mar 26 - SPX 5215p Entry $1.20 - High after $11.50 ($1200 → $11500 potential)

Mar 25 - SPX 5210p Entry $0.50 - High after $6.50 ($500 → $6500 potential)

Mar 22 - LULU 390p Entry $1.25 - High after $5.7 ($1125 → $5700 potential)

Mar 21 - SMCI 1000c Entry $4.80 - High after $22.60 ($480 → $2260 potential)

Mar 21 - SMCI 1000c Entry $4.80 - High after $22.60 ($480 → $2260 potential)

Mar 20 - SPX 4200c Entry $7.50 - High after $27.12 ($750 → $2710 potential)

Mar 19 - SPX 4170c Entry $1.10 - High after $11.30 ($1100 → $11300 potential)

Mar 18 - GOOGL 147p Entry $0.65 - High after $1.71 ($650 → $1700 potential)

*runner reached $2Mar 18 - SMCI 900p Entry $10 - High after $30 ($1000 → $3000 potenital)

*runner reached $60!Mar 14 - SPX 5150c Entry $3 - High after $10.50 ($3000 → $10500 potential)

Mar 12 - SPX 5150c Entry $4 - High after $27.50 ($4000 → $27500 potential)

Mar 11 - SPX 5120c Entry $3 - High after 7.50 ($3000 → $7500 potential)

Mar 8 - SMCI 1150p Entry $5 - High after $56.20 ($500 → $5620 potential)

Mar 8 - AMD 220c Entry $0.50 - High after $7.65 ($500 → $7650 potential)

Mar 7 - SPX 5175c Entry $0.50 - High after $2.40 ($500→ $2400 potential)

Mar 6 - SPX 5120c Entry $3.50 - High after $12+ ($3500→ $12000 potential)

Mar 5 - SPX 5070c Entry $0.50 - High after $10.75 ($500 → $10750 potential)

** alerted 0.30 entry wanted. dipped to 0.40. entered at 0.50Mar 5 - SPX 5070p Entry $1 - High after $13.50 ($1000 → $13500 potential)

Mar 4 - SMCI 1200c Entry $33 - High after $61 ($3300 —> $6100 potential)

Mar 1 - SPX 5120c Entry $2 - High after $20 ($2000 —> $20000 potential)

Feb 29 - SPX 5095c Entry 0.50 - High after $10 ($500 —> $10000 potential)

Feb 29 - SPX 5100c Entry 0.30 - High after $5+ ($300 —> $5000 potential)

Feb 27 - TSLA 195p Entry 0.90 - High after $2.30+ ($900 —> $2300 potential)

Feb 26 - SPX 5070p Entry 0.20 - High after $2. ($200 —> $2000 potential)

Feb 23 - NVDA 800p Entry 2.50 - High after $25.11 ($3000 → $25110 potential)

**Dipped to 2.57 (had to chase entry 3)

Feb 23 - NVDA 820c Entry 2.25 (swing from Thursday) - High after $25.00 ($2250 → $25000 potential)

Feb 22 - SPX 4090c Entry $2.50 - High after $9.20 ($2500 → $9200 potential)

Feb 16 - SMCI 1000p Entry $11 - High after $195 ($1100 → $19500 potential)

Feb 15 - TSLA 195c. Entry $1.20 - High after 5.95 ($1200 → $5950 potential)

Feb 14 - NVDA 720p. Entry $4.5 - High after $12 ($4500 → $12000 potential)

Feb 13 - SPX 4955p. Entry $5 - High after $34 ($5000 → $34000 potential)

Feb 12 - ARM 180c. Entry $1.20 - High after $14.10 ($1200 → $14000 potential)

Feb08 - ARM 100c. Entry $5 - High after $27.50. ($5000 → $27500 potential)

Feb07 - TSLA 185c. Entry $2.53 - Hight after $5.60 ($2530 —> $5600 potential)

Feb05 - SPX 4940c. Entry $3 - High after $16.60 ($3000 → $16,600 potential)

Feb02 - AMD 180c. Entry 0.15 - High after $1 ($1500 —> $10000 potential)

Jan 29 - SPX 4910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22000 potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Wednesday’s Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

SPY/SPX

After SPY sold the gap up initially, it proceeded to stay pinned most of the day but eventually leading to a squeeze higher into the close. Let’s review the short trade on open and the 10x trade for the close.

So market was selling off and I commented it was strange that SPY was holding up. So we wait, but as soon as the red bars started come on a lower high, we had about 5 minutes to be hawking and as soon as vwap crossed after the first 15min, it was go time. Why do we want to go short? One of the core THT trade setup is gap up reversals and this played out nicely.

The SPX 5230p went from $6 to $16. Using $2 risk that is $5R potential. Following my rules I start taking profit at 3R and out 80% at 5R.

After this trade. SPY essentially bottomed out. This is where given recent price action I alerted a credit sell trade. This lets me take advantage of the bleed out on the contracts.

Sure enough these contracts eventually went to 0 by end of day with very little draw down if any. Think about this. You could have had 2 solid trades in the morning and been done and all the work is done is less that 2 hour. I’m running about an 80% win rate on my credit sells which is fantastic and lets me go bigger and not baby sit.

Let’s get it the afternoon action, which tricked me at first, but I was able to quickly recognize the flip and take advantage of it.

I want to focus on process and how I trade in this lesson. After 3pm it appeared SPY had pushed above vwap and failed And so following process, and in case we got another flush like the day before I started short after 5222 level rejected. we quickly broke the peach line a second time and contracts were up. YIKES! back over the peach line. I stopped out at entry. No big deal. Let’s then watch if it start reversing higher and it did. That peach line turned and 5222 break turned into the failed breakdown reversal I wanted. So I look 2 levels above and that gives me 5242. So the 5230c should hit $12+. I grabbed them for $1.20! anything under $2 is a GREAT risk/reward.

If you waited for 5230c break then at $3.50 it is still a possible $3x+ trade! and 5R+ risking 1.50. YOU TAKE THE TRADE! and go big.

I fumbled the execution a bit since I sold too much at the 5230 level, but made up for it later by taking SPX 5250c for 0.20 and selling for $1.

Always go back through your trades and review what can have been done differently or better? Normally SPY contracts give a smaller multiple than SPX contracts. If I had applied the same logic/plan and taken 522 SPY calls when I took 5230c, they went from .04 to 1.40!!! for over 30x!

TSLA

Yesterday’s trade on this gave me a lot of satisfaction because I don’t think I could have planned it any better.

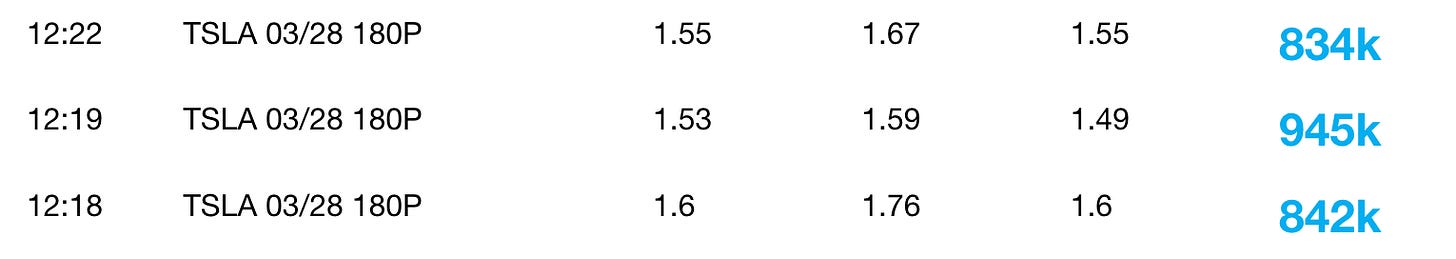

Edge alerted these TSLA puts which is what got me interested

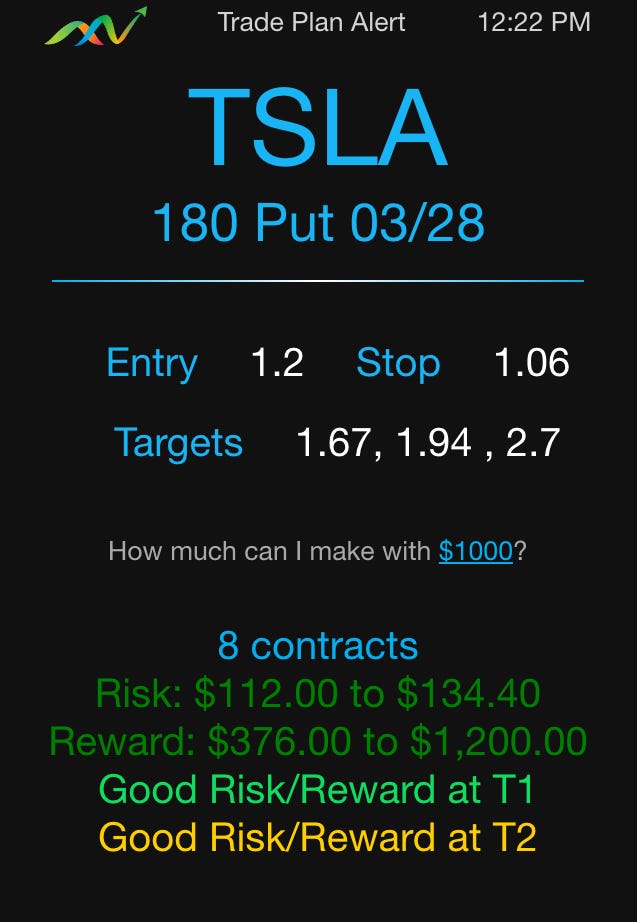

I made made an initial plan to enter these at 1.50 with 1.20 stop, but then revised the plan to anticipate the failed breakout. I had just had the conversation with someone about how big money often positions before the big move and we as the smaller players can often get in at a better price. So decided to change my plan and place order at 1.20 with 0.90 stop for sizing. Why 1.20? Because how often does our stops get hit and things reverse? So I made my entry the price that my stop would have been!

And guess what, it filled! and reversed immediately. I then took the low of the contracts and made it the stop and revised the plan in Edge to get my new sell targets. Both t1 and t2 were met! In fact I could also add more size around 1.45-1.50 which is a better price than the buyers that made in sum a $2.4m bet.

Using Edge, has made being able to consistently extract profits from the market so easy! Here is the plan that Edge created.

And check out how well Edge did with targeting!

The high was 2.03! I used 1.06 for the stop because I wanted a little bit past the 1.09 in case of a double top push. This part is the art, it doesn’t have to be perfect! It just has to be right enough, that you size appropriately and consistently extract profit from the market at a multiple of your risk!

Trade Ideas - Plan for Thursday Mar 28

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

So where do we make money today and is today the day to give it?

That is what I’m thinking. Given tomorrow is a holiday and news event and today is the last day of the trading month, anything can happen. Because of the holiday, trader often take today off or leave at lunch for an extended weekend / trip.

This means we could have a low volume environment. It also means that we could just be pinned or we could have some low volume rangy moves.

Trade extra careful today. I plan to trade smaller and keep the option open to not open any trades. You don’t have to trade everyday to grow your account! I got 3 10x trades this week and all those came in the last 30 minutes!

Today I’m watching SPY, NVDA, SMCI and RDDT