Volatility and Traps Galore, a momo trader's paradise. Earnings season underway and the plan for Wed Oct 18.

Being patient and planning for reversals and chop is how to get paid in this market

Yesterday I said I expected us to be range bound and that is exactly what we did. We got a small over extension to the downside, and a little extra squeeze right into the 438 resistance level for a fantastic short!

Let’s review the action. Members that study my 3 Killer Trade Setups and put it to use got paid yesterday. The open gave us a text book gap down reversal setup that followed the process to a T. I was coding all night (working to add Algo generated Trade Plans into Edge Trade Planner) so while I caught entry for the long, I took profits early and told members I needed to take a nap and would come back and trade the move after lunch. This is one of the great things about Two Hour Trading. One can focus on planning and entries, be systematic about taking profits, and then just wait for the trades to come to you. And soon waiting will mean getting algo signals 10 to 30 minutes before moves trigger, so we don’t have to sit and look at charts all day.

The Bear Trap….

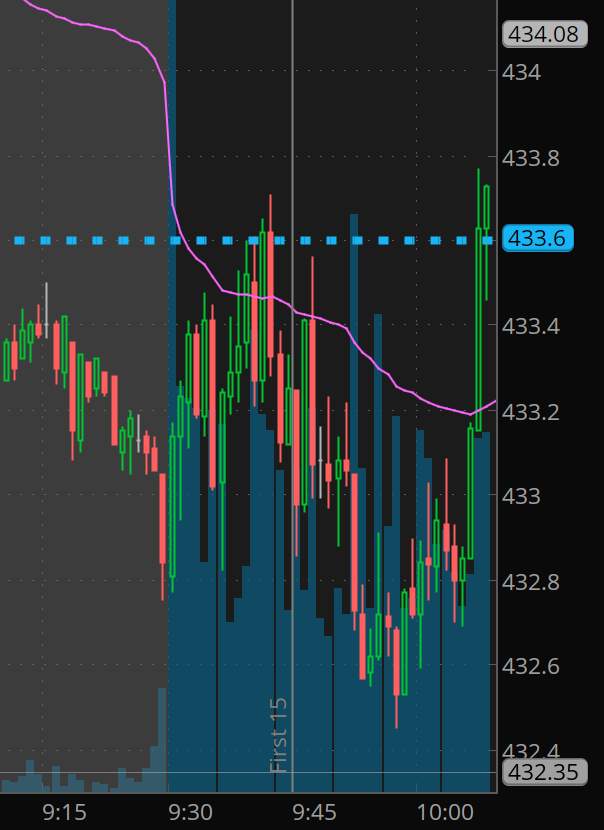

This is how things looked after the first 15 minutes. That reaction/rejection of 433.30 looks so bearish. But you have to ask yourself, is going short hear worth the risk? DO NOT get so focused on making a buck that you lose sight of the bigger picture which is that we have a large gap down. I regularly miss the trend on gap and go moves because I HATE THE RISK. I’ve had contracts lose 50 to 80% of value in seconds on chasing trend.

One of the things I love about doing the Premarket Prep livestream each morning is that my premarket plans are uncanny. Yesterday I said if we get a dip into 432s I want to get long…. That planning allowed me to look at the chart differently and say, I want confirmation of upside and then take that long. and we got it just 10 minutes later when SPY crossed vwap after establishing a failed breakdown move! One of my favorite setups and highest win rate triggers. We broke morning support at 432.80, made a low, pushed higher, backtest 432.80 for a higher low, and then crossed vwap!

Absolute magic! You can get long anywhere between 433.20 and 433.80 targeting 435.30 and 436 for the gap fill, and leave runners in case of 438 squeeze. Classic Killer Trade Setup and predictable move.

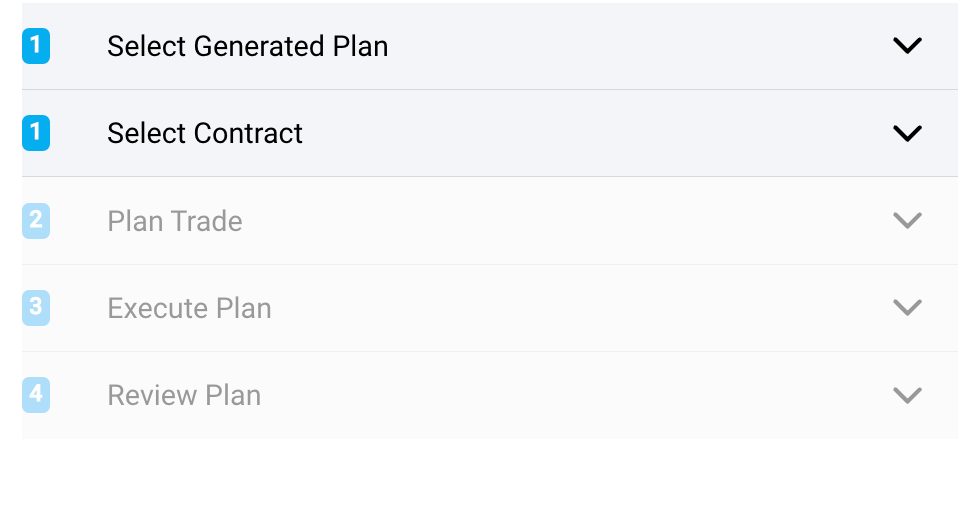

So I checked Edge using SPX and the 3 killer trade setup logic and the squeeze targets using the SPX watchlist levels to see how it would have done with suggesting plans and targeting. When you plan trade, you can choose between manually select contracts or the generated plans in Step 1.

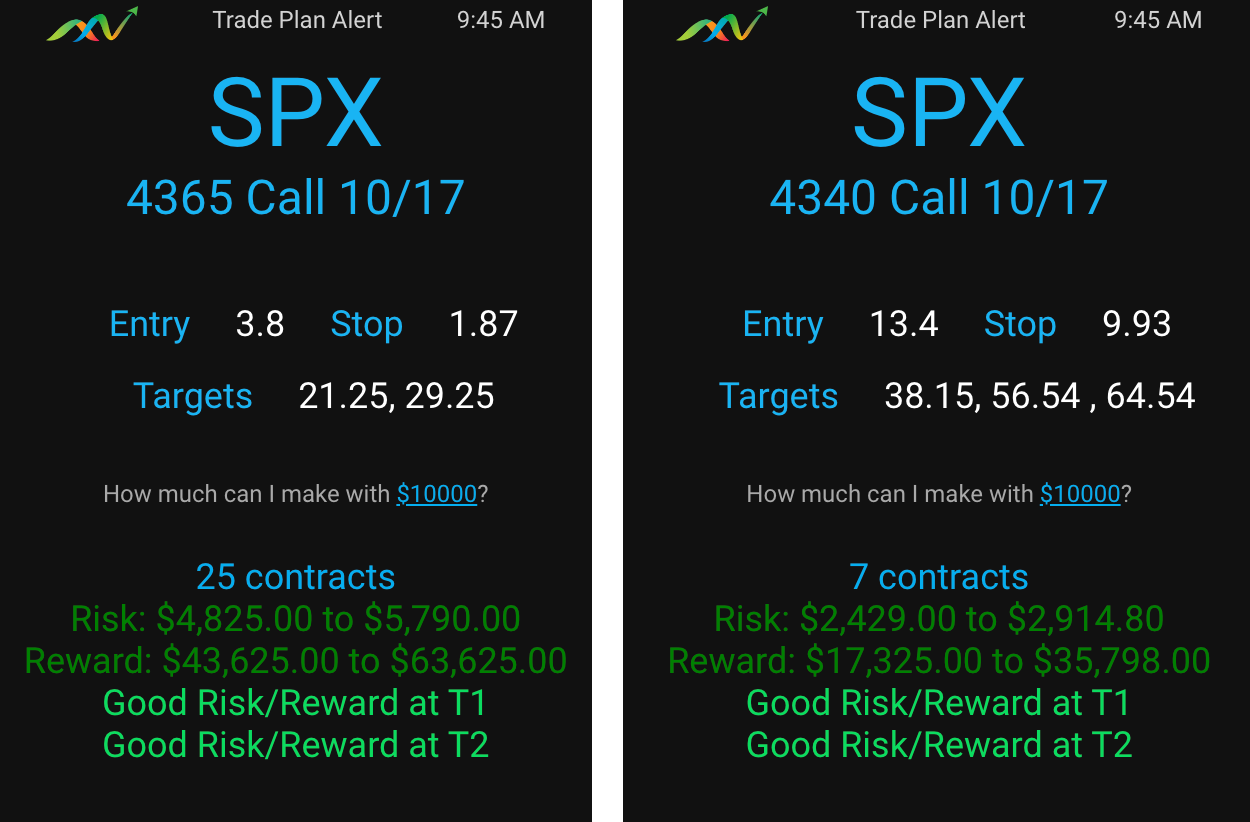

Here are the 2 plans it generated for the idea.

Let’s see how it did. When saw the result I was a bit expressive and forgot I had a hot mic, and members got a little worried. (I was upset I didn’t have the planner in production yet to have helped me plan this trade).

WOW Right? Purple line is entry, Red is stop, and Green lines are take profit targets.

Ok. So back to the price action, after seeing the first hour, I indicated that market is likely to squeeze and decided to take a 2 hour nap and then come back and see if I can position for a short after the squeeze. (Notice how I wasn’t stressed about missing the short.. you want to get to that place. Being systematic told, me I don’t want to open trades until after lunch or a key level is tested/rejected, so let the market do its thing)

SO I woke up around 12:30pm, and here is the action in SPY, clean rejection. As it approached 438, it looked like it was going to break out further and squeeze, trapping bulls, but 438 is a strong level… And so we planned for the short.

And guess what… Algo generated this plan at 12:41

And here is what happened….

The sell targets were aggressive and I need to dig in and figure out why it gave the contracts such an extra premium (predicting option prices is very hard!). That said, when a plan is alerted, you can click Analyze/Plan and then adjust the take profits orders to fit your multiples. 0.60 to 2.60 to the magic peach line is good enough for me. That is a 7R trade! I’m ecstatic with anything over 4R.

NVDA 0.00%↑

Ok. Let’s take a quick look at the desire to short after squeeze fail. I was originally targeting 441.50 for rejection for a short, but because I was patient and went for a nap, was able to see it had squeezes hard into 447. Once it gave that lower high at 445, that was the all clear to start short with an even better entry! 430p dropped to $1.70! These could be $10+ if market dumps this week. By end of day these doubled to $4.25 and settled around $3.50. Overall, if market doesn’t catch a bid by late Wed, we could see 420 or less into Friday.

All this volatility and range, is a dream come true for me. I don’t care are we going up or down, let the market be rangy and exhaust. We can catch the reversals on exhaustion to make high probable win and high R trades. It’s paradise.

What I’m looking for on Wed Oct 18

I’m looking for more of the same, but have a small bearish bias. That said I continue to watch SPY 0.00%↑ bounce and consolidate between 432 and 438. Which ever way and when it decides to breakout or break down we should get a nice paying trade. From 432s I plan for calls,, and from 437s I plan for puts. If we open heavy and 435.30 is back tested I may consider a short with a tight stops.

NVDA 0.00%↑ I plan to add short on pops targeting 415-417 to come by Friday.

TSLA 0.00%↑ reports in evening and has been acting weak. I got stopped on my swing calls for e/r run up for a 50% loss . Guys, its absolutely ok to have ideas, and lose on trades. It’s part of the business. What is not ok is operating without risk and capital management. Any number of trades will easily pay for the TSLA loss so I don’t sweat it, I move on. Please look in terms of ideas and if it worked or not, vs profit / loss and creating emotional baggage around how good or bad a trader you are. I see trades put too much importance associated with each and every trade vs looking at them as part of a system and no one trade should matter as long as systematically your account is growing over multiple trades.

NFLX 0.00%↑ has been acting weak and sitting on support. Also reports Wed after close.

Overall, my primary goal today is to be patient, let large trends run and exhaust, and get paid on the mean reversion. (unless we break out of the 432/438 range, in which case I will join trend)

Thoughts…

I’m striving hard to get to a point where its all about fewer trades, less time in front of charts, making insane profits, and spending time and helping those I care about. Making Edge Trade Planner and the algos behind it is to help automate my business of trading and most importantly be more consistent with larger profits while spending as little time as possible. I’ve spent hundreds if not thousands of hours working toward this goal. I hope you’ll join me on the adventure toward a more systematic and automated trading life style.

I’d love to get your feed back on if this blog is helpful. Please send me a message.