Use Edge to Plan Reversal Trades that pay 5x+ your risk

THT PRO members, be sure to read this blog and watch the video in the learn tab in Edge.

We had 2 gap up reversal trades develop yesterday and this one of my goto and favorite trade setup. One is MSFT and another in SPY/SPX

So how do we plan and time option trade for this?

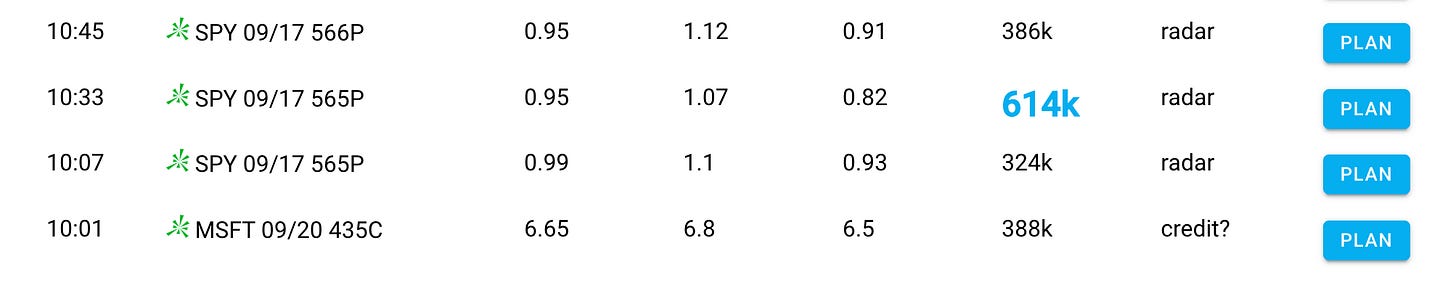

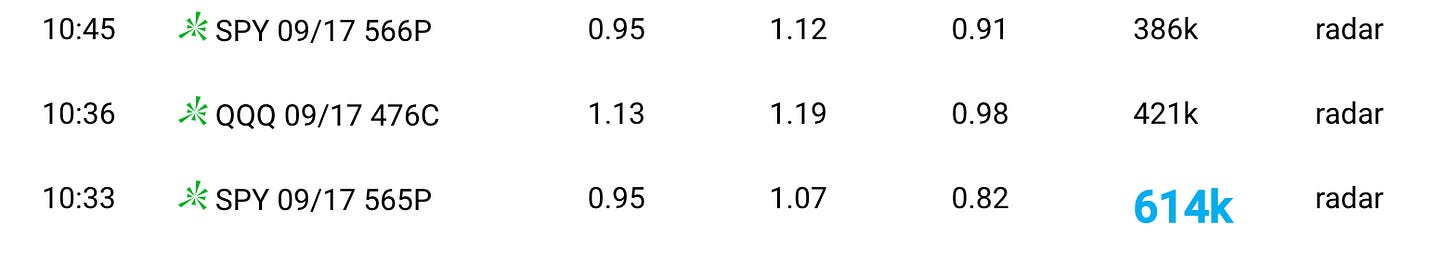

Remember less is more. In Edge, you can limit the stocks you watch from the watchlist. These were the only alerts generated for SPY and MSFT before 11:00am.

Edge is designed to find the diamond quality trade opportunities and then help you plan the trades to take take advantage of it.

Gap Up Reversal Trade Process

Step 1: Recognize that there is over a 2 level gap up.

Step 2: Monitor Ideas - Option Scanner

Step 3: Identify option contracts to use

Step 4: Plan trades

Step 5: Place Bracket Orders

Step 6: Walk away!

Examples

MSFT

MSFT gapped up and pushed 3 levels to 440 per my Watchlist levels, It pushed over 440 and then rejected 440.

The option scanner flagged this option volume as a possible credit sell

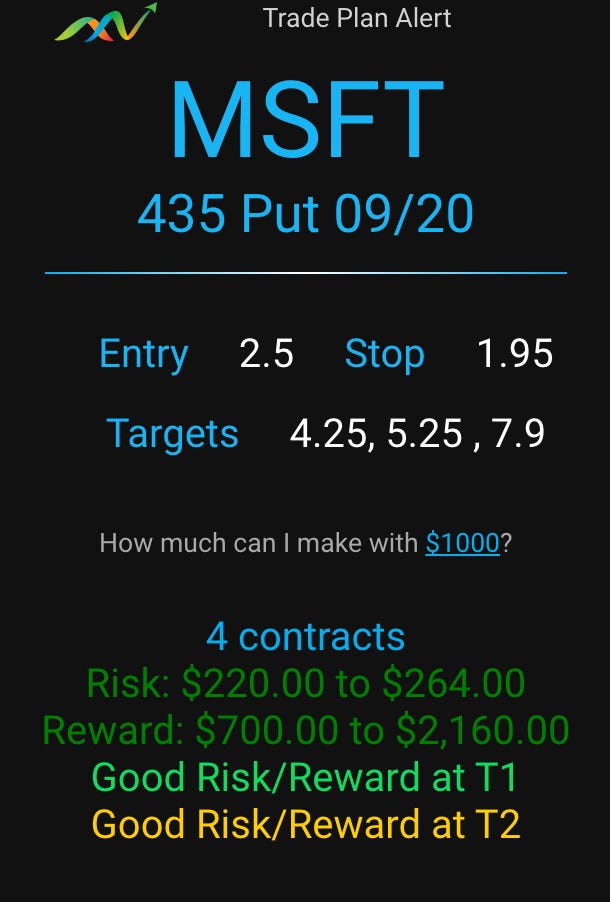

Let’s make $1000 bet using that alert… Risking about $250.

So what happened?

It dipped to 2.20 and then ran to 5.50! Not bad sell targets by Edge!

If you sell all at T2… 5.25-2.50 = 275 profit per contact. 4 contracts = $1100 Profit risking $250. That is 4R!!!

SPY / SPX

Step 1: SPY gapped up 2 levels to 565.20

Step 2: Put action came in an hour after the open

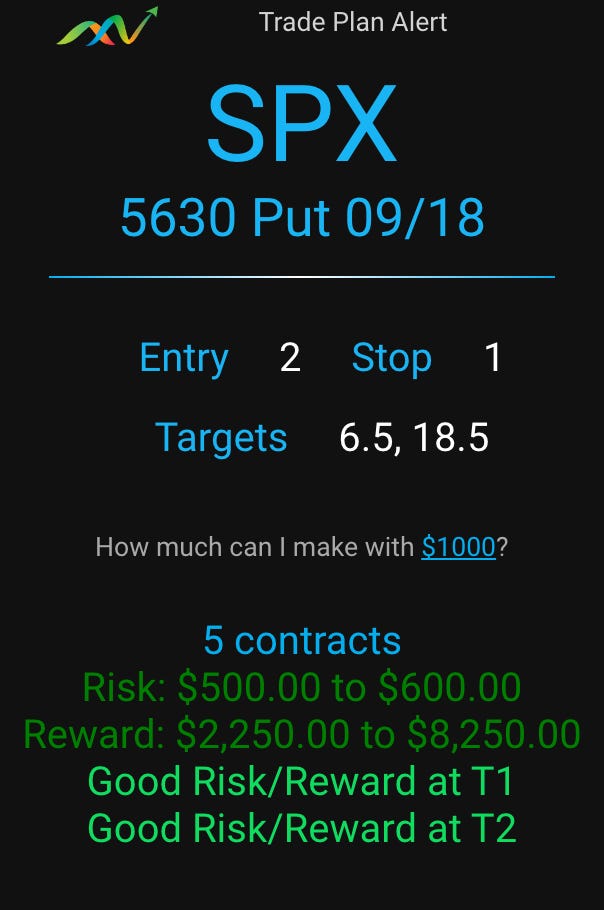

Step 3: We want to trade SPX, so count 2 levels down and take SPX 5630p

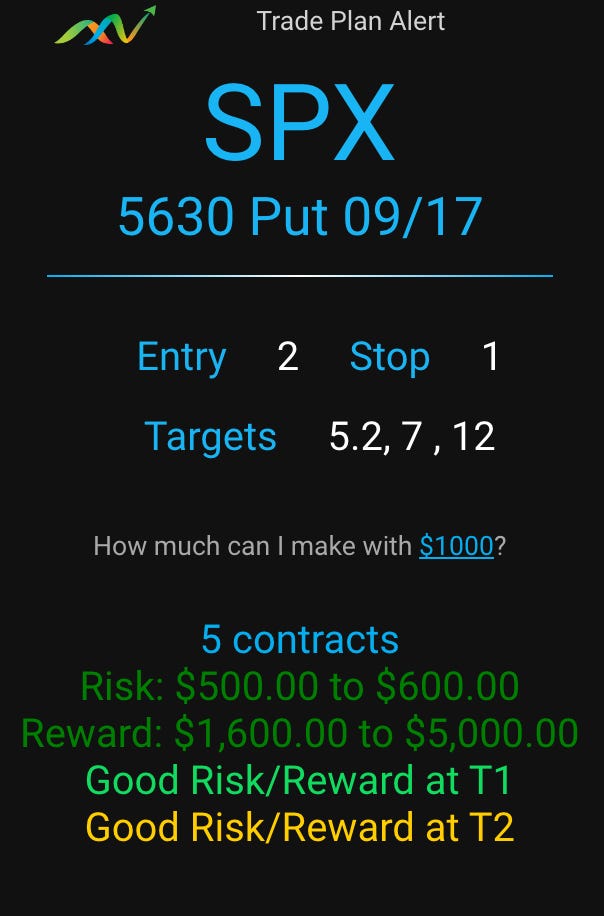

Step 4: Plan the Trade.

There are 2 sell target methods in edge. Risk/Reward based (80%+) of my trades and Move based.

Here is the plan for RISK based:

Here is the plan for MOVE based:

Both plans yielded great results. Notice how Edge also calculated how many contracts, and told you the risk/reward in $ terms! Edge’s the move based plan targeted 18.50 for exit, high of day was 20!

I choose Risk based when I’m less confidant about the gap fill or momentum and Move based when I have high confidence that I will get at least a 2 level move

Step 5 : Place the bracket orders

Step 6: Walk away and watch for notifications for take profit or loss from your broker.

Here is what happened after the alert came in from the scanner:

The contracts went from 2 to 20!

Summary

Combine, the levels, price action, and scanner to consistently plan trades.

Edge isn’t perfect and won’t always maximize results, but if you are directionally right and the momentum is there, Edge should help you systematically secure profits of 5R+ regularly.

Want to start using Edge? Join THT PRO to start scanning and planning your trades, get real-time commentary, and improve trading habits.

VIDEO

Watch the video explanation and see Edge in action