Upward range break. Rally continues. Does it continue? My plan for Tue Nov 21

Why did market rally at 1pm yesterday

Yesterday was a solid trading day. Let’s review yesterday’s trades/price aciton.

NFLX 0.00%↑

NFLX was on my radar for possible breakout continuation. Once I saw 469/470 clear at the open, I knew I wanted to get long.

The biggest challenge process wise, I ran into, was estimating the dip price on the contracts. I started in long at 2.45, stopped half at 2.20, and then added a little under 2, but then waited for the first hour to complete. Once it cossed the $2.20 price again, was able to add back contracts and then again on hod break targeting $5+ for the first sells. Overall thinking we see 485-490 on Friday.

SPY 0.00%↑

SPY finally made the move I wanted on Friday. I was unsure if today was the day it would or not or how choppy it might be so opted for doing a credit sell. This is where edge’s scanner helped out. I identified this action as being a premium sell trade instead of a short bet and joined the same idea.

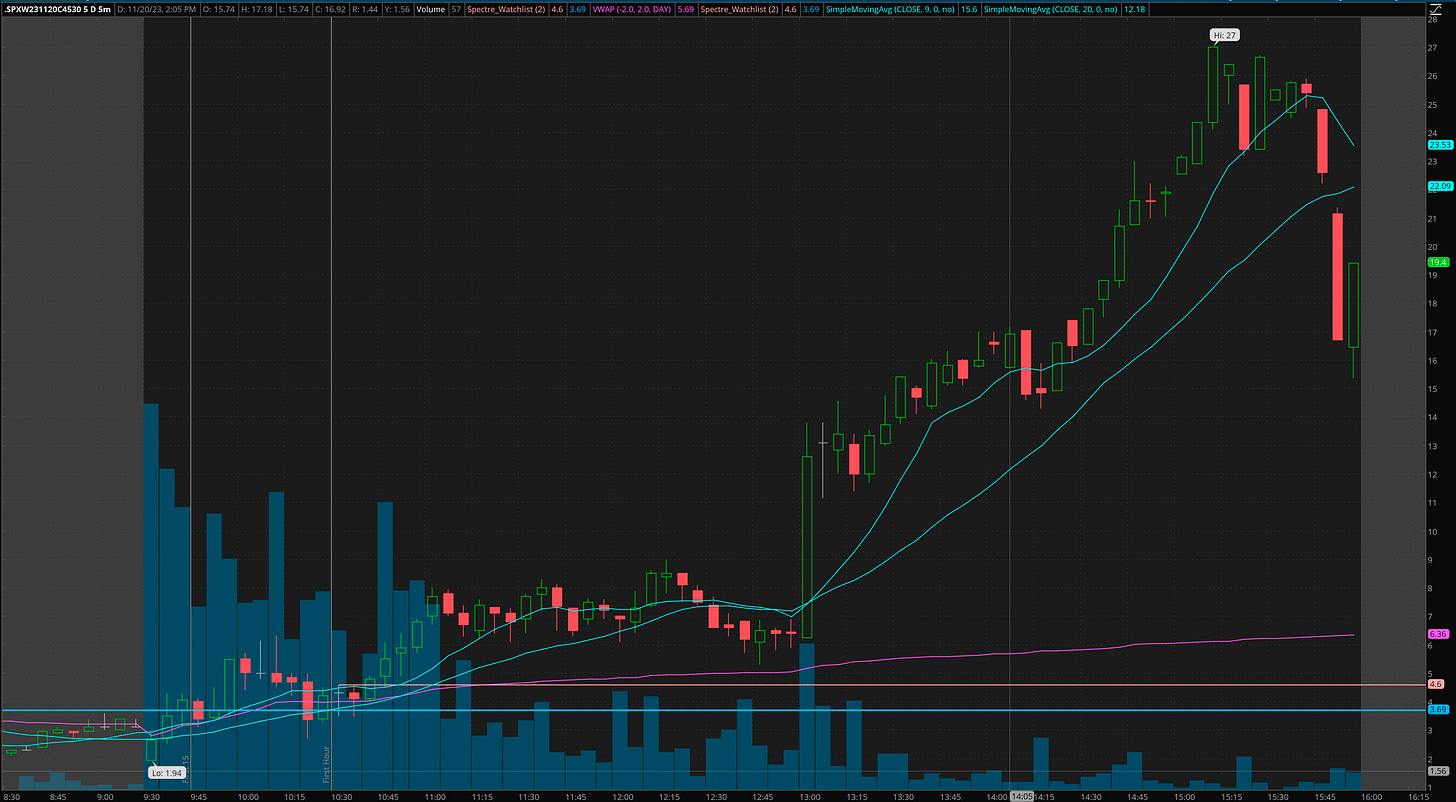

It was a nice stress free trade. I also shared a plan to scoop SPX 4530c for 2.50 when it was around $5, targeting 20+. It dipped to 2.75 and then ran to $27. (had a typo in my rush… 5430 lol.)

So after the initial move there was consolidation through lunch and then a low volume rally into the last hour. So what happened at 1pm yesterday? It was the bond auction and there was healthy buying meaning investors were not demanding higher rates.

You can see how the 10Y dropped at 1pm ET (13:00)

As market approached highs decided to get short near the close. Unfortunately I chose credit sells again that worked beautifully, but I should have taken 4550p which did 10x.

MSFT 0.00%↑

This is my major screw up on my trades yesterday. The gap fill had me convinced it was a sell the news event especially after the selling on Friday. I tried shorting twice, nailing the turn, only to have it get bought up. Unfortunately I didn’t follow the I’m wrong flip with double the size once I saw it was headed higher.

Got short on 376 rejected, luckily added just when it was about to break vwap, for a 50% gainer, but I was stubborn and stopped out for small gains. Made a short attempt a second time thinking 376 double top but that got bought up and that was it for me.

Overall congrats to MSFT 0.00%↑ on the new hires. It’s now open season on picking up staff from OpenAI.

Plan for Tuesday Nov 21

If we break 453/435.50, I’ll start watching pops for profit taking. my overall target was 455 to 456 on SPY and we got there for this leg. Continuing long feels a bit like playing press your luck and calling No Whammy. It’s better to sit tight and/or wait look for a good A+ risk/reward trade setup only.

under 453, I’m looking for 449/450 back test and if that breaks a flush into 444-445.

Given how savage this rally has been for shorts, it is still very possible we continue higher, however the risk is very elevated. I’d like some relief/pull back before more highs.

gotta run. will post on twitter.