Unlocking 50x Potential: High-Risk Bets in Venezuela’s Post-Maduro Landscape

Ideas for profiting from Trump's actions in Venezuela

The US capture of Nicolás Maduro on January 3, 2026, and President Trump’s plans to oversee Venezuela’s transition while seizing its oil reserves have ignited speculation across markets.

While energy majors like Chevron (CVX) and ExxonMobil (XOM) offer solid upside (potentially 20-50% over multi-year horizons as production ramps), the quest for 50x potential points to ultra-speculative plays. These involve extreme leverage, distressed assets, or turnaround stories where regime change could unlock massive value. Based on current dynamics, the highest-reward opportunities lie in small-cap mining stocks with expropriated Venezuelan assets—companies that could reclaim gold mines or enforce billion-dollar arbitration awards amid US influence.

Oil prices at $57/barrel temper short-term enthusiasm for energy stocks, but Venezuela’s untapped resources (including gold) could drive explosive gains for niche players. Gold futures are currently around $4,345/oz, enhancing asset valuations significantly. Expect volatility: initial market reactions on January 5, 2026, may include safe-haven flows, but successful stabilization could favor risk assets. Below, we refine ideas into 3-5 suggestions per timeframe, emphasizing mining over oil for 50x asymmetry. Each includes thesis, invalidation, entries, and targets. These are lottery-ticket bets—allocate <1% of portfolio, use stops, and monitor US policy updates.

Intra-Day Trades: Quick Scalps on Volatility Spikes

Focus on momentum from news leaks or pre-market futures. Use options for leverage, targeting 50-100% intraday if hype builds.

Rusoro Mining Ltd. (RML.V or RMLFF OTC) Calls (e.g., nearest expiry OTM at C$1.00 strike)

Thesis: Rusoro’s gold mines were nationalized in 2011; it holds a ~$1.58B USD arbitration award (with accrued interest) against Venezuela. US oversight could accelerate enforcement via Citgo proceeds or asset returns, turning this $420M USD market cap stock into a multi-bagger if mines reopen (historical reserves ~3M oz gold, valued ~$13B at current $4,345/oz).

Invalidation: If stock gaps below C$0.85 (recent support) or no positive US statements on asset restitution by session end.

Entry: Buy on open above C$0.95; dip to C$0.90.

Targets: C$1.05 (quick resistance) for 10-15% on shares/100%+ on options.

Gold Reserve Inc. (GRZ.V or GDRZF OTC) Shares

Thesis: Gold Reserve won a ~$1.1B USD award for its Brisas project (10M+ oz gold reserves, valued ~$43.5B at $4,345/oz); recent ICC win adds $29M. Regime change could enable mine revival—50x+ if operational.

Invalidation: Drop below C$2.20 amid backlash from allies like Russia/China.

Entry: C$2.30-$2.35 on early surge.

Targets: C$2.50 for 8-10% intraday.

Rusoro Shares

Thesis: As above; intra-day hype from X buzz or analyst notes could spike volume.

Invalidation: Oil below $55, signaling broader risk-off.

Entry: C$0.92 dip.

Targets: C$1.00.

Gold Reserve Calls (if available; or proxy via GLD options)

Thesis: Leveraged play on gold sentiment; Venezuela’s 161 tonnes reserves (~$22.5B at $4,345/oz) add tailwind.

Invalidation: Below C$2.00.

Entry: Above C$2.40.

Targets: C$2.60.

2-Week Holds: Capturing Initial Resolution News

Hold through early transition details (e.g., US asset recovery plans by mid-January). Buy dips post-volatility.

Rusoro Shares or February Calls

Thesis: Settlement could yield C$1.52/share near-term; full award implies C$3.40/share. US control accelerates.

Invalidation: No progress on Citgo auction or claims by January 15; below C$0.80.

Entry: Dip to C$0.88-$0.90.

Targets: C$1.20 (30% upside).

Gold Reserve Shares

Thesis: $1.1B award enforcement in Portugal; potential mine restart adds 10x+.

Invalidation: Below C$2.10 if transition stalls.

Entry: C$2.25 pullback.

Targets: C$3.00.

Rusoro Calls

Thesis: Buzz from creditor meetings.

Invalidation: Gold below $4,200/oz.

Entry: C$0.90.

Targets: C$1.10.

Gold Reserve February Calls

Thesis: Recent 131% rally extends on news.

Invalidation: Below C$2.00.

Entry: C$2.30.

Targets: C$2.80.

Long-Term Multi-Year Positioning: The 50x Lottery Tickets

Buy deep dips if unrest lingers, positioning for production revival (3-5 years). These could 50x if mines resume at scale, but risk total loss if claims fail.

Rusoro Shares (Core Holding)

Thesis: Full asset recovery + mining ops could value at $20B+ (3M oz reserves at $4,345/oz imply ~$13B base; ops add premium); from $420M cap, 50x potential.

Invalidation: US withdrawal or re-nationalization (below C$0.50).

Entry: C$0.75-$0.80 dip.

Targets: C$5.00-$10.00 (5-10x initial; 50x long-term).

Gold Reserve Shares

Thesis: Brisas (10M oz) revival under US-friendly regime; $1.1B award is floor, ops add exponential upside (~$43.5B resource value).

Invalidation: Failed enforcement by 2028 (below C$1.50).

Entry: C$2.00 dip.

Targets: C$10.00-$20.00 (5-10x; 50x if full scale).

Rusoro Long-Dated Calls (if LEAPs available)

Thesis: Leveraged to gold boom + Venezuela recovery.

Invalidation: Below C$0.60.

Entry: C$0.85.

Targets: C$15.00+ multi-year.

Gold Reserve Shares

Thesis: Diversified claims ($29M recent win); gold exposure amplifies.

Invalidation: Below C$1.80.

Entry: C$1.90.

Targets: C$25.00+.

Proxy: Physical Gold ETF (GLD) Shares

Thesis: Safer play on Venezuela’s gold reserves unlocking; less direct but 2-5x if prices double.

Invalidation: Below $400 (adjusted for current levels).

Entry: $410 dip.

Targets: $500-$600.

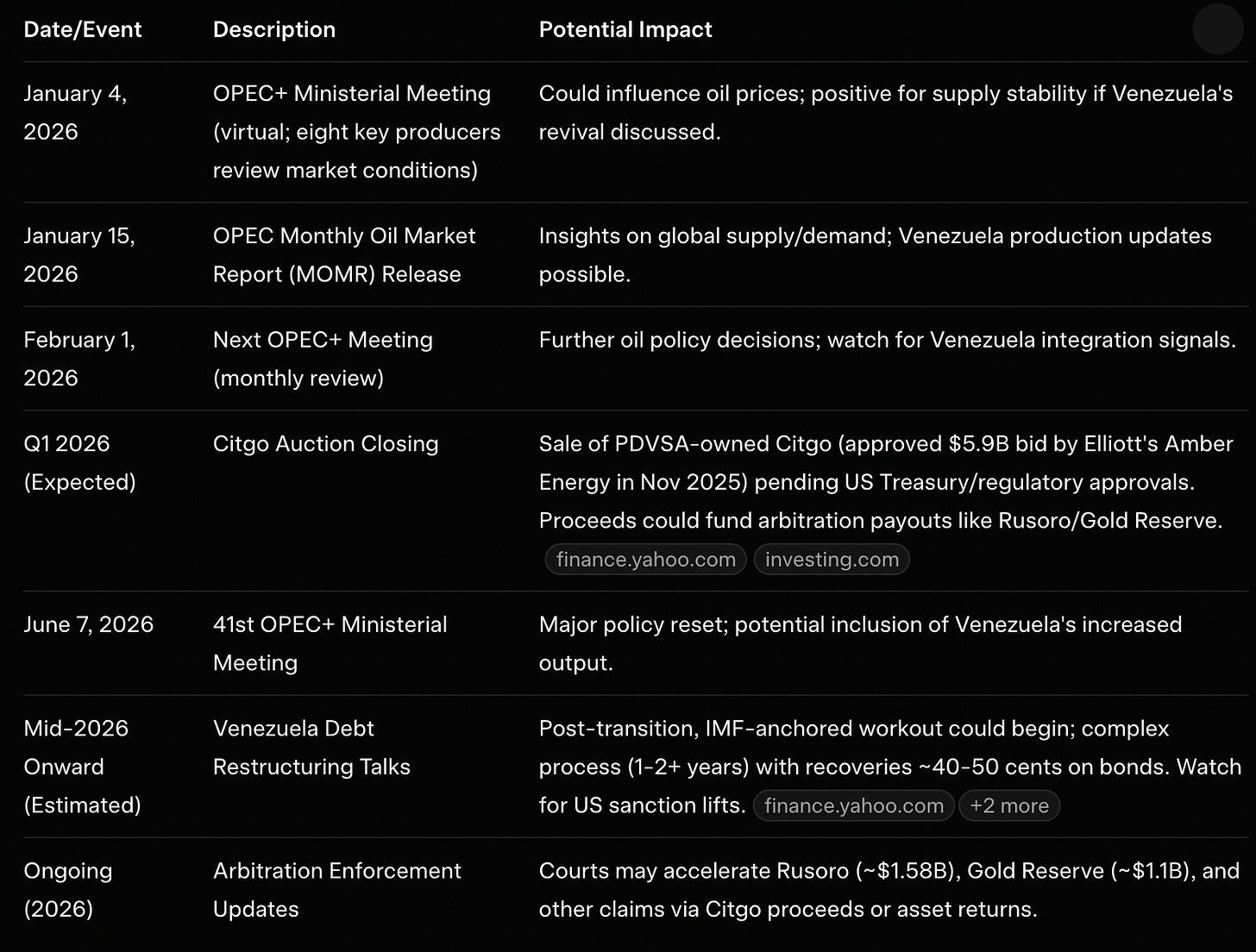

Calendar of Major Events: Key Dates for Investors

Investors should monitor these milestones, as they could trigger volatility in related assets. Dates are based on recent announcements and estimates; events may shift.

Bonus: Venezuela Bonds Revisited

Distressed USD bonds (e.g., PDVSA 5.375% 2027 at ~14-20 cents, sovereign 11.75% 2026 at ~31 cents) offer 3-5x if restructured to 40-50 cents under US-backed IMF deal. Cheapest issues could hit 4x, but not 50x without par recovery (unlikely). Thesis: Fast restructuring yields 100-300% in 1-2 years. Invalidation: Delays beyond 2027. Entry: 15-25 cents via funds. Targets: 50-70 cents.

Disclaimer: These are speculative, illiquid plays with geopolitical risks. Not advice; consult pros. Monitor Citgo auction and Trump updates for triggers.