$TSLA and $NFLX Reported and Market reaction. Introducing the Incredible Scanner. Does the week end on a red or green day?

PLUS: A How To find great trades in this market without getting chopped.

Yesterday gave us the flush a day earlier than I expected. I was expecting a bit more of a push before a dump came so for the most part stayed out of SPX. I look for certain patterns that consistently pay. In the last 2 days, the amount of chop we have had has been insane. And was too slow to enter, out of fear of getting chopped. Guess what — That is totally OK. It is better to stay out, than to get in and get chopped up.

Thursday Market Price action

I haven’t seen a chart with so many traps. It took a lot of discipline to recognize the trap and for the most part stay out.

The scanner was on fire finding plays during Powell’s speech, catch the peaks and the lows, but I chose to stay out this time and stay focused on TSLA 0.00%↑ short.

When uncertain make it ok to stay out and given the velocity of the turns that were happening, I was too slow to take advantage. By recognizing that I don’t like the risk reward at the lows to join short, I avoided the traps and the same for when we were at the highs. I didn’t want to get into trades until after Powell’s speech was done and sure enough going short after 1pm would have been ok.

Trade Reviews

I stayed hyper focused on trades that looked like no brainers and used Edge’s Scanner to help support me. I recently made improvements to the algo and it is on fire!

AAPL 0.00%↑

I saw the alert above, and knowing the scanner often picks up trades before the big moves happen, I checked and saw the contracts at 0.25… That was a no brainer for me for 2 reasons. 1, Its a discount to their entry and 2 I had made a plan earlier this week that if AAPL 175p come down to 0.25 I want in because if market yanks we could see 173 or less. So I then made a plan to sell 50% at 0.75. And sure enough we got the triple quickly, made profit and have a free trade if we flush into Friday.

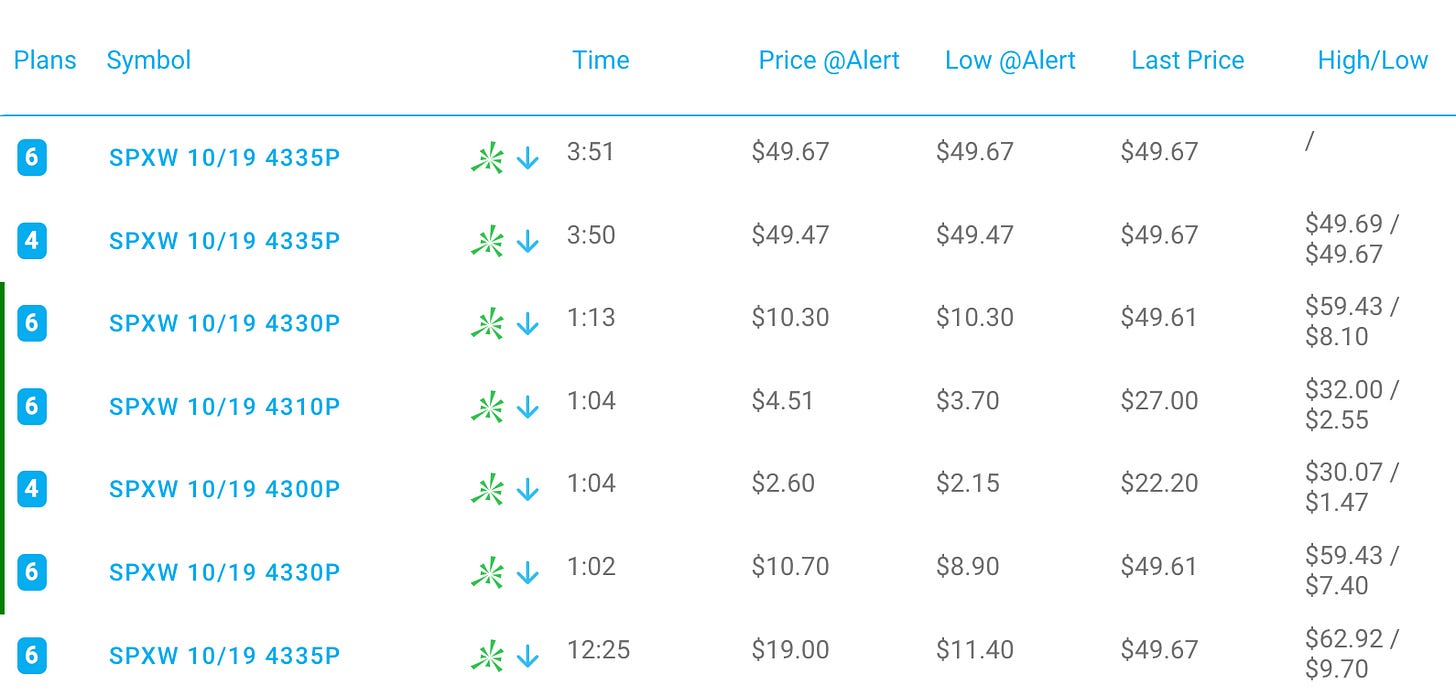

$SPX

I saw this, but entered with a chase at $3 on 4300p with a 50% stop. Unfortunately it literally ticked me out at the lows and then proceeded to run to $30. Sometimes that is going to happen. So what could I have done better? Used smaller size and an order to add at $2 and risked 100% for $20+ target.

So even though I lost on this specific trade, I’m super excited because the scanner is finding great trade opportunities. There will soon be a plan button next to the alert so I can generate trade plans that should avoid the chase entry and getting stopped.

TSLA 0.00%↑

After their report, TSLA wasn’t catching a big even with some rally in many names in the morning. That is a big clue to have conviction for all day selling.

This play was gorgeous. We took 220 and 215 puts above vwap, at the vwap test. Also again after 1pm seeing the magic peach line getting rejected. These trades gave over 5R and will possibly be 10X+ on Friday.

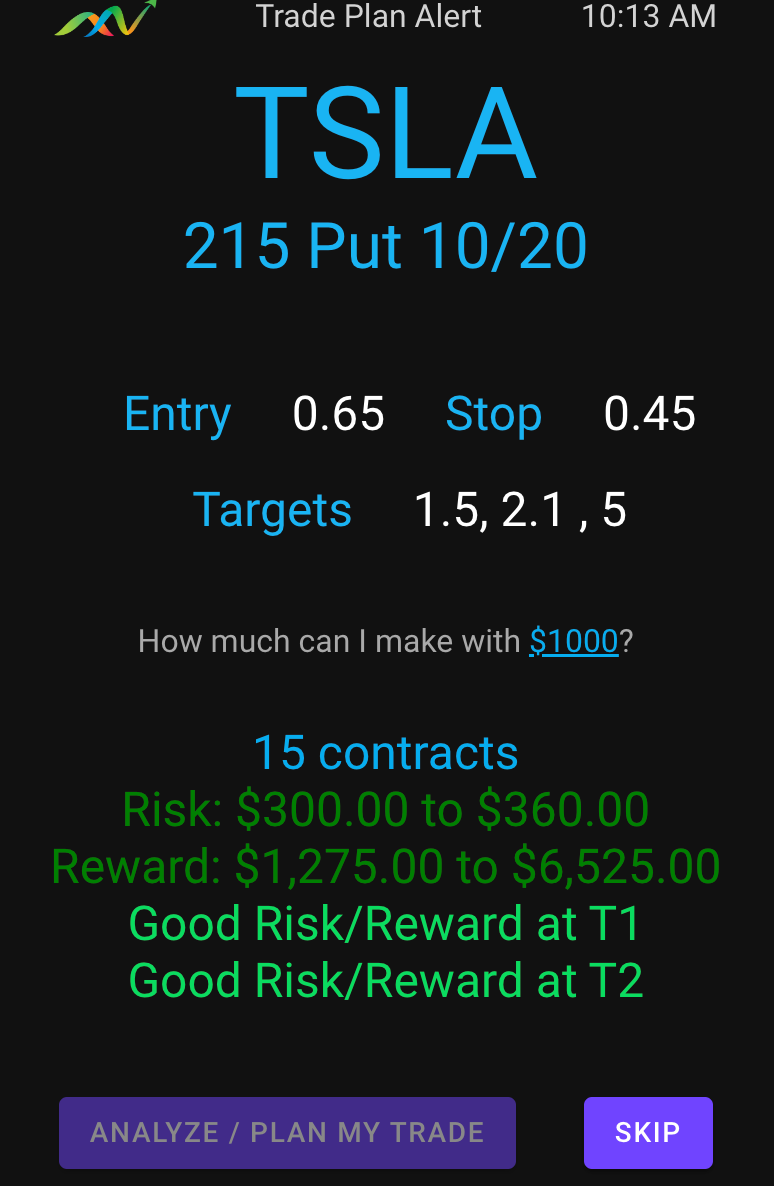

I made a plan yesterday after see the scanner alert that supported my overall thesis.

But I tweaked the play and chose the 215p. Here is the plan I shared with members yesterday.

How did it do? Both targets were met by end of day. This was a high conviction trade for an all day seller Plus potential for a bonus payout of 5+ on Friday.

Overall Great Day, and the scanner combined with the trader planner are turning into a killer combo to support the the trade ideas I have.

I tried a small short near 403 that was in the money but got stopped out when it got back near entry. totally ok. I want to get short at the open but missed the entry and contracts were way to juiced compared to the reward. One of the great things I’ve noticed is I’ve been adapting from want to catch every predicted move, to predicted moves with incredible yield vs the risk only. so If the contracts are priced so tp the odds in my favor, skip it!

What am I expecting on Friday?

After Powell’s speech and seeing the 10Y yields near 5%, I don’t see the pressure on stocks letting up.

Ideally we get a relief bounce back test 427 on SPY, break 424.80 and drop down to 420 to 422.

There is an elevated risk the market makers pin us today, but if they don’t we could see as low 418-420 by end of day.

Overall I’ll be patient today for any exhaustion on rallies, to get short and I’ll be paying attention to the scanner.

Introducing the scanner in Edge

I coded up an algo that looks for certain factor and generates a number of alerts. I chose to have it give me more info than less. Yesterday there were over 175 alerts. However you can use the filters in Edge to focus in on just the stocks you want to trade which brings the criteria down even further. I was bearish so I filtered for puts only.

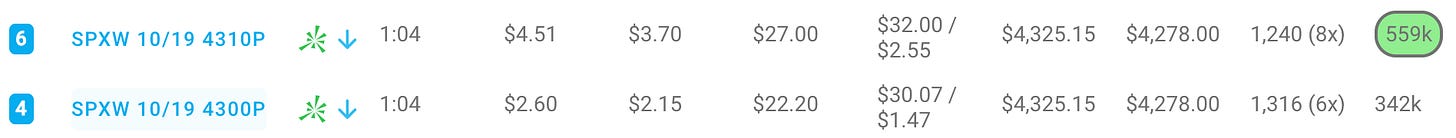

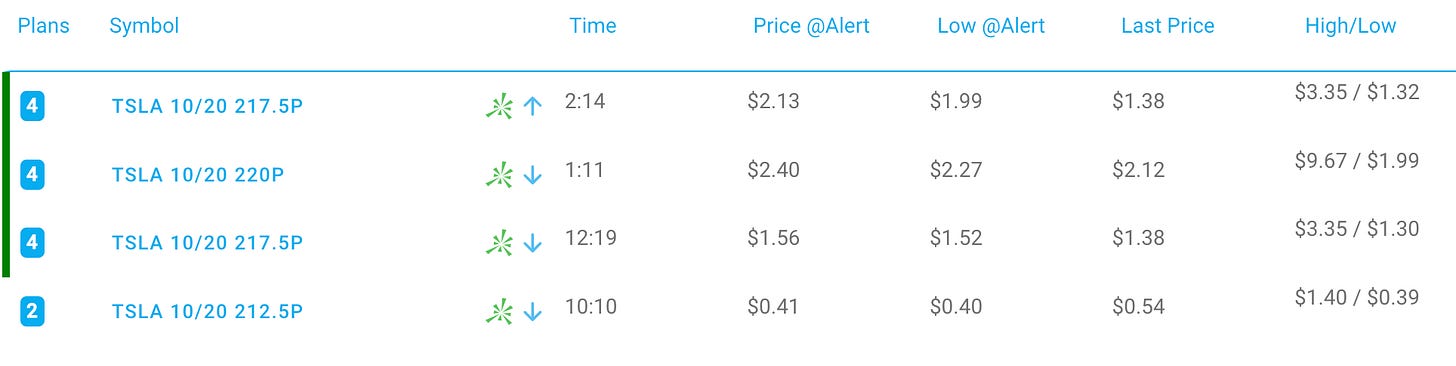

For TSLA this is what it found

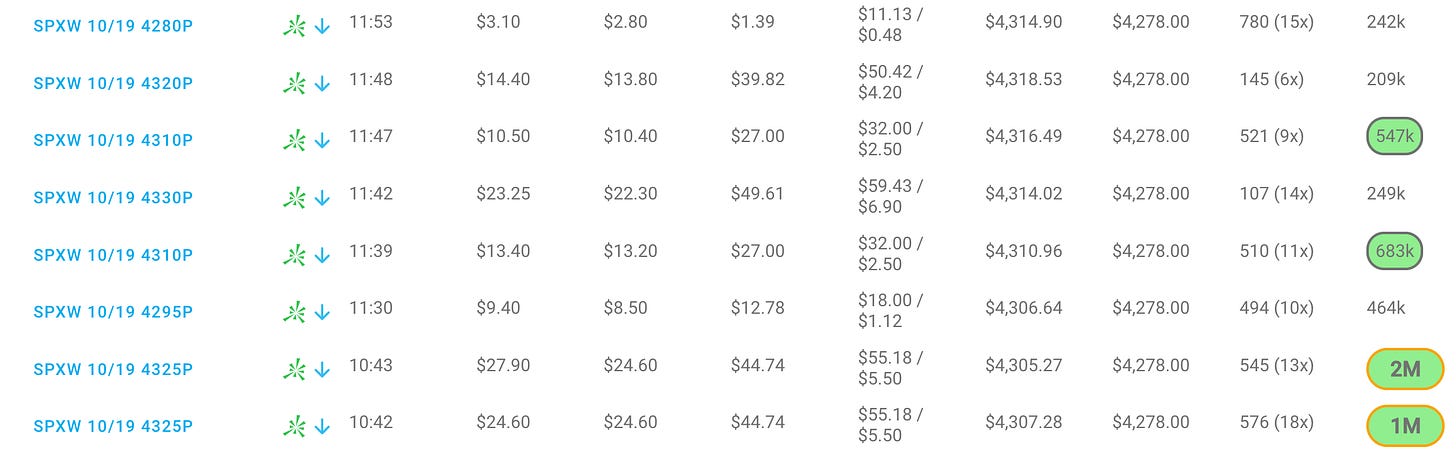

For SPX, there were many, but if you focus on after lunch (1pm), only 4 (ignore the alerts near the close)

And here are the morning alerts. The volatility from the morning discount was huge, but you can see there were big bets after the first hour for down side! This helps me gauge the “mood” and then plan trades.

The scanner is having an incredible win rate! I personally created additional rules that yesterday would have limited the trade plans on SPX down to less than 4 with a 5x or better win rate of 75%. I will be testing these rules over the next week and publishing the alerts.

The theme for today

I get to turn $2000 into $10k to 20k today or lose $1000 in the attempt.