Trade Ideas for Tue Feb 10 - Will the rally continue?

Master class yesterday in 2 hour trading!

I was on fire yesterday!!!

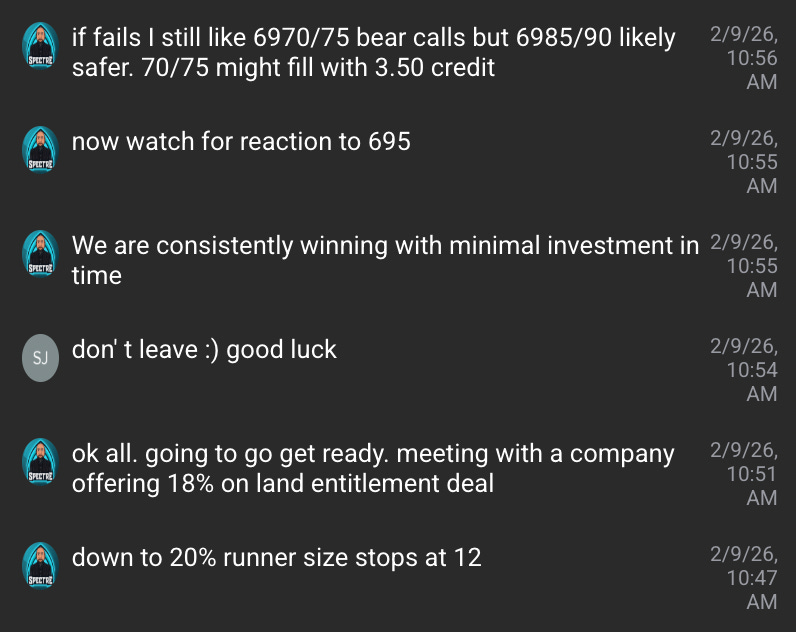

I alerted I expected the rally upside but also exactly where the pull back would be and which bear calls to take and at what price. All before 10:30am/11am.

I told THT Pro members as long as pre market low holds, upside bias targeting 695.

This meant that SPX 6950c should reach 22-27 and that I want to buy for $4-5 and scooped for 4.80. These reached $30 by end of day! I sold most most for 8-12 for over 100% gain. good enough, the rest was bonus.

This plan also allowed us do bull puts for the upside grind. Both won!

Finally check this comment out..

Between 2-3pm the bear calls I wanted reached 3.50-3.95 and by end of day wiped out. that is $3500 premium collected with less than $500 draw down in under 2 hours!

Best part I didn’t even have to watch the charts. My math and planning did the heavy lifting!

Here is a FREE Lesson on why I went back short after getting stopped on my runners earlier this week.

Process = Profits

Lately I’ve been doing the following:

Premarket establish where we likely wont reach. Sell premium for 0.8-0.60 on open.

After 11: second positioning of credit sells.

After 3:30: start hawking/planning for a Spectre Special

What’s a Spectre Special? A yolo trade that goes 300-1000% in under 30 min.

FREE LESSON on catching eod exhaustion

If you are tired of overtrading, not knowing how to plan trades, and want to make more in less time, come join us.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

SPY Pivot Trap: Survive the Breakout Fakeout

Premarket holding steady at 694.34 amid choppy range action

Market Context

SPY premarket closed at 694.34, sitting between pivot at 692.8 and resistance at 697.61 after a volatile 5-day range from 670.92 to 697.64. Recent sessions showed multiple failed breakdowns below 689.74 with quick reversals on volume spikes, suggesting bullish bias above pivot but risk of trap below 692.8. Overall range-bound with potential for failed breakout above PMH 695.66.

Key Events Today

No major events scheduled today, potentially leading to range-bound action.