Trade Ideas for Thu Feb 12

Solid trading yesterday morning. Choppy grind recovery. What will today bring?

What a drop yesterday! We were paid and done in 40-50 minutes!

The high probability trade yesterday was the textbook trade setup I teach. Two leve gap up reversal. And we traversed and filled the gap!

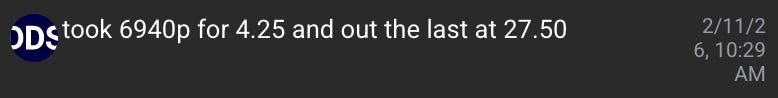

We took multiple bear calls and naked puts. Member DDS nailed a 600% trade

After that it was mission accomplished! Guys one of the issues I had for a long time was overtrading. Trying to milk profits out of every move, every hour of the day. It was stressful. New process is incredibly less stress, more peace of mind, AND freedom in time!

If that is the style of trading you want… 1-2 hours a day, consistent extraction of profits from the market, I encourage you to trade and learn with us.

Here is a FREE Lesson on why I went back short after getting stopped on my runners earlier this week.

Process = Profits

Lately I’ve been doing the following:

Premarket establish where we likely wont reach. Sell premium for 0.8-0.60 on open.

After 11: second positioning of credit sells.

After 3:30: start hawking/planning for a Spectre Special

What’s a Spectre Special? A yolo trade that goes 300-1000% in under 30 min.

FREE LESSON on catching eod exhaustion

If you are tired of overtrading, not knowing how to plan trades, and want to make more in less time, come join us.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

SPY Pivot Trap: Survive the Breakout Fakeout

Premarket at 694.69 eyes failed breakdown below 693.54 pivot for quick reversal gains

Market Context

SPY premarket closed at 694.69, sitting just above the 693.54 pivot after ranging between 693.48 low and 695.45 high. Over the last 5 days, price action shows repeated failed breakdowns below key supports like 693 with quick reversals on volume spikes, and failed breakouts above 697 on low volume. Bias leans range-bound with downside risk if 693.54 breaks, but strong support history suggests reversal potential.

Key Events Today

8:30 am - Initial jobless claims (Period: Feb. 7) - Forecast: 225,000 | Previous: 231,000

10:00 am - Existing home sales (Period: Jan.) - Forecast: 4.15 million | Previous: 4.35 million

7:05 pm - Fed governor Stephen Miran speaks