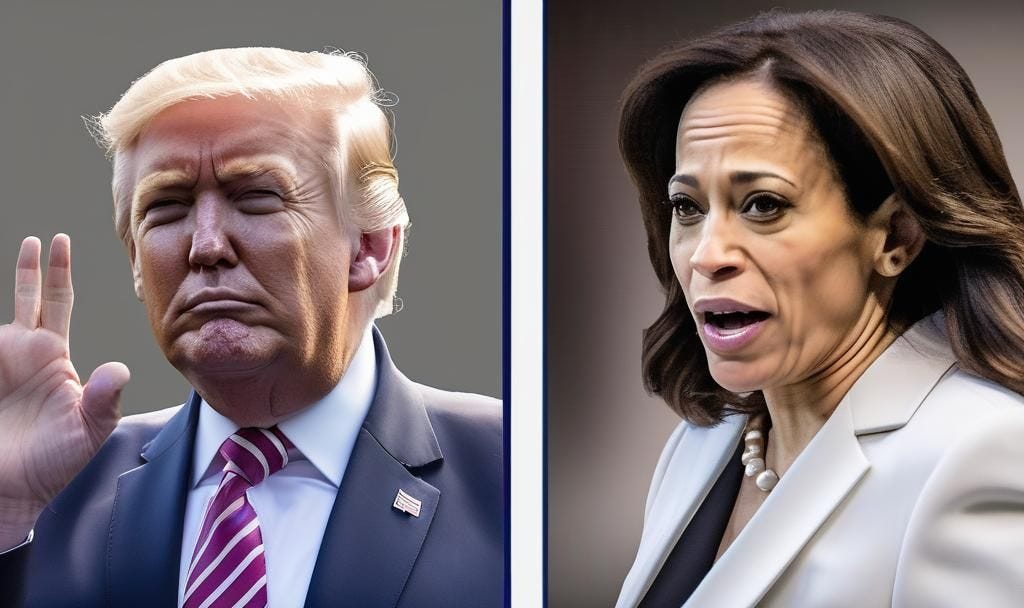

The Countdown to Market Mayhem: The Next Big Trade is Coming with Election & Fed Decision!

Prepare for 10-20x Potential Gains as Markets Brace for Impact

With election day just around the corner and a critical Fed meeting in the same week, we’re looking at a storm of factors that could rock the markets — and set up the next big trade. This week is shaping up to be a defining moment for 2024’s market trajectory. Let’s dive into what you need to know to catch the wave and, ideally, not get swept under it.

Key Events That Will Drive This Week’s Market Action

Election Day – Nov 5

Markets don’t care much about who wins, but they do care about closure. A quick, decisive result? Great. An extended battle over the outcome? Not so much. If there’s conflict over results, expect a hard sell-off. Markets crave stability, so any unresolved tension could set the stage for a rough November.Federal Reserve Meeting – Rate Decision on Thursday

The Fed’s decision this week could be the tipping point. If they cut rates and keep their tone supportive of economic growth, we may be in for a rally. But if the Fed isn’t accommodating, prepare for a sell-off that could rival election volatility. Keep an eye on PMI and ISM numbers too; they’ve been flashing warning signs that may force the Fed’s hand.Other Market Movers – Global Rate Decisions and China CPI

The Bank of England and Australia’s rate decisions, as well as China’s CPI data, could inject additional uncertainty. These will likely play second fiddle to the U.S. election and Fed meeting but don’t ignore them. If global economies start showing more strain, we could see increased pressure on U.S. markets. So for the news seems underwhelming for china stocks.

Goldman’s recent commentary:

They are suggesting limited upside after elections in stock markt

Goldman Sachs mentioned that the options market is implying a +/- 2.1% move in the S&P 500 on election day. This range of expectation underscores the high volatility potential, especially with so much riding on a smooth election outcome.

A 2% move should open the opportunity for a 50-100x trade. so if I can catch a 10-20x trade as part o the overall move, I’ll be pretty happy

Process for Trading This Market

With all this volatility, sticking to a process is essential. Here’s how I’ll be approaching the week:

High-Volume Red Days

When we see a major red day, I’ll be looking to buy inexpensive, short-term options (“YOLO” trades) and hold them for 1-2 days. If I see 200-300% gains, I’ll lock in 30% and let the rest ride.

Sustained Sell-Offs

If we get two big red days back-to-back with a significant breakdown in price, I’ll look for a back test of previous support. I’ll position for another leg down if recent lows break. For this setup, I aim to lock in 50% gains in the 200-500% range.

Why Intraday Trading Works for Me (And Could Work for You)

Around 95% of my trades are intraday or same-day, but I’ll make exceptions when the setup is right. High-volume dips into lows are when I’m most likely to swing for a day or two. These trades are calculated, giving me the opportunity to cash in on quick moves without holding through unnecessary risk.

Potential Overnight Swing Setups

For those who prefer overnight plays, here’s what I’m watching:

Look for high-volume days that signal extreme fear — these can be ideal for buying a short-term dip and holding into a bounce.

Be patient for red days that push the market into oversold conditions. Those are the times when swing setups have the highest success rate.

Bottom Line: This Week Could Set the Tone for the Rest of 2024

Regardless of who wins the election or what the Fed decides, the market’s direction will become clearer in the days to follow. The potential for major moves (10-20x in the right setups) is in play, so stay sharp and stay disciplined.

Are you ready to catch these moves? Join us in The Two Hour Trading Pro community where we navigate volatility with focus and precision.

Exciting Times!!