"Tech stocks tumble as markets turn red: Is it time to buy or sell?" We got 2 trades with 10R+ gains. My game plan for Thu Oct 26

SPY rejects 200dma, QQQs head lower, MSFT holds gains, META follows GOOGL lower after ER.

Monster plays yesterday. Even after the morning debacle by CBOE. Basically that issue wiped out the gains I made on shorting MSFT out of the gate.

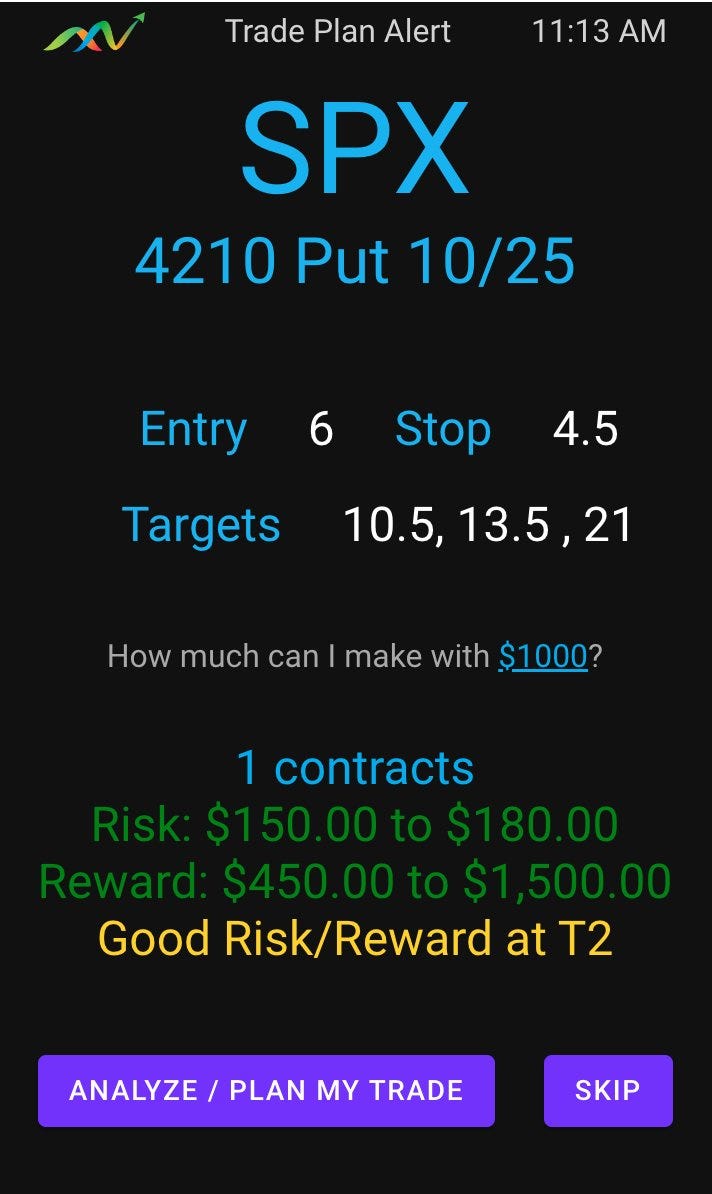

You let it pass. I didn’t let that derail me from getting paid later. I was definitely hawking longs for a gap fill especially when news of delay on invasion by Israel delayed, but the reaction was muted and experience taught me what it should have looked like if there were bulls in the market. 10minutes later I planned a short using Edge Trade Planner. I was considering 4200p and it suggest 4210p.

Plan worked out perfectly. the puts got to 29, but I just cared if it met my plan and got 21. so 21-6= 15. 15/1.50(risk) = 10R!!!!!

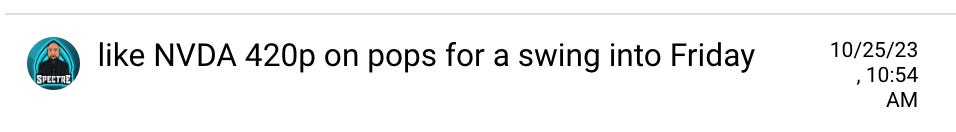

I had mentioned this week how 435-440 was my short zone for NVDA and so the price action in the morning showed a rejection of 435.

So came up with this plan and I like to give a heads up of my thoughts in chat.

At $7 this is 10R trade. Contract prices hit $8+

The best part…. got positioned around 11-11:30 and I walked away to spend time with family with take profit orders set.

SPY 0.00%↑ Price action

Overall we rejected 200d ma, and 418.50 key support broke. We flushed after hours, and are started pushing in premarket after jobs data.

My Game Plan for Thur Oct 26

Stay nimble. I’m worried about a violent short squeeze, but will continue to look for pops/back tests of previous support to get short. unless 420 is quickly relaimed, I think we hard headed to 390-400 into end of November.

My attention will be on