Super SPY makes record high! But can it keep going? My plan for Monday Feb 5

500% in under 2 hours again! Is this normal?

What's next?

On Friday morning I wrote about bears getting squeezed and that I wanted to see a gap fill and push on SPY to 495+ by the close.

Friday’s job growth numbers filled the gap for us in premarket. During the first hour, SPY charged up and broke morning highs after the first hour and broke premarket highs after the second hour running to 495+!

SPY 495 lines up with my model and timing I’ve been talking about since the December breakout and that I wanted 495 to start hawking for a short in February.

So does SPY keep flying or is it time for a reversal? Read on…

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to my THT PRO and ELITE members. (I will open up new memberships in mid Feb)

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Feb02 - AMD 180c. Entry 0.15 - High after $1 ($1500 —> $10000 potential)

Jan 29 - SPX 5910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22k potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

Friday’s Price Action (Education)

AMD - morning action

All week I had a bug up my but that AMD should be 180+ to match the rally in NVDA and SMCI.

I had wrote I wanted AMD 175c for 0.50. it dipped to 0.60 and started turning and I jumped in but I also though man, if I get my 182 turned, that’s 2 bucks and it is currently 0.30, but I think any dip can get us a fill at 0.15 and 2 minutes later it came.

At this point I automatically know I need to set sell orders at 0.60 and 0.90 to exit 80%. What about the $2?!? As a trader being process driven is everything, and my goal isn’t to be right, but to extract profit from the market. Anytime I can collect 300-500% gains I will lock in and leave runners. The only time this changes is if I’ve collected 300-500% on leg 1 and I can reload for leg 2 and I using profit from the left 1 trade to let trade 2 be free do or die trade. Even then I will take 50% off at 300-500% gains to protect my original capital and secure some profit.

Here is the chart for the 180c. we got 500% gains in 30minutes! and I was mentally mostly done for the day.

After the initial push, I decide to wait and see if vwap holds after the first hour. It didn’t, and so I waited to see if the contracts would come back to support. and give a failed breakdown reversal. This time I focused on 175c instead of 180c since it was Friday and the pull back was much more than I wanted. Sure enough we dipped right to my entry target. (and yes my typing is crap)

Here is the the chart for the 175c. I tried to fill at 0.75 but ended up starting in at 0.90 and adding at 1.20 when idea was confirmed. These hit $4 by end of day.

Overall this was my 2 hour trading system. We planned and positioned and set take profit orders. so if 0.90 and stops at 0.40, where do we sell? That’s right. $2.40 and $3.40. for and leave runners for if w get 182 into close while raising stops to $2.40.

SPY/SPX

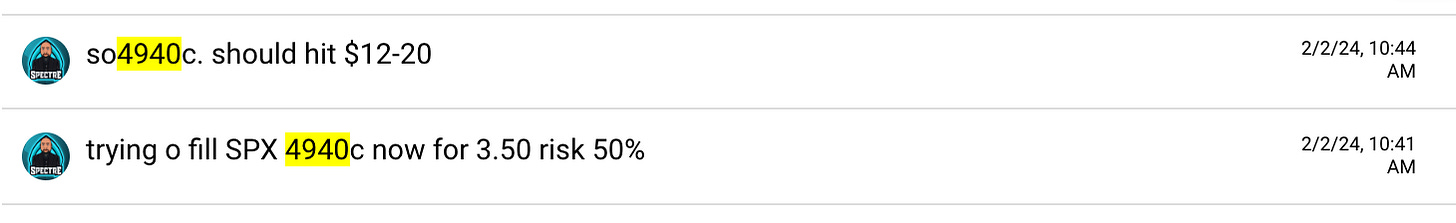

Once I saw SPY/SPX about to breakout and run i alerted I was trying to fill and the minimum targets for 4940 was $12-20 for the first push and looking at my SPX levels $25 would be next target.

Unfortunately we weren’t getting the dip into 3.50 and so I had to grab into around 5.5-6 once support on contracts got established. This is where risk/reward comes in. if $12-20 can come an I can get for $6 risking $3. That leaves me $6-14 of profit or a 2-7 result, with high probability of win given the short squeeze. So we set sell order at $15 and 20 and both hit. before a fast yank back to 8-9 trapping more bears and then squeezing to 35.

One of my whale traders called me to go short based on that afternoon yank. But I was emphatically HELL NO I’m not shorting that. I think its a trap and I scooped for $10 while on the call with sell targets of 18 and 30. (18 because that would be a lower high if I was wrong about the upside continuation)

Solid day. Spent maybe 3 hours looking at screens letting me grow account over 38%. Why? the bear trap let me go long with bigger size for the squeeze.

Summary Review of Market Price Action

Perfect follow through day of the short squeeze pushing us into 495+ target on SPY.

Every dip was bought, and the early bears who piled on ket getting squeezed. I didn’t doubt bears jumped in on that dump at 12:45pm. Trust me I was thinking about it, but we were too close to that 495 and it was too good an opportunity not squeeze bears one more time!

Bottom line. If you look back, every dip in market has been bought since December. Bears keep trying to be first in on the reversal short and keep getting crushed.

Everything past 495, was overbought conditions near term and we got profit taking into the close as one can expect after an all day run.

Educational Lessons

From the price action review you should have learned the following:

Take profits systematically

GO BIGGER when bears get trapped

You can still make 300%-500% gains being wrong on targets!

Even if you don’t get the ideal entry you want, if your targets are right, be ok paying more as long as the risk/reward still is at least 3R (gain $3 for $1 risked)

Trade Ideas - Plan for Monday Feb 5

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Can SPY keep going? Let’s got over the ideas for today…