Successful traders create their "Luck"!

A Guide to How I Create My Own Luck in Trading

Is It Luck, or Is It Preparation?

Ever watch an elite athlete pull off an unbelievable play and think, man, that was lucky!? Maybe it was a last-second shot, an impossible catch, or a perfect golf swing under pressure. But here’s the thing—was it really luck?

The best athletes don’t just stumble into greatness. They spend years training, refining their skills, and preparing for those exact moments. When the opportunity presents itself, they execute.

Trading is no different. The best traders don’t rely on luck; they create it.

How I Create My Own Luck in Trading

Just like a top athlete, a trader’s success comes down to preparation, discipline, and execution. Here’s how I’ve built a system that puts me in the best position to “get lucky” in the markets.

1. The Playbook – Knowing My Winning Strategies

Athletes don’t just wing it—they have a playbook of proven moves they practice relentlessly. In trading, my playbook is a collection of high-probability setups I’ve studied, tested, and refined.

🔹 I only trade setups that have an edge.

🔹 I know exactly when to enter, where to take profit, and when to cut losses.

🔹 I track and review my plays to improve execution over time.

When the market presents me with one of these setups, I don’t hesitate—I attack it with confidence.

2. The Film Room – Reviewing Every Trade

The best athletes watch film to study their performance. They analyze mistakes, adjust their technique, and look for ways to improve.

I do the same with my trading.

🔹 I review my trades daily, looking at what worked and what didn’t.

🔹 I study the best setups to recognize them faster in real time.

🔹 I adjust my approach based on data, not emotion.

Every trade I take, win or lose, is a lesson that makes me better.

3. The Warm-Up – Prepping for Every Trading Day

No elite athlete jumps into a game cold. They stretch, warm up, and mentally prepare. Before the market opens, I do the same.

🔹 I scan for the best setups.

🔹 I define my risk for the day.

🔹 I set alerts so I’m ready to strike when opportunity knocks.

🔹 Visualization – I spend 15-20 minutes reviewing my playbooks and the stocks I’m watching that day, imagining how the plays may set up and me executing the trades. I visualize everything—from entry, to planning with Edge, to setting bracket orders, and letting it play out to either success or me cutting it because it isn’t doing what I expect.

By the time the opening bell rings, I’m not reacting—I’m executing a plan.

4. The Mental Game – Controlling Emotions Under Pressure

Great athletes don’t let pressure shake them. They stay focused, trust their training, and execute when it matters most.

Trading is one of the most mentally demanding games in the world. If you can’t control your emotions, the market will punish you.

🔹 I follow strict risk management—no YOLO trades, no revenge trading.

🔹 I train myself to stay disciplined, even when a trade is going against me.

🔹 I stay in the zone by focusing on my process, not just my P&L.

Luck in trading isn’t about randomly hitting a big winner—it’s about sticking to a process that consistently puts you in high-probability situations.

SCROLL DOWN TO BOTTOM TO READ ABOUT 2 REAL LIFE EXAMPLES

The Tool That Helps Me Stay “Lucky” – Edge Trade Planner

Speaking of systems, Edge Trade Planner is the tool I personally built to support my trading process. My goal? To spend just 2 hours a week trading, with everything running on autopilot. It’s not there yet, but working on it. For now 2-3 hours each day is more than enough.

With Edge Trade Planner, I’ve designed a system that helps identify the best opportunities, automate the planning, and track performance—all with minimal effort on my part.

Here’s what it does:

✅ Option Scanner – Spots patterns in option flow to see where big money is moving.

✅ Playbook Scanner – Generates trade ideas based on my personal playbook of high-probability setups.

✅ Level-Based Ideas – Helps me and other traders focus on key price levels for reactions.

✅ Real-Time Chat – A space for experienced traders to share ideas and execute together.

If you want to create your own luck in trading, come be a part of this journey. Join the exclusive THT community and get early access to the tools that are helping me automate success.

👉 Join THT PRO today and start making your own luck.

Final Thoughts: Do You Create Your Own Luck?

The best athletes don’t hope for a lucky break—they train, prepare, and execute so that when the moment comes, they’re ready.

It’s the same in trading. The market isn’t going to give you money. You have to be prepared, disciplined, and ready to attack when the opportunity presents itself.

So, ask yourself:

🔥 Are you setting yourself up to “get lucky” in trading?

🔥 Or are you hoping the market hands you easy money?

Successful traders make their own luck. Now it’s your turn. 🚀

Want two real life examples?

Intraday Trade in SPX

On Feb 13, I planned a spectacular trade using my levels in SPX. My thesis: SPX 6115 by end of day.

Here is the action in SPY.

Key factors:

Failed break down reversal from Wednesday continuation

I expected a faker dip

Here is how I “created” my luck. I fully expected a faker dip was coming based on the price action. Practice and experience. Let me alert and target SPX 6100c for 0.80 while it had been basing at 2-2.50 for 90minutes. I also set the sell orders in advance often selling into the spikes (edge generated targets often happen to correlate)

Why sell any if going to $15. Nothing is guaranteed and with complete loss possible off a Trump tweet, on 0DTE I must take profit systematically. Besides, it’s not like I never find these trades. So my philosophy is focus on constant gains.

This trade was over 1500% on the last sells. Is this luck? Or is it preparation?

Swing Trade in AAPL

In the beginning of February I saw the following price action in AAPL.

Key factors:

I saw, 220 got bought.

We had a recent big gap up

We were testing the oversold support from previous week.

If support held there I gave it:

95% probability of 235-238 coming

80% probability of 240+

Monday morningI looked at the 235c options chart. with an 80-90% probability of $3-5 payout and seeing that we were around 0.70c at the close on Friday. I said, if I can scoop anywhere under $0.50 I like it. From past experience, I have had great results when I scoop for 0.30-0.50. So I alerted members my intention to scoop at 0.35. (I was happy to buy anywhere under 0.50). If my thesis was right a payout was coming.

Here is how I created my luck:

Did I monitor the options all day ? NO. I placed the order in advance. I had a plan.

Here is how I broke my luck. I didn’t follow the process fully:

I didn’t visualize how the trade would play out

I didn’t visualize the execution

So what happened? I DID follow the process for reviewing and journaling this trade.

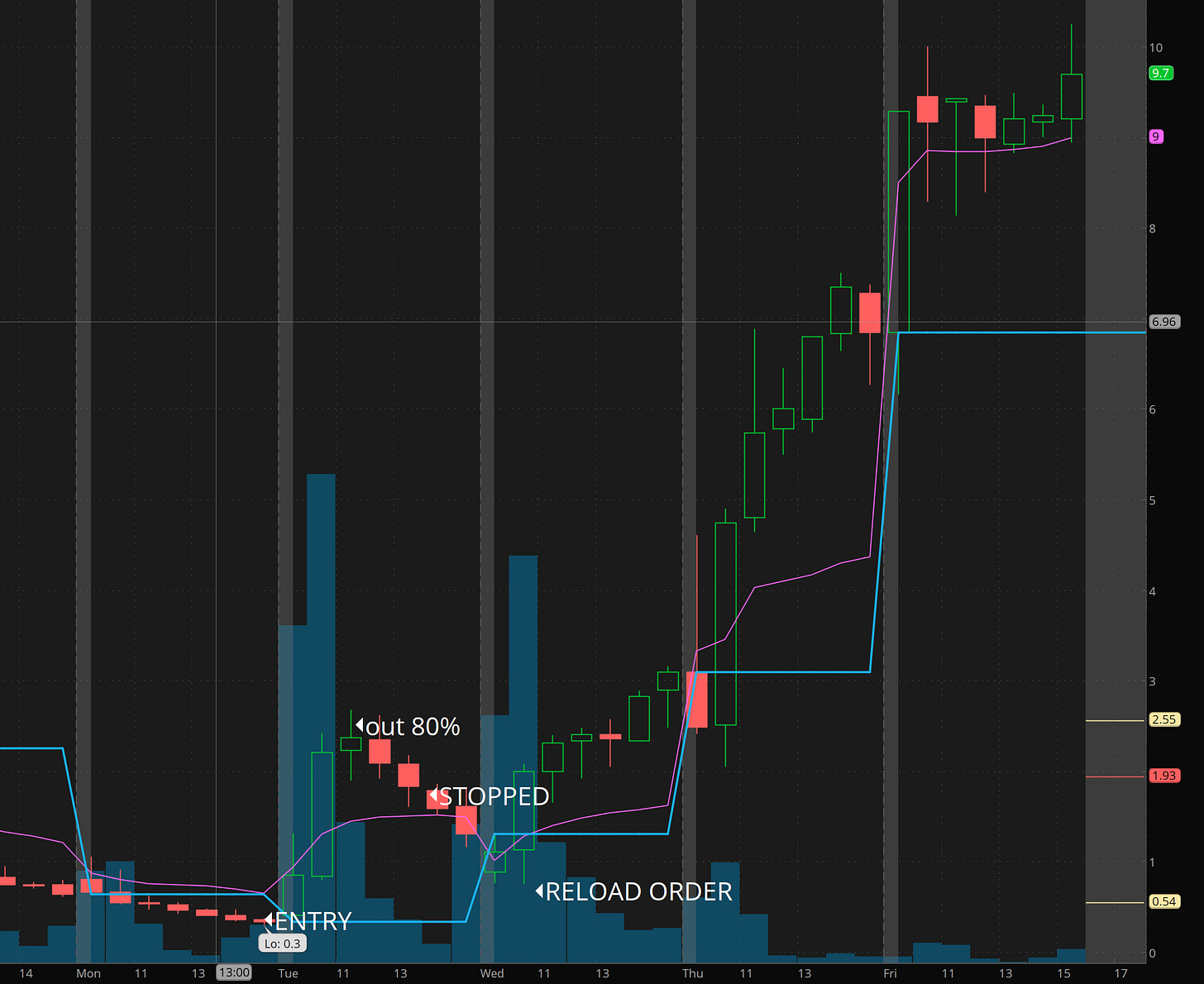

I fell into scalp habits on a swing trade

I was up 500% and locked 80% (3500→ 25000) isn’t bad right?

My stop got hit

I placed an order for a reload too cheaply that didn’t fill.

I missed the opportunity to turn $3500 into 50k-100k. PLAN was for a minimum of 30-50k payout.

Was this result bad luck or bad preparation? Bad preparation.

I don’t usually swing trade so this isn’t a surprise result however, will I let this happen next time? NO. I may even go bigger. 35k→500k-1m in one week on one trade is my goal for 2025 with perfect execution. This will be my clutch victory for being a top player in our field and doing it with swing trades.

I hope you found this useful. if so, please like, comment, and share.

If you feel my process could help you, I would love to have you in our community.

👉 Join THT PRO today and start making your own luck.