SPY's Day 10 in consolidation range. Trade Ideas for Mon Jun 2

How I planned a 1000% trade. How bias prevented me from taking advantage of a clear signal.

What a wild Friday. The crazy part I slept most of it and still nailed the trade plan.

First let’s talk about what is going in with SPY and the market. Over the last 2 weeks the market has essentially been stuck consolidating between 588-590. Moves outside this range have eventually reverted back to the range. Even after the huge back test dip to 573 I predicted was quickly bough and SPY rallied back to this range, triggered a large overnight gap up that was sold off back into this range.

The action toward the end of last week implied some weakness developing but even the dump on Friday was recovered.

Pay attention to the volume. Where was the volume and the price action after.

On consolidation days and attempted pushing we have had low volume near the highs at 588-590. On days into lows there was heavy volume on Friday in the 583-584 area.

This implies dips are being bought but there aren’t enough buyers above 590 yet.

There is increasing headline risk/imho. Institutions appear to be positioning short while retail is buying the dips. If what I think is happening develops, we may get a faker breakout 610 followed by a fast drop to 500 this month. Let’s see if this comes true or not.

The important things is I’ll continue to execute my process and trade intraday, and when I see an amazing risk/reward opportunity, I’ll position a swing a again.

SPY / SPX

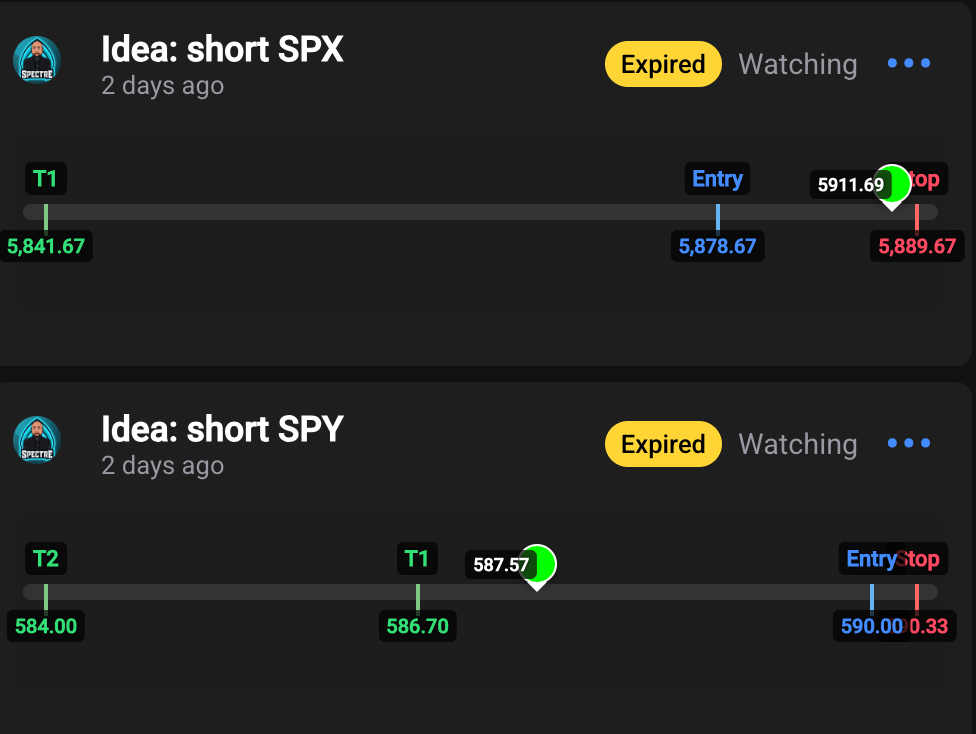

In Friday’s blog I wrote I was looking for 590 to be rejected and 586 to break for 583-584 to come. I also shared this with THT-PRO members as my only ideas for the day.

I will also share the trade I missed with the failed break down reversal on 586 that developed.

IDEA: 590 reject

Using my levels for SPY and SPX I estimated that 5850c would hit $12-24 if the drop came mid day, and $10-12 if it came into the close.

With that idea, the plan was wait the first hour, and get 5850 as cheap as possible.

After 10:30am we got the $2 fill :). I sold 50% at 4 to make it risk free and fell asleep. Edge planner had a $24 target, but since I was going to take a nap I thought 15 and 20 were great exit targets. I fell asleep and missed the slow chop and consolidation for the next 90 minutes.

And then BOOM! Headline and drop by SPY right into 583-584 target. SPX 5850 hit $22! all while I was sleeping. What a great feeling to wake up and see the sell targets hit! :)

The second green zone is around 4-6 is when SPY broke 586. and where my second idea triggered for an entry. Notice that while the 590 reject idea gave the perfect entry and max gains. One could have entered AFTER the volume and break came to enter at $5. This required patience, watching all day. This also was triggered during the lunch hour.

My goal is to spend as little time as possible in front of the screen. that means planning, accepting risk and being wrong, getting positioned and setting bracket orders and let the thesis play out.

What I need to do is spend time developing signals/code that can alert me in realtime when a level break with volume is met. To have had Edge alert my phone. That will be my goal for this week is to get that written.

The chart above show the short and long trades possible.

Members caught the volume and signal by Edge Scanner to get long but I doubted it because of bias.

The 5890c reached $30!!!!

My bias kept me from planning another 500%+ trade opportunity. sorry guys.

Thoughts from Friday’s price action:

Market is continues to be in consolidation mode and dips are still being bought.

Give the strong recovery and squeeze it appears market wants to go higher but support breaks are triggering sells.

Waiting for after 11:00am is ideal for getting great risk/reward pricing on ideas.

We are starting to get random large moves mid day and secondary moves/position possible after 2pm again.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Education

How to Join a Strong Trend

The process I typically follow for joining a strong trend are as follows:

All day grinder: join on dips to 20ma

Multi-day grinder:

Join either on support test of morning lows or failed breakdown reversal at key level

Join at VWAP mid day or end of day

Keep it simple. Don’t chase, wait for support levels for great risk/reward entries!

Systematic Profit Taking

How do I take profits? I keep it relatively simple. Depending on the entry and range to the next levels I typically with take profits 50-100% of my profits at 3-10R and then raise stops to above entry with a goal of letting runners take me to the next level or 2 and to then reload if I believe we are consolidating before the next leg.

I then repeat the same process on the reload.

Securing Profits on Options overnight

Sometimes you get this massive paper gains overnight on options but you can’t secure it right? Well if you have a big enough account and a margin account if you have calls you can. What you need to do is buy or sell the stock overnight. and the option turns into a hedge against that position essentially securing your profits.

I’m out of time, but I’ll make a video on this later.

Trade Ideas - Plan for Mon Jun 02

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Ideas

Premarket looked a little weak at first but has since push back to 588. Overall consolidation is back but 588 needs to reclaim for bulls. Given action from Friday without a range break, its’ going to be harder to gauge where buying and selling will trigger. I’ll likely watch most of today and unless I see an extreme range test plus volume signals in edge, stay out of trades today.

Here are the key levels and ideas I’m looking for…