SPY Trade Ideas for Mon Jan 12

Our Bull Puts and Bear Calls paid! AlphaOS is making Credit Selling and directional bets easy. My focus is on consistent yield per time spent instead of volatile results and overtrading all day.

Friday, we said good bye to a home that has been in our family for over 45 years. An emotional day, and I only traded the morning and missed long off vwap double double bottom into new all time highs.

I’m 100% ok with that because my credit sells are paying and I’m getting consistent gains that are allowing me to trade bigger.

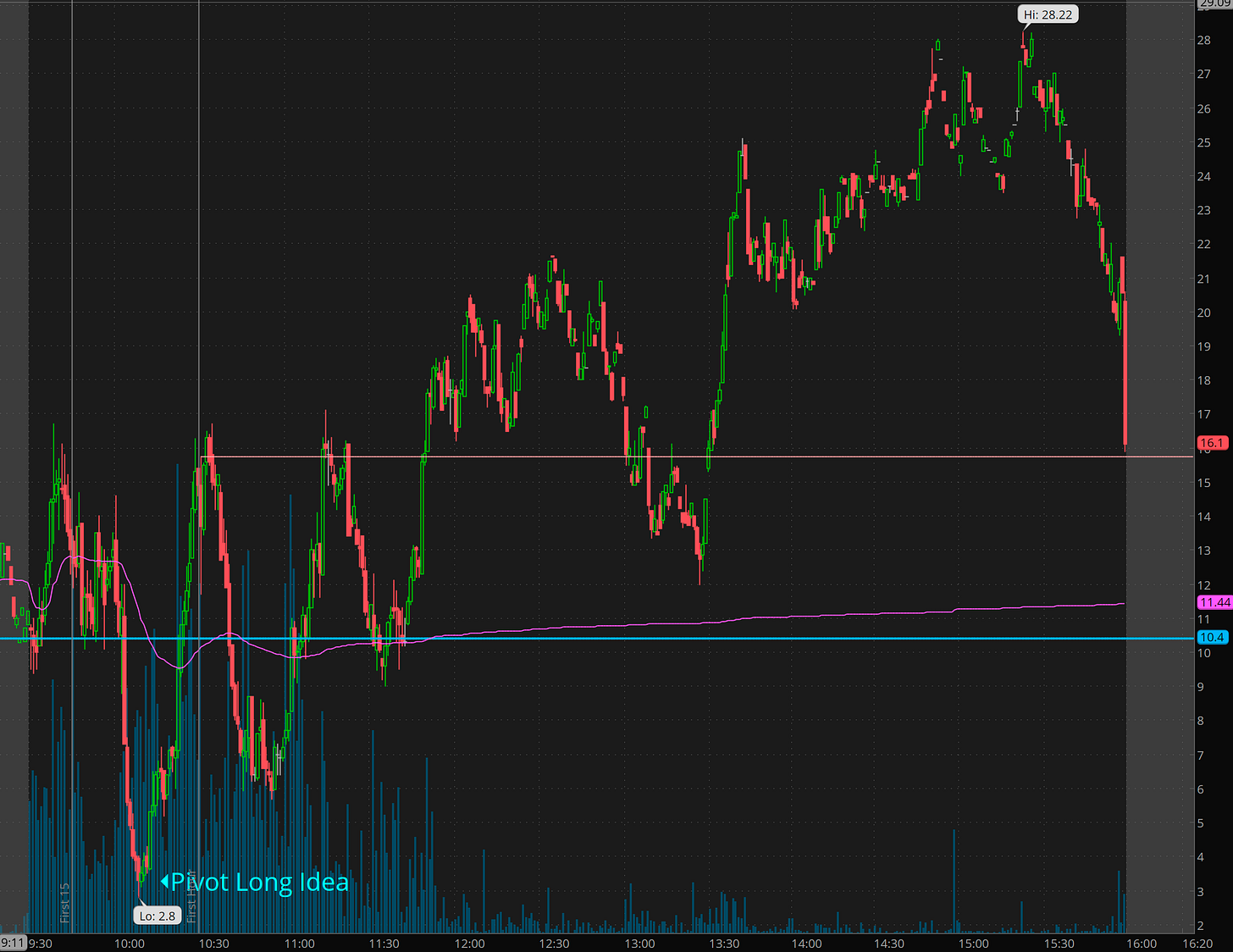

Here is what we did on Friday.

If you took long off the 689.30 idea with SPX 6950c it almost did 10x. But what a choppy trip.

Process = Profits

Lately I’ve been doing the following:

Premarket establish where we likely wont reach. Sell premium for 0.8-0.60 on open.

After 11: second positioning of credit sells.

After 3:30: start hawking/planning for a Spectre Special

What’s a Spectre Special? A yolo trade that goes 300-1000% in under 30 min.

FREE LESSON on catching eod exhaustion

If you are tired of overtrading, not knowing how to plan trades, and want to make more in less time, come join us.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Plan for Mon Jan 12

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

SPY Survival Guide: Hold 690 or Face Deeper Pullback

Premarket steady at 689, eyeing Fed speakers for breakout cues amid range-bound action.

Market Context

SPY enters today in a consolidation phase after a choppy close on January 9, trading in a tight range between 689 and 692 in premarket. The index shows a neutral bias with potential for a bullish continuation if it holds above the pivot at 692.83, but downside risks loom if support at 690.36 fails, potentially testing lower levels from recent volatility. Chart patterns reveal a symmetrical triangle forming over the past sessions, with volume tapering off, suggesting indecision—watch for a decisive break to confirm direction, as yesterday’s late-session push higher hints at underlying buyer interest but lacks conviction without catalyst-driven volume.

Key Events Today

12:30 pm ET: Atlanta Fed President Raphael Bostic speaks (potential insights on regional growth and rate path).

12:45 pm ET: Richmond Fed President Tom Barkin speaks (focus on inflation and labor data implications).

6:00 pm ET: New York Fed President John Williams speaks (could signal policy stance ahead of CPI tomorrow).

These Fed comments may introduce volatility, especially around 12-1 pm ET, as markets digest any hawkish or dovish tones ahead of tomorrow’s CPI report.