SPY Trade Ideas for Fri Jan 16

Our Bull Puts and Bear Calls paid! AlphaOS is making Credit Selling and directional bets easy. 10 bagger trade potential off 695.15 short trade idea via AlphaOS

Spectre AI analysis nailed it again! The primary idea didn’t develop at 693 for a long but the Alternative idea for a short at 695.15 did!

SPX 6950p 2.25 Alert - hit $14! Entry (AFTER VWAP BREAK)

If you got short at 695.15, the 6950p was $1 for over 1000% return!

Yesterday’s SPY Action Review and trades

Process = Profits

Lately I’ve been doing the following:

Premarket establish where we likely wont reach. Sell premium for 0.8-0.60 on open.

After 11: second positioning of credit sells.

After 3:30: start hawking/planning for a Spectre Special

What’s a Spectre Special? A yolo trade that goes 300-1000% in under 30 min.

FREE LESSON on catching eod exhaustion

If you are tired of overtrading, not knowing how to plan trades, and want to make more in less time, come join us.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Plan for Fri Jan 16

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Fed Speakers Fuel SPY Breakout Potential

Key levels converge as industrial data and multiple Fed officials could spark decisive moves

Market Context

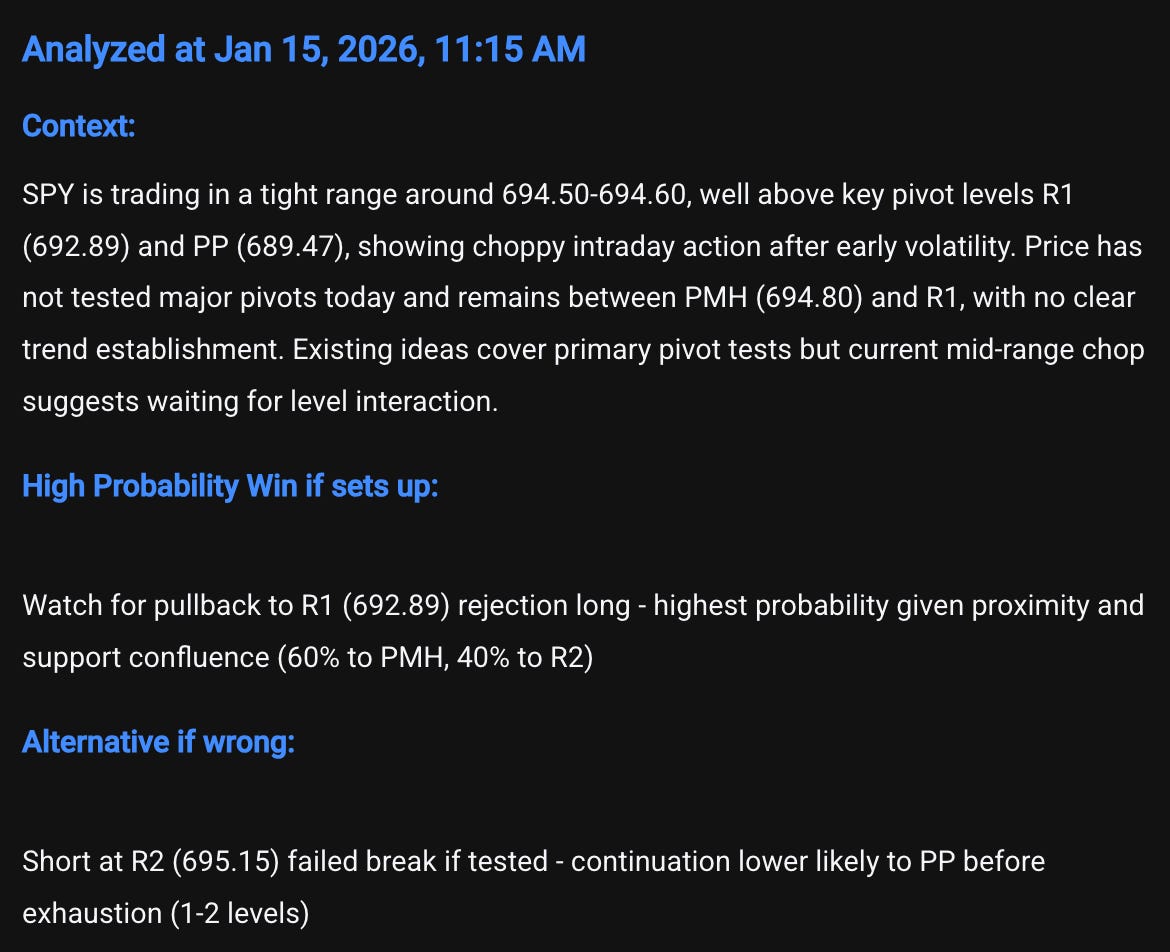

SPY closed premarket at 693.48, hovering just above the critical pivot level at 693.16. The recent price action shows consolidation within a tight range, with multiple failed breakdown attempts below 693.00 creating a coiled spring effect. Volume patterns suggest accumulation near current levels, while the proximity to key resistance at 696.33 sets up potential breakout scenarios. The market appears poised for directional movement as traders await today’s industrial production data and commentary from five Fed officials.

Key Events Today

9:15 am - Industrial Production (Dec.) - Forecast: 0.1% vs Previous: 0.2%

9:15 am - Capacity Utilization (Dec.) - Forecast: 76.0% vs Previous: 76.0%

10:00 am - Home Builder Confidence Index (Jan.) - Forecast: 40 vs Previous: 39

10:50 am - Boston Fed President Susan Collins opening remarks

11:00 am - Richmond Fed President Tom Barkin speaks

11:00 am - Fed Vice Chair Michelle Bowman speaks

3:30 pm - Fed Vice Chair Philip Jefferson speaks

Key Levels and Their Significance

696.33 - High Priority: Primary resistance level with 75% probability of reaction based on volume clusters. Key breakout target for swing traders, most active during morning session. Clear rejection patterns visible on 1-minute charts.

693.16 - High Priority: Central pivot showing strong magnetic properties. Multiple bounces with elevated volume, 80% hold probability. Critical for both scalpers and position traders throughout the session.

690.88 - Major support level with historical significance. Strong volume accumulation zone, 70% bounce probability. Primary target for failed breakdown reversals, most relevant during market stress periods.

698.61 - Secondary resistance level for extended moves. Swing trader target with moderate probability, active during strong momentum phases.

687.71 - Deep support level for major corrections. High-conviction reversal zone with institutional interest, relevant for position traders during significant selloffs.

704.06 - Extended resistance for major breakout scenarios. Long-term target level with lower immediate probability but high reward potential.

682.26 - Extreme support level for crisis scenarios. Maximum downside target with very low probability but critical for risk management.