SPY takes a breather while SMCI gives us incredible range! What will pay us 100%+ today?

Why I trade more than just SPY/SPX - Patience another big pay day coming is coming. TSLA reports tonight. This and more in today's blog.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas, all based on real-life examples and my personal approach to trading. Additionally, you will have access to the top scanner results for ideas in Edge Trade Planner (Beta), a powerful tool to enhance your trading decisions.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day with a goal of earning 100-300% on the capital I risk. A few key benefits of limited-effort trading:

Higher Quality trades with better reward/risk

Avoiding Overtrading and losses from it

Not selling too soon

(more info to come )

Monday’s Price Action

SPY consolidates after the recent rally

Monday turned into a consolidation day, but with range being limited it was tough to score massive gains.

Yesterday I wrote:

And that is exactly what we got. I can’t stress enough how having levels identified ahead lets one plan trades.

The trade on this developed during first hour and paid out within an hour later.

Have you been wondering about how to use Edge Trade Planner?

This alert was generated.

Clicking PLAN and using 483.30 and 482 for the targets, here is the generated plan:

High of day was 0.72. Not bad targeting given that SPY ended up basing at 483. Nice 100%+ gainer off the 485 reject plan.

NVDA - Perfect gap up reversal trade

Yesterday my idea was to take 590p at the open. We got the spike right into the 603 target for entries.

Please review the logic and comments in the chart for my process for entering and exiting.

Contracts were juiced so getting 100% on face value was tough, but getting 300% vs risk was very doable. Entry $6 stops at $5 so risk $1. target exit $9+

SMCI - absolute magic

I usually trade SPX and am content with that, however when I see a name with wild momentum, my old roots for trading come back. I love great risk/reward and opportunity. And this provided in spades!

I took a long on 500c out of the gate at $10 that ran to $24. I sold some at 17 and tried to at 22 but it dropped so quickly I had to market out.

Following process as soon as I saw close under vwap, I had to take puts.

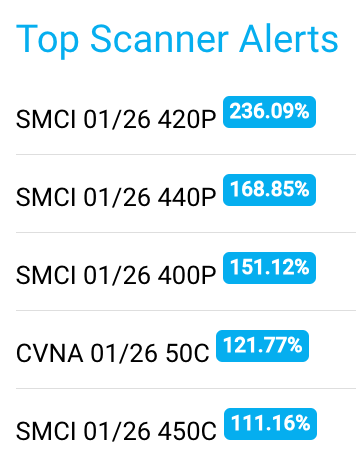

The Scanner showed a range of puts being put out of the gate and into the spike AND as vwap was broken.

Overall nice 100% gainers! The puts paid nicely and I decided to target 400-420 area to start getting long.

Notice the volume spike and reversal candle at the lows, that is when I alerted my plan to take SMCI 450c for $7 stops at $5 and I wanted to sell at $11 and $14 to get 200% reward to risk and 100% value gains. At at 450 later in the day the runners hit $20! We nailed the long entry using failed breakdown reversal as the signal!

TSLA - failed push

Just can’t keep a big going. Yesterday I said watch for the reaction at 217. and sure enough it failed with yesterday’s low being 206s. TSLA reports tonight. if reaction is negative, I’m expecting so see 180.

CVNA - is a whale reading this blog?

yesterday I wrote

Out of the gate there was $133k of 50c gaining over $150% in minutes!

Summary Review of Market Price Action

Overall IWM turned higher and large cap names more or less entered consolidation mode. Ideally we get one more red day today, and I want to load up on a gap down down reversal move tomorrow.

Let’s see if market can back test the breakout today on SPY.

Educational Lessons

From the price action review you should have learned the following:

Don’t have to catch every trade

Making 100%+ trades is on a consolidation day is still very achievable.

Failed break down reversal at major levels WORKS! Learn it, trust it, bet on it! Even when emotionally you don’t agree with it.

Keeping an eye on names other than SPY/SPX can provide lucrative opportunity on slow consolidation days.

You don’t need to trade all day. Most of the trades involved positioning between 10:00 and 12:00 and then doing nothing more. Use bracket orders.

Edge Trade Planner - Top Scan Alerts

The scanner showed over 100 signals yesterday, and with filtering one can get down to 25 and of those only about 8 were during first 2 hours. When that happens, it implies a slow and chop day could be in the works. Let me know if you would like a workshop on how I read/interpret the scanner alerts.

Nice job/finds by the Scanner! Interesting how the 2 new names I added to the watchlist yesterday were the ones that provided the most opportunity!

Trade Ideas - Plan for Tuesday Jan 23

Overall would like to see another consolidation day.

SPY - I want to see 480 retested, ideally this comes today or tomorrow. I may trade the chop to get 50% gains twice and call it a day.

TSLA - reports tomorrow night so expecting chop. Ideally test 200-205 before the report tonight but could stay pinned around 209.

COIN - with bitcoin fading, I’m wanting a pop into 125 to take 120p

NVDA - likely take 590p out of the gate for a quick profit taking scalp.

SMCI - ideally dips into 390 to 410 to get a swing trade on for a run ahead of or after earnings next week. I’m thinking 460-480+ coming by Friday.

NFLX - gapping into 500. reports tonight so tomorrow should provide a great trade. Gapping up on WWE news

DWAC - watching for possible all day seller trade coming soon.

Overall I’m looking to size into 1-2 trades and make 50-100% and call it a day. I’m expecting tomorrow or thursday to be the big payout days so why force trades.

Don't forget to like and share this post to spread the knowledge and help your fellow traders!

Disclaimer: All content provided is for educational and entertainment purposes only. It should not considered financial advise or a recommendation to buy or sell a security. The content is the author’s opinion only and may or may not be accurate.