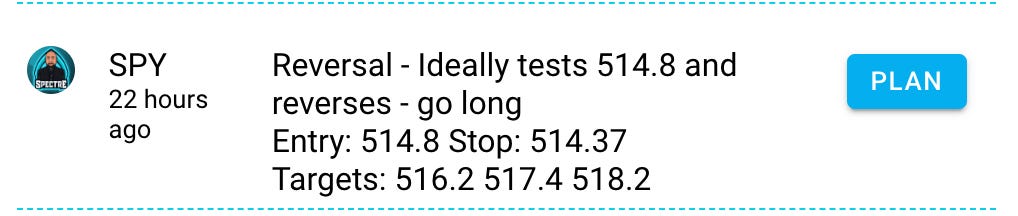

SPY tags 514.80 level and reverses. Now gapping up toward 518. Will PPI push it to 520 today? My plan for Thu March 14

PPI incoming at 8:30, TSLA continues its fade, SMCI to be included in SPY tomorrow

Good morning traders.

Thanks to everyone that came to the webinar. Don’t sweat it if you missed it. There will be another one. The next webinar, I’ll do a deep dive in the THT philosophy and share more examples of must know price action and planning. If you learn just this, you will want to trade less and make more with less time and effort too!

Yesterday’s action on SPY was annoying, but that is because my impatience was getting to me, I was excited to load up on a dip and get paid on the move to 518+.

I called it a day, but in the last 30 minutes before close, SPY finally did the move I had been wanting. Unfortunately I was away from my desk and missed the entry.

One of the items on the todo list for Edge is alerting when a price meet a planned trade and autogenerating a plan and notification for it.

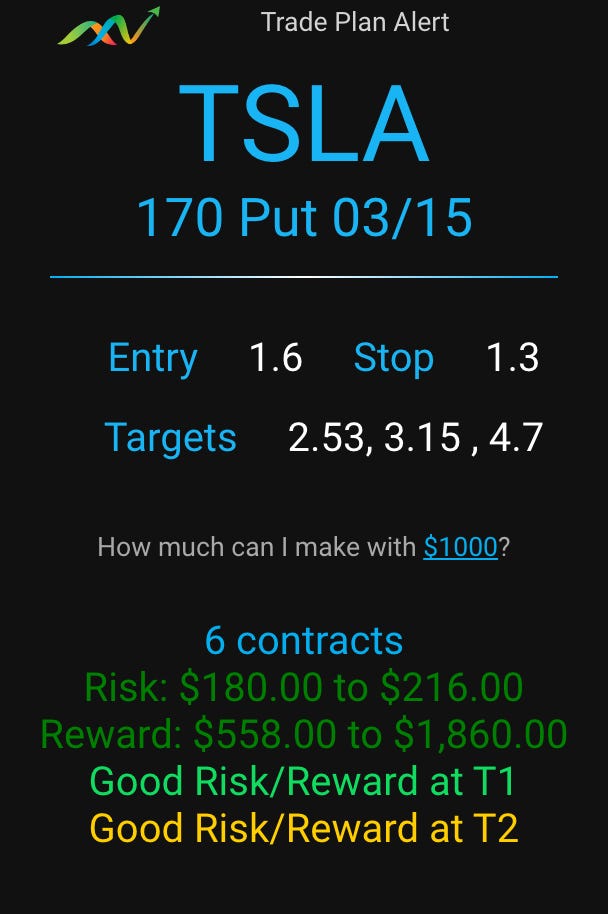

TSLA on the otherhand TSLA was great and gave and all day fader. The 167.50p and 170p should be nicely green by the open.

I hope you are excited for today. Reaction to PPI should give us range and possibly a 5 to 10 bagger.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas each morning, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Mar 12 - SPX 5150c Entry $4 - High after $27.50 ($4000 → $27500 potential)

Mar 11 - SPX 5120c Entry $3 - High after 7.50 ($3000 → $7500 potential)

Mar 8 - SMCI 1150p Entry $5 - High after $56.20 ($500 → $5620 potential)

Mar 8 - AMD 220c Entry $0.50 - High after $7.65 ($500 → $7650 potential)

Mar 7 - SPX 5175c Entry $0.50 - High after $2.40 ($500→ $2400 potential)

Mar 6 - SPX 5120c Entry $3.50 - High after $12+ ($3500→ $12000 potential)

Mar 5 - SPX 5070c Entry $0.50 - High after $10.75 ($500 → $10750 potential)

** alerted 0.30 entry wanted. dipped to 0.40. entered at 0.50Mar 5 - SPX 5070p Entry $1 - High after $13.50 ($1000 → $13500 potential)

Mar 4 - SMCI 1200c Entry $33 - High after $61 ($3300 —> $6100 potential)

Mar 1 - SPX 5120c Entry $2 - High after $20 ($2000 —> $20000 potential)

Feb 29 - SPX 5095c Entry 0.50 - High after $10 ($500 —> $10000 potential)

Feb 29 - SPX 5100c Entry 0.30 - High after $5+ ($300 —> $5000 potential)

Feb 27 - TSLA 195p Entry 0.90 - High after $2.30+ ($900 —> $2300 potential)

Feb 26 - SPX 5070p Entry 0.20 - High after $2. ($200 —> $2000 potential)

Feb 23 - NVDA 800p Entry 2.50 - High after $25.11 ($3000 → $25110 potential)

**Dipped to 2.57 (had to chase entry 3)

Feb 23 - NVDA 820c Entry 2.25 (swing from Thursday) - High after $25.00 ($2250 → $25000 potential)

Feb 22 - SPX 4090c Entry $2.50 - High after $9.20 ($2500 → $9200 potential)

Feb 16 - SMCI 1000p Entry $11 - High after $195 ($1100 → $19500 potential)

Feb 15 - TSLA 195c. Entry $1.20 - High after 5.95 ($1200 → $5950 potential)

Feb 14 - NVDA 720p. Entry $4.5 - High after $12 ($4500 → $12000 potential)

Feb 13 - SPX 4955p. Entry $5 - High after $34 ($5000 → $34000 potential)

Feb 12 - ARM 180c. Entry $1.20 - High after $14.10 ($1200 → $14000 potential)

Feb08 - ARM 100c. Entry $5 - High after $27.50. ($5000 → $27500 potential)

Feb07 - TSLA 185c. Entry $2.53 - Hight after $5.60 ($2530 —> $5600 potential)

Feb05 - SPX 4940c. Entry $3 - High after $16.60 ($3000 → $16,600 potential)

Feb02 - AMD 180c. Entry 0.15 - High after $1 ($1500 —> $10000 potential)

Jan 29 - SPX 4910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22000 potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Wednesday’s Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

SPY/SPX

We got initial selling then some buying and a lot of consolidation.

It was important to buy on dips and support, but we were only getting 50-100% gain moves and the premium in the contracts started to decay which led to need to wait for afternoon session.

The afternoon session gave a nice push and failed breakout leading to a fast dump on 516.20 break leading to the 514.80 dip buy I had wanted and originally shared as a plan yesterday morning.

We can control when the market does it’s thing, but if you waited and caught the long on the level, SPY hit 518.20 this morning in premarket.

NVDA

Was surprisingly weaker than expected. By the time market opened(after I published yesterday’s blog), it had filled the gap and broke lower dropping right to the 885 level and basing there at the first hour. I was a little early for my long entry and ended up averaging down using the logic of as long as 885 hold, I want to swing NVDA for upside move into 920+ by Friday.

So I ended up with an $11 average on NVDA 920c, it had dipped as low as 8.50. I had started in with too much size as 12 but had some confidence about the upside move.

NVDA finally got to 910 but the contracts barely benefited, getting to $14-$16 to size down to overnight size. I was happy about getting green, super unhappy about allocating so much capital for only a 20-30% gain.

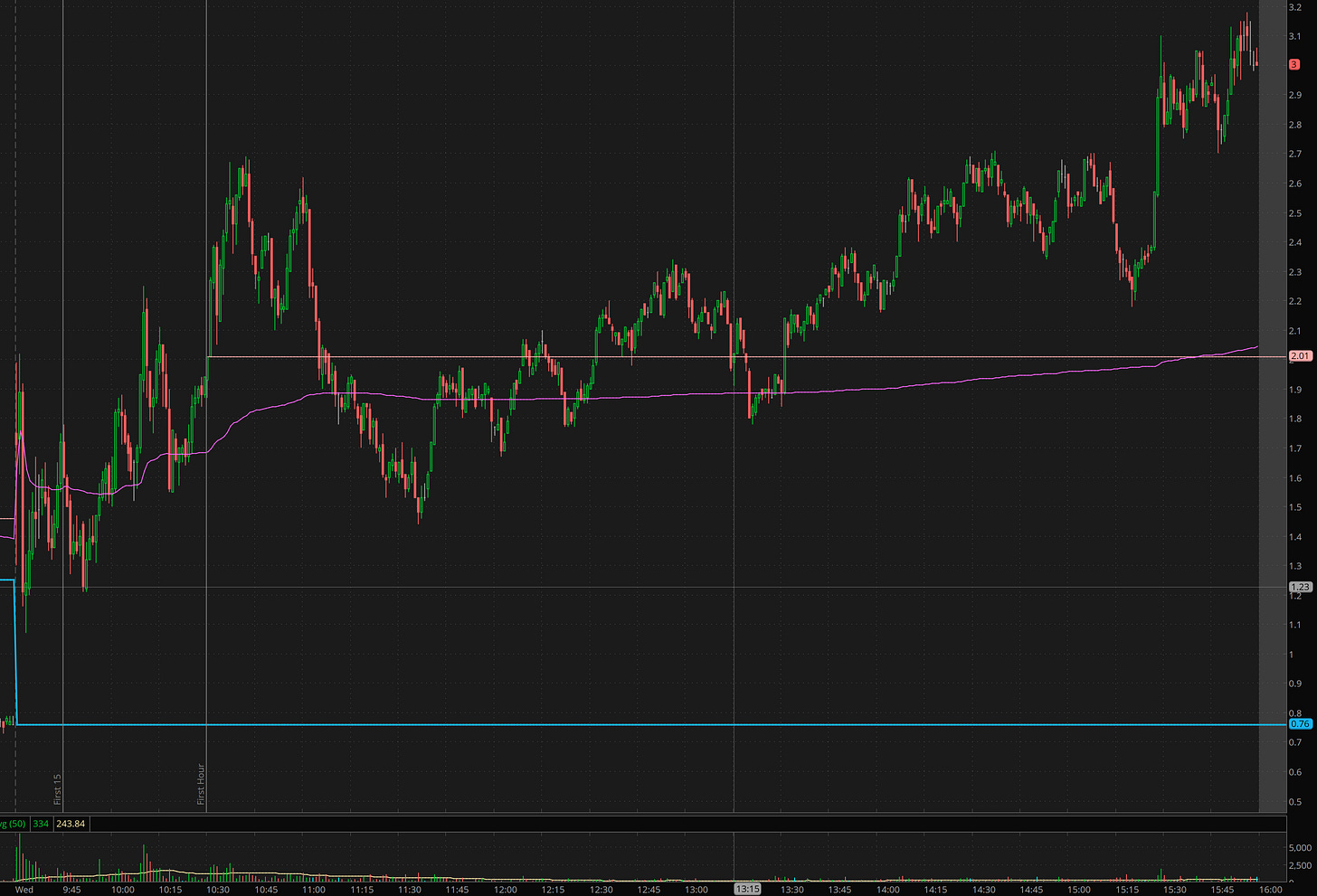

TSLA

What a beautify. This gave a nice pop into 175-176 and failed. Eventually breaking 172.50. The SPX 170p and 167.50p should pay nicely.

The trick to not chasing, is looking at the move and action and saying, ok, this has confirmed it wants to go lower. Where should I get in. Many times that is vwap.

So yesterday I wrote, if 172.50 breaks , I want 167.50p. So it broke, now where do I want to get in? Ideally on a back test of 172.50. In our case that was a failed push into 173 and break back under vwap.

Notice how the dips/low price coincide with vwap. Patience will give you great entries and let you get much better yield for your money than chasing!

if using Edge, type /plan b TSLA 170p 1.60 s 1.30 and it will generate sell targets for you. Below is the generated plan using 1k in capital. Both T1 and T2 were hit by the close. and we may get T3 this morning.

Summary Review of Market Price Action

Yesterday, SPY consolidated and big money was focused on positioning for PPI this morning. Meanwhile, clean selling in TSLA.

IMHO, TSLA has lost its luster and money is shifting to the next big thing which is AI. If TSLA announces full production of robot line or launching of AI related services, it will be a catalyst and would bring growth money back into TSLA.

Educational Lessons

From the price action review you should have learned the following:

Wait for the levels to plan trades

Be patient. Let trades come to you. Make it OK to take only 1 trade a day.

Use /plan in Edge Trade Planner to quickly create trade plans.

Learn how to recognize failed breakdown reversals at key levels.

Trade Ideas - Plan for Thursday Mar 14

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Market gapping up again. Let’s see how market reacts after PPi. In theory we shoud see a 3 to 6 point move today if we get volume.

I’m watching the following today: SPY, NVDA, TSLA, SMCI