SPY puts in another green day! (barely). Will SPY break range today or continue the chop? Plan for Nov 9.

NVDA continues its rally, CELH move caught by Edge. Should you sell premium?

Let’s review the price action/trade plan from yesterday morning.

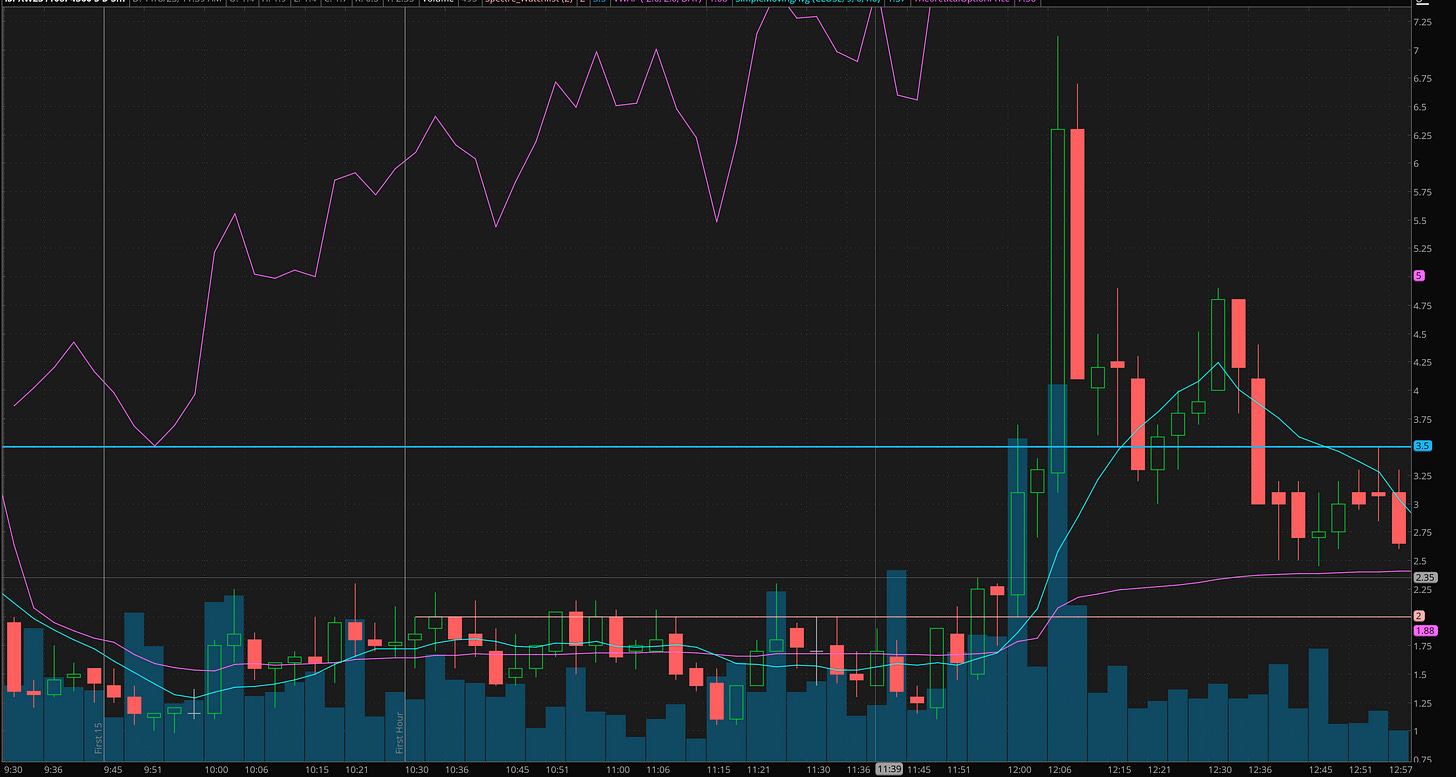

I initially took 4400c on the opening for around 3.50-4. but as it pushed it wasn’t getting bids, so cut it quickly at 4.50. I also started small on 4380p just in case at $5 risking 50%. A few minutes later we got the big red candle and break of vwap. If you follow the process I teach, this is a rejection of the level above after a gap up, and given the multiple green days the “right” thing to do even if we lose is to go short and hold as long as we don’t cross vwap.

I told members to be patient on the puts as we could get a nice pay out and sure enough we did

Here is the move on 4380p. if entered after the vwap break, the plan would be enter at $6 stops at $4. It hit $22. exiting at $20 would be a 7R trade!! By following process and being systematic.

Unfortunately I was away at lunch just before the big drop happened for me to scale in on 4360p. I initially wanted to get short at 1.50 with a stop of 1 but thought we get a dip into 1 so cancelled that order to watch. (Forgot we are now an hour ahead in PR and made a lunch date for 12). if you were hawking the 4360p came down to 1.05 and ripped to $7!

TIP: sometimes i will chase If I miss my desired entry, because my thesis is right, and I will start in half size so if I get another dip, I can add at a better price.

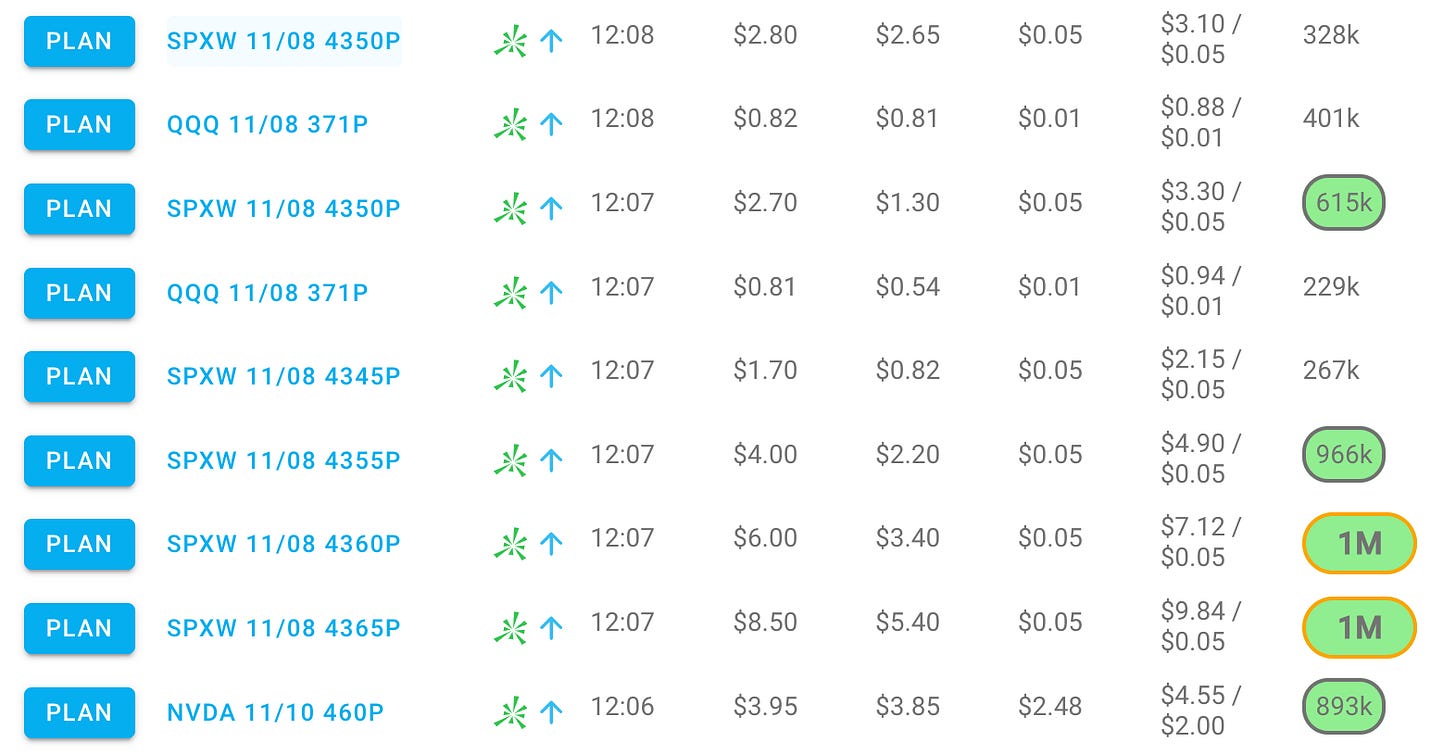

Now here is the very interesting thing about the option flow that happened into the dump.

Look at all the put flow into the lows!

I’m becoming a big believer of smart money does not buy at the highs. SO why are they loading up here? This volume imho is premium selling! So use the scanner and pay attention, if it is put flow into new lows after a big move or call flow into a resistance or new highs, it could very well be a contra-indication. We should do the opposite. (I’m still working on the logic to make it very apparent on the scanner that this could be what is happening, but for now I want you to be able to recognize it and be aware of it)

Should you sell premium?

Its a new process for me but I am starting to experiment with it. The tough thing I’m finding is selecting contracts and determining risk/reward and probability of win/loss. I wanted to join the put premium selling but given how many green days we have had, I didn’t like the risk/reward because I could also see another leg down developing later in the afternoon. You’ll have to make a determination for yourself if premium selling is right for you, but the one thing I like for it is, when it aligns with my bias for the day, I like to do it and love seeing the contracts go to 0!

One tip, is I never sell naked! Too much risk. With SPX I like to use a $5 or $10 spread. This way my max loss is predetermined.

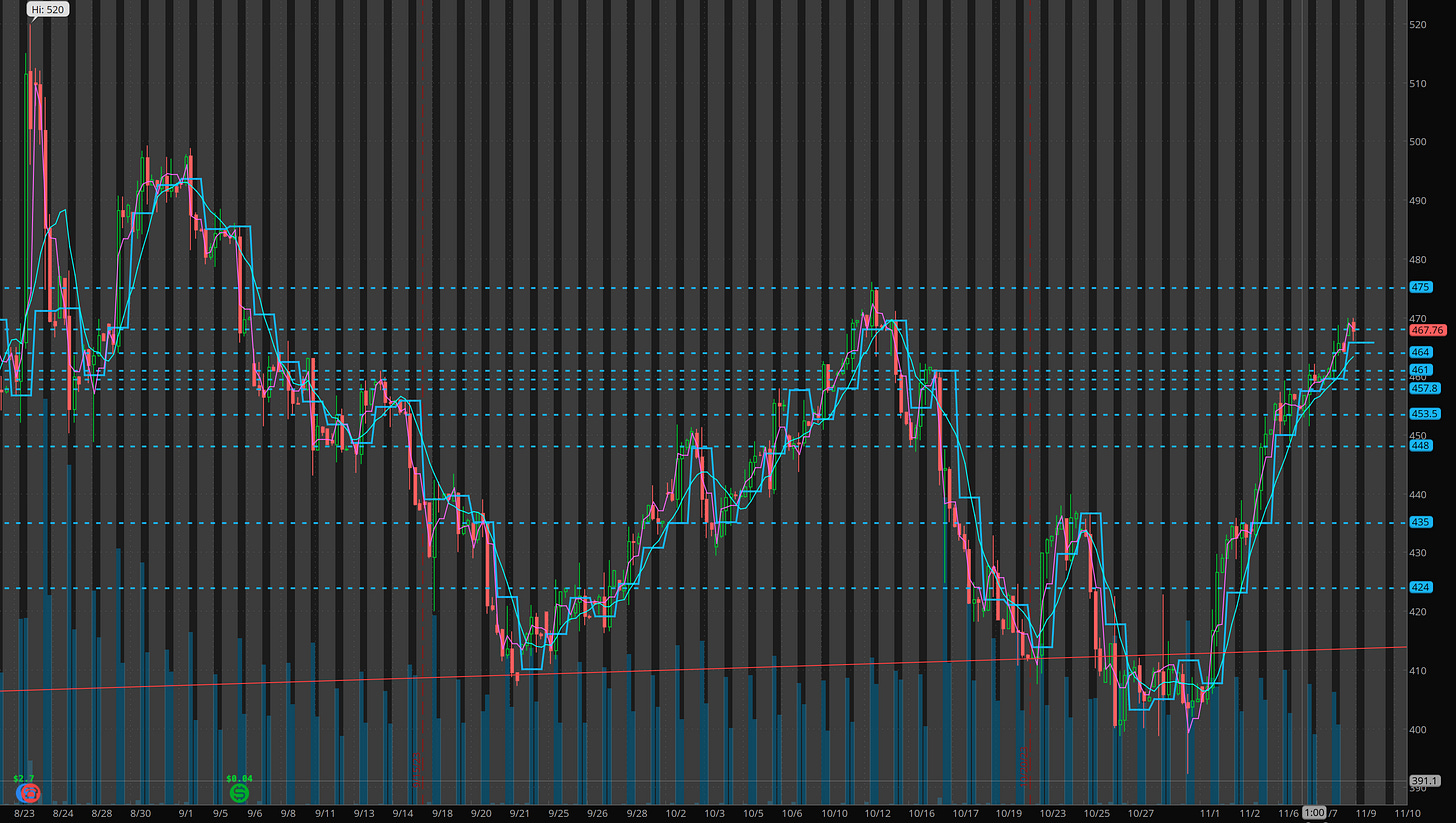

8 Green Days on SPY!!?

KEY OBSERVATIONS ON THE PRICE ACTION

Ok so here is the crazy thing. IWM has dumped for 3 days, possibly into a support level.

Yesterday, SPY went red on day, but didn’t break the previous day low, and was able to close green.

During the last 3 days as SPY has consolidated volume has dropped off.

So be careful today, we may get some faker moves. I’m expecting a push into 440, but what happens after? Overall I feel like if the rally is to continue, we need a higher volume day a larger move to develop.

Overall if you are bullish, consider using next week’s contracts as the range is tightening up and we don’t know which days triggers a move.

NVDA continues its Rally

470c continue to be bought. Looks like 475 to be tested this week and may see 500-520 next week.

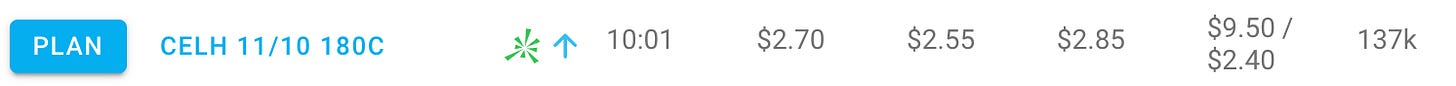

CELH move caught by Edge’s scanner

One of the nice things about edge is that it watches the various tickers on the watchlist for me.

It caught this at 2.50 and CELH ran as high as 9.50!

But then remember the idea of premium selling? if someone is super bullish, why buy calls heavily at the highs and so far in the money?

I believe this is premium selling!!! And by end of day the contracts had dropped to 2.40. It is super important to learn how to interpret volume. This reaffirms that I need to figure out how to classify/flag premium selling activity. If you took 380p thinking that is premium selling then those contracts went from $1 to 3.80.

So much opportunity being found by the scanner, the key is to learn how to interpret the activity. Unfortunately I was away at lunch and missed this.

Plan for Thursday Nov 9

Overall, I’m going to look for volume and a range break and/or faker move to develop otherwise no trade. The bigger paying trade I feel will likely develop after lunch today.

Premarket action so far is implying a move to 440 is coming on SPY and a move to 442 to 445 is in the works by next week.

I struggle to get long with out a dip after this many red days, so will prefer to go long on short squeeze setups like we had into the close yesterday and day before.

So watch if clear 438 and 438 turns into support after first hour, I will consider going long. if we get to 440 I will consider a short on failed breakout reversal setup.

That’s it for now. overall plan is to be patient and let market show us what it wants.

Risk to go long at moment is elevated imho, so I’ll continue to scalp long/short for 1 level moves with size until market gives us a bigger trend move.

While I’m waiting, I’m going to start looking for earnings winners that may have pulled back and are starting to grind higher and have a lot of room to the upside. (assuming rally continues). I’ll also start making a list of runners to short that are over extended for when a profit taking day comes.

Tip: Make it OK to not take trades today unless A+ setup.