SPY Levels On target! Standard Monday GAP UP in effect after Friday sell off. Trade Ideas for Monday Aug 04

Yesterday I shared a scenario with THT PRO members... what if Wed night move was a short squeeze? if it is then 632 can break and we see sub 628! Planning for this scenario provided 1000% gains!!!

Good morning!

What a day Friday! I was short using /ES from Thursday and we got a 50 point drop into the next morning!

I missed the short on the open on options given the /ES position and the long, but I’m going to mark up the chart for how and why to trade it.

The afternoon is where money was made. Nothing too amazing, I think a couple of 100% trades and maybe one 400%.

Still a bit sick so don’t recall.

The big one I do remember is the long in the afternoon ont he anticiapated failed breakdown reversal off SPY 620.

Let’s get into the trade setups and education and then the ideas for today.

SPY/SPX

Morning Setup: 4 Level Gap Down Reversal

There were 2 setups. I don’t typical chase trades after large gaps but BP from the THT PRO room did taking SPX 6200p which went from $3-15 in about 30 minutes!

I was looking for a pop, and take 6230 or 6250p. The important thing here is I don’t regret missing it. I had my short in from /ES. That was paying and I was following my rules of not chasing gaps. I miss plenty of opportunity by not doing that but I also avoid a lot of losses.

If I was to take it, it wosuld have been on that mini pop about 7 minutes in and 6200p for 4.50 risking 1.50. notice how it did a perfect 2 level move to 620! That is the goal! Every trade on trend days we want 2 level moves and lock it in. On consolidation days 1 level or less.

The clean move was the long off 620 but contracts were juiced! it would have been better to take SPX 6200/6195 bull puts than calls imho.

here is what the SPX 6250c did.

Basically $10-22. A 100% gainer but 5R if you got in risking $2!

The play I was looking for came in late afternoon.

Afternoon Setups: Double Top Lower High + Failed Breakdown Reversal

The afternoon gave 2 great trades.

The first started over lunch so I got in a little later than I would have liked but the 6230p paid.

I need to be less stringent about not trading over lunch….

The second trade was the failed breakdown reversal around 2pm.

This time I was in SPX 6250c. Take profit at 4.50 and 7.50!

And that was it. I told members Im exhausted after that last long and calling it a day . Not going to try for a spectre special in last 30 minutes.

There is massive opportunity in this market. Are you taking advantage? Literally have planned and alerted trades that pay over 300-1000%! You will need patience to wait for entries and the exits. But if you have self discipline or trust bracket orders, my process can help you get the results you want.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Education

How to Join a Strong Trend

The process I typically follow for joining a strong trend are as follows:

All day grinder: join on dips to 20ma

Multi-day grinder:

Join either on support test of morning lows or failed breakdown reversal at key level

Join at VWAP mid day or end of day

Keep it simple. Don’t chase, wait for support levels for great risk/reward entries!

Systematic Profit Taking

How do I take profits? I keep it relatively simple. Depending on the entry and range to the next levels I typically with take profits 50-100% of my profits at 3-10R and then raise stops to above entry with a goal of letting runners take me to the next level or 2 and to then reload if I believe we are consolidating before the next leg.

I then repeat the same process on the reload.

Securing Profits on Options overnight

Sometimes you get this massive paper gains overnight on options but you can’t secure it right? Well if you have a big enough account and a margin account if you have calls you can. What you need to do is buy or sell the stock overnight. and the option turns into a hedge against that position essentially securing your profits.

Trade Ideas - Plan for Mon Aug 04

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Ideas

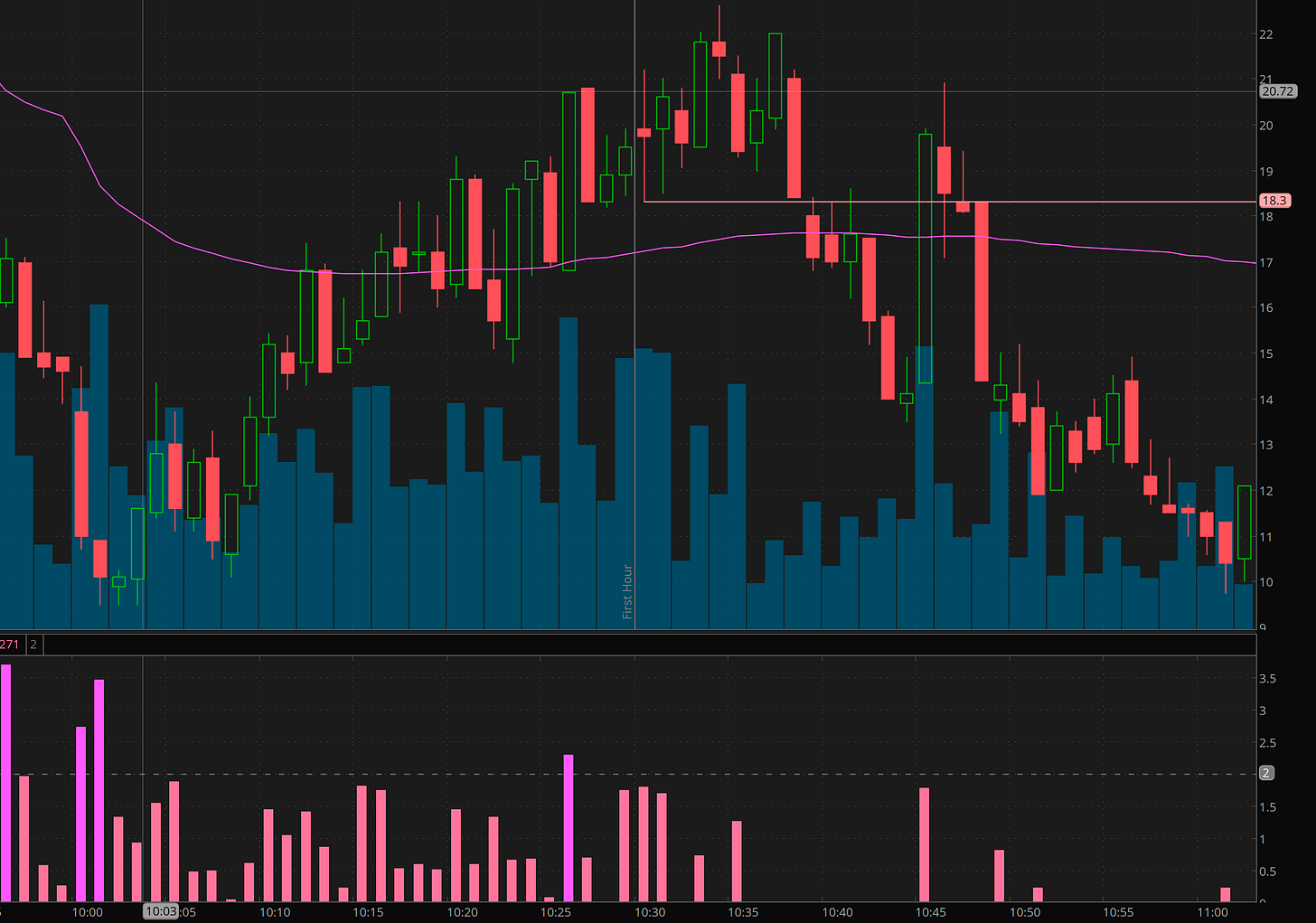

Ok so mostly focused on SPY today but I may look to get some RKT if keeps getting some love.