SPY is finally over 460, more highs or a head fake? My plan for week starting Mon Dec 11.

Also NVDA, GOOGL, and more

Week in Review

We had so many amazing trades and opportunities last week. Here are a few highlights.

SPY stayed range bounce for the most part but with timing and planning we had multiple 3-10R trade opportunities in SPY.

NVDA gave 4 20 point moves as part of its consolidation.

TSLA has been tightening up

Friday’s action/education

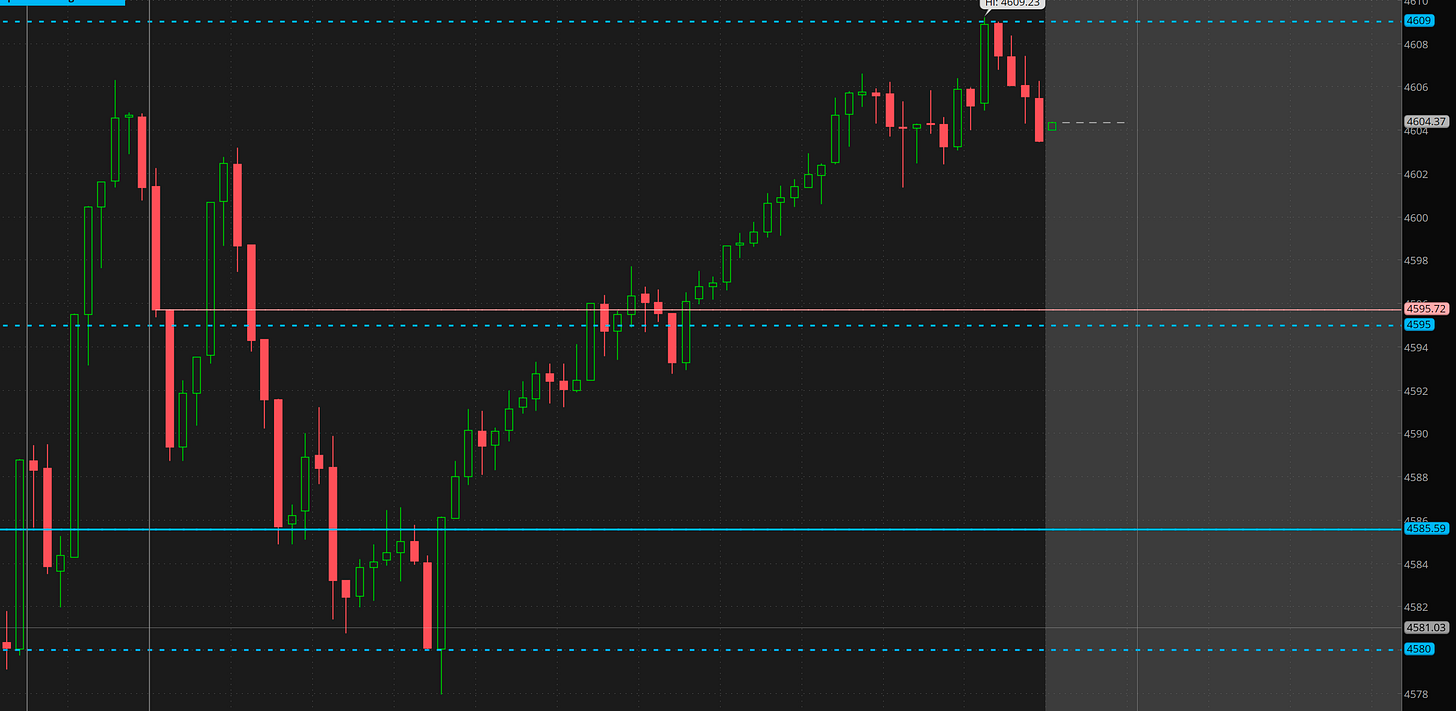

Lately I’ve been focused on core names like SPY, NVDA, TSLA, but every now and then, especially on Friday’s I’ll spot insane risk/reward trades.

AFRM was the one. Notice how I’m giving an idea of a scoop buy. The contracts had just hit 0.80 and I was thinking if the breakout continues it should hit $2+, so if we can get some Friday cheapies, it’s worth it.

The contract dipped as low as 0.30 and hit $2.20+ by end of day.

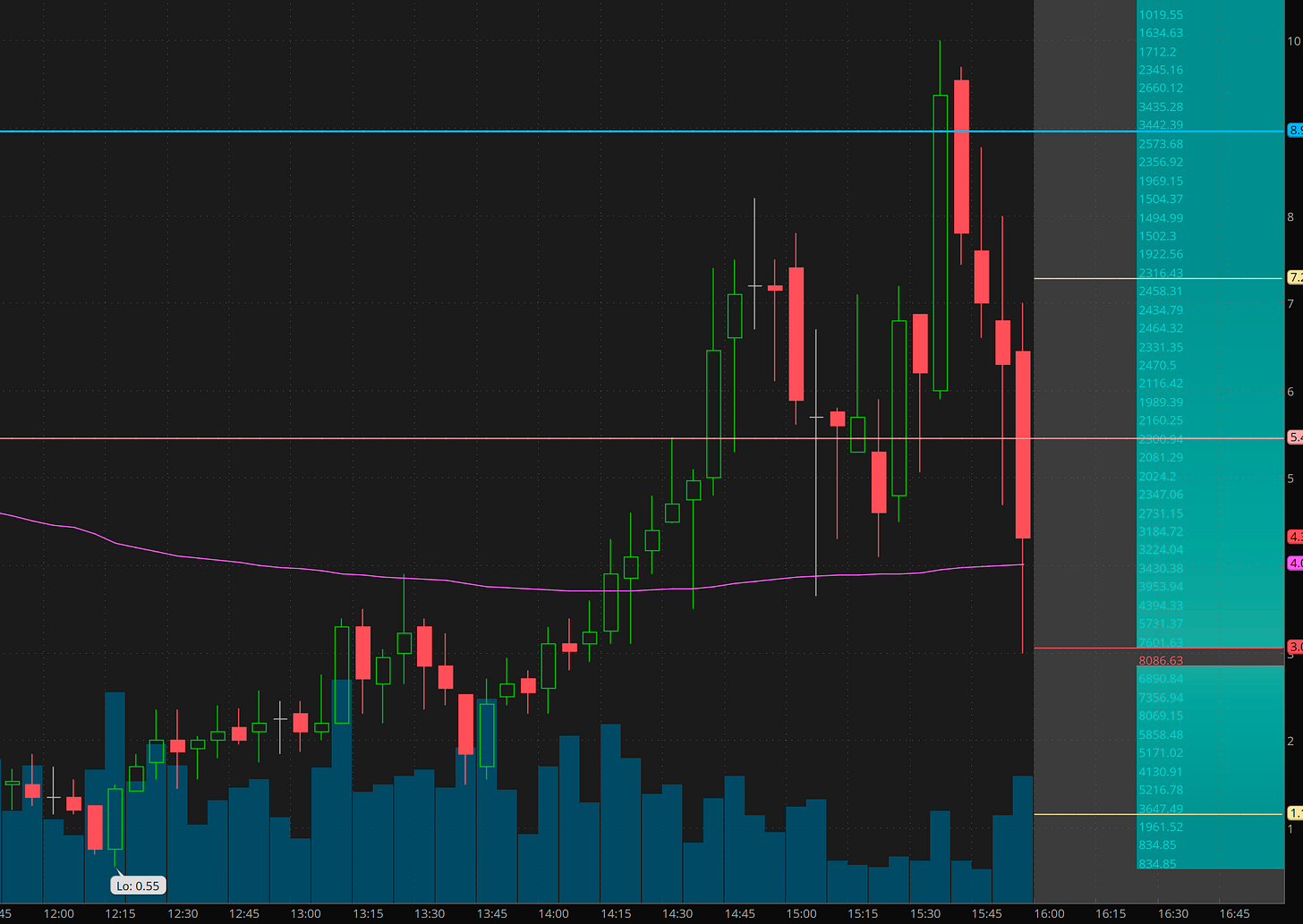

SPY gave an amazing dip in premarket where I was able to scoop SPX 4580c for $5.50 in premarket and hitting $22 during the first hour. Got to love that jobs data volatility giving great dip buys.

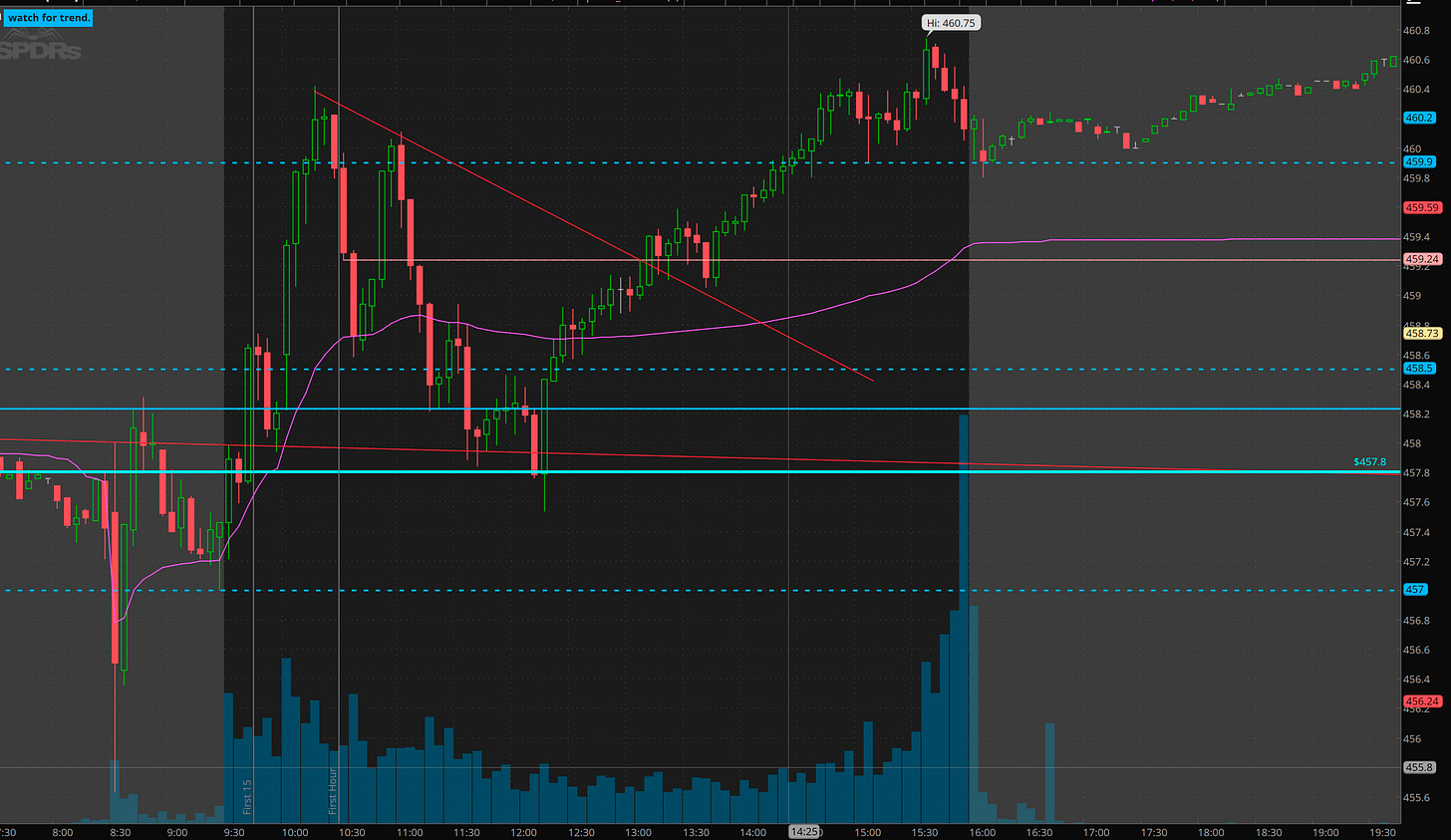

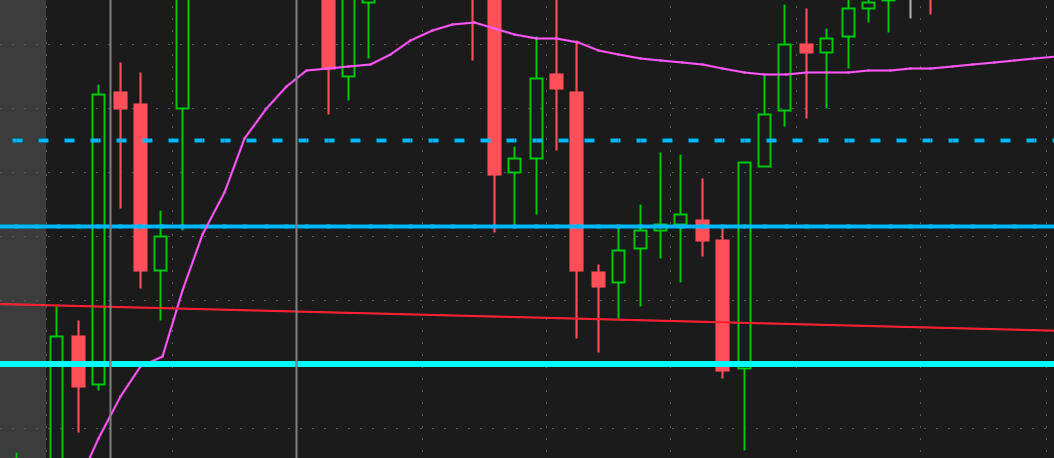

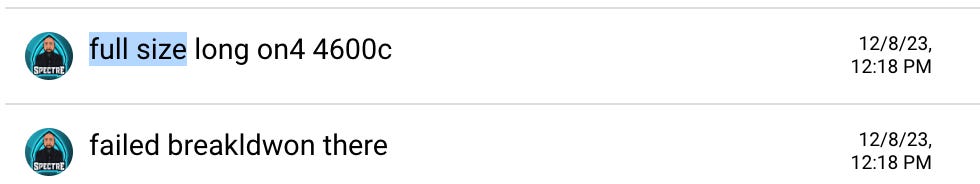

As you can see we topped out at the first hour and made a lower high. Being process driven, when I saw the close under vwap I had to start a short. Why? I’ve seen SPY make a new high only to reverse and make a large move to the downside. So I started a small short excited for the possibility. But I was also looking for a BTFD move. A sure enough we suddenly got the signal I love. The failed breakdown reversal!

You can see how we made lower highs and even broke below the opening high, but the very next candle was bullish engulging and started to reclaim the solid blue (previous day close). That is exactly what I was looking for!

So what do we do, we take calls targeting 2 levels above.

The levels are amazing. We went exactly to 4609! The 4600c went from $1.50 to $9

You don’t need to get in at the bottom. Once the signal is defined, you can see how there was 30minutes of build up a pop, and then another dip to get a chance to reload for the all afternoon grind!

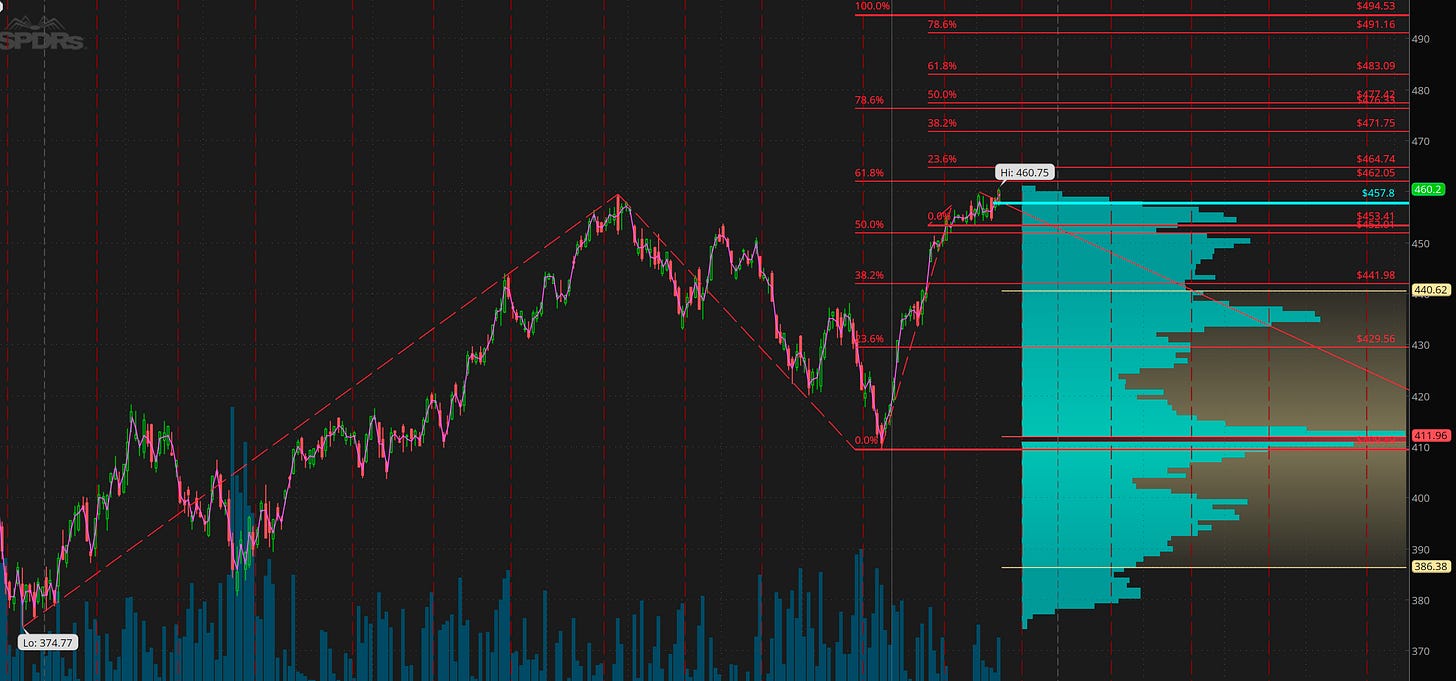

This close over 460 opens the door for a rally.

The Week Ahead

The VERY Big Picture.

With the close over July highs after 2 weeks of consolidation, upside is implied.

The chart below shows the Fib extension from the 22 lows to July highs and October lows. Overall this implies a move toward 494 is coming in the next 3 to 6 months. Reaction to this weeks’ economic data CPI and FOMC rate decision will set the tone.

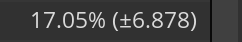

I’m looking for a 462-464 pop and then a back test of 457-458 at some point and then a move higher. Overall would not be surprised if we get a little more chop before FOMC in a 3-5 point range, but overall I think we can see 470+ by end of week if reactions to past economic data is a guide. Overall thinking 8-12 pt move this week. SPY options are priced for a 6.8pt move as of Friday’s close.

At some point, we will get profit taking and a correction. Maybe its today, or this week, but until it shows itself, I will keep doing the same thing. Focus on BTFD plays to scoop long and scalp short when major resistance levels are met.

I’m also going to look for outsized risk/reward plays to take advantage of reaction to FOMC. I want to plan out the levels for what if we get an outsize up or down reaction after FOMC, where will things move to? What are the yolo orders I want to see filled at what price to get 10x or better returns.

I will be watching the following tickers this week for those opportunities:

Google admits to faking Gemini presentation

I expect GOOGL to dip into 128-130, so will be taking 132 puts on any pop. I’m also looking to scoop long on the “panic sale” if that develops. Why? bottom line, currently tech is grinding higher and these news related moves create opportunity/imbalance.

NVDA possible downtrend break

dips as long as 460/462 hold this week, I’d like to scoop swings long/add to swings long.

I might do buy Jan 490c and sell 500c each week against it to collect premium until we get a close over 488.

For a weekly scalp, I am looking at 480/490c vertical if I can get for $2. target exit 5-8.

Good luck this week!

In case you missed it and you are struggling in your trading but can’t seem to change your patterns be sure to read this post: